You guessed it, he chose the clapped out Liddell coal-fired power plant.

AEMO, the Australian Energy Market Operator, said New South Wales may be short of power when Liddell closes, as scheduled, in 2022, based on known plans and government policy positions, federal and state. AEMO had just published two documents – Electricity Statement of Opportunities for the National Electricity Market and Advice to Commonwealth Government on Dispatchable Capability. Apart from the risk of blackouts this coming summer in SA and Victoria, the next pressure point could be in 2022 in NSW with the closure of Liddell.

As David Blowers of the Grattan Institute said, the second report carried a clear message, though not stated directly – the system is broken a bipartisan clean energy policy is badly needed.

The purpose of both reports was to scope adequacy of supply and to identify for industry where new investment is needed.

Turnbull’s needs were quite different. He needed to show the fossil-loving sectors of the Coalition that he was a genuine coal lover, (see Giles Parkinson Turnbull’s abject capitulation to the coal lobby is now complete) and more proximally, he needed to get the political conversation off Barnaby Joyce and back to electricity, where he is building an image of himself as the friend of the people, a visionary, and a fixer of Labor mess.

His response was immediate. The owners, AGL, must keep Liddell running, and if they don’t want to, they should sell it to someone who will. A man of action, he was straight on the phone to AGL CEO Andrew Vesey before the report was public, and in Michelle Grattan’s account, after some initial reluctance, says that Vesey is willing to talk. However, he should have done his due diligence before investing so much political capital. And unlike Turnbull, Vesey is a man with a plan, one that actually makes a fair bit of sense.

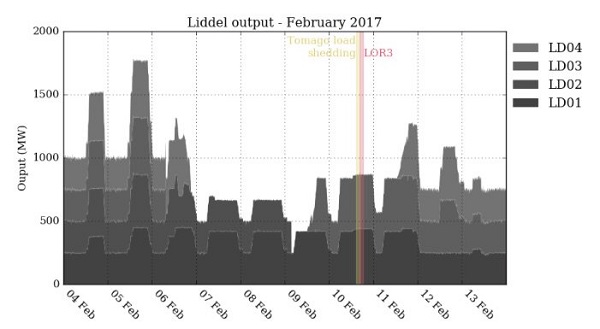

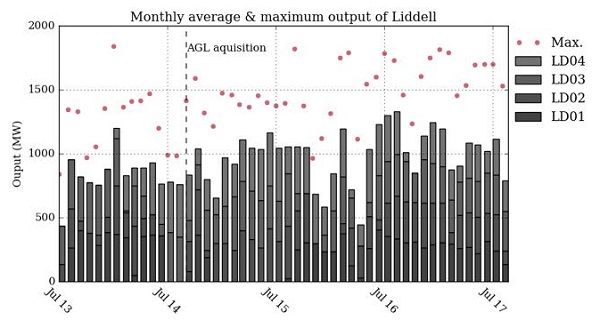

Giles Parkinson relates how the clapped out Liddell power station was thrown in for nothing as part of an asset sale by the NSW Government to AGL in 2014. That is, it was deemed to have no value at all. Parkinson reminds us that Liddell, operating at less than half its nominal capacity of 2000MW, was part of the problem in the heatwave in early February.

The red line shows when the heatwave was at its maximum. Its failure in the heat was why AGL chose to close down the Tomago aluminium smelter rather than turn off the lights in 400,000 homes.

Parkinson shows how for years Liddell had been struggling to operate at half capacity.

Matthew Stevens in the AFR tells why Vesey would not want to sell.

The first reason is that in the next four years Liddell may make more money than in the past 46, given current prices and the shortage of supply.

If the plant is to be sold to be kept open, it should be sold now so that the new owner can plan the refurbishment. Why would AGL hand over that slice of the market to a competitor, without charging a hefty premium?

In fact AGL has been planning to replace the Liddell supply with something more appropriate to the modern world. This is what Vesey recently told the AGM:

- “When Liddell reaches the end of its life in 2022, 1680 megawatts of effective capacity or about 8000 gigawatt hours of annual energy will be withdrawn from the NEM,” Vesey continued.

“Replacement of this energy in the NEM will most likely comprise a mix of energy from solar and wind including the 200MWs we are already developing at Silverton and the 453MWs at Cooper’s Gap.

“Replacement of capacity will likely be provided by a mix of load-shaping and firming from gas peaking plant, demand response, pumped hydro and batteries.

“We assessed the potential scale of investment in these shaping and firming technologies to meet our portfolio needs to be between 500 and 1500 megawatts of peaking plant, representing a potential investment of $800 million to $1.5 billion. We continue to assess the potential to develop gas peaking plants in New South Wales which would be further supported by our gas supply projects.”

On a gas peaking plant he reminded people that AGL are developing a floating gas hub off Crib Point, to import gas if necessary. They believe that this will put a cap on eastern coast gas prices, certainly for AGL and perhaps for the whole market.

Moreover, AGL has plans to clean up the existing Liddell site and turn it into a clean energy hub. It has allocated $898 million for the purpose. 2019 will be the critical decision time when they plan to go to public tender in search for the best way to use the site.

The AFR today says that, hidden from view, the NSW has also had its finger in the pie, suggesting it has not ruled out purchasing Liddell itself, and has not ruled out new ‘clean coal’.

Labor has taken a while to get its act together, but late last night Mark Butler was swinging behind the AGL plan, suggesting Turnbull sort out his own party rather than come forward with yet another market intervention.

In fact, spooking the market once again would be the price Turnbull pays if he succeeds in the Liddell intervention.

Matthew Warren, chief executive of the Australian Energy Council, representing 21 Australian energy companies including coal and gas generators, penned an opinion piece in the AFR There is no reliable power with no reliable plan.

Warren says:

-

The future of the grid will not be decided by whether or not to extend the life of an old power station in NSW. It will be delivered by the development of a credible, flexible and bipartisan strategy that businesses and governments can invest behind and adapt over the next generation.

Only the brave will invest in a place where the politicians intervene erratically and without warning.

- Bruce Mountain, director of Carbon and Energy Markets, said the government risked upsetting the entire pipeline of investment if it persists in pressing AGL to keep Liddell open.

“It will impact AGL’s proposed investments and operations and all the other market participants will be thinking, ‘what’s the chance that the government will intervene or bring something forward that will affect our proposed investments’,” Mr Mountain said.

“If they are worried about investment certainty they could not be doing more to fan the flames of that particular concern.”

That’s a pipeline recently estimated at $11 billion dollars.

For the life of me I can’t understand why Labor is not screaming from the roof tops about energy.

Geoff, in question time this week Labor continued to pursue Joyce which the gubblement batted away easily, and all their own questions were Dorothy-Dixers about electricity. It was a hands=down win the Turnbull & co. Laura Tingle has noted how comfortable they are now talking about energy.

There’s a debate they have after Q-time on a topic of choosing by the opposition. Labor chose energy, led off by Mark Butler. I think it’s 10 minutes a speaker. I listened to the first four, and in debating terms Labor wiped the floor with them.

But Labor are not getting any cut-through story across. The Oz are rabidly anti-renewables I’m told, and the ABC base their news coverage around LNP talking points.

Meanwhile Vesey as an American businessman must be wondering what a strange place he has come to, and I would think Audrey Zibelman, the American boss of AEMO would be amazed at what happened to her report.

Mark Butler is an impressive performer.

He is clear and concise when interviewed (on radio, at least).

Various business lobby groups are shouting about the need for a clean energy target, etc. Hard to see why the PM is taking it so slowly.

I’m feeling increasingly betrayed by our politicians. I guess we need to take some responsibility for the poor quality, but it has to change.

He has no spine.

The nominal capacity of Liddell is the equivalent of 9 solar towers of the same size as the one to be installed at Whyalla. Solar towers with back-up molten salt heating will give 24/7 baseload power or be used for peaking power as required.

In terms of the current debate on grid stability the big attraction of solar towers is that, from a grid point of view solar towers behave the same as coal fired power because both produce power using steam powered generators.

I don’t know whether solar towers are the best option for replacing Liddell capacity or finding ways to remove the demand for its out put but it doesn’t seem unreasonable to expect a vaguely competent government to do what is needed by 2022.

John, a competent federal government would just get the policy framework right and leave the rest to the market.

If the federal government did nothing and just left it to the market, AGL would fix this one and there would be no problem.

Liddell is only an issue because the AEMO report ignored everything that had not yet happened.

Only an idiot or someone wilfully misinterpreting what was said would think there is a need to take such action now.

Concentrated solar with molten salt “firming” is one of the options being considered by AGL.

Brian: Can’t agree with:

Market failure is at the core of the problems currently being faced by our power supply system. Think of:

A spot market that failed to encourage a critical peak power supplier to start up because they were uncertain the power they generated would be purchased.

RET and carbon price schemes that depended on robust political consensus.

Shock and anger re rising power costs from carbon price supporters even though the carbon price was supposed to drive change because it would drive up the price of fossil power. (A big reason for the current power price increases is the rising price of fossil gas.)

I am not opposed to the use of market systems that are designed to efficiently drive the changes we want but, to my weak little mind, the marketing systems used to drive changes to our power systems are a textbook case of what happens when inappropriate marketing systems are use.

John, I can’t totally agree with what I said either, but I think we need to get our roles right.

Finkel says that the states have prime responsibility for electricity.

Essentially they have not relinquished this responsibility, but are exercising it through the COAG Energy Council. COAG has set up various initiatives of their own to plot a path forward, but mainly they have set up the National Electricity Market established via National Electricity Law, which, curiously, you’ll find on a SA Government website. The Wikipedia entry gives the history, and says:

NEM is operated by AEMO (Australian Energy Market Operator) which is answerable to COAG, not the Commonwealth government. The Finkel Review also reported to COAG.

The final Finkel Report included this recommendation (7.1):

How is it in any way proper for the Turnbull government, one member of COAG and without any direct electricity responsibilities except a part share of Snowy Hydro, to be intervening about what should happen to one power station in five years time?

AEMO has identified two periods in the next five years where there will be (on the information currently available) an unacceptable risk of blackouts. The first is the coming summer, after the Hazelwood closure and the second is in five years, after Liddell closes down. In both cases what’s needed is 1000MW of dispatchable reserve power, not ‘baseload’ from unreliable clapped-out generators.

For the first AEMO is working with the SA government and ARENA, including demand management and behind-the-metre power aggregated by Greensynch and similar firms, to provide the necessary reserve.

Their recommendation was that AEMO work with the relevant parties to develop a similar quantum of reserve power for 2022, not for the fricken prime minister to big-note himself by taking preremptory action on matters which AGL seems to have well in hand, and damaging the generation investment market in the process.

The man is dangerous and politically should be put down at the earliest legitimate opportunity.

I think Commonwealth action on gas exports is regrettable, but probably necessary, and is within the Commonwealth government’s bailiwick. Not so sure about jawboning retailers.

However, in this one he’s seriously out of line.

It is a flawed system Brian, not helped by the vagaries of state authority being undermined by the money of the federal government.

Yes, I agree, John. Will have more to say in my next post.

The whole Liddell debarcle is about one thing and one thing only, preserving a convenient customer for Hunter Valley Coal for as long as possible. Turnble is very clearly acting solely in the interests of the coal lobby, full stop. The “public interest” is a total phurphy.

If Turnbull’s government was acting in the interests of the public it would not taken every action at its disposal to cripple renewable energy development in this country.

Look where Liddell is situated, right in the heart of the Hunter Valley open cut coal field. And the only other energy initiative that Turnbul is prepared to bat for is a minor Snowy Mountains energy storage project which won’t be available for years, probably not before Liddell is scheduled to be decommissioned.

The other appeal of Liddell to the coal lobby is that it is so inefficient relative to any new fossil fuel plant. Liddell would be of the 30 to 35 percent efficient generation, relative to today’s most efficient combined cycle plants at 61% efficiency. ie it consumes twice as much coal for the same output as a new plant would.

The shear dishonesty of the government’s position is breathtaking, and deranged to the extent of dragging Turnbull’s leadership almost down to Abbott’s level which was the lowest that Australia has ever experienced, in my opinion.

Meanwhile the electricity oligarchs are wallowing in the riches from their unbelievable luck, in that Australian politicians bought yet again the bullshit argument that deregulation would deliver efficiencies and lower costs. Wrong again.

http://www.news.com.au/national/nsw-act/electricity-crisis-premier-gladys-berejiklian-cant-rule-out-summer-blackouts/news-story/53a9e7ed30283a14756b59d2ee5dde0a

This weeks essential report polled strong support for a number of energy related actions 81% favoured “Increase investment in renewable energy and smart solutions like energy storage” and 86% favouring regulation of gas and electricity prices. In addition, Labor was seen as the best hope for reduced energy prices – but only 28% vs 19% for the LNP.

Thanks, John for the Essential poll link.

I’ve used it in a new post Turnbull goes feral on electricity.