Tag Archives: Energy

COMMENTS ON QCA REPORT ON FEED IN TARIFFS

- When calculating the “fair” FIT the QCA managed to find excuses for not including most of the savings associated with the use of RTS. This made an enormous difference. If these savings are included, the FIT would have to be above 100 cents/kWh before RTS stopped reducing the power bills of Qld householders who don’t have RTS. The QCA exclusions reduced this figure to a measly 8 cents/kWh.

- The difference in estimates highlights the problems associated with having bureaucrats or politicians set the feed in tariff. It also highlights the problem of determining the FIT on the basis of the effect on household power bills.

- This post is not advocating that the FIT be raised to $1.00 kWh. It is suggested that auctions or some other market based system be used to set the FIT.

US NAVY PRODUCING FUEL FROM SEAWATER

The US navy has been investigating the production of fuel from seawater using electricity from ship’s nuclear power systems for a number of years. This process would allow aircraft carrier task forces to stay at sea longer without depending on vulnerable fuel tankers to keep the planes flying. The navy has now announced that they have successfully used the fuel from their pilot plant to fly a plane with an internal combustion engine. (Well, OK a model mustang.)

The process used involves electrolysis of sea water to produce CO2 and hydrogen followed by a catalytic reaction to produce hydrocarbons. There is nothing radically new here. Hydrogen has been produced commercially using electrolysis for a long time. There are also well established commercially available processes for converting mixtures of hydrogen and nitrogen or hydrogen and CO2 into a range of useful chemicals and fuels. My guess is that most of the effort taken by the US navy has been focused on developing a process that could fit into a small part of an aircraft carrier.

The potential of these types of development go well beyond the needs of the US navy. Think about it: Unless there is an amazing breakthrough, renewable power plus batteries are not going to be able to deliver 100% renewable transport. Renewable power + batteries is not going be suitable for long distant flights, travel in the Australian outback or long distance sea travel. There is a need for energy intensive transportable fuels to cover these needs.

Bio-fuels are not the answer. Diversion of land to the production of bio-fuels is already causing starvation of people in some countries as well as damage to the environment. (Think jungle clearing for palm oil production.) In addition, the production of bio-fuels is vulnerable to climate change and pests as well as posing potential problems if the organisms used escape into the wild. What is needed are low impact renewable fuels produced by inorganic processes such as the US Navy process mentioned above.

The end of coal?

This post started out as four related items in Climate clippings. When a fifth showed up I decided to extract them and put them in a separate post. Hence it is a collection of opinions and perspectives rather than an analysis of the future of coal as such. Still, a message seems to emerge.

BHP calls for carbon pricing

Believe it or not Andrew Mackenzie, CEO of BHP Billiton, has called for a price to be put on greenhouse gas emissions to address the threat of global warming.

Talking in Houston Texas on the future of fossil fuels and carbon emissions Andrew Mackenzie said BHP needs to think carefully about controlling its carbon emissions. He wants BHP to lead the way. BHP is the world’s largest mining company and the third biggest company in the world.

Beyond coal the company is also a major player in shale gas in the USA, investing a cool $US20 billion in 2012.

Mackenzie was on message about ‘clean coal’, spruiking the virtues of carbon capture and storage (CCS).

Rio weighs in

Rio Tinto’s head of energy, Harry Kenyon-Slaney, also weighed in saying “Idealistic discussions” about climate change should be abandoned and Australians should recognise that coal will remain an important energy source for decades.

Coal will continue to “do the lion’s share of heavy lifting” to meet energy demand, he says.

Rio has invested $100 million in carbon capture and storage.

Martin Ferguson, now an adviser to the Australian Petroleum Production & Exploration Association:

stepped up criticism of the Coalition government’s emissions-reductions policies and called for the watering down of the renewable energy target, which he said was undermining the national electricity market.

Tristan Edis comments

Tristan Edis comments on Rio Tinto’s clean coal idealism.

He reckons CCS would be great if you could also retrofit it to existing coal-fired power stations, implement it at large scale and a reasonable cost and start doing it by, say, 2025.

The Australian Coal Association instituted an industry-funded initiative to progress zero-emission coal with a levy and created ACA Low Emissions Technology Ltd (ACALET) to undertake initiatives. Unfortunately from 2012-13 the requirement to pay the levy was suspended and ACALET is now concentrating on promoting the use of coal in Australia and overseas.

Edis reports that Industry Minister Ian Macfarlane seems to be willing to acknowledge that carbon capture and storage is a pipedream.

One senior Liberal referred to it as ‘vaporware’ (new computer software promised by companies to be delivered in the future that never eventuates but scares off competing software development).

The end of coal?

Paul Gilding has called the end of coal and the dawn of renewables, especially solar.

He believes the fossil fuel industry live in a delusionary analytical bubble, convinced of their own immortality. They are about to be swept away. Markets can be brutal.

The top 20 European utilities have lost $600 billion in value over the past 5 years.

Tesla, presumably because it makes electric vehicles (see also below), is now worth more than half GM although GM makes 300 times as many cars.

HSBC’s Global Solar index rose 65% last year and is already up 23% in 2014.

Underground coal gasification

Trials are underway or planned in diverse parts of the world in burning in situ coal that can’t be mined, according to an article by Fred Pearce in the New Scientist (paywalled). The process is underground coal gasification (UCG).

The potential is enormous, with enough coal available to supply the world with energy for 1000 years. For example, 70% of the coal in the UK has never been mined. One company has a licence to prospect for UCG sites beneath more than 400 square kilometres of the North Sea.

The attraction of UCG is not just power production. The process produces methane, carbon monoxide, hydrogen as well as CO2. The Brits see potential to use these chemicals as feedstock to revitalize their industrial chemicals industry. The article lists the following uses:

- Gas to electricity Power stations can burn methane to produce electricity for the grid

- Gas to chemicals Hydrogen, methane and CO all have value as feedstock for the chemicals industry

- Gas to liquid Methane can be liquefied (LNG) for storage or transport, or the CO and hydrogen converted through the Fischer-Tropsch process to synthetic diesel fuel for vehicles

- Gas to tech Hydrogen can provide an alternative transport fuel

CO2 can be reinjected into the void created by the burnt coal.

The article refers to a 2007 MIT study which found that commercial CCS was unlikely before 2030. Undaunted Myles Allen, an Oxford University climate scientist, reckons that CCS is the “only practical way forward”.

Christiana Figueres is hopeful

Christiana Figueres, Executive Secretary of the UN Framework Convention on Climate Change (UNFCCC), points to 60 countries with 500 pieces of climate legislation, and is confident that an international climate change agreement will be delivered on time in 2015. She looks forward within 20 years to the time where everything new we do will be carbon neutral.

She does see a need for research into energy storage – batteries – and into CCS.

It is only with marketable CCS that we will be able to use the fossil fuels that we need. Storage and CCS would be my top two choices for technology investment.

If so someone, for example BHP and Rio, get cracking.

Meanwhile…

Investment bank Morgan Stanley says it has been overwhelmed by the response to its recent analysis which suggested that the falling costs of both solar modules and battery storage presented a potential tipping point that would encourage huge numbers of homeowners and businesses in the US to go off grid.

And Tesla is building a $5 billion ‘gigafactory’ for battery production, then providing an

emergency power service by monitoring the power levels in home batteries and delivering replacement batteries in the event home batteries run out of power.

Someone should tell Andrew Mackenzie and Harry Kenyon-Slaney they’ll need to shake a leg with CCS. Schumpeter’s creative destruction seems to be at work in the energy industry.

Update: Murray Energy, the largest independent coal producer in the US, is suing the EPA for not taking into account job losses when formulating emissions regulations.

Climate clippings 89

These posts are intended to share information and ideas about climate change and hence act as a roundtable for readers to contribute items of interest. Again, I do not want to spend time in comments rehashing whether human activity causes climate change.

These posts are intended to share information and ideas about climate change and hence act as a roundtable for readers to contribute items of interest. Again, I do not want to spend time in comments rehashing whether human activity causes climate change.

This edition is a mixture of science and implementation issues that found me rather than I found them. A couple came from Mark’s Facebook. The last item was drawn to my attention by John D.

1. Electric tents

If you want a tent for the holiday period that stands out from the pack and generates enough electricity to power computers, phones, cameras and loud speakers then

Bang Bang Tents is for you.

Saving the CEFC

Sophie Vorrath at RenewEconomy reports that both Senators Xenephon and Madigan spoke against the bill to abolish the Clean Energy Finance Corporation (CEFC). The Abbott government may not be able to complete their destructive war against renewable energy, even with the new senate next July. My understanding is that they need six votes from the cross benches. These may be hard to find.

However, Vorrath gave prize for best and most impassioned Senate speech in defence of the CEFC to WA Greens Senator Scott Ludlam, who repeatedly pointed out the lack of Coalition Senate representatives to argue their side of the debate. I’ve republished here her selection of highlights in plain text rather than italics. Continue reading Saving the CEFC

Galilee Basin coal: a vision splendid or a kind of madness?

This map gives some idea of the geographic positioning of the vast Galilee Basin, one of the greatest untapped coal reserves in the world.

This map locates it in relation to some well-known towns.

Last year we were told that nine coal mines are proposed. The Alpha proposal and Kevin’s Corner (GVK and Hancock Coal) could each produce 30 million tonnes per annum for export, Palmer’s China First hopes for 40 million tonnes. The Carmichael deposit (Adani) at 10 billion tonnes is the world’s largest coal deposit. I think the plan there is for another 30 million tonne mine.

Greame Readfearn has calculated that the Alpha and Kevin’s corner projects alone will produce 3.7 billion tonnes of CO2-e when burned. He compares that to the UK which emitted 571.6 Mt of CO2-e last year. He also outlines some of the difficulties being encountered, including contestation in the land Court.

Greenpeace calculated that if the Alpha coal project was a country, its annual emissions would be higher than the likes of Austria, Columbia and Qatar.

Last week Lateline highlighted the problems encountered by Adani, mainly high debt. A report by the Institute for Energy Economics and Financial Analysis commissioned by Greenpeace found the project “uncommercial” and found that Adani Power was losing money on its other operations. Continue reading Galilee Basin coal: a vision splendid or a kind of madness?

Numbers add up to keep Clean Energy Finance

This article from Climate Spectator tells us that shutting down the Clean Energy Finance Corporation (CEFC) will actually cost the government $200 million each year in lost revenues.

The article refers to an article (by Laura Tingle) in the AFR. Apparently my $3 per day subscription doesn’t entitle me to see the article online – the first time I’ve encountered this problem.

In the dead tree version we are told that the CEFC is making 7% on funds invested, as against their benchmark of 3%, being the five-year bond rate. Other than being a good Labor idea, I think the Government’s objection may be that the CEFC adds to gross debt. The fact that it adds nothing to net debt is apparently irrelevant.

The dividend stream more than covers the cost of administration. The Direct Action alternative is to pay public servants to hand out taxpayers’ money without a return.

Each dollar spent by the CEFC leverages $2.90 in private capital expenditure. So far over $500 has been spent leveraging $1.55 billion of private capital investment.

Apparently the CEFC operates in a niche that would not happen without it.

It has been able to do deals that are too small, too complicated, or not previously done in Australia. In other words, deals that bankers can’t get past their own credit committees which prefer easier propositions.

Perhaps the CEFC’s real crime is to offend Big Coal.

Toyota’s fuel cell car

Around 16 years ago Toyota unveiled its hybrid electric-gasoline car. Since then it has sold almost six million of them. Now the company is taking a different direction and will start selling cars powered with a hydrogen fuel cell as soon as 2015. The battery car, they say, could only exist as “a niche toy for [rich] eco-snobs”, but is not suitable for the masses.

The fuel cell car will have a range of over 500 km or perhaps as much as 650 km in range driving, and will be refillable in seconds if you can find a filling station. Germany currently has 15.

The price is given as between five and 10 million yen, or about €37,000 to €74,000. Not cheap, but perhaps cheaper than expected as an initial offering.

On the downside, the car is only 30% efficient compared to 70% for battery electric. Hence masses of renewable energy will be required if the cars are to be environmentally friendly. There is a question as to whether sufficient renewable energy will be available for a mass rollout, but the car is more efficient than a conventional petrol model.

Toyota have devoted 500 engineers to the project, so they are certainly serious. Daimler has been working on the concept for some time and expects to have vehicles on the road in 2017, as does a Ford-Nissan alliance. General Motors, Honda and Hyundai are working together on a fuel cell project, Volkswagen has formed an alliance with Canadian fuel cell producer Ballard so as not to be caught out if the technology takes off. Continue reading Toyota’s fuel cell car

Queensland power generation at the crossroads

Giles Parkinson at RenewEconomy tolls the bell for fossil fuel energy producers pretty much on a daily basis. Recently he posted that Energex’ business model was broken, according to its annual report.

To explain the set-up, Energex is the state-owned electricity wholesaler and distributor for South East Queensland. It doesn’t generate power or retail power to the customers. It services 1.3 residences and other customers in an area with a population of 3.1 million:

Power is generated by power stations and delivered to Energex through a high-voltage transmission network that is owned and operated by Powerlink Queensland, also a government owned corporation. Go here for brief industry structure. The network that delivers power to residences and other customers is owned and operated by Energex.

In our house we buy power from AGL. I’m not sure they do anything other than send us a bill. They probably outsource their metre reading. Certainly they outsource marketing as became clear when I asked a question of a sales representative.

Ergon Energy, also state-owned, is the equivalent company for the rest of the State. Actually it is a cluster of operating companies with several joint ventures, including SPARQ Solutions Pty Ltd, which provides information and communications technology (ICT) solutions and services to both Ergon and Energex. Ergon owns and operates 33 stand-alone power stations in remote off-grid locations selling directly to customers. The shaded area on this map shows the extent of the grid: Continue reading Queensland power generation at the crossroads

Climate clippings 78

These posts are intended to share information and ideas about climate change and hence act as an open thread. This post has emphasised adaptation and mitigation, essentially what we need to do to achieve a safe climate.

These posts are intended to share information and ideas about climate change and hence act as an open thread. This post has emphasised adaptation and mitigation, essentially what we need to do to achieve a safe climate.

Comments, about science, observations, impacts, and future predictions are welcome. I do not, however, want a rehash of whether human activity causes climate change.

1. Mining company donations to political parties

Bernard Keane Looked at the astonishing trend in mining company donations to political parties:

Sandi Keane adds some value in her two part series on the cartelisation of the major parties. Bernard wrote:

The sheer scale of mining company generosity illustrates why Tony Abbott remains committed to repealing the carbon pricing package and the mining tax.

Sandi added:

He might also have added that if Abbott wins office on September 14, we will no longer have a democracy but an oligarchy – a government run by powerful mining and media magnates looking for a return on their investment – with George Pell as spiritual adviser. As Keane tweeted recently:

“Australians are a bunch of sheep about to hand themselves over to a pack of wolves”.

National greenhouse emissions accounts

Tristan Edis at Climate Spectator makes a valid point that insufficient attention has been given to the increase in mining emissions in our national inventory.

The two graphs displayed represent change in emissions. To provide context we really need to know the total quantum of emissions for each category. So I looked for the source of his graphs.

Turns out there is no one source. You have to go to this page. There is also a search facility here.

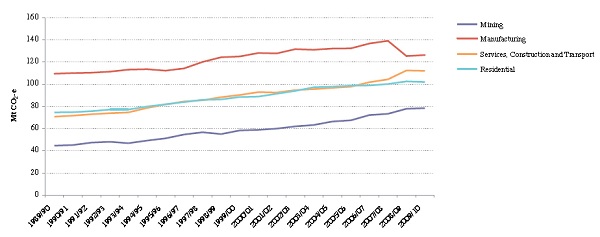

Edis has chosen his graphs well to make the points he makes, but some of the impressions may be misleading. Mining is the fastest growing sector but agriculture, residential and manufacturing are all still larger sectors. And residential in his graphs is only about half electricity consumption. The other half is mostly transport, but also includes emissions generated at residences, presumably mainly from gas. There are many messages you can dig out of the mine of information provided online. I’ll try to give a brief overview here.

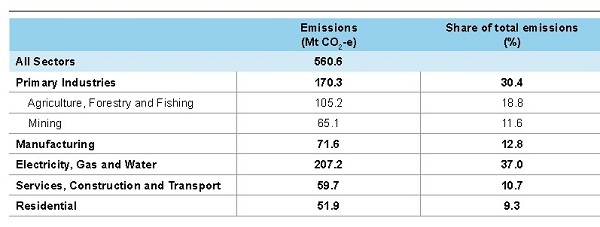

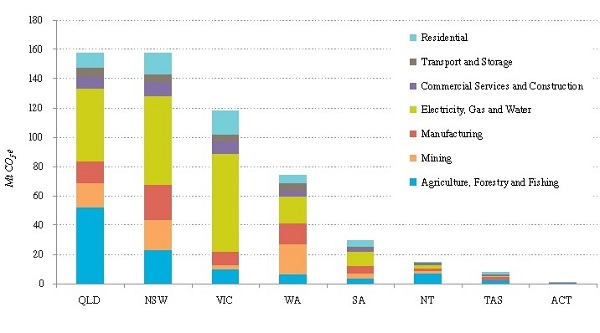

This table, from the National Inventory by Economic Sector 2009/10 gives a snapshot of Australia’s direct emissions, that is from the point they are generated:

Land use, land use change and forestry (LULUCF) activities are included.

The figure for electricity needs to be largely distributed across the other sectors. For example, the residential figure cited here would comprise only transport plus other emissions generated at homes.

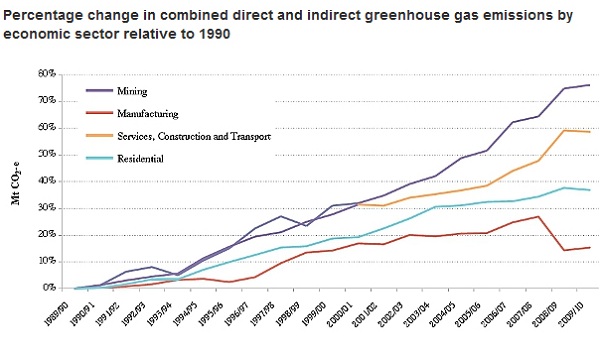

Edis’s first graph is Figure 6 in the Quarterly Update of Australia’s National Greenhouse Gas Inventory: December 2011. I’ll skip it and go to his second graph, which is Figure 7 of National Inventory by Economic Sector 2009/10:

The MtCO2e on the y-axis should have been omitted. Use of grid electricity is included in each sector. Agriculture is left out. It really should have been accompanied by Figure 6:

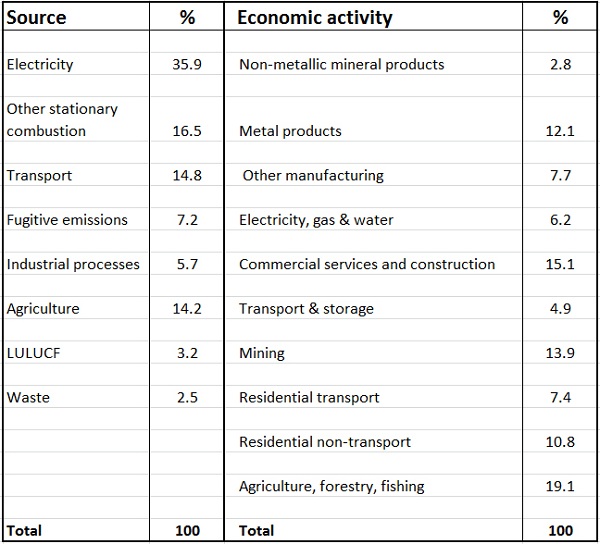

The graph that best captures everything happening now (at least in 2002-2010) is Figure 8 from the same document (p20). The graph is too big to reproduce here, so I’ve made this table:

Some thoughts.

Given the size of the electricity sector as a source and its potential in reducing emissions in the transport sector, clearly decarbonising electricity generation would go almost half way towards achieving zero emissions. Tackling electricity generation and transport represent the low-hanging fruit.

We have to ask whether an emissions trading system (ETS) by itself will achieve this in a time frame compatible with avoiding dangerous climate change. Recently I heard on Radio National that the fall in the demand for electricity is effectively locking in coal as a source of baseload power. If this article is correct we are spending $100 billion on a grid which will not be capable of handling diversified power generation.

This article is one of many detailing the falling electricity demand and some of the implications.

From the National Inventory by Economic Sector document, Figure 3 gives the direct emissions for each state:

Queensland would be the champion in per capita terms.

The Queensland LNP Government has decided to axe the policy and programs section of the Office of Climate Change. ‘Can-do’ can do whatever he wants!