Last week ended with talk of breaking up AGL, along with experinced political journalist Philip Coorey saying:

- It is becoming more apparent the government is as happy to have a fight as find a solution.

A fight over energy all the way to the next election could suit it very well, if the main priority is to “kill Bill”. What it says it wants is “dispatchable baseload”. Cheap dispatchable baseload, and for a sizable rump it must be with coal.

Of “dispatchable baseload”, Giles Parkinson asks is that a thing? His answer:

- No, it’s like describing something as a “round square,” or trying to fit a square peg into a round hole. It is being used as a marketing term like “clean coal” or “high efficiency coal”, neither of which exists.

Wikipedia’s definition is useful: “Dispatchable generation refers to sources of electricity that can be dispatched at the request of power grid operators or of the plant owner; that is, generating plants that can be turned on or off, or can adjust their power output accordingly to an order.”

And distpachable resources, as discussed by AEMO, goes beyond generation, and can include storage such as pumped hydro and batteries, behind the meter resources, flexible demand resources, or flexible network capability.

The key is flexibility. Baseload isn’t flexible, it cannot be easily turned on or off, and so is little use when a market operator needs to respond quickly to changes in supply and demand.

So the solution to the government’s problem does not in fact exist.

Parkinson has more useful exposition of the AEMO reports, which were difficult to read. AEMO, he says, sees two big threats. One is not putting in place any policy to encourage dispatchable generation, the other is the failure of a big thermal unit at periods of critical peak demand.

It is not concerned about Liddell closing, but if another old coal plant closes as well, or fails suddenly we could be at unacceptable risk of blackouts.

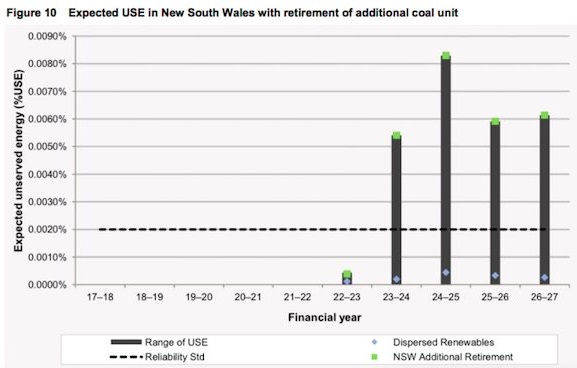

Blackout risk is calculated in terms of “unserved energy” (USE). This is simply an estimate of the potential shortfall in energy over a year. In this regard Parkinson says Australia has about the highest standard for “reliability” in the world – it is expected to meet demand 99.998 per cent of the time. This, he says, has been the justification for much of the over-building of networks.

The story of risks is captured in this graph of future USE in NSW:

The reliability standard (USE) is the dotted line. If Liddell closes and another big coal generator shuts as well, the green dot on top of the black lines represents the risk.

However, if we have a coherent renewable energy policy, represented by the blue triangle, risk is virtually eliminated.

It’s a pity this could not have been said in plain English at the outset.

Meanwhile ACCC competition supremo Rod Sims, currently conducting an electricity affordability inquiry, is reminding people that he has not changed his mind about AGL’s acquisition of Liddell being anti-competitive.

Back in 2014 the ACCC opposed the Liddell acquisition saying the three largest generator-retailers would own about 70 per cent of electricity generation capacity and 80 per cent of output in NSW, as well as more than 85 per cent of the state’s retail market, making it difficult for smaller retailers to secure the hedge contracts they needed to operate effectively. The ACCC took the matter to court and lost, but Sims is not one to change his mind.

AGL has responded by saying that if it is broken up, or if retailing is separated from generation, it simply will not have the financial grunt to make the investments it is proposing to replace Liddell and remediate the site. At present AGL is:

- the country’s biggest power production business, comprising about 11,000 megawatts of thermal and renewable generation capacity, separated from the huge retailing arm with its 3.65 million customers. The two parts of the business are run together within AGL’s Energy Markets business, the powerhouse of its $802 million profit in 2016-17.

As I reported at Saturday salon, the government knows that it can kick big business without affecting its popularity, and actually seems intent on doing so.

UBS energy analyst Nik Burns has calculated:

- that AGL could stand to lose $32 million a year in earnings in keeping Liddell going, assuming a $500 million investment to extend the plant’s life, higher coal and operating costs, and lower wholesale prices.

His estimate assumes the price for coal for the plant rises to about $US70 a tonne after its current cut-price contract of about $35 a tonne expires in 2025, and uses the Finkel review modelling of average wholesale power prices under a Clean Energy Target of $60 per megawatt-hour from 2022-27.

Presumably a third party taking over Liddell would fare no better.

Sims has explained that AGL is not in breach of any law, and no legal case can be made to force them to sell.

AGL has said they would consider selling to a “responsible buyer”. This article reports that Delta Electricity, the only company expressing interest, is being accused by environmental law group Environmental Justice Australia (EJA) of seriously under-reporting micro pollution. Seriously, old coal plants cause health damage, even death.

Please note above, AEMO says all we need to solve this is a clean energy target.

Other solutions will be put to a Melbourne Economic Forum on energy today according to Ben Potter in the AFR.

Ross Garnaut says we should have two carbon targets, a strong one and a weak one. If prices stay the same we should pursue the weak target. If, however, prices fell at a compound rate of 1 per cent per annum after inflation, so that they were a few per cent lower when a new policy begins in 2020, a stronger target could be pursued.

Not sure Barnaby Joyce could wrap his mind around that.

Bruce Mountain will tell the forum that the government should subsidise home batteries. He says they are already economic in South Australia, and would only have to fall another 30 per cent for the system to save typical households in Queensland, NSW and Victoria as well.

His idea is to get ahead of the technology curve, to push it faster in the direction it is already going.

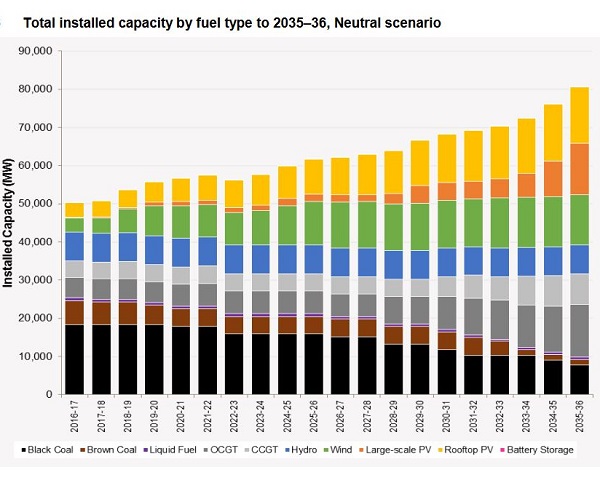

On the weekend Ben Potter in the AFR dug up AEMO’s national network development plan published in December 2016.

They found that coal-fired generation equal to 10 Liddell power stations will have to be closed by 2036 for Australia to meet its Paris climate agreement pledge. This is the energy mix they see if we are to reduce emissions by 28% by 2030:

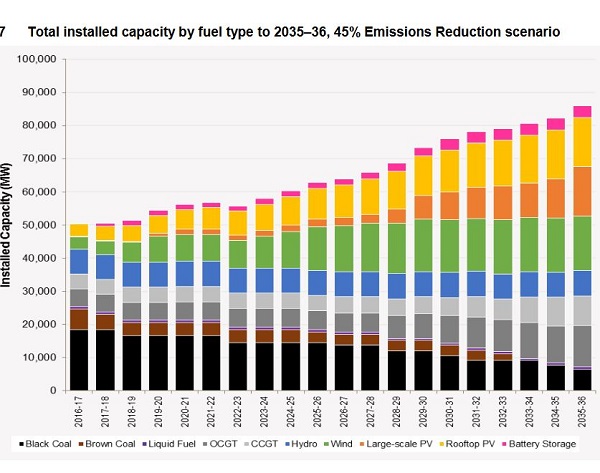

They also mapped a scenario based on Labor’s more aggressive target of 45% emissions reduction:

In both cases coal fades faster than Finkel. Which shows, really, that Finkel would save coal.

However, the real need is to be able to distinguish themselves from Labor, so as we saw in Grattan on Friday: King Coal is wearing big boots in the Turnbull government where they demonise:

- Labor’s attachment to renewables, with derision against “Blackout Bill”, “Brownout Butler” and “No Coal Joel [Fitzgibbon]”.

Last week in the Senate I heard a Liberal senator get all three in one sentence. Penny Wong immediately made a point of order, objecting to childish abuse.

Brandeis was immediately on his feet, saying Australian parliaments are robust, and any way it was a joke.

The President of the senate ruled that the remark be withdrawn, but they’ve been using it ever since, including by Turnbull in parliament.

It might be a joke, but it’s central to their electoral strategy.

Elsewhere Michael Lambert takes a look in Australia’s electricity markets policy: The shambles continues.

Having been involved in setting up the NEM he summarises everything nicely. Bottom line, he says, is that Turnbull should stop engaging in stunts and allow AEMO to get on with its job and put in place a national transition scheme with an emissions reduction target for the NEM, plus a Clean Energy Target or Emissions Intensity scheme. Then, he says, we’ll know that the Commonwealth is serious about electricity markets policy.

Brown coal power in Latrobe Valley is not “despatchable”. Takes HOURS to fire up a generator.

Presumably similar with black coal?

Are these turkeys serious?

Craig Kelly spelling out the Coal-ition’s position, basically engaging in perception management to delay renewables till “end of next decade” on RN breakfast this morning.

Today too the Limited News’ Un-Australian reported “Liberal MP Craig Kelly backed Mr Sukkar’s call for taxpayer subsidies to keep Liddell open. He also said there should be no subsidies to renewables.”

It is not a government anymore it is the perception management handmaid for the fossils rather than governing over the important and massive energy transition process of our nation is undergoing. It will end up an absolute cluster f#$K just like with the NBN where we totally missed the boat, being sold out for political and corrupt purposes while committed to obsolete and costly legacy technology and stifling costs.

Ambi, I keep asking whether Turnbull and Frydenberg are seriously stupid. I can’t convince myself that they are. Joyce, Canavan and the rest may be, or are deeply ideological which means that their reason supports their ideology. Abbott is probably intelligent, but has a seriously f****d up brain. With Josh and Mal I keep coming back to the notion that their priorities are political.

Ootz, I like your last paragraph!

If Kennet hadn’t mindlessly privatized the Vic power system the government would have been able to time the shutting down of Hazelwood to suit the needs of the system, not the private owner’s business plan.

If the NSW LNP government hadn’t mindlessly privatized Liddell we wouldn’t be having the current pissing match about when Liddell should shut down.

If government’s hadn’t mindlessly set up a spot price marketing system that was supposed to ensure power would be available at times of peak demand, South Aus would not have had a blackout because private owners of a key gas fired generator didn’t think it was going to be worthwhile to start up.

I emphasized the word “mindless” because any reasonable thinking through of what needed to be considered to achieve “privatization done well” would have identified the potential problem of a private provider deciding to shut down because their power station was no longer running at a profit.

Ditto the marketing system. Once again thinking through would have identified that sometimes an owner of a peaking power station would decide that starting up in the hope of a sale at a reasonable price wasn’t worth it. (There is also a risk that some owners would not bother to have their peaking power station ready to run for a few hours during summer.)

It is not unreasonable to suggest that government’s chose privatization because it would reduce debt or give them money to spend rather than providing a way to produce cheaper, more reliable power.

Call me a cynic but I think the marketing system represents the touching LNP belief that the market is the answer and accepted a system that would make money for the marketeers.

Those that support a rapid growth of renewables need to do a bit of thinking through as well.

In terms of the post question I suspect Turnbulls thrashing around is not going to help him. Voters don’t like a persistent shambles and it is a bit hard to blame a Labor government that lost power in 2013.

John, I bought the Oz today to see what they are saying. On page 23, tucked away, there is an article by Paul Kerin, adjunct professor of economics at the University of Adelaide. He reckons that when the privatisation was originally done there was care to avoid what he calls horizontal and vertical concentration.

In other words, owning generation and retailing was verboten. Whether there was enough competition at the outset, I wouldn’t know, but prices didn’t seem to go markedly up or down. He puts the starting point at 1998.

He simply says the “acquisition activity” has weakened the original arrangements. Presumably the authorities caved in the face of large corporates and in a couple of cases where the ACCC tried to intervene, they failed in the Federal Court.

He says that you can’t break things up now without disturbing “property rights”, which would disturb the whole basis of the capitalist system.

We could nationalise, however, by paying a fair market price. No sane government would buy Liddell.

The other page 23 effort was an article by Colin Barnett, ex WA premier. He reckons a pipeline from the NW shelf to Moomba would only cost about $5 billion. We can’t send it around by ship or we’d have to condense it into LNG and then pay export prices.

I’m not sure we need gas that badly.

I’ve been quoting the AFR in this and other posts in the knowledge that the AFR is read by big business and big finance. In the last week AGL has been on the front page again, and the message is very clear. Stop the stunts and do what you a paid for, make some sensible policy.

An article I didn’t quote goes into the make-up of the AGL board. It’s mostly experienced Australian corporate players, who shouldn’t be too intimidated by a rogue PM.

The Oz initially last week had coal all over the first three pages. If you read the text they told you in one article only that in fact many of the coal power stations ostensibly planned will not be built, and that the policy is moving the other way. Still, it was 299 in China and 130 odd in India, where we know the story, followed by 32 in Indonesia, 30 odd in The Philippines. Still too many, and the Oz showing them in prominent tables and large maps.

I didn’t buy it again until today. Now on the front page we find the AGL, greedy buggers, will make in total over $500 million in renewable energy subsidies and grants. I think politicians read the Oz, and that would be pissing some of them off mightily.

Why not spend our money on coal?

AGL are quoted as saying, without the subsidies we still would not build coal.

Some of the same pollies are saying forget Paris and climate change, with Abbott says our commitments are only “aspirational”. At least Turnbull is saying, no, they are real.

Rex Connor, Minister for Minerals and Energy around 1973-5, wanted a Govt owned gas pipeline grid.

Unfortunately he chose Tirith Khemlani to arrange a loan for the project.

Big loan. National infrastructure building vision.

Parts of it worth doing 42 years later??

Bilb is probably the person to ask this, but it’s an open question, what is the gap between capacity and realised output of energy production methods ( including Nuke ) ?

To my mind there are big differences but the ratios I’m unsure of.

Just to make clear, business people reading the AFR would understand that to build new coal would take eight years to commission, and then given the concern about climate change, it may not be allowed to fire up and there is an unacceptable risk of it never earning anything.

Certainly, the chances of getting a return on investment would approach zero.

The AFR today has two opinion pieces. The first by Richard Dennis points out that the government continues to ignore the science, the economics, and the polls.. He says that Turnbull has become a man with a plan for more plans.

However, his main criticism is for business and the peak groups, who are not being as voacal as they should be.

That’s probably business as usual, unless they are whinging about industrial relations.

The second opinion piece was from Alan Finkel, who still thinks the government will end up with a CET, because there are no better ideas floating around. However, he says that delaying is not without penalty. It allows space for mischief.

Brian, it could be that the tide is turning re ” business and the peak groups, who are not being as voacal as they should be.” see my comment on BHP and also AGL doing a presser at Liddell today, demonstrating clearly that extending it’s live is economic bonkers.

It appears though that the mining council is engaging in a populist rearguard action by embarking in a social media with the dubious claims of how many coal generators are built around the world and not here. Populist claptrap, their figures are dodgy, for example not incorporating the recent shelving of plans and stoppage of constructions in China. Funny they don’t highlight that non are being built in US and GB, etc. etc.

I am with you and Finkel, it is all about mischief and delaying the inevitable. At who’s cost I ask?

Today, I had a look at what my broker advised about AGL. I’ve had trouble getting onto the site, but had no trouble from my wife’s computer.

An analyst had done a report the week before the AEMO reports had appeared. It was the best three-paragraph summary I’ve seen, and I would quote it except I’ve agreed not to. they obviously had pre-publication access.

Like the UBS analyst quoted in the post, it says running Liddell after 2022 could only be done at a loss, so why would AGL agree to that?

If they sold it, they reckon AGL would use the funds they were goig to use to replace it, remediate the site, and turn it into a clean energy hub for a share buyback, which would increase the value of the remaining shares. Shareholders would be happy, it’s just that no jobs would be created – none at all. And the poor buggers working at Liddell would run of the end five years later.

I haven’t looked at Delta Energy, but they’d have rocks in their head to take Liddell on. The segment is not up on the net yet, but just now on The World Today we heard from the woman who runs the thing day to day briefing journalist. It’s in unbelievably poor shape, being held together by sticking plaster and bluetack.

My other interest is on how big AGL actually is. It’s worth about $15.5 billion, with revenues of around $12.5 billion. My guess is that it would rate somewhere around 25 on the ASX.

Obviously I’m not an analyst, but my estimation is that it takes a company of around that size to make the kind of investments they are making to transition Liddell.

Further, I suspect we need companies of around that size to invest in electricity generation. Does Rod Sims think that Tasmanian Hydro which dominates the Tasmanian market should be broken up?

I suspect there is an issue of critical mass which Sims is ignoring. As I’ve said before, breaking up SC Energy and Stanwell in Queensland into nine companies would see some go to the wall, and energy security may not be better as a result.

John D

Your comment at 3.30pm on 18th is cogent and worth much pondering.

An example of a poor outcome from Latrobe Valley privatisations: there seems to have been far less effort on fire prevention in the Morwell open cut brown coal mine, where hot, dry summer conditions could see fine coal dust blown across the landscape and/or coal dust fire hazards.

One pyromaniac operating in nearby scrub sent sparks across into the Morwell mine; the fire ran for weeks; initially CFA brigades had trouble getting into the site, etc. Health hazard in the town close to the mine.

Huge social costs.

Some years later the power station using that mine closed.

Huge social costs again.

Oldtimers said the fire would not have spread in the old SECV days. Sprinklers were maintained and used; socialists hate fire damage!! In the old days I remember the sprinklers operating on hot windy days to dampen down the surface dust.

It seemed to me that was a public good.

Here’s the segment on The World Today where Kate Coates who manages Liddell explains what a basket case it is.

I think Turnbull and Frydenberg didn’t do their due diligence, and are fast becoming a joke.

According to the Oz, Rod Sims of ACCC gave a speech yesterday, and attempted to attribute causes of higher energy prices.

Network costs 41%

Retail costs 24%

Green schemes 16%

Generation costs 19%.

I don’t know how his people estimated these percentages. Paul Kelly notes that “declaring war on renewables” makes no sense, if your main gripe is rapidly rising power prices.

Ambi, that was a speech at the National Press and was on the occasion of the release of the interim report of the ACCCs inquiry into electricity affordability.

Unfortunately I only heard the last few questions from the floor on Newradio. He was interviewed on local radio here again.

My impression is that there is value in what he’s done, but I think there are a few questions. I’m not sure he’s talked to electricity industry engineers, I doubt it.

I’m going to wait to see whether there is informed comment before I tackle it.

The speech as written is “Shining a light: Australia’s gas and electricity affordability problem”.

At ACCC website

https://www.accc.gov.au>speech

Ambi, here it is.

I’ll have to email you on how to do links, but thanks for the heads up!

Quiggin has a post, which makes some assertions, but doesn’t really argue the case.

I was impressed with derrider derider’s comment.

Declining demand would have seen us in trouble even if we hadn’t privatised.

SMH reports that a new start-up called Power Ledger is exploring ways for households to sell power to each other through the existing, standard grid.

Sounds as if they are running simulations with Origin.

Sounds like a “spot price” scheme.

Presumably grid operator would take her cut?

Ambi: Power ledger could be yet another cunning marketing scheme that gives most of the benefits to middle people.