The Coalition government is calling Labor’s proposals to end cash payments by the taxation office for excess share dividend imputation credits a “retiree tax” and an attack on pensioners. In fact:

- No pensioners or part pensioners will be affected at all.

- Exemptions include individuals receiving the Age Pension, Disability Support Pension, Carer Payment, Parenting Payment, Newstart and Sickness Allowance.

- Self managed super funds (SMSFs) can have up to six members. Where one of a couple is receiving a part pension the exemption will apply to the fund.

- SMSF schemes set up before 28 March 2018 will be grandfathered according to Peter Martin talking on ABC RN Drive.

- Martin also pointed out that it is possible to receive a part pension with an income of up to $78,000 pa.

- Currently under the existing rules it would be theoretically possible to receive a superannuation income of $80,000 pa, and then in addition receive a cash cheque from the taxation office of about $34,000.

- These benefits flow to one in every 25 Australians, the rest of us in effect pay for them.

- When cash payments were introduced in 2001 the rule change cost the budget $550 million. The current cost is about $5 billion, $8 billion next year. It is simply unsustainable. Peter Martin says the current scheme is as Australian as the echidna. No other country in the world does it.

The average cash payment is currently $2,200, but the examples given on TV and radio are more like $10,000 to $20,000, which must be rare. I’ll work through one example actually given.

The example was of a very vocal person receiving a tax-free income from super of $75,000 pa, then complaining loudly because he claims to have structured his affairs on the basis of receiving an additional annual cheque of $19,000 in franking credits.

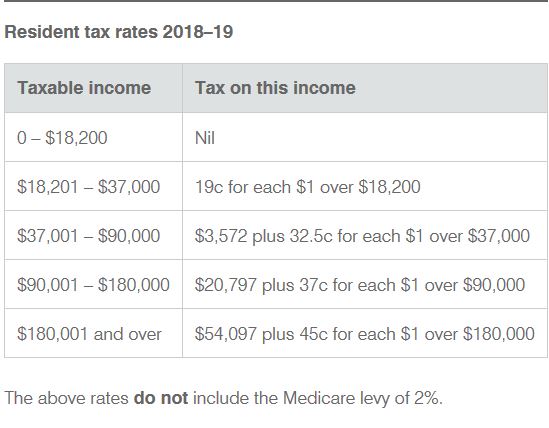

The Australian tax rates are:

Leaving aside Medicare, a working age taxpayer would have to be on an income of $115,000 to receive an after tax income of $75,000.

Add in the $19,000 and that becomes – I didn’t work it out, but I think you add another $51,000 or so.

He said he had not been on a cruise for the last five years. However, he could have done, every year. I’ve personally known people who do just that in retirement income about two-thirds of what he is getting. No-one asked what he was doing with his money, whether he is supporting the grandkids at private school or whatever. Financial advisors commonly assure us that a retired couple can live in comfort with $50,000 pa. If you own the roof over your head.

By my calculations he would have had around $1.5 million in super assets, including around $886,000 worth of Australian shares paying franked dividends.

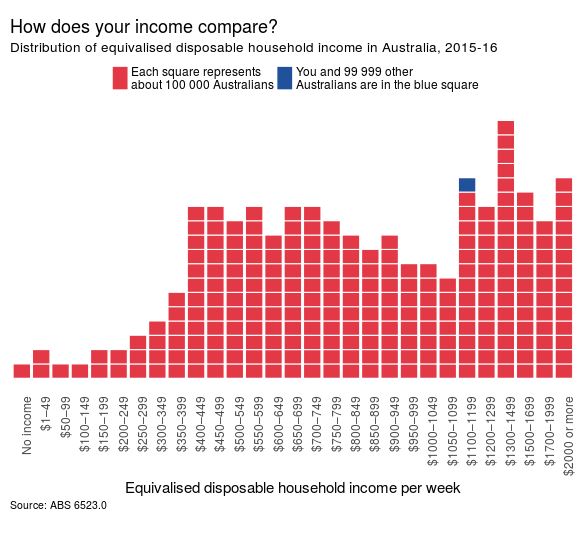

To put all this in perspective in the Australian community, Matt Cowgill has some calculations based on the distribution of equivalised disposable household income for 2015-16:

The poor sod in the example gets demoted from the second highest column ($94,000 pa = $1807 pw) to the fourth highest column ($75,000 pa = $1442 pw).

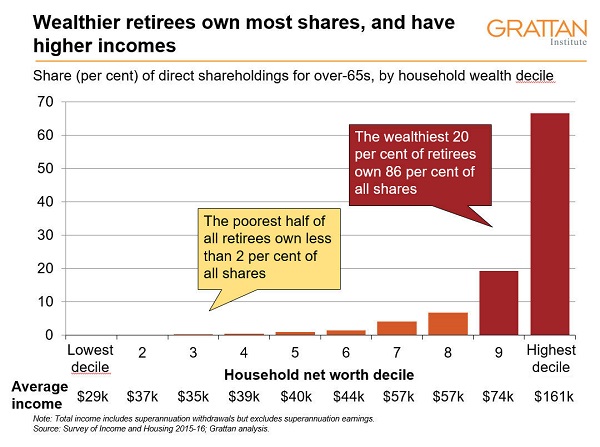

Labor says that “analysis from Industry Super Australia shows that 80% of all refunds to people aged over 65 go to the wealthiest 20% of retirees.”

This graph from the Grattan Institute I have on file from March 2018 also shows who gets the gravy:

Multiple sources have given the average payout for imputation credits is $2,200, meaning that the vast bulk of the 900,000 or so people affected are getting very little.

In summary, Australia has a particular feature in its retirement taxation rules that grossly favours a minority of wealthier retirees. No other country has adopted the scheme. Because it is unsustainable into the future, a correction has to be implemented at some time. Bill Shorten is saying that he wants to Australia be known for the quality of its institutions, infrastructure and services rather than for its retirement lurks.

Below I’ve explained some of the issues further.

Further reading and listening

Essential is Peter Martin’s article Words that matter. What’s a franking credit? What’s dividend imputation? And what’s ‘retiree tax’?

The article does not mention grandfathering of existing schemes, which he mentions in the interview with Patricia Karvelas on RN Drive. Well worth a listen.

Beyond that I can recommend Liberals and Labor in battle over franking credits at ABC’s The World Today, especially the advocacy for Labor’s proposals by Emma Dawson, Executive Director of Per Capita. Dawson believes that the current rules fund distorted investment behaviour to favour the large legacy companies, like the banks, Telstra and the retailers, compared to say Germany where some retirement funds are used to support startups and innovation.

History

Paul Keating original concept, introduced in 1987, was that company profits should not be taxed twice, once in the hands of the company, and again in the hands of the shareholder. However, if the shareholder’s tax liability is reduced to nothing and then goes negative, it was never intended that the taxation office would send out a cheque. This would mean that no tax at all is paid on the company profits.

Keating called the scheme “beautiful” and hailed it as a world first. Peter Martin’s piece outlines how it was copied in some other countries, and how some later backed off.

An additional lurk feature was added by Peter Costello and John Howard in 2001, when the tax office started paying out cheques if the tax owing by the taxpayer went negative. No country has ever followed. This largesse was turbo-charged in 2007 when they made superannuation in the pension stage tax free. Wealthier retirees had a field day. On that basis, the 184 people owning self-managed super funds (SMSFs) with balances of over $10 million could be getting large cheques from the taxation office. Indeed the top 1 per cent of personal SMSFs received a cash refund of $83,000 (on average) until July 2017 when the Turnbull government wound back this bounty by limiting tax-free status to super accounts with less than $1.6 million.

When the scheme was introduced in 2001 it cost the budget $550 million. That has now become $5 billion and is due to become $8 billion next year. Anyone with half a brain can see that it is unsustainable.

When Labor announced the end of cash payments in March 2018 it was intended to apply to all retirees including pensioners. Within two weeks Labor back-tracked introducing the exemptions mentioned above. The resulting revenue change was small:

- The backdown, badged as the Pensioner Guarantee, will reduce from $11.4 billion to $10.7 billion the revenue the policy was estimated to make in its first two years, and from $59 billion to $55.7 billion the revenue it was slated to earn next decade, a fall of $3.3 billion.

So there never was a sizeable grab on pensioners benefits.

How does dividend imputation work?

Peter Martin has an explanation. Here’s mine.

Compaies pay tax at the rate of 30 cents in the dollar of profits made. Actually companies usually keep about a third of their profits for investing in new ventures or company improvements of some kind. However for every $70 distributed to shareholders, $30 is sent to the taxation office. The dividend is called a “franked dividend”.

When the shareholder does his or her tax, the $30 is actually added to the taxpayers income column. Martin misses this point, but it doesn’t change their outcome in the super environment. Then at the very end the $30 is taken off the at owing as an imputed credit (which in the lingo has become an “imputation credit”). For ordinary tax payers this can reduce their tax owing and in some cases with credits to spare, ‘negative tax’, which since 2007 have been paid out to the taxpayer. In the super environment, no tax is paid unless income-producing assets are above $1.6 million, so up to that limit the whole $30 is paid out.

Ditching cash payments will lead to better super investment

As Emma Dawson above asserted, the dividend imputation scheme has resulted in a bias to Australian companies paying franked dividends. It is actually one of the riskier options to be taking. For example, as a snapshot last Monday the big banks offered an average 6.65% yield fully franked. An attractive proposition, right?

Wrong.

Contrary to what politicians and most of the public think, investors have marked the price of the big banks down for the following reasons.

- There is a sovereign risk to earnings because the politicians are likely to have the state grab some of their earnings for a variety of reasons.

- Governments have placed additional burdens on how they operate to ensure ethical treatment of customers. Necessary and good, but it costs dollars.

- Banks are massively exposed to housing, where a world-class bubble could be starting to unravel (to mix metaphors).

- Earnings per share have been flat for the last 3-5 years, and the prospects for growth over the next few years are not great.

- Disruption by other players especially in housing finance is a real possibility.

So a fat cheque in franked tax credits looks tempting, but carries risk.

Moreover, to minimise risk, self-managed funds have to spread investments over a large number of companies. If they do, the time to research and monitor each company becomes unrealistic.

Fund managers such as QSuper offer a variety of investment strategies, including the following investment options for diversified portfolios:

-

Moderate

Balanced

Aggressive

Socially responsible

The ‘Balanced’ option probably offers the best combination of longer term returns and low risk. Currently the asset allocation is:

-

Cash 11.3%

Fixed interest 23.4%

Real estate 8.4%

Equities 33.6%

Infrastructure 16.5%

Commodities 1.1%

Alternative 5.8%

Equities, or shares includes:

-

Australian shares 6.3%

International shares 21.4%

Private equity 5.9%

The fund manager varies these weightings according to how market segments move and are valued. From this you can see that Australian shares are not flavour of the month. Personally I think the Australian market is 5-10% over-valued.

It is also obvious that by using the fund managers facilities a retiree can access many market segments not easily available, if at all, to the individual.

Retirees can still opt to put all their super in single sector funds, as follows:

-

Diversified bonds

International shares

Australian shares

I think a balanced fund is the way to go, but there are articles around like How to beat Labor’s dividend franking crackdown. So the rich will not lack assistance in preserving their wealth.

As a personal disclosure, my wife and I have been receiving a nice cheque from the tax office every year for the last decade or so. It’s our business as to how big, but it is noticeable. Nevertheless we both support Labor’s proposed change of rules as being best for the country.

Politically, Labor has done a calculus that people affected changing their votes will not cost them seats.

However, they may have underestimated how noisy the relatively few higher income people affected would be, or how blatantly the LNP would misrepresent their proposal.

The latest Newspoll suggests that the offset credit changes don’t affect enough people to make much difference. Not many people are in SMF’s to be important and not enough people directly own shares.

Not surprising. The examples I have seen on TV are people who look well off whinging about incomes the average voter could only wish for.

I find it hard to be very sympathetic with someone who set up an SMF to avoid tax and has been so successful that they have got down to so little tax that they can’t double dip by using the offset credits.

From time to time figures come out showing that the government could save money by stopping all the subsidies and tax savings associated with super and simply paid everyone over 65 the full old age pension. (Admission: The JohnD’s would be better under this change.)

The other advantage of paying all the oldies the old age pension is that it removes the harsh dicencentives that discourage oldies from working or setting up micro business’s.

John, it’s a small percentage of the 900,000 of people spread over 150 electorates, from a demographic that already favours the LNP.

However, ScoMo and co. are using blatant lies, untruths that they know are untruths, to mount a more general attack on Labor.

So far I think the credibility of the LNP is shot to a degree that the scare campaign may not work.

Essential Report has Labor 52-48, down from 55-45 where it was two weeks ago, but back to where it was four weeks ago.

None of this effects me directly (though I wish I had enough money for that to change).

Brian, if what you have written here is quite correct – and I have no reason at all to believe otherwise – then it has changed my perspective entirely. Hitherto, I had just taken as reasonably true what I had heard in the mainstream news media; I should have known better than to believe what the Ministry Of Truth puts out. However, this has confirmed my naïve opinion that Complexity Is Theft – or, at least, opens wonderful opportunities for theft. Let’s hope that if Labor does form the next government, they simplify and clarify the whole system so that we can all have confidence that we will not be punished for having foresight and for being prudent, hard-working and thrifty – and further, that the filthy rich and crooked are not helped to become filthier, richer and even more crooked. Thanks Brian. Shall copy this item and pass it around, non-digitally, to some friends and relations. 🙂

Thanks, Graham. Dividend imputation under Labor will still work, but as intended by its author, Paul Keating.

For example, if I sell some bank shares, which I would like to do for reasons of risk, dividend imputation can be used to offset capital gains to the point where my tax owing is zero, but not to the point where the tax office sends me a cheque.