There are a few things we need to bear in mind when discussing the effects of proposed changes to negative gearing.

There are a few things we need to bear in mind when discussing the effects of proposed changes to negative gearing.

According to the AFR median weekly incomes in Sydney have increased by 17 per cent in the past eight years, while house prices have nearly doubled from $546,000 to more than $1 million. In Melbourne over the past six years median incomes have increased by 10 per cent while house prices have risen by 70 per cent, from $442,000 to $749,999. Prices are high and are due for a correction.

Sydney has the second most unaffordable housing in the world with households spending 12.2 times their annual income. Melbourne comes in fourth with 9.7 times and Tweed Heads 10th.

Across Australia in 2011 on average households valued their homes at nearly six times their average household income. In 1990 that ratio was four times.

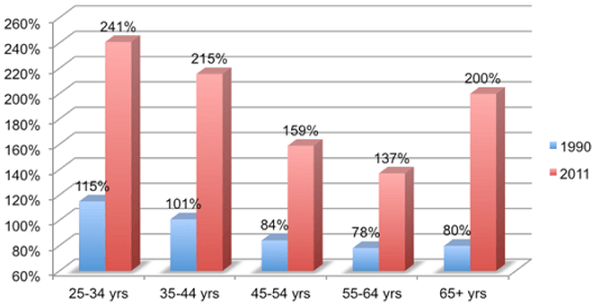

Our household debt to GDP ratio is the highest in the world. Look at how things have changed with mortgage debt:

Renters are doing it tough, there is a housing affordability crisis overall. There are problems in other countries, but the IMF says we are one of the worst, in part because prices did not suffer to the same extent during the GFC.

The young are finding it increasingly difficult to get into the ownership market, and more a staying at home longer because of the difficulty and expense of renting.

Negative gearing was supposed to make more housing available, but we are told that’s a myth.

What is negative gearing?

Negative gearing occurs when the rental received is less than the costs of ownership – That is, interest on a loan, rates and property maintenance. Under present tax law, this loss can be offset against other income, usually a salary. Someone on $200,000 will receive about half their loss back, while someone on $30,000 will only get about a fifth. Hence while ‘ordinary’ mums and dads outnumber the rich as negative gearers, most of the tax relief goes to the rich with multiple houses.

Labor has proposed that negative gearing be only available to investors in new property (about 7%) from July 2017, while existing negatively geared homes will be grandfathered. Capital gains tax concessions when an investment home is sold will be reduced from 50% to 25%.

So of the three sources of benefit from housing investment, one (tax concession) has been closed off. The second, capital gain, has been reduced and new investors will be buying into the top of a bubble. The AFR link above reckons the market in Sydney and Melbourne is due for a 2 to 5% pullback in any case.

That leaves rent.

Average gross yields (before the cost of interest on borrowed money, rates, maintenance etc) in the capital city markets average just 3.4% on houses and 4.1% on units, according to Corelogic RP Data cited in the AFR. Michael Janda cites Saul Eslake and ABC Fact Check to say that rents did not rise when negative gearing was removed in the 1980s.

That was then, this is now. It seems to me that yields are pathetic from an investment perspective. The only reason why they wouldn’t go up is that renters have no more capacity to pay.

So where will the new landlords come from in rent and capital gains are taken out of play? Labor hopes that more renters will become owners, but unless prices drop substantially, is that likely?

In truth the price of property should reduce by about a third, but this would leave investors and banks with loans unsecured by the value of the property, probably a collapse in the building industry would ensue together with all sorts of economic mayhem.

There is opportunity for a scare campaign and Turnbull has waded in by saying that property values would be smashed.

John Quiggin points out that Turnbull is effectively saying that more affordable housing is a a bad thing.

On the 7.30 Report Malcolm’s minion Senator Zed Seselja cited the Grattan Institute as saying that prices could be reduced by up to 10%. That’s way short of “smashing” and would seem to me as a desirable outcome.

Dr Jim Chalmers, Labor’s spokesman on Financial Services, says they think prices will still rise, but sustainably. Recent capital gains are not sustainable, having strayed as far as possible from their anchor, namely incomes.

The sums to be saved by Labor’s policy would be significant, around $32 billion over 10 years. Savings start slowly because of the grandfathering, but are said to increase to $6 or $7 billion pa over time.

It seems that the LNP will also change negative gearing, either by limiting the number of houses eligible or the amount that can be deducted from tax. If so they may be more politically acceptable, and possibly more fair, but unlikely to make much difference to the property market or to budget savings. Probably more in the short run if they don’t grandfather, but less in the long run.

Turnbull says they’ll use a scalpel rather than an axe. It’s a pity he can’t discuss policy in neutral, rational terms, rather than look for the political jugular. Bill’s right, he no better than Tony.

And guess what, the public are onto him, with Newspoll now 50-50 TPP.

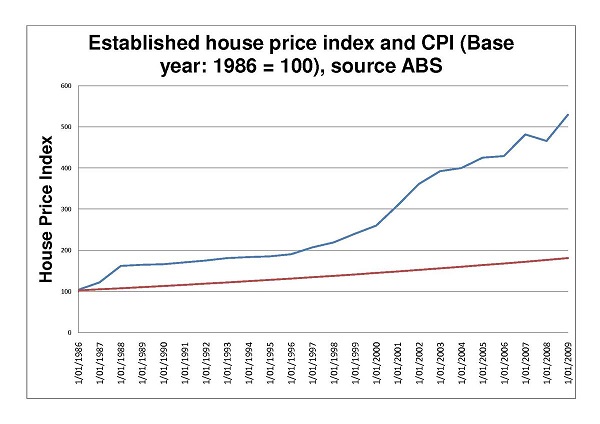

Update: here’s a chart of Australian house prices relative to CPI 1986 – 2009 with source data from ABS, linked by BilB in comments:

The LNP is shooting itself in the foot when it is attacking Labor for changes that the LNP claims will make housing more affordable. Even for parents that own houses the problems faced by their children trying to buy houses is a matter of serious concern.

The return on rental investments is a bit misleading in that rents rise with inflation and their is the prospect of capital gains over the longer term. By contrast, term deposits don’t grow with inflation so some of the interest after tax would need to be added to the term deposit to maintain its real value.

Not sure what is going on with capital gains tax. A fair system should only charge capital gains tax on the after inflation charge.

If housing supply and therefore affordability is the goal then any reduction in negatively geared benefit to investors should be matched by tax reductions on positively geared housing investment.

I suspect the policy is just another ALP money grab disguised as a Robin Hood manoeuvre that will only slightly pacify ALPs insatiably vote buying addiction.

That said, the Libs will support it in the end.

Jumpy, to put it another way, I think Labor were focussed on the revenue problem – you know, money to balance the budget, pay for schools and hospitals and look after bracket creep – rather than housing policy.

John, yes, I think rents will rise for sure, but the ultimate limit is anchored by income growth rather than inflation, which is slightly different. If house prices were reduced by about a third, I think that would be reasonably fair to everyone, going forward, as they say.

I agree that capital gains should be considered after inflation. I was shocked to find that this is not actually so at present.

BTW Turnbull specifically ruled out changes to capital gains taxation today.

I think the most likely people to get new homes built are those that intend to live in them. Perhaps these are the people who should get negative gearing?

Jumpy, what term did you have prepared to disguise a lazy LNP money grab 5% GST increase should that have happened?

Not a bad idea, John.

In related news, Newspoll found that 47% of people favoured the ALP proposals on negative gearing, compared with 31% against. 22% were undecided.

Most in favour were Labor voters at 60%, then Greens st 50% followed by LNP at 40%.

That is a good idea, John D. And I would add that people should be able to apply their compulsory super to reducing the principle on their mortgages as well. Before anyone comes up with a bunch of cliched negatives to this there are straightforward solutions to every one of them.

Bilb

The same way if the idea ( and that is all it was, not a policy as ALPs is ) wasn’t proposed as Revenue neutral with corresponding tax cuts.

( note my comment above fully )

Funnily enough, the GST thang is a State tax to fund Schools and Hospitals, as is their Constitutional responsibility, not the Fed.

Any Income tax thang, which is the topic, goes to Fed consolidated revenue.

John

That’s correct, around 2 to 1 owner occupier v investor.

That said, owner occupiers get a lower interest rate as a rule and the States fund various ” first home ” buyers grants as well.

Oh, and John, owner occupiers pay zero capital gains tax either.

GST not a federal tax?? Really. So Howard, the federal Prime Minister of the day who introduced the GST (that he would never introduce) did so as a favour for his Labour Premier mates? Jumpy? And Turnbull must be totally confused fool in wanting to increase the GST to fund income tax reductions.

Jumpy, the GST was legislated by the Feds. They own it. Costello put around a story that it couldn’t be changed unless all the states agree, but that was a fiction.

On tax in general, I’ve had the feeling for some time that Chris Bowen, Tony Bourke, Shorten et al have their entire revenue/savings regime worked out, but they are just releasing it bit by bit. This feeling came through strongly listening to Bourke ton ight on the 7.30 Report. By contrast Morrison and Turnbull seem to have worked nothing out at this stage.

Bilb

No.

An neither was income tax till the States relinquished it ” temporarily ” to help the war effort. That too should revert back.

Only from a Keynesian numbskull perspective.

How’s that stimulus debt hangover, for a generation or two, working out for ya ? Negative a $Bill per month atm.

Prevention of that is better than he cure.

Here is a little bit of lateral economics for you, Jumpy. This is what Howard did to property prices,….

https://en.wikipedia.org/wiki/File:20100517_Australian_House_Price_Index_1986_-_2009.pdf

…not from negative gearing, the effect from that was flat up to Howard’s election, but from tax cuts for the upper tax bracket and the fluke of the global economic prosperity of the noughties. This was an intention gross inflation of property values as confirmed by Turnbull and Morrison as recently as today.

If there is anything that can be called theft of future generations by present generations it is this deliberate over valuation of the properties that our future generations have to buy some how in order to have a place to live.

Government debt, on the other hand, as inadvertently pointed out by GrueBleen (a play I suspect on Blue Green algae….poisoning the waters he thinks), can be seen as future generations paying something for the national infrastructure built and paid for by present generations, and past, through their taxation over time.

So you see some government debt passed forward to future generations, a fair distribution of effort. Hyper inflated real estate prices? viscous theft from future generations and the economy.

There is no end to the arrogance and stupidity of greed. The LNP engineered the housing price inflation, but for that to work it requires the general populace to be able to afford ever more expensive houses so that the speculators can become “rich quick”. The kicker is that to afford ever more expensive property it requires either steadily increasing wages…or ever decreasing living costs. So we export all of our production except farming and construction to lower labour cost countries, until employment starts to diminish. What to do next? engineer interest rates ever lower. And so it goes on until one day an idiot called Abbott pulls plug on on one of this countries leading industries coincidentally at the very time that an unprecedented minerals boom is ending.

Today’s LNP comedy event is Turnbull and Morrison desperately trying to keep the property theft scam going. And as usual for right wingers, its every one else’s fault that things are going wrong.

And then there is climate change.

BilB I’ve added that chart to the end of the post as an update. It places the whole problem quite specifically as something that happened on the Howard/Costello watch.

Wow Bilb !

It seems like Howard had the same influence on US house prices, the S&P 500 and the All Ords.

Now that is lateral thinking.

There you go harvesting cherries again, Jumpy. If you put all of the information together the trend to concentrating wealth is clear. From this distribution which income group is buying the weighted average house cost at $660,000

http://www.economicpopulist.org/files/u1/incomepercentile.jpg

you certainly cannot do it on a 50,000 income as the interest alone is 46,000 .

Haha, bullshit.

You fluttered away from admitting GST was State revenue by ranting on about blaming Howard for house inflation.

I showed you that stock market inflation ( world wide ) was the culprit.

Now your banging on about successful people buying nicer houses or sumin…

Come up to Mackay here and see all the empty houses bought by investors for $800K + with a current sticker price of around $400K or less. Investing is gambling, dividends vary from positive to negative.

I can tell you for a fact, coz I was in it, directly after the GST came in new house prices dropped dramatically from 12 months earlier and the building activity reduced to a trickle.

Why? Coz 50% of folk were tricked by ALP into believing a new build would be more expensive so they overheated the market leading up to it’s introduction, that’s why.

Since when, Jumpy, have the speculative surges of a remote country town been representative of a nation.

Generally share market and real estate prices work opposite to one another. When the share market is boiling real estate prices flat line. To have both on fire at the same time there is something else going on.

So you lost your shirt did you?

Jumpy: Housing prices in Mackay were inflated by the mining boom and the number of mines using services in Mackay and drive in drive out people based there.

Even worse part of it was driven by the mining construction boom which made the whole thing even more cyclic. Had nothing to do with Labor.

Ah, i see, I’ve unintentionally cause confusion with you clumsy formatting. I’ll try to clear things up.

The first para was a summery of Bilbs …whatever he’s doing…

The second addresses the fact ” evil negative gearers ” can often dump money as well. ( and no, I wasn’t one )

And the last was me stupidly chasing Bilbs GST distraction, which I’m now going to stop doing.

John

Yes, good point.

Many things come into play with house prices, not least of which regional economic fluctuations.

Also, I think, the value of the land the house is on has risen more that the house itself.

Perhaps add ” vacant land values ” it the graph above for a clearer picture ?

I wouldn’t have thought many would invest in negatively geared vacant blocks, or do they ?

Jumpy: Our first house cost $1400 for the land and about $20,000 for the house. (1967) You would know better than I do what it costs to build a house these days but my guess is that the land is by far the largest cost for urban buildings.

We now have the LNP (defence) white paper on “accommodation”. We are going to spend, did I hear a trillion dollars?, on submersible and flying (multi-tenant) houses at about 50 million each.

That’ll take the wind out of Shorten’s sails, and put a new complexion on affordable.