I’ve been meaning to do a new open thread for a while (last Salon was 12 January). When I saw news of the first entry below I thought it was too good to pass up!

1. Morrison’s ultimate gift to the world

His agent described him as “virtuous globalisation mastermind”

Our discarded PM has been picked up by the Worldwide Speakers Group:

- Australia’s 30th Prime Minister, Scott Morrison is the true definition of a leader with a 360º worldview. During his tenure, Morrison was tasked with several difficulties that required unique and innovative solutions. From managing the public safety of Australians during the pandemic to mitigating an economic crisis, controlling natural disasters, and leading the country while others were at war—Prime Minister Morrison led Australia with his particular brand of calm decisiveness and rationale. A globalization mastermind, Morrison lends his boundless influence and experience to audiences around the world.

Controlling natural disasters!!!

From The Guardian, Canberra’s Prof Chris Wallace said the gig:

- “raises former prime minister Scott Morrison from the national to world-class gaslighter league”.

The article picks up this which, time-shifted, could be a possible reaction:

Seems Morrison has five speeches ready to go:

- Mr Morrison can be booked for speeches on topics including “The Future of Globalism”, “Covid-19: Lessons from The Great Disruption”, “Navigating the Indo-Pacific”, “The Net Zero Global Emissions Economy” and “Faith, Religion and Technology in Liberal Democracies”.

2. Speaking of speeches

When Gillard took over I recall an expert in rhetoric saying that Gillard unscripted was better than when scripted.

Ten years after landmark speech, Gillard wishes she’d spoken out sooner

Gillard ‘cool anger’ drove misogyny speech

It went viral worldwide, and will be remembered as long as humans have organised society and a collective memory.

-

Ms Gillard said the unplanned speech was fuelled by a cool anger.

“I felt analytical. I knew precisely what I wanted to say,” she said.

“And I felt empowered, not embattled, not cowed.

“And that is the spirit of the misogyny speech.”

Ms Gillard believes that almost exactly a decade after the speech, sexist and misogynist behaviour is not tolerated as much as it was during her prime ministership.

Now, she says:

- “Things have changed, it’s impossible to imagine a prominent woman in Australian politics would be called the things I was without it having huge negative consequences today,” she said.

3. Urban trees are threatened by climate change

That’s according to the New Scientist (pay-walled):

- Cities around the world may need to start planting different types of trees and shrubs that can tolerate warmer and drier conditions. By 2050, about three-quarters of the species currently grown in urban environments will be at risk as a result of climate change, a study has found.

“By ‘at risk’, we mean these species might be experiencing stressful climatic conditions,” says Manuel Esperon-Rodriguez at Western Sydney University in Australia. “Those trees are likely to die.”

…

To assess the threat, Esperon-Rodriguez and his colleagues used a database called the Global Urban Tree Inventory to work out the conditions required by 3100 tree and shrub species currently grown in 164 cities worldwide. The researchers then looked at how these conditions would be affected by climate change under a medium-emissions scenario called RCP6.0.

By 2050, 76 per cent of these species will be at risk from rising average temperatures and 70 per cent from decreasing rainfall, the team concludes.

So urban planners need to select species that will survive in the Anthropocene.

4. A budget to start a conversation

Michael Keating asks What do we need from next week’s Budget? An increase in tax revenue. Note what we need not what we’ll get. Basically Jim Chalmers, treasurer of our fair land, has told us we will not get what we need, rather a ‘responsible’ budget, whatever that might be. We are told that the expected revenue will:

- “go nowhere near to properly paying for the five fastest growing areas in the budget: healthcare, the National Disability Insurance Scheme, aged care, defence, and the rising cost of interest we pay to service the $1 trillion of debt.”

Meanwhile:

Relative to GDP, total government spending in Australia is:

- 4 percentage points below UK and Canada

-

More than 2 percentage points below even the US and NZ which are low compared to most other countries

- More than 10 percentage points below the typical European country in the Euro area.

During the election Dr Chalmers’ leader said on several occasions that under a Labor government no-one would be left behind. However, circumstances have changed in ways that were certainly unforeseen by most. It is quite clear that with inflation outdoing average wages, and a property market which is bleeding many dry in an effort to keep a roof over their heads, the less well-off will certainly bear the brunt of rectifying the ship.

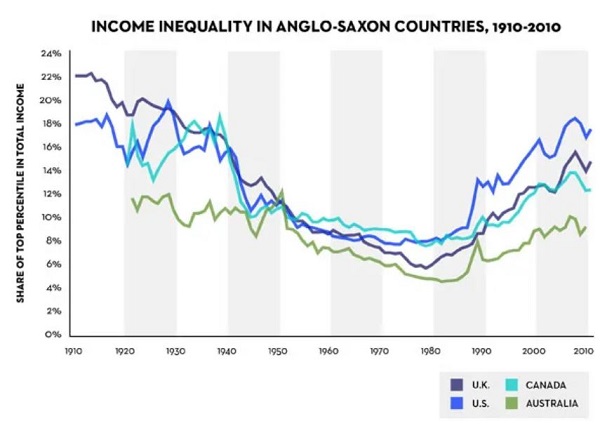

For some time now, as Thomas Piketty has demonstrated, income inequality has been trending upwards:

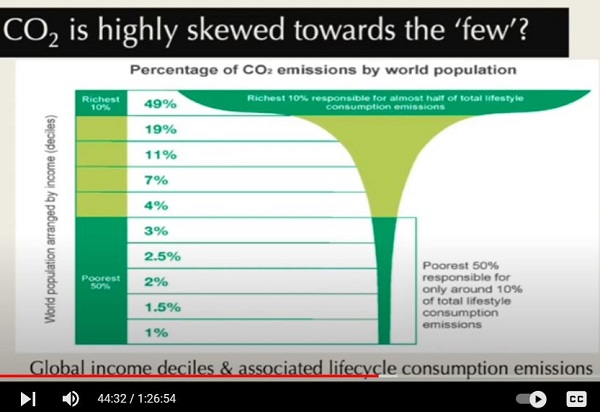

Climate change, or rather global heating, is already disrupting our ecology and life on the planet quite violently. Prof Kevin Anderson in a longish talk Timely responses to the climate emergency: what role for aviation? sees the rich and inequality as fundamental to our situation:

Chalmers understands that we need to start from where we are building support within society and our polity. So he is seeking to craft a “solid, simple, sensible budget, suited to the times” (CM), honouring promises to engender trust so that we can have a sensible conversation about how we want to proceed in the Anthropocene.

Meanwhile Gaia has her own timetable.

Update 26 October 2022: Of all the commentators Stan Grant nailed the problem underlying the budget in Stan Grant – The dirty secret at the heart of the federal budget — the poor will pay, and the government needs them to.

Except it’s not a secret. My wife and I came in on the end of Chalmers’ National Press Club session today. He is acutely aware of what is happening. This from the press club speech:

-

Chalmers said Labor felt for those doing it tough, but had to be careful not to add extra inflationary pressure with any cost-of-living relief in Tuesday’s federal budget.

Dr Chalmers said balancing support measures with the extraordinary level of inflation was a tough act.

“That temptation becomes a lot stronger when you see people hurting … as a Labor government, as Labor people, we feel that, we care about that, it keeps us awake,” he said.

“Whether it’s food, whether it’s electricity, whether it’s rent, inflation is public enemy number one, inflation is the dragon we need to slay.”

And it’s not the government that needs them to. We all have a part in this story.

I think the best commentary so far has been Tim Colebatch with Chalmers’s long game.

It’s good to have the adults back in charge and he got the big call right: fight inflation first. However, he could have done more/better. This budget is a good start but there is much more to do.

5. A possible tipping point

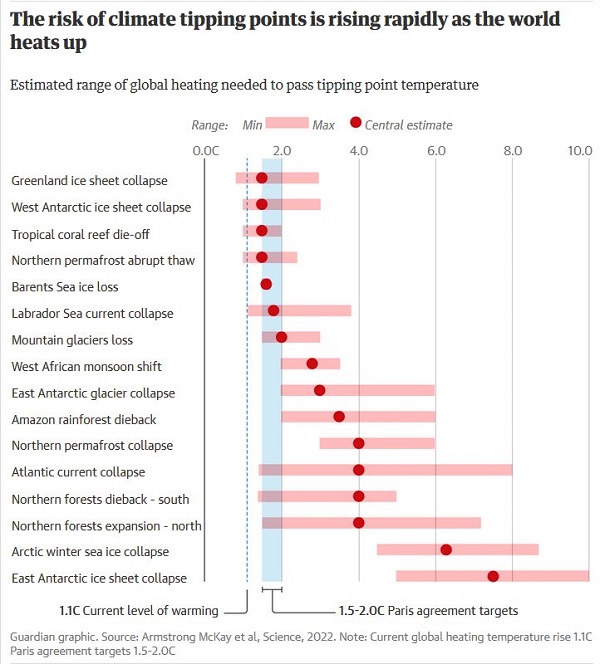

Much has been said about climate tipping points recently, and some notable scientists have warned about the Climate Endgame where we have to ask what the authorities mean when they assert that the 1.5°C limit is necessary to avoid the ‘worst’ of climate impacts. What exactly is the worst? Extinction? The end of civilisation as we know it?

If 1.5°C is worse than what we have now, how can we honestly offer hope?

Questions for another time, but the worst news of the week for me had nothing to do with what is happening in Hungary, or homeless people in our midst. We know that:

- 1. The Greenland and the West Antarctic ice sheets are in play.

2. During the Eemian interglacial when the temperatures were similar to now there was sea level rise (SLR) of 6-9 metres, with only 300ppm of CO2 in the atmosphere.

Our latest take on tipping points is that they begin to cut in at an increase of 0.8°C:

That graph is from World on brink of five ‘disastrous’ climate tipping points, study finds.

In order to offer hope of a safe climate we need to bring the climate thermostat down to the settings of the Holocene for a temperature of less than 0.8°C.

During the week I received from a Google feed to an article Antarctica’s Collapse Could Begin Even Sooner Than Anticipated:

Two expeditions to the Thwaites Ice Shelf have revealed that it could splinter apart in less than a decade, hastening sea-level rise worldwide

Scientific American won’t let me back in without paying, but if my aged memory serves it tells of the international research team inserting a robot under the tongue of the giant Thwaites Glacier. They found huge uneveness, hollows opening up to create swirls and eddies of warmer water in contact with the ice. There was danger of huge cracks developing from underneath.

A rocky mount thought to be holding back the flow is now thought likely to break up the giant stream of ice as it cracks around the impediment.

If Thwaites goes, it could go suddenly, but its repair would likely take centuries.

We should have listened to James Hansen when in 2007 with CO2 the 386ppm he told us that we had already gone too far and we needed to turn the thermostat down in the direction of 350ppm.

Meanwhile I’d appreciate it if anyone can find further information about this research. I think we are dealing with a Scientific American reporter’s story on the trip rather than ‘science’.

I’ve included climate topics along with sundry other stuff this time, because, realistically, I could not hope to produce one of each.

I’ve accumulated about 10 unfinished posts this year, the most recent two being a supplementary one on the Great Barrier Reef, and one on batteries.

There’s been a couple more studies showing that the GBR is in trouble at 1.5°C but the science is not even clear on what 1.5°C means. Does it mean we are there the first calendar year that averages 1.5°C, or do we need a 5-year average, or what?

Similarly, there will almost certainly be corals to be found when the global average is above 1.5°C, but not complex, diversified ecologies we would call reefs now.

David Spratt has even argued that the scientific method as such is too backward looking to serve us well in the situation we are in.

On batteries, I think we are, in Australia, actually manufacturing at least four different kinds of battery, but none at a scale to make much of a presence even on the local scene.

I’m really impressed with the notion that we can make graphene like no-one else on the planet and are developing a battery that charges 70 times faster that lithium iron, that does not overheat or catch fire, that probably never wears out before the object it powers, that uses no rare earths and should be dead set easy to recycle.

It’s happening a few suburbs away from me, but I’m not sure Chris Bown, Ed Husic, Annastacia Palaszczuk or any of her ministers know about it.

Beyond that the world is becoming a very strange place!

“Our discarded PM has been picked up by the Worldwide Speakers Group:” “Australia’s 30th Prime Minister, Scott Morrison is the true definition of a leader with a 360º worldview. ” I guess he won the unwinnable election before people had much chance to understand how he worked. So a chance to see how a Morrison achieved this would be interesting to political tragics.

Brian: –

Per IPCC’s SR1.5 FAQ Chapter 1:

https://www.ipcc.ch/sr15/faq/faq-chapter-1/

To wait 30 years for confirmation of passing a threshold is a long time.

I’d suggest that with the Earth System’s current rate of warming it’s possible that while the +1.5 °C threshold is being “officially confirmed”, the +2 °C actual threshold is being approached (or perhaps even breached).

Geoff, yes I did know that 30 years was considered the standard, but didn’t have the links.

I think any sensible policy maker would not hang around that long. I did have the idea of referring to James Hansen’s August 2022 temperature update, which I’m sure you’ve seen:

I like the way Hansen uses running averaged and trend lines. That particular post is disturbing, but I think very credible.

It seems to me interesting that Morrison apparently has all the answers now (that you need to pay to hear), but seemingly not when he was in office as PM.

IMO, Morrison was a flip-flopper on EVs.

ICYMI/FYI, there’s an opportunity to have your say on the Australian National Electric Vehicle Strategy (NEVS) that expires on 31 Oct 2022:

https://www.dcceew.gov.au/about/news/consultation-nev-opens

I think it would be very foolish to assume that global supplies of crude oil & petroleum fuels will remain cheap & abundant – see my slides #33 through #47, with particular emphasis on #42 in my Submission attachment (10.4 MB).

Extreme Miyake radiation events captured in tree rings stump scientists. The Carrington event that disrupted power supply systems in ??? was a relatively minor version of this event. The tree ring data suggests that some of the events last for years.

They disrupt power supply systems because transformers have inductive resistance to AC power but negligible resistance to DC power. This means that the large surge of DC power caused by Myake events burns out power distribution system transformers.

The problem can be avoided by converting to DC power distribution.

The problem can be avoided by converting to DC power distribution.

I’d suggest we change ‘can’ to ‘should’!

Geoff, thanks for your links on EVs and oil. With limited screen time sometimes these things escape me.

However, the bigger problem is that the authorities seem to be sleepwalking into disaster. Since you have provided publicly available information, I’ll bring it to the attention of a few people.

Brian: –

I agree with your assessment. I think people that are part of these “authorities” have never experienced sustained declining petroleum supplies, so it seems they are in denial of the accumulating data.

The world has experienced a few ‘oil shocks,’ notably in 1973 when OPEC cut supply, 1979 with the Iranian revolution, 1990 when Iraq invaded Kuwait, but these have been geopolitical. Further price shocks developed in 2005-2008 and 2010-2014, due to increasing demand from China & India, where OPEC was unable to support due to a lack of investment.

I’d suggest the latest oil shock is as a consequence of geology gaining the upper hand over technology, particularly with gasoil/diesel production, compounded by poor investment during the COVID pandemic, and exacerbated by the Russian invasion.

Per the graph in my slide #35, most of US crude oil production has been ‘tight oil’ over roughly the last decade, which is generally not suitable for refining into gasoil/diesel fuel without extensive blending with heavier crudes sourced elsewhere.

Data indicates Saudi Arabia’s crude oil production has already plateaued and it may be beginning to decline. It seems from the production graph, Saudi Arabia’s oil production can’t be sustained near or above 11 Mb/d for very long – select the 10-year graph at: https://tradingeconomics.com/saudi-arabia/crude-oil-production

Saudi Arabia & Russia crude oil productions both appear to have peaked. Most other oil producing countries are in production decline. The world is fast running out of pre-peak oil producing countries.

Gasoil/diesel fuel is becoming scarcer than petrol/gasoline because the proportion of crude oils being produced globally, that contain the necessary heavier compounds needed to refine into diesel, is decreasing.

With our civilisation configured as it currently is, diesel is the workhorse of the global economy. When the price of diesel goes up, then the price of nearly everything else follows.

Tom Quinn tweeted a thread on Jun 28 about scenarios on how long it could take Australia to transition its vehicle fleet away from petroleum fuel dependency. One of the scenarios considered 99% EVs by 2030, but even at this pace, it was suggested that 80% of Australia’s vehicle fleet would still run on fossil fuels: https://twitter.com/tomdquinn/status/1541635198148046849

What will the price of petroleum fuels be then in 2030 to operate Australia’s perhaps more than 15 million remaining ICEVs? $5/litre? $10? $20? Would there be enough fuel supply to meet demand, or would fuel rationing be required?

Indeed, Geoff. I think Australians hang onto our old bangers longer than most.

On the budget, I did an update:

Update 26 October 2022: Of all the commentators Stan Grant nailed the problem underlying the budget in The dirty secret at the heart of the federal budget — the poor will pay, and the government needs them to.

Except it’s not a secret. My wife and I came in on the end of Chalmers’ National Press Club session today. He is acutely aware of what is happening. This from the press club speech:

Chalmers said Labor felt for those doing it tough, but had to be careful not to add extra inflationary pressure with any cost-of-living relief in Tuesday’s federal budget.

Dr Chalmers said balancing support measures with the extraordinary level of inflation was a tough act.

“That temptation becomes a lot stronger when you see people hurting … as a Labor government, as Labor people, we feel that, we care about that, it keeps us awake,” he said.

“Whether it’s food, whether it’s electricity, whether it’s rent, inflation is public enemy number one, inflation is the dragon we need to slay.”

And it’s not the government that needs them to. We all have a part in this story.

I think the best commentary so far has been Tim Colebatch with Chalmers’s long game.

It’s good to have the adults back in charge and he got the big call right: fight inflation first. However, he could have done more/better. This budget is a good start but there is much more to do.

Brian, your reference to the ABC’s piece The dirty secret at the heart of the federal budget — the poor will pay, and the government needs them to, included:

There are rapidly rising domestic electricity & gas prices in the eastern states of Australia, while energy consumers in WA face bill rises in line with inflation. Why? WA Premier Mark McGowan explains that: 1) WA has a gas reservation policy for 16 years (that the eastern states don’t); and 2) WA hasn’t privatised their electricity assets (like NSW & Victoria have done).

The solution to high domestic electricity & gas prices is so simple, low risk and achievable. Why won’t the Labor Federal Government act? Perhaps Labor is beholden to major political donors?

Brian: –

See my slide #17, including Prof HJ Schellnhuber’s quote:

Geoff, yes, thanks. WA’s showed good sense, but what do NSW, Victoria and Qld do now?

Qld only has one privately owned coal-fired power station, so can keep coal running until the clean stuff is built. If you look at what is happening now on the NEM with coal supplying around 60%, and keep an eye on NEM Watch I think it is clear although unpalatable that if we want to keep the lights on we may have to subsidise coal and gas.

Schellnhuber has become very frank since he retired, not so much when he was working. I tried to follow your link but it just took me to the magazine. The link is ‘I would like people to panic’ – Top scientist unveils equation showing world in climate emergency.

His latest I’ve seen is here, or if that does not work it’s in David Spratt’s Climate stories and insights in 2021:

“Ich sage Ihnen, dass wir unsere Kinder in einen globalen Schulbus hineinschieben, der mit 98% Wahrscheinlichkeit tödlich verunglückt.”

That translates as:

I’m telling you that we are shoving our children into a global school bus that will with 98% probability end in a deadly crash.”

Geoff:

The Reserve Bank doesn’t hep the poor by increasing interest rates to drive down inflation. Wonder how inflation would look if rising RBA interest rates were included in the inflation calculations.

The rich argue for no pay rises for the poor. This loss to the income of the poor seems to be ignored by your quote.

I’m having trouble posting comments again. Just get “internal Server Error”.

Brian: –

At the very least, introduce a domestic gas reservation policy, like WA did 16 years ago.

Australia also needs to introduce a windfall profits tax.

Minister Ed Husic says “[Santos] can either be Team Australia or Team Greed.”

New data has revealed that a handful of the biggest miners of Australian gas have paid no income tax for the better part of the past decade.

John D: –

Climate change hits the poor the hardest, and sooner.

https://theconversation.com/heat-waves-hit-the-poor-hardest-a-new-study-calculates-the-rising-impact-on-those-least-able-to-adapt-to-the-warming-climate-175224

Climate change will decrease food availability and increase food prices.

https://www.ipcc.ch/srccl/chapter/chapter-5/

If we don’t solve the climate crisis, then our civilisation will likely collapse within this century. That’s bad news for both rich & poor.

Geoff, I’m not against a super profits tax, but I’m cautious about any information on the gas industry. My default position is (a) tight gas, whether coal seam or shale, is expensive to produce, and (b) if miners generate free cashflow then they are more likely to invest it in new ventures than give profits to shareholders. Meanwhile the senior corporate officers pay themselves extremely well.

I read in the AFR the gas company profits in the past year went from $4 billion to $13 billion. That’s pathetic for the scale of activity.

I also read that the Qld coal seam gas operators had averaged 5% profit per annum until the most recent year.

Finally, I checked what the Australia Institute said about Santos. The profit was cited as $5 billion. In fact it was $US 946 million as reported to the ASX according to broker research.

So count me confused.

My default position is that no-one really understands what happens in the gas industry.

Nevertheless I accept, Geoff, that you are citing what should be reliable sources, and that you seek answers.

So I’d like to ask, why does gas determine the price of electricity when generation constitutes about a third of the electricity bill, and gas is about 6% of that? I know it ballooned to 9 to 12% in June and they could not get enough of it, but we are told now that gas is in good supply.

Just to cheer us all up, More bad news for the planet: greenhouse gas levels hit new highs:

Carbon dioxide concentrations in 2021 were 415.7 parts per million (ppm), methane at 1908 parts per billion (ppb) and nitrous oxide at 334.5 ppb. These values constitute, respectively, 149%, 262% and 124% of pre-industrial levels before human activities started disrupting natural equilibrium of these gases in the atmosphere.

“WMO’s Greenhouse Gas Bulletin has underlined, once again, the enormous challenge — and the vital necessity — of urgent action to cut greenhouse gas emissions and prevent global temperatures rising even further in the future,” said WMO Secretary-General Prof. Petteri Taalas.

“The continuing rise in concentrations of the main heat-trapping gases, including the record acceleration in methane levels, shows that we are heading in the wrong direction,” he said.

“There are cost-effective strategies available to tackle methane emissions, especially from the fossil fuel sector, and we should implement these without delay. However, methane has a relatively short lifetime of less than 10 years and so its impact on climate is reversible. As the top and most urgent priority, we have to slash carbon dioxide emissions which are the main driver of climate change and associated extreme weather, and which will affect climate for thousands of years through polar ice loss, ocean warming and sea level rise,” said Prof. Taalas.

“We need to transform our industrial, energy and transport systems and whole way of life. The needed changes are economically affordable and technically possible. Time is running out,” said Prof. Taalas.

This morning the message is even more clear:

“Untold human suffering” is in the near future as U.N. warns climate change is pushing Earth closer to extreme warming By Li Cohen

Three new reports from the United Nations paint a grim picture of what’s to come in the near future as the world falls short in mobilizing against climate change. According to the reports, nations are failing to create and act on sufficient plans to reduce warming as global greenhouse gas emissions are on the rise — a combination that is putting the planet on track to hit nearly 3 degrees Celsius of warming within less than 80 years.

The U.N. issued the reports on Wednesday and Thursday providing details on the state of the planet. For years, scientists both in and outside of the organization have warned with growing urgency that limiting global warming to 1.5 degrees Celsius compared to preindustrial times is critical to minimizing extreme temperatures and climate disasters.

But according to U.N. Environment Programme’s Emissions Gap Report, there is now “no credible pathway” remaining to make that happen.

“Loss and damage from the climate emergency is getting worse by the day and global and national climate commitments are falling pitifully short,” United Nations Secretary-General António Guterres said. “…Under current policies, the world is headed for 2.8 degrees of global heating by the end of the century. In other words, we are headed for a global catastrophe.” (Emphasis added)Earlier this year, following the IPCC reports, the UN is called for greenhouse gas emissions to be cut by 43% by 2030 to limit warming to 1.5 degrees Celsius. I think you’ll find the starting point for that call was emissions at 2020, not 2005. Globally 2020 is much higher than 2005. For us it is lower.

However, in effect the “no credible pathway” implies drawdown beyond planting trees and soil carbon, plus consideration of geoengineering.

We lived for years on Groote Eylandt (hot/humid – gulf of Carpinteria) without air conditioning and then more years at Mt Newman (Hot dry – Center of WA) with air conditioning that was off most of the time. Both places walked all yr round.

People do adapt to warm weather and develop strategies to deal with them.

The big problem is the growing human plague that increases consumption, makes it harder to move people from crisis areas, increases production of green house gases and generally make it harder to adapt.

European Union bans sale of petrol and diesel cars from 2035 to boost electric vehicle uptake

Hopefully we will see lower cost, cars with lower energy needs by that time.

Me I am starting to think about electrical for most of my travel while using hire vehicles for longer trips. The right cars aren’t there yet.

Brian: –

IEEFA’s gas analyst Bruce Robertson argues that the coal seam gas from the now IPCN approved Narrabri Gas Project will cost $6.40 a gigajoule at the well head plus $2.10 a gigajoule for transmission to Sydney.

https://ieefa.org/articles/gas-and-electricity-prices-will-rise-if-narrabri-gas-fields-australia-approved

Professor Kevin Anderson from the Tyndall Centre at Manchester University, in the YouTube video titled Kevin Anderson methane is a transition fuel to 4°C, published Jun 5, IMO was telling it bluntly, including:

0:09:32: “So, there’s lots of money around the world being spent on gas, erm, and the rhetorical language around it is that it’s a transition fuel – it’s, it’s probably accurate – it’s a transition fuel to four degrees Centigrade of warming. It’s not a transition to one-point-five to two degrees Centigrade of warming.”

https://www.youtube.com/watch?v=vXEL4ZfDbdE

Brian: –

<

blockquote>

See the AEMC’s Fact Sheet: How the spot market works, dated 11 April 2017.

https://www.aemc.gov.au/sites/default/files/content/d6cc8e9d-6a9f-4648-bef7-b25cad5df460/5-Fact-sheet-How-the-spot-market-works.pdf

The market has transitioned from six 5-minute bidding intervals with an averaged 30-minute settlement period, to a single 5-minute bidding interval aligned with a 5-minute settlement period, on 1 Jul 2021.

https://www.aemc.gov.au/sites/default/files/content/18f019ff-de8c-40f3-836f-1bf3c8e43d2b/3-Info-Sheet.pdf

The successful generator that bids with the highest price sets the price for all the other successful lower-priced bid generators.

For example, in period 4:00-4:05, Generator 1 bids its capacity at $20/MWh, Generator 2 bids its capacity at $30/MWh, and Generator 3 bids its capacity (but only part of it is required) at $40/MWh. The settlement price for Generators 1, 2 & 3 is $40/MWh for that period. But in period 4:05-4:10, Generator 4 is also needed, bidding at $80/MWh, and Generator 4 sets the price for Generators 1, 2, 3 & 4 for that period.

From the RBA, Aug 2022:

https://www.rba.gov.au/publications/smp/2022/aug/box-a-recent-developments-in-energy-prices.html

I was trying to find a reference that corelates the gas-fired generator fuel price ($/GJ) to breakeven NEM wholesale electricity price ($/MWh). Some other time.

Brian, I found a reference from a MacroBusiness post dated Sep 29 headlined Albo’s cowards lock-in immense energy shock, which included:

The units given are not correct: IMO, “Gj” should be written as GJ; and “600MW/h” should be $600/MWh.

With more than a dozen gigawatt-hour scale BESS projects in the planning & construction ‘pipeline’ and more likely to be added soon, plus some PHES projects also being proposed, the days of expensive gas-fired generators are likely numbered.

Geoff: I am a capacity contract fan. Capacity contracts are dominated by a contract to provide capacity rather than spot prices or $ per gWH supplied. Governments should look at how contract based industries work, not economists. My background includes working for Thiess contractors in their mining and processing related sections.

Geoff, I do have a basic understanding of how the market is put together. Back in 2017 if you scroll down this Electricity prices tab I did a number of posts because I got agitated over claims being made here by Steve Austin, who used to present the local ABC Mornings program. They moved him to Drive in 2018, and I’ve avoided listening to him ever since.

Your RBA link is a good one, because it explains the relationship between the spot market, the wholesale market and the retail market for consumers. It makes clear that elevated coal prices and issues of supply started the whole thing, which called in the gas.

The whole story is long and complicated. I don’t want to attempt it right now (not confident I’d get it completely right) but would like to make a few points.

First is that it is not the Commonwealth Government’s responsibility to fix the electricity price problem. States have the constitutional responsibility for electricity. The NEM (National Electricity Market) was set up to allow the eastern states to support each other. The NEM is a human artifact which is meant to facilitate the best price emerging from free market competition. Its entities were originally answerable to the COAG Energy Council, chaired by the Commonwealth but including stakeholder groups representing all sectors of the market. This was destroyed by Morrison when he set up ‘National Cabinet’, which now makes the Commonwealth look as though it is in charge.

Certainly the Commonwealth has a head of power from signing up to international emissions reduction agreements, and has responsibility for exports, corporations, competition institutions (as Treasurer Chalmers has the ACCC as part of his brief).

The Albanese government routinely acknowledges state responsibilities and acts co-operatively, but journos and the public tend to think the Feds run the show.

Secondly, the RBA doesn’t quite tell the story of how consumers buy their electricity.

The key to it is to understand the role of the retailers. My understanding is that AEMO pays the generators and charges the retailers, who have to pay, but also engage in hedging. Ultimately the retailers have to extract the cost from us, but can’t charge us more than the ‘standard offer’ if that is the tariff we are on.

The ‘standard offer’ of retailers to consumers is actually set now by the Australian Energy Regulator (AER) in NSW, SA and SEQ, with state regulators doing the rest. The AER needs detailed commercial information to do this. They also determine how much the transmitters get, which traditionally was more than half the bill.

It’s instructive to look at the ACCC Inquiry into the National Electricity Market – May 2022 report. I’ve just skimmed it, but it’s clear that they encourage consumers to shop around for cheaper ‘market offers’.

Personally we are a bit lazy and traditional, so just went with the standard offer from one of the big gentailers. So until June 2023 we get electricity based on an offer which was formulated before the proverbial hit the wall in June. Origin, which is a public company, had a hole in its profits, essentially because they can’t recoup the damage suffers in the second half of 2021-22 until next financial year. Some of the smaller retailers offering slimmer margins, went bust.

Probably enough from me. I think the Feds are going to broker a WA style deal with the gas companies. Laura Tingle’s article is worth a read.

Gas companies are not the most ethical around, but tight gas is expensive gas. Unfortunately we need some to keep the lights on, but as Prof Anderson says, methane is a transition gas to 4°C.

The ACCC report does comment on an increase in spot prices, especially in NSW and SEQ, with SEQ expecting to go from the lowest prices in the NEM to the highest. They say this:

The Australian Energy Regulator stated that the elevated contract prices in Queensland were being driven by high underlying energy prices due to the ongoing transmission constraints relating to the Queensland-New South Wales Interconnector upgrade, combined with high coal prices and generator outages.

The blog seems to have survived the 6.1 updated version of WordPress. Doesn’t look any different inside.

Brian,

The Australian Energy Regulator’s (AER’s) annual volume weighted average 30-minute prices chart by regions, from periods 1998-99 through to 2021-22, can be found at: https://www.aer.gov.au/wholesale-markets/wholesale-statistics/annual-volume-weighted-average-30-minute-prices-regions

The AER’s quarterly volume weighted average spot prices chart by regions, from periods 2017 Q2 through 2022 Q2, can be found at: https://www.aer.gov.au/wholesale-markets/wholesale-statistics/quarterly-volume-weighted-average-spot-prices-regions

Brian: –

Perhaps not as much gas is needed as you may think.

Gas analyst Bruce Robertson at IEEFA, told the IPCN regarding the then proposed Narrabri Gas Project, at a public hearing on 23 Jul 2020 (from the Day 4 transcript, pp71-72):

The IPCN subsequently approved the Narrabri Gas Project on 29 Sep 2022.

correction: IPCN approval of Narrabri Gas Project on 29 Sep 2020.

One of the basic problems is that the Qld coal seam gas operators were given an export licence on the basis that domestic gas would be sold on a ‘net back’ arrangement equating the domestic price with the export price.

I’m not sure how that was worked out, but obviously the domestic gas does not need to be liquefied, and does need to be pushed through a pipeline.

It looks as though the government may specify a sensible maximum price for domestic sales which won’t send companies broke. Rod Sims was pushing this idea on radio today.

As to Narrabri, from what I read at the time the the risk of damage to agricultural aquifers was unacceptably high. I recall Lock the Gate having evidence that would have nailed that point, but missed the deadline by a day or so.

I checked tonight, and APA is expanding the pipeline from Qld by 12%, followed by a further 13%, then a further 25%. Since we are being told that Qld is supplying 90% of the gas used domestically for electricity, and now it seems as though there is enough available, then it would seem unnecessary and more than a shame to inflict coal seam gas extraction of NSW.

Meanwhile, my search turned up this article from February:

Australia spending billions on new gas pipelines that may end up worthless stranded assets

That would see a pipeline straight down the middle of the east coast market, picking up Narrabri on the way.

Is the ship is heading for an iceberg, and the does the captain have a good grasp of the situation?

I also came upon a link to a study commissioned by the AER on energy equity:

AER starts a journey towards energy equity

Brian: –

It seems to me that Santos lied to Australia about its gas reserves for export in 2011. From a 15 Jun 2020 post headlined How Australia committed energy suicide to save one dirty company:

Brian: –

You may wish to look at the IPCN public hearing expert witness testimonies (on Day 4) on behalf of EDO by:

Dr Kevin Hayley – groundwater modelling consultant

Associate Prof Matthew Currell (RMIT University) – hydrologist

Prof Stuart Khan (UNSW) – water & waste water quality & treatment

David Milledge – threatened fauna specialist

David Paull – expert on biodiversity

Dr Peter Serov – expert on groundwater dependent ecosystems

Dr Alison Ziller – expert on social impact assessment

Prof Penny Sackett (ANU) – former Australian Chief Scientist

Tim Forcey (Melbourne University) – chemical engineer

Dr Alistair Davey – economist

Mark Ogge (TAI)

Prof Will Steffen (ANU) – climate scientist

Other testimonies include:

Bruce Robertson (IEFFA) – gas analyst

Greg Mullins (Emergency Leaders for Climate Action)

Simon Nicholas (IEEFA)

Ian Dunlop

It seems to me the IPCN dismissed all these testimonies, together with almost 23,000 other public objections, and approved the Narrabri project anyway. I doubt whether Lock the Gate’s evidence would have made any difference.

I think at the time almost 23,000 objections was an all-time high for any project being assessed by the IPCN.

Former Australian Senator Rex Patrick tweeted earlier today:

PM Albo needs to act NOW!

https://www.abc.net.au/news/2022-11-03/ed-husic-gas-crisis-corporate-greed-not-supply-shortage/101610072

Geoff, nothing about Santos surprises me. I knew they didn’t have enough gas when they set up the coal seam gas train, but in 2020 I think I was distracted by COVID and had problems with my eyes.

Yes I do recall 23,000 objections.

Bruce Robertson in an article today A gas reservation policy will cut electricity prices, and still make money for gas companies reckons an east coast gas reservation policy could be set at $7 a gigajoule (GJ), which would still allow gas companies to achieve a decent profit. Sims was suggesting $10, but my recollection was that the LNP’s famous ‘Gas led recovery’ was based on $4.

On Q&A tonight Jim Chalmers said they were considering three possible options, but it was clear that he favoured some form of gas supply regulation.

He said they were working flat out on finding a solution, but was very clear that it wasn’t as simple as everyone seems to imagine.

Brian: –

I’d suggest it’s not “as simple as everyone seems to imagine” because member companies of the gas cartel and the peak body APPEA are major political donors.

ICYMI/FYI, it seems to me there was a train-wreck of an interview by David Speers on ABC TV’s 7:30 program last night (Nov 4) with Samantha McColloch, CEO of the Australian Petroleum Production & Exploration Association (APPEA), that’s the peak body for Australian oil and gas producers. Simon Holmes à Court looked at and responded with evidence/data contradicting what she said in a series of tweets.

Correction: last night (Nov 3).

ABC TV 7:30 full segment titled VIDEO: Albanese government considering an intervention in gas market to bring prices down

Sorry, have been busy, still busy.

James Hansen said back about 20 years ago that people would not attend to climate change as an important issue until it started happening around them and they could see it with their own eyes.

We’ve been seeing dangerous climate change for over a decade now, and the penny still hasn’t dropped for senior policy makers. This one shows a selection of what has been happening:

‘It was like an apocalyptic movie’: 20 climate photographs that changed the world

Geoff, David Speers is not my favourite interviewer. Usually asks dumb questions which the interviewee is never going to answer, and then interrupts them all the time. I saw the segment and thought it was a complete waste of time.

Good on Simon Holmes à Court for supplying information. I read the thread for ages, and must say I didn’t find all comments informed or enlightening. I gave up when Tristan Edis reminded us of an article he had written about why gas prices were high (see What is the real cause of our energy crisis – and what should we do? only to find it dated 7 June, which is before the crisis kicked up a gear, and some of the statements he made were not then true.

The best account I’ve seen so far is Mike Seccombe in The truth about today’s gas prices. It’s paywalled, but here are a few excerpts:

As the Albanese government reminds us regularly, defensively, the current energy crisis is global, driven largely by the war in Ukraine and the curtailment of Russian gas exports to Europe, which have driven prices through the roof. But, says Rod Sims, in at least one way Australia’s problem with high power prices is unique.

“Australia has the highest, by far the highest, domestic gas prices of any gas-exporting country,” says the former head of the Australian Competition and Consumer Commission (ACCC), who spent much of his 11-year tenure working to rein in the greed of Australia’s gas miners.

“Of course, if you import gas, you’re going to pay the world price. But no country that exports gas pays anything like the prices we are paying. None requires that their local consumers pay the international price, if they’ve got gas themselves. It just does not happen.”

Except in Australia.

However, I don’t think it is warranted to assume that Chalmers, Bowen, Husic and company are just bending to their fossil fuel masters. Albanese is trying to run a deliberative and consultative cabinet. Some are better than others at it. Albo has said that the matter will be discussed at the next cabinet meeting. I’ll be surprised if a decision is not made then.

Today’s media sees the states very much divided, so not sure how that will work out.

Seccombe’s article still does not come to terms with the fact that the gas supply is increasingly reliant on coal seam gas from Qld which cost a fortune to set up (I don’t have time to check, but I think $60 billion). It says of the PRRT:

Polls indicate a majority of Australians, and a growing number of governments around the world, want a super-profits tax. Sims says we’ve in fact already got one. “That’s what the petroleum resource rent tax is. It’s just that it doesn’t work.”

The PRRT imposes a 40 per cent tax – on top of ordinary company tax – on most, but not all, offshore oil and gas production. But, says Dr Diane Kraal, a senior lecturer at Monash University’s business school, who specialises in resource taxation, the PRRT raises “almost nothing” because costs incurred during the exploration and construction phases of projects can be expensed against future tax liabilities.

“The credits are carried forward and the whole amount is uplifted annually until such time as there are sufficient petroleum receipts to cover expenditure,” she says.

Without getting too technical, these uplift rates were set extraordinarily generously, so that some projects will never pay any PRRT. Most won’t pay much, and not for long time. Kraal would scrap the whole system and replace it with a new regime of royalties.

Sims says it should at the very least be dramatically overhauled to make it less generous to the miners. “If you fix it up, depending on how you fix it up, there’s many billions of dollars per year to be collected,” he says.

“Many billions” is still loose talk. As with banks, many billions don’t necessarily mean super profits. Can anyone tell me why the share prices of Santos and Woodside are stuck pretty much at their 2005 levels?

The fact that we are dealing with companies which have specialised in dissembling and dishonesty doesn’t help. However, there is a review of the PRRT taking place initiated by the previous government. We should all wait to see what it says and refrain from simplistic opinionated positions until then.

I meant to say that Samantha McColloch, CEO of APPEA, looked like a rabbit caught in the headlights and was clearly uttering untruths.

She hadn’t learnt the basic skill of dealing with the likes of Speers. If you don’t want to answer the question, then just say what you wanted to say in that air space.

Joh Bjelke was taught how to do that by a clever media adviser, and it has been the standard ever since.

The conversation on the crisis and its causes.

Go to the link for more.

We see this problem in a whole range of areas. Our affordable housing crisis has at it roots developers trying to maximize their profits by building houses that are much larger than needed while not building housing for people at the bottom of the pile. And…..

Brian: –

Perhaps investors are judging these companies by their actions, not their aspirations.

Bruce Robertson at IEEFA wrote in Feb 2022 a piece headlined Santos racked up nearly $7bn in unconventional gas and LNG losses in 5 years. Key findings included:

High global gas prices may threaten Australian fossil fuel megaprojects as growth forecasts for the industry are reduced by as much as a third. Permanent demand destruction occurs when the price of a commodity is so high it becomes unaffordable for too many consumers.

Geoff, you say:

Perhaps investors are judging these companies by their actions, not their aspirations.

In general that’s what investors do, Geoff. The fact is that as an investment Santos has been a dog. Here’s a screenshot of their earnings since 2012 from Commsec:

If the company makes a loss it can carry that forward as a tax deduction until the whole is written off. Investors get nothing, the taxpayer gets nothing, but the executives live very well. And presumably the workers get paid and pay tax.

I think the Treasurer and Treasury would understand this stuff pretty well. It’s a pity that many of the commentators, some of whom should know better, don’t.

If when Santos finally gets a return on investment it gets snatched by an arbitrary windfall profits tax, then, yes, there is an issue of sovereign risk.

So I simply don’t know whether Chevron and others actually owe any tax. Investing in NW shelf and the Timor Gap would be quite expensive, I would think.

I’d take a small bet that Shell is making some money out of the Surat Basin gas, simply because, if memory serves, they weren’t there in the beginning and probably bought in at a marked down price.

I’ve just had a look at Origin. They’ve made a bit more along the way, but their share price is also around what it was in 2005, and looks flat but choppy with forecast looking more of the same.

Coal and iron ore is where the money is.

Your second link is good. I like “permanent demand destruction”. I heard today that demand for new rooftop solar in recent months has increased by 700%.

John D, that a seriously good article. I liked this:

The concept of “hegemony” was developed by the Italian intellectual Antonio Gramsci. In the 1920s, Gramsci sought to explain how dominant classes maintained their power beyond the use of force and coercion.

He argued hegemony involved a continuous process of winning the consent of key actors in society such as industrialists, the media, and religious and educational institutions, to form a ruling bloc. Civil society would thus accept the prevailing order, dampening any threat of revolution.

Gramsci’s ideas help us understand the lack of action in response to the climate crisis. In particular, it helps explain the business sector’s inordinate influence on climate policy across the world.

For instance, a range of recent studies have explored the “fossil fuel hegemony” in countries such as Australia, Canada and the US. These studies argue such hegemony comprises a coalition of corporate and political actors with interests aligned around carbon-dependent economic growth. This leads to limited progress on legislation to reduce carbon emissions.

The hegemony has also extended to corporate-political activity seeding doubt about climate science, lobbying against emissions reduction and renewable energy, and the capture of political parties by interests aligned with fossil fuels.

United Nations Secretary-General Antonio Guterres has been blunt in telling us we are committing suicide. I believe he is an engineer, as well as an ex-PM, and politically is said to be a socialist.

The ‘one percent’ are the problem. However, I’ll be surprised if they are overthrown by Extinction Rebellion. Civilising global capital is the mission. We could do with an FDR rather than a second dose of Trump.

Seriously scary news from the far north:

Solar boom set to accelerate as electricity and gas prices soar and payback times shorten

750% increase in rooftop solar inquiries. And looking at making them here.

Matt @crudeoilpeak tweeted yesterday (Nov 8):

It included a graph of Australian monthly diesel imports from Sep 2020 to Aug 2022.

Australia’s diesel consumption cover is averaging at approximately 20 days in-country stocks – see Figure 12 in Matt’s post headlined Only 3-4 years to replace/save 45 % of Australian diesel imports?

The European energy crisis shows us how quickly circumstances can change.

Emilia Terzon, national business reporter for ABC News, presented a video report segment on ABC TV last night titled Volvo won’t sell petrol cars in Australia by 2026. Will Toyota and Ford follow? I think Volvo have the correct approach.

IMO, there’s a growing risk that new ICEVs being sold now may become worthless well before the end of their design lives, due to petroleum fuel supplies required to operate them becoming increasingly scarcer and more unaffordable.

Thanks, Geoff. We need to get on with EVs or we will be left behind.

Meanwhile some links of interest:

Climate change: 460 World Heritage glaciers will be wiped off the map by 2050

‘It was like an apocalyptic movie’: 20 climate photographs that changed the world

Harrop: Putin’s war ‘exploded’ fossil fuels

Before the war, Russia provided 45 percent of Europe’s natural gas. That’s now down to 10 percent.

Andrew Blakers and company at ANU have found that Australia has 300 times more pumped hydro storage potential than we would need for a fully renewable grid.

Now they’ve identified 1,500 new Australian sites with one reservoir already in place, meaning only one new reservoir needs to be built. That is more than enough to support 100% renewables. Existing reservoirs already have a social licence and are usually publicly owned.

None of the sites require damming major rivers. Water usage to replace seepage and evaporation is about three litres per person per day.

Batteries of gravity and water: we found 1,500 new pumped hydro sites next to existing reservoirs

Climate change: 1.5C warming threshold to be passed in 9 years as emissions hit record high

Key Points:

“Global fossil emissions are back to a record high and expected to keep growing before they stabilise

It is an “impossibility” to keep warming within 1.5C without overshoot, scientists say, and we’ll cross 1.5C early next decade

Natural carbon sinks are becoming less efficient at absorbing carbon as warming intensifies.”

CSIRO scientist Pep Canadell, director of the Global Carbon Project and a co-author of the report, says it’s an “impossibility” that we can keep warming within 1.5C by reducing emissions alone.

To do so would require the equivalent drop in emissions we saw under COVID — around 1.4Gt — every single year until we reach zero emissions.

“We are going to cross, early next decade, 1.5C [of warming],” Dr Canadell said.

“Our only chance to stabilise at 1.5C by the end of the century is by then removing a lot of CO2 from the atmosphere. Otherwise we are going to cross it and move well beyond 1.5C.”

However, the technology to do so at scale doesn’t exist.

“Whether we can do it at the scales needed or not, that’s a different matter.”

And natural carbon sinks, which remove CO2 from the atmosphere and sequester it in, for instance, forests or seawater, are becoming less efficient as warming increases, Dr Canadell says.

“[There’s been a] 17 per cent loss of [CO2 absorption] efficiency on land, and 4 per cent loss of efficiency in the ocean. Oceans have a harder time dissolving CO2 when temperatures are higher.

“Tropical forests are already working at their highest efficiency with current temperatures. Increasing temperatures in the tropics are making this less efficient.”

Brian,

I love the Morrison speech themes.

I can’t think of anyone less accomplished in every one of those topics. I can see that I have a lot of catchup reading to do.

Bilb, there is a torrent of reports and such coming at us. It’s one of the main reasons I don’t get much written.

John, they told us COP26 kept 1.5°C alive. Now they are telling us it’s dead and we need drawdowns. Too bad we don’t have the technologies at scale, because many of the fossil fuel capitalists are assuming they can expand their operations with offsets.

Meanwhile we are on the brink of five ‘disastrous’ climate tipping points.

And on the home front Perrottet has hired the “Best and brightest:” Perrottet hires ex-Snowy chief as energy advisor, bats for gas. Matt Kean will be pleased!

We’ve had family full on and I’m very tired.

However, look at this:

World faces ‘terminal’ loss of Arctic sea ice during summers, report warns

State of the Cryosphere Report 2022: Growing Losses, Global Impacts

We face more than loss of the Arctic sea ice:

A huge amount of sea level rise appears to be already locked in due to the rampant burning of fossil fuels, the report states, with sections of the west Antarctic ice sheet potentially collapsing even without any further emissions over the coming centuries, causing more than four metres of additional sea level rise. Greenland’s ice loss has already committed around 30cm to sea level rise.

The UN recently warned there is “no credible pathway” to governments keeping temperatures below an agreed threshold of a 1.5C (2.7F) increase, with 2.5C (4.5F), or possibly more now likely by the end of the century. Such a scenario could raise sea levels by up to 20 metres, although over hundreds of years. Such an outcome would prove “irreversible” on human timescales and pose an existential threat to low-lying countries and coastal communities.

The Conversation: Global carbon emissions at record levels with no signs of shrinking, new data shows. Humanity has a monumental task ahead.

It is not the grandchildren any more. Bloody Hell! If I live as long as my mother I could still be alive when 1.5 deg C is passed!!!

John D: –

Do you think you will still remain vertical in 2026? See the graph from James Hansen & team’s temperature update, dated Sep 22, included in Brian’s comment on Oct 24.

On 9 May 2022, the World Meteorological Organization (WMO) stated:

https://public.wmo.int/en/media/press-release/wmo-update-5050-chance-of-global-temperature-temporarily-reaching-15%C2%B0c-threshold

Do you think you will still remain vertical in 2026?

GM: I am still pretty healthy at the moment and have plenty of experience of living in the hotter parts of Aus. Who knows how I will be in 4 yrs time.

On my Google feed, on a daily basis I get links like these:

Outer Banks homes keep falling into the ocean, and septic tanks causing issues

Another Outer Banks house collapses; sea level rise due to climate change likely to make problems worse

And then this from Egypt:

Cop27 bulletin: Visionless summit flails into week two :

A loss and damage finance facility would be a huge Egyptian gift to the developing world. But, as John Kerry said on Saturday, “that’s just not happening” because the US and others still fear being sued for their historic pollution.

Instead, the rich world is offering a hodge-podge of initiatives like insurance and early warning systems. Some vulnerable countries are working with them on this.

But the sums of money involved pale in comparison to the toll of disasters like Pakistan’s floods. And all these worthy initiatives don’t need a Cop to go ahead.

To the extent that Egypt has outlined a goal, it is to promote “implementation”.

So it’s the coalitions and the side deals in the trade fair bit of Cop that matter to the presidency.

Well, the trade fair is heavy on oil and gas greenwashing.

I understand the fossil fuel reps are up 25% this time, to about 600.

I understand also that a report commissioned by the UN on the adaptation and mitigation needs of the developing countries now amount to 1 to 2 trillion dollars each, apart from ‘loss and damage’.

Things are becoming bizarre.

I seem to be getting less and less optimistic about saving the planet as more and more greenhouse gases rise into what used to be the heavens before they they were bought by the fossil fuel lobby.

Energy crisis puts global climate measures to the test

While world leaders and negotiators are primarily concerned with the future at the UN climate change conference in Sharm el-Sheikh, Egypt, the latest Climate Change Performance Index is taking stock of the current state of global climate protection measures.

The report, released on Monday, is published by environmental NGOs Germanwatch and the New Climate Institute, together with the global Climate Action Network. It assesses the climate protection measures of the European Unionand 60 other countries, which together are responsible for more than 90% of the world’s greenhouse gas emissions.

Here’s what they found:

As in previous years, the first three places in the ranking remain empty — no single country is doing enough to meet the Paris climate protection targets agreed in 2015 to limit global warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit), compared to pre-industrial times.

Australia’s policy has improved to poor from very poor, so we are still only ahead of Canada and Russia.

See Today is the Day of Eight Billion, according to the United Nations.

Economist Steve Keen was interviewed on ABC TV’s The Business, saying the planet cannot sustain 8 billion people. Interesting comments include (from time interval 0:00:39):

“The simplest thing is they ignore the role of energy in production. They simply think you can wack workers and machines inside a factory and goods will come out the other end. My little insight was that, ah, a worker without energy is a corpse; a machine without energy is a sculpture. If you want a worker work and the machine turn you’ve got to give them both energy – now food for the human and oil for the machine, fundamentally. And they ignore that – they just leave it out. Now once you take it into account, if there’s a fall in energy availability there’ll be a fall in GDP, and it’s virtually one-for-one. And when they put their stuff into the model, and they do include energy their way, they say oh, 10 per cent fall in energy, maybe one per cent fall in GDP. They are so fundamentally wrong that when it comes to an energy crunch, the real world will tell us the economists have got it wrong and it will be too late for us to do anything.”

Plain speaking!

Geoff: “They simply think you can wack workers and machines inside a factory and goods will come out the other end. My little insight was that, ah, a worker without energy is a corpse; a machine without energy is a sculpture. ” is a bit glib even if it catches the way some people think.

There are lots of things we can do to reduce the energy and other resources needed and, while I think population control is desirable we could support a lot of healthy people by doing things like changing diets, food production methods and reducing waste. We could also reduce the damage caused by production by choosing less destructive goods and processes and not producing goods that have little effect on the quality of life.

Shutting down the advertising industry might be a good start.

When I went to the LEAN national conference in Sydney in September 2019 one of my abiding memories was hearing from one of the representatives who had studied paleo-biology as part of her university studies.

The standard expectation is that when a species reaches plague proportions there is a population crash where the population reduces by 95%.

COP27 works on UN voting principles, where complete consensus is required. Why anyone would have expectations that they would cope with an existential threat like global heating (AKA climate change) beats me.

New from the CSIRO:

Climate change will clearly disrupt El Niño and La Niña this decade – 40 years earlier than we thought

ENSO will be in one of three positions – El Niño and La Niña or neutral. Apart from El Niño and La Niña being stronger when in phase, I gather the neutral position is going to occur less frequently.

This is not good for farming/ food production.

Just in, now we have this:

City of Gold Coast mapping shows additional 88,000 properties at risk of flooding

That makes about half the properties on the Gold Coast.

Our insurance is going up by 25% this year.

Brian: Why is your insurance going up by 25%? You are well clear of flood zones. Not so sure about fire. but Mt Coutha has regular fire risk reduction fires.

I don’t know, John, but they don’t do it house by house. It is supposed to relate to claims “in your area”. Many houses were tested. In the three days of the big wet our house developed a wee drip near the middle, caused by how the solar panels were attached to the roof. Our plumber fixed it (we hope) from below by crawling up though the manhole.

I don’t know the boundaries of ‘our area’ but we have a creek down the bottom of the hill that puts on a pretty good flood in heavy downpours. We are probably paying for them.

I’ve done a quick post on COP27.

A graph of OPEC’s crude oil production 1960-2021 tweeted today @crudeoilpeak indicates production peaked in 2016, at least three years before COVID-19 emerged.

https://twitter.com/smh/status/1594876630148734976

Where’s the additional & sufficient kb/d of oil & petroleum fuel production coming from to offset Russia’s oil/petroleum fuel supply decline?

Not Asia – already peaked in 2010-15, and now declining.

https://crudeoilpeak.info/asia-peak-oil-update-nov-2021

Canada? It seems Canada may still have room for further growth in crude oil production, but for how much longer?

Set & see the 10-year graph at: https://tradingeconomics.com/canada/crude-oil-production

The world is fast running out of pre-peak oil producing countries/regions, while the number of post-peak oil producing countries/regions is increasing.

Thanks, Geoff.

Look what I found today – Energy requirements and carbon emissions for a low-carbon energy transition:

Achieving the Paris Agreement will require massive deployment of low-carbon energy. However, constructing, operating, and maintaining a low-carbon energy system will itself require energy, with much of it derived from fossil fuels. This raises the concern that the transition may consume much of the energy available to society, and be a source of considerable emissions. Here we calculate the energy requirements and emissions associated with the global energy system in fourteen mitigation pathways compatible with 1.5 °C of warming. We find that the initial push for a transition is likely to cause a 10–34% decline in net energy available to society. Moreover, we find that the carbon emissions associated with the transition to a low-carbon energy system are substantial, ranging from 70 to 395 GtCO2 (with a cross-scenario average of 195 GtCO2). The share of carbon emissions for the energy system will increase from 10% today to 27% in 2050, and in some cases may take up all remaining emissions available to society under 1.5 °C pathways.

They are keen on the concept of energy return on energy invested (EROI) which seems to have been overlooked at least to some degree.

Thanks Brian,

But why are people still talking about “pathways compatible with 1.5 °C of warming“? The Earth System is already locked-in to breaching the +1.5 °C warming threshold. We could be seeing the first breach as early as 2024, if James Hansen & team’s warming prediction coupled with a strong El Niño emerges in 2023-24.

Meanwhile, the Australian BoM has published their State of the Climate Report 2022 today.

Kohler is saying that:

See it in broader article

BTW he doesn’t seem to realize that liquid hydrogen can be shipped using similar tech to LNG shipment and ammonia can be used as fuel without splitting it into nitrogen and hydrogen.

On the Victorian election seems Labor’s demise was announced prematurely by some of the pundits, although most said it was too close to call.

In the event it looks like a comfortable victory.

Newspoll called it 54.5 to 45.5 TPP, with Labor on 38%, the Coalition on 35% and the Greens on 12%. In fact it turned out on counting so far Labor 37%, Coalition 33.8% and Greens 11.1%.

The Greens have claimed a ‘greenslide’. Their vote overall increased by 0.4%, but that is not what matters. Success comes seat by seat, so they have increased their seats from 3 to five, and are said to be competitive in three more.

I don’t know anything about Victorian Greens, so no comment from me.

On the Coalition, I did hear that many branches have been taken over by Christian fundies, which is definitely not good for democracy.

I can find only one Green gain – Richmond.

This piece by Lucy Hamilton on Victorian Elections: Liberals under siege from extremist religious groups is plain scary.

Great article by Richard Dennis:

Privatisation has failed. Australia needs to ditch the ‘incentives’ rhetoric and simply spend money on things we need

It seems Dan Andrews is going to go big on the state taking back functions that have been privatised.

I don’t think the public anywhere in Australia has ever favoured privatisation.

There has been a lot happening on climate, on policy and around this place.

I’ll say, without a doubt, that the service and treatment at the Royal Brisbane Hospital is better than I ever thought it could be.

For our family it has been on several occasions now the difference between life and death.

That said, every day I hear, see and read multiple things I’d like to share, but it has not been happening. One pearler this week was listening to Niki Savva’s brutal assessment of Scott Morrison:

Niki Savva has seen ten prime ministers move in and out of the lodge during her decades as a political reporter in Canberra. She also served inside government, as Peter Costello’s press secretary during the John Howard years.

But one of those leaders stood out to her from the rest for myriad reasons.

Prime Minister Scott Morrison – simply the worst, by a fair margin!

I’m still inclined to think It’s all John Howard’s fault.

Getting rid of the one vote above the line for the upper house would be a good move. It was a system badly rorted for the senate vote. I also seem to remember senate preference negotiations included preference allocation for local government.

Energy finance analyst Bruce Robertson and Bloomberg Energy Writer David Fickling joined RN Breakfast earlier this morning (Dec 13) with PK to discuss this year of energy market chaos.

Geoff, that was brilliant. However, I have a couple of queries.

First, the statement that there is plenty of gas, eight years in reserve etc, does not sit well with AEMO’s warnings that there could be shortages in 2024.

Second, there was talk of gas being available at $3 per Gj. I think this must have been traditional gas from Bass straight etc, which is running out. I do have doubts that new coal seam or shale gas gas from north of the Qld border could be supplied to Sydney and Melbourne at less than $7 per Gj.

Almost inevitably there is cherry picking of facts. I’ve been a direct share investor for 30 years and although I don’t invest in mining stocks I do see some reports from time to time. It’s true that coal companies, such as Whitehaven, are showing ROE (return on equity) stats of 50%, which is ridiculous. However, listed gas companies do not do so well.

For Woodside the ROE has been in single figures or negative in 6 of the last 9 years. The negative year was -33%.

For Santos the forecast 4-year average from an actual 9.1% in 2021 is 12. I understand 12 is considered a pass mark in the industry. Origin has a 2022 actual of 4.1%, with subsequent years in single figures until 12.3 in 2025.

The above indicates why a super profits tax would not yield anything significant for gas. In the case of coal, Queensland has already done it by grabbing a share through upping royalties as the price elevates to stratospheric levels. The recent Qld mid-year budget report indicated $5 billion this year, and $27 billion over a 5-year period, which the treasurer says is 100% being invested in regional developments. Qld already has a $175 payment to reduce consumer electricity bills, sourced from public ownership of poles and wires.

What international companies are making for notoriously paying no tax is another matter.Tim Buckley reckons they are making a mozza in Fossil fuel majors are reaping obscene profits: A simple levy could protect Australians from hyperinflation.

Brian: – “First, the statement that there is plenty of gas, eight years in reserve etc, does not sit well with AEMO’s warnings that there could be shortages in 2024.”

Per Australian Energy Statistics 2022 Energy Update, Figure 3: Australian natural gas flows, petajoules, 2020–21:

Production:

– Coal Seam Gas: _ _ _ _1,510 PJ

– Conventional gas: _ _4,220 PJ

JEDA Imports: _ _ _ _ _ _ _208 PJ

Stocks & disc.: _ _ _ _ _ _ _ _55 PJ

Consumption:

– LNG Plants: _ _ _ _ _ _4,747 PJ

– – – LNG exports: _ _ _4,314 PJ

– – – LNG plant use: _ _ _433 PJ

Domestic economy: 1,136 PJ

Gas power plants: _ 393 PJ

Manufacturing: _ _ _408 PJ

Residential: _ _ _ _ _ _165 PJ

Mining (excl. LNG): _ _69 PJ

Other: _ _ _ _ _ _ _ _ _ _103 PJ

https://www.energy.gov.au/sites/default/files/Australian%20Energy%20Statistics%202022%20Energy%20Update%20Report.pdf

LNG exports take the lion’s share of Australia’s gas production. Data indicates there is currently no gas shortage. I’d suggest the gas cartel chooses to prioritise LNG exports over Australia’s domestic supply unless we pay international prices. There is no gas supply crisis – there is a domestic gas price crisis.

Brian: – “Second, there was talk of gas being available at $3 per Gj. I think this must have been traditional gas from Bass straight etc, which is running out.”

At the 29 Nov 2022 National Press Club Address, with the Minister for Industry & Science, Ed Husic MP, ABC’s political editor Andrew Probyn said that Origin Energy told its shareholders that its gas production breaks even at $3.50/GJ, and yet a NSW steelmaker was offered $35/GJ for 12 months supply of gas. He asked Ed Husic, was a domestic supply gas price cap at $10/GJ fair? See from about 43 minutes.

https://www.youtube.com/watch?v=wvyUnY0q7BI

Bruce Robertson’s IEEFA report titled What’s a fair price for domestic gas? $12 per gigajoule is too high, published 7 Dec 2022, includes Figure 1: Annual Consumption of Gas on the East Coast of Australia, 2021, showing:

Total East Coast Consumption: _ _ _ 1,960 PJ

– – – – – LNG exports: _ _ _ _ _ _ _ _ _ _ _ _1,407 PJ (72%)

– – – – – East Coast Domestic: _ _ _ _ _ _ _553 PJ (28%)

Residential & Commercial: _ _ _ _ _ _ _ _196 PJ

Industrial: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 258 PJ

Gas powered generation: _ _ _ _ _ _ _ _ _ _ 98 PJ

The report includes:

Table 2: Eastern Australian gas reserves, shows (I’ve included my calculated R/P based on 1,960 PJ production rate):

2P Developed Reserves: _ _ 16,432 PJ (R/P = 8.4 years)

2P Undeveloped Reserves: _15,810 PJ (R/P = 8.0 years)

2C Resources: _ _ _ _ _ _ _ _ _ _58,516 PJ (R/P = 29.9 years)

Nevertheless, we need to get off gas ASAP.

Where I would readily agree is that we need to get out of gas ASAP and that the major gas companies act as though they are in a cartel. Cartels need to be either broken up or regulated.

Geoff, I have some problems with Bruce Robertson’s paper.

First, if there is so much gas around, why does AEMO still express concern over short supply later in this decade?

Why does Twiggy Forrest’s Squadron Energy still want to go still want to go ahead with a gas import terminal?

Why do we have the Senex $1 billion joint venture development (Surat Basin, western edge, I think) including Gina Rinehart the sole purpose of which is to provide domestic gas exclusively? Why Narrabri, why exploration off-shore in Victoria and onshore in SA?

On $4.5/GJ for Surat and Bowen basin gas, my question is where? Is that well-head, Gladstone, Wallumbilla. Moomba or Sydney? Add $2 and $4.55 doesn’t look so smart. The notes to the table say ” Production costs are the marginal cost of producing a GJ of sales gas to the point of sale into a transmission pipeline (inlet flange) and thus exclude transport costs.”

It is also clear that “return on equity” means all costs of production, but not profit.

Why does he mention that China is using Qld gas for making fertilizer, but not Incitec, which before Ukraine was a thing relocated fertilizer to Texas because they could not get gas supplies in Qld within 300km of their facility.

I did hear a few weeks ago the Narrabri at $13/GJ would not be viable. Well good!

Santos and co are complaining that before embarking on new ventures they would have to negotiate and sign an agreement with the government to guard against future arbitrary interference.

Well good! The agreement should include the employment of proper offsets for Scope 1 and Scope 2 emissions, plus an indication that Scope 3 emissions, where the gas is burnt, is also done within conditions that won’t cook the planet.

Offsets should be molecule for molecule and immediate, not trees which may or may not grow and have a fair chance of burning.

The AFR has masses of articles on the gas issue, especially in relation to electricity prices and the use of gas as an industrial feedstock. Angela Macdonald-Smith is a senior writer who is my kind of journalist. Just reports what is happening and what people are saying without ideology or opinion.

Immediately after the legislation was passed, she reported Wholesale power prices down 50pc:

The gas industry has reacted as though the price cap was arbitrary, unexpected (what rock were they under?) and smashing the market system as we know it with references to Venezuala and Russia. Santos said the every CEO of a business should be concerned, because if politicians happened not to like the price a business was charging then they could intervene and change it. It’s pay-walled but see ‘Draconian, reckless, vandalism’: Gas fights for its future:

Others are warning that no sector of the economy is safe given what has happened in gas.

“Every business owner in Australia should be alarmed at what the federal government has done today,” Santos’ Gallagher said on Thursday. “If it doesn’t like your business, your profits or the prices you charge for your products and services, it will regulate you.”

Elsewhere the CEO of Incitec-Pivot said that high gas prices could see the hollowing out of our industrial base. Today Macdonald-Smith reports Gas buyers await better offers after intervention bill:

… the Energy Users’ Association of Australia, which represents large industrial power and gas users, voiced support for the price cap, telling the government it represents “a measured response to balance the needs of consumers and producers”. The association’s members employ more than 1 million Australians.

Along the way Wesfarmers CEO called for a multi-decade transition plan to introduce clean energy. He and the rest of them seem to be unaware of work being done to have 82% renewable energy by 2030. AEMO has just produced a roadmap which says that we can reach a point by 2025 where for substantial periods the NEM could run for hours and days at 100% renewables. See AEMO’s Engineering Roadmap to 100% Renewables December 2022 and Giles Parkinson “Unparalleled in world:” AEMO maps route to “hours and days” of 100 pct renewables.

This is world-leading stuff, but some CEOs can’t see what is happening under their nose.