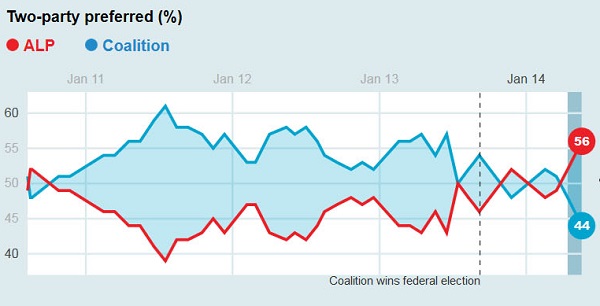

The Reserve Bank cut interest rates by 25 basis points in the jargon on Tuesday to a new low cash rate of 2.25%. This is the first cut since August 2013, just before the last election. Back then Joe Hockey lambasted the Rudd government for the sluggish economy requiring such stimulus. Now he hailed the RBA decision as good news for families, businesses and jobs.

ABC business editor Ian Verrender comments:

Make no mistake, this is an emergency cut to a level well below what already was considered crisis level.

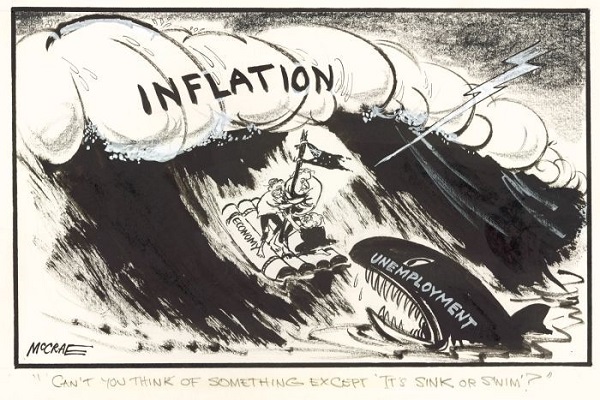

Verrender explains that the RBA has two main roles. The first and primary role is to maintain steady prices, that is, to keep inflation under control.

Secondly, it has a responsibility to maintain the labour market as close as possible to full employment.

Verrender suggests that the RBA has now adopted a third role – massaging the level of the currency. This indeed seems to be supported by the Reserve Bank governor Glen Stevens’ continual commentary on the currency.

What really has spooked Mr Stevens are the actions of his global central bank contemporaries, many of whom have either embarked on programs specifically designed to depress their currencies or to cut interest rates.

Despite the Australian dollar falling sharply in the past year, from around US94 cents last September to US77 cents early this week, Mr Stevens argued the currency was still overvalued, given the crash in commodity prices and the decline in our terms of trade.

Last year Stevens called for a currency level of US75 cents. His comments indicate that he has an eye to the Trade Weighted Index, which measures our currency against a parcel of our trade partners. The TWI has not fallen as much, essentially because of the successful massaging done by other central bankers.

The Guardian quotes Stevens thus:

The Australian dollar remained above “most estimates of its fundamental value”, Stevens said, and reducing rates would therefore bring more downward pressure on the currency “to foster sustainable growth”.

Problem is that interest rates in other countries are down to almost nothing or less, so we will still attract money looking for yield, putting upward pressure on the currency.

On the box tonight one economist was suggesting that the RBA should trim a whole 100 basis points off the cash rate over the next year and take the currency down to US70 cents or thereabouts.

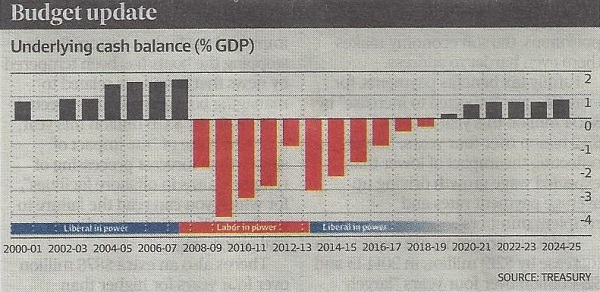

BT chief economist, Chris Caton, says the RBA is rightly concerned about employment and the investment needed to transition the economy out of its dependence on the mining construction industry. He sees Hockey as overly concerned about debt and deficits, which is not a big issue. Certainly it would be nice to reduce the deficit, but not at the expense of killing the economy.

Caton sees one more cut of a similar order down the road.

Chris Bowen (see at the bottom of the Hockey link) reminded Hockey of his 2013 comments.

“Joe Hockey and Tony Abbott both used to say that falling interest rates were a sign of a weak economy and a bad government,” he said.

“Instead of engaging in hypocrisy and spin, the Government just needs to start producing a proper economic plan with economic growth and jobs at its core.

“Making it harder for low and middle-income families to make ends meet while gutting science, research and development funding is no economic plan, it does nothing other than undermine future sources of economic growth.”

Peter Martin at The Age pointed out before the RBA move that our 10-year bond rate was now about 2.5%, basically the same as inflation. Effectively the government could borrow money for nothing.

Martin suggests that the government should borrow $100 billion or so to use in nation-building projects.

That’s enough to build the long-awaited Brisbane to Sydney to Melbourne high-speed rail line, or to build Labor’s original national broadband network, or Sydney’s $11 billion WestConnex road project plus Melbourne’s $11 billion metro rail project plus Melbourne’s $16 billion East West Link plus something big in each of the other states.

Or we could buy all the coal-fired power stations, shut them down and install solar with battery storage everywhere.

It’s a once in a lifetime opportunity. All we need is vision and confidence.

But that would mean ‘picking winners’, and increasing our debt numbers, so we’ll do exactly nothing.