That’s from an article by Simon Ings in the New Scientist – Why using rare metals to clean up the planet is no cheap fix, about a book by French journalist and filmmaker Guillaume Pitron now translated as The Rare Metals War: the dark side of clean energy and digital technologies.

Oliver Balch in Literary Review reviews the book also along with Wars of the Interior by Joseph Zárate, translated from Spanish.

From Ings:

- Before the Renaissance, humans had found uses for seven metals. During the industrial revolution, this increased to a mere dozen. Today, we have found uses for all 90-odd of them, and some are very rare. Neodymium and gallium, for instance, are found in iron ore, but there is 1200 times less neodymium and up to 2650 times less gallium [on the planet] than there is iron.

To get one solitary kilogram of lutetium you need to crush, extract and refine it from 1,200 tonnes of rock.

Seventeen of those 90 minerals are the concern of Pitron in relation to ‘clean’ energy and digital technologies.

Rare earth metals are toxic to mine and toxic to refine. In China:

- 10 per cent of its arable land is contaminated by heavy metals, 80 per cent of its groundwater isn’t fit for consumption and air pollution contributes to around 1.6 million deaths a year there, according to Pitron

The Lancet says 1.24 million deaths in China a year, so, whichever, it’s a lot.

Presumably air pollution goes well beyond rare earth metals, but in Inner Mongolia Pitron:

- visits the Weikuang Dam, which holds back ‘10 square kilometres of toxic effluent’. Cancer, strokes, heart conditions: the health effects on the local population are ghastly. In one nearby village, locals talk of children growing up with no teeth.

There are concerns about how much power is used in metal extraction. In the case of cobalt, the concerns also go to child labour exploitation amounting to slavery. See:

- Children mining cobalt in slave-like conditions as global demand for battery material surges

- When subterranean slavery supports sustainability transitions? power, patriarchy, and child labor in artisanal Congolese cobalt mining

- Elon Musk’s worst nightmare: child labor and cobalt supply

- Dirty Rare Metals: Digging Deeper into the Energy Transition

Those are from 2017-18, the last one is by Pitron. However, I have heard of this concern on ABC Radio National as recently as the last two weeks.

A UNICEF estimate made in 2014 found that 40,000 children were toiling illegally in Congolese mines. That is thought to be a significant underestimate.

Andrew Forrest in his Boyer Lectures Rebooting Australia — How ethical entrepreneurs can help shape a better future addressed the problem of labour exploitation in supply chains in his third lecture, The economics of inequality. In the first lecture he expressed a clear preference for hydrogen over batteries for cleaning up transport. From memory his reasoning was that batteries are made from elements which are rare, whereas hydrogen is plentiful. Forrest thought that if we make a paradigm shift in transport technology we should be looking at long term sustainability.

China currently produces the vast of rare earth metals, said to be 95%, but it was not always so. KIRKUS Reviews tells the tale:

-

During most of the 20th century, American rare metal mines led the world but produced immense chemical and radioactive pollution. The mines were in constant trouble with the EPA. Then, in the 1990s, China offered to sell ore cheaply (actually at a loss). Because American entrepreneurs realized that Chinese labor was cheap and skilled and not subject to environmental regulation, over time, large numbers of high-tech firms moved operations across the Pacific. China once sold Apple the rare metals that make up the iPhone; today, it manufactures the device. China leads the world in renewable technology production—solar panels, wind turbines, electric-vehicle batteries, etc. This not only requires mining, which is not renewable, but leads to massive pollution. Furthermore, experts calculate that the mining, manufacturing, fueling, and operation of clean energy products generates more, not less, greenhouse gas. “Put simply,” writes the author, “clean energy is a dirty affair. Yet we feign ignorance because we refuse to take stock of the end-to-end production cycle of wind turbines and solar panels.”

The statement ‘experts calculate that the mining, manufacturing, fueling, and operation of clean energy products generates more, not less, greenhouse gas’ demands scrutiny. So far the story I keep coming up with is along the lines of this article:

- The mining industry is responsible for 4-7% of global greenhouse gas emissions – 1% of these are from Scope 1 and 2 emissions, caused directly by mining operations or indirectly through, for example, electricity consumption used to power mines; the remaining 3-6% coming from fugitive methane emissions.

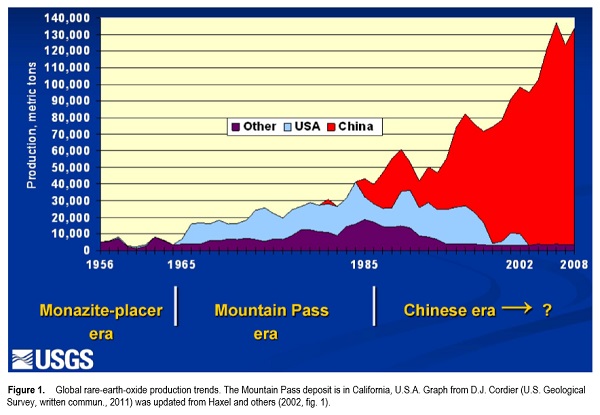

From Wikipedia here is a graph showing the historical trend of global production to 2008:

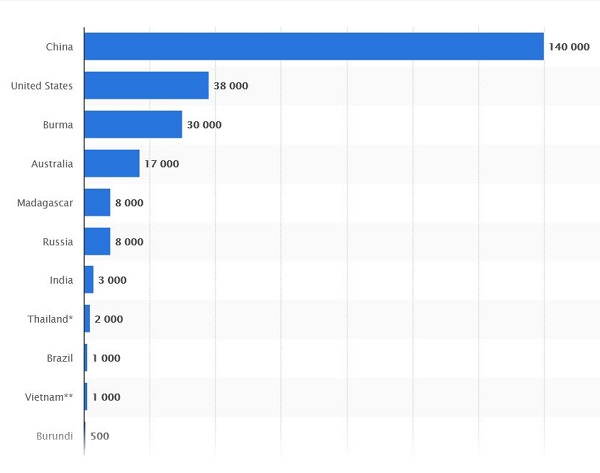

According to Statista, China has around 35% of the world’s rare earth reserves, but still dominates production:

In 2010 China weaponised its near monopoly of rare earth production to cut off supplies to Japan. Given recent problems with China, the Quad looks to Australia for rare earth elements usually supplied by China.

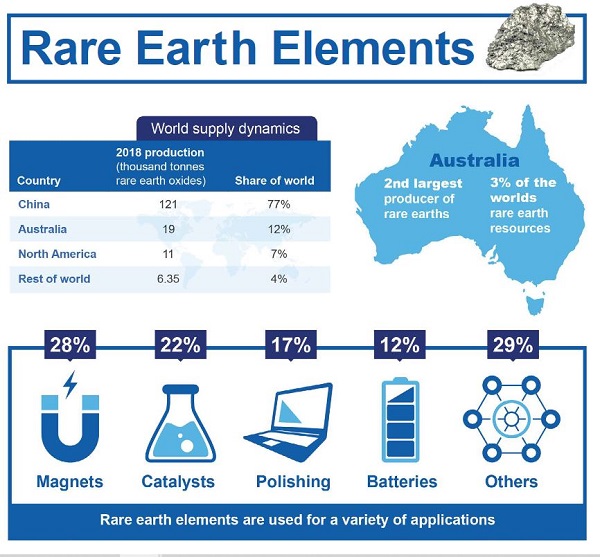

Australia has significant resources in rare earths and Lynas Corporation is apparently the world’s only big, vertically integrated supplier of rare earths outside of China. Currently the metals are sent to Malaysia for processing.

This image from the Chief Economist’s site in 2019 sums up Australia’s situation:

Recently, addressing the National Press Club, Australia’s new Chief Scientist, Dr Cathy Foley was asked about the issue of Australia having to export rare earths to Malaysia for processing. She said in effect, ‘Watch this space’. Apparently leading edge science is happening in Australia which should make the whole process cleaner and more sustainable.

As a disclaimer, I’m well outside my area of expertise in attempting this article, so if major corrections are needed I will not be surprised. However, I’ll leave with a link to Scott Stephens and Waleed Aly’s latest episode of The Minefield – Does climate change challenge our concept of moral responsibility?

Turgid as usual, but well worthwhile when Dr Danielle Celermajer, Professor of Sociology and Social Policy at the University of Sydney, and the author of Summertime: Reflections on a Vanishing Future appears later in the program. It’s about individual and collective responsibility to a sustainable planet, having participated in and benefitted from actions that have brought the whole life earth system close to destruction.

She wasn’t looking for pat solutions, like ‘Become a vegetarian!’. She was home on acreage when she took the call. When the conversation was punctuated by a the distraction of a kookaburra eating a worm, that seemed to add meaning.

This started out as an item on a new Climate clippings, but it got away a bit.

Brian: When I graduated BHP was looking at rare earths as an additive to steel. So the very young John D was asked to look at the production of rare earths from the monazite that was a byproduct of mineral sand mining. Gave me an excuse to look at the growing number of uses rare earths were being put as well as Thorium cycle nuclear power. (Thorium would be a byproduct of producing rare earths from monazite.)

My take is that rare earth mining doesn’t have to be done by slave labor and there are alternatives to appalling mining conditions.

There are also alternatives to the current ways that renewable energy etc. can be produced in ways that reduce dependence on particular resources.

Think about it.

The biomass of all vertebrates on earth (anything with a spine)

59% livestock for human consumption (or use)

36% humans

5% everything else

Does it really matter how miserable human lives are?

I’m pretty sure that is the Republican/Libertarian take on it is, as long as the “best” ones live in comfort.

Just saying.

By chance I have this link up in google

https://m.magnetzb.com/

Along the way I saw a graph and then lost it which shows how minuscule mining of rare earths was in the context of mining. So I’m not convinced about how much energy it takes.

Everything else on the downside is worth thinking about, though.

Bilb, you are reminding us that homo sapiens is a plague and pestilence upon the earth.

It’s more than that, Brian. Humans are effectively a necrotizing fasciitis of the Earth’s Biosphere https://en.m.wikipedia.org/wiki/Necrotizing_fasciitis

….. when an area is infected with humans we kill the surrounding biosphere, and our infection spreads.

For some hundreds of thousands of years the biosphere could kill the infection with periodic climate change and heal the infected area. Now, however, humans have become climate change resistant are in the process of killing the very biosphere that sustains us.

Australia is a classic case of a small infection severely damaging a whole organ of the biosphere. The devastation that the British infection wreaked on the Australian continent with complete indifference and miss understanding of this country’s delicate biome has been tragic. Many areas have completely lost their biological covering right down to the bones of te country with only desolation left behind.

The worst outcome has now occurred and the infection has given rise to a super bug, persistent neoliberalism with intensive corporate feedback.

5% of the wild natural world remains.

That has got to be jarring to anyone who is not an Australian Liberal.

Well spoken, bilb.

Many years ago I recall someone ringing up on the radio, saying that in 50 million years homo sapiens would be noted by a layer of toxic nuclear sludge in the geological record.

In September 2019 at the national LEAN conference I met a woman who had studied paleobiology. She said we were probably following the pattern of any species that reaches plague numbers. On that basis there would be a population crash of 95% by the end of the century.

Bilb: Yep1: the growing human plague: “Particularly over the course of the 20th century: Over the last 100 years global population more than quadrupled. Population growth is still fast: Every year 140 million are born and 58 million die – the difference is the number of people that we add to the world population in a year: 82 million.

I can remember being taught that the Aus population was 6.3m.

Yep2: The growing footprint per person and the long term damage of things we have done in the past.

In Aus it doesn’t help to have CEO’s pushing for growing population to make it easier for them to produce growing profits.

Brian: “In September 2019 at the national LEAN conference I met a woman who had studied paleobiology. She said we were probably following the pattern of any species that reaches plague numbers. On that basis there would be a population crash of 95% by the end of the century.”

A key difference between humans and other species is that, at least in theory, humans can analyze the whole world pattern and come up with and implement solutions to identified problems.

One of the problems is that humans are becoming more and more able to fix problems that, in the past, would have slowed down the growth of local/world populations. Think better medicine, the ability to transport food to areas suffering from drought etc.

For example, in the past, covid might have driven a big reduction in world population reduction. But now our medical abilities and world cooperation are going to limit the impact of covid.

The Chinese one child policy is an indication of what could be done by a determined government. However, a two child policy might be a more durable approach.

We could also do things to reduce individual impact on the environment. But perhaps we need an economics that does not mean a shrinking economy makes lots of people worse off.

we need an economics that does not mean a shrinking economy makes lots of people worse off.

Indeed, John. We keep being told that if we are going to solve the climate/ecological sustainability issue we need to solve inequality and need a new economics.

I’m not clear about what that looks like. However, the comment has been made that Biden is implementing redistributive economic policies which would scare the horses if they came from Bernie Sanders or Elizabeth Warren. There was a opinion piece to that effect recently in the AFR. I’ll see whether I can dig it out.

Brian, I’ve been putting forward a pathway to a new economics of property ownership with the capital growth restrained property title concept, but you guys just refuse to demonstrate any inquisitiveness at all.

It really amazes me.

Sure, we are all smugly comfortable with our Boomer Property Holdings and no debt, but that is not true for 40% of Australians (guessing), and Labor have zero solutions. Labor have zero solutions, but worse, have developed a blindness to the situation which functionally alienates the under 30 year olds, the demographic Labor desperately needs to become government. Labor have deluded themselves into thinking that their standard platform of Health, Education, and Workers Rights/Working Conditions demonstrates a level of empathy not available from the Liberals, and there fore all young people will vote Labor.

Frankly what I see is a smug elitism even in labor where there is an unspoken desire to keep young people out of property ownership thereby increasing rental demand so the negatively geared property holders can keep their rents being paid to perpetuate and secure the property wealth industry, an industry in which politicians are as a professional group are the most energetic participants.

There are other pathways to new economic realities only one of which is eventually healthy. The obvious ones are based on crime, corruption, and political/economic collapse. The only positive outcome of these is where displaced communities of people create shanty towns or refugee camps, and generate their own internal economics based on common need. Mexico has a number of these.

Capital Growth Restrained Property titles are the only pathway I can see to a permanent and growing social housing structure that is not government financing dependent. I am happy to discuss this. Or support any one else’s solution that offers a completely different property price reality.

Here in the Netherlands they have a type of property ownership that is intended to keep green land green. I got quite excited about it recently, but it doesn’t exactly fit, but still very interesting. This is for land planted out as forest land. Under a title that I don’t know much about, land can be subdivided and sold off in allotments, but the land cannot be built on and must retain at least 50%. The attraction of investing in this is that the land is exempt from property tax. In the Netherlands at present one cannot earn any interest on bank deposits, and for accounts over Euro 240,000 the account holder pays the bank (negative interest) to hold the funds. The land earns a solid 3% per year and on that basis is a good investment, relatively. The land was priced at Euro1.49 per square meter making a hectare quite affordable. A subdivision can be created for around Euro 600.

On the Dark, and Needy Side …

https://apple.news/AazybguKdRD6B1ZPSM2gDig

I don’t have to try hard to legitimize the need fro social housing.

But, hey, we can ignore. It’s not about us, right?

bilb, I’m interested. None of my kids has a stake in the roof over their head. I cut grass for a bloke who owns half the house he lives in, but starved himself to feed his cat.

Right now I feel a bit like Baron von Münchhausen who in one story jumped on his horse and rode off madly in all directions. (Our German teacher used to read us Münchhausen stories on the last day of term.) About five times a day I get the urge to post something which is interesting and important.

I didn’t know about the concept of ‘hot-bedding’ but I’m not surprised. Last week the government moved to preserve wage theft as a new report finds agricultural workers working for as little as $1.25 per hour.

I found a site, Capital Growth Restrained Property Titles (CGRPT’s) for Affordable Accommodation which does an excellent job of explaining the concept.

It’s clearly Australian from the phone contact number. I clicked on the pdf and scrolled down. I suspect you know the bloke behind it really well!

I’ll put it in the queue. Seems like a simple concept Labor could latch onto.

I tried to post this comment last night, but Telstra was doing work on the system.

During the last few days we’ve had 238mm of rain, that’s about 9 .5 inches on the old scale. Bottom line is hat the sun is shining now, but I won’t have time to scratch myself for the next month or so.

Bilb: I have never had to hot bed but I have spent time in some of the grottier accommodation supplied at various construction and mining camps. Grotty could mean things like sagging beds, cramped quarters and coal trains stopping and starting at night.

Yep, I preferred living in our home in Brisbane but I got used to dongas and got to a point where I could sleep through the coal train stops and starts.

I suspect that the people hot bedding got used to it and found it acceptable because it fitted in with their budget. I guess the question is “were they being ripped off?” The positives in the surveys suggest that most of the hot beds systems were OK.

I am interested in affordable housing policy. One of the problems I sometime see is middle class people advocating more expensive options than needed because they felt a variety of things they could afford were “essentials.”

Thanks for those positive comments, Brian. Of all of the people I know, you do the most.

Yes, please make this a discussion soon. I am happy to write up the thread as best I can.

It is something Labor could implement with ease, I even had a discussion with Wayne Swan, but got an “I’m really busy right now with restructuring”, but this initiative costs the government nothing at all. More valuably it makes money spent on supporting first home buyers who participate a once up permanent investment that becomes available to later first home buyers.

bilb, I have in mind raising it in our local ALP branch, and trying to get someone I know to push it in another branch.

A post would be helpful. If you could have a crack at something about 6-900 words and send it to me in a Word file. For links just put the link in the text next to the highlighted link words.

If you don’t mind I could edit, add and change and send it back to you to check and make suggestions etc.

You can send me images like graphs and stuff for inclusion, or just link to where they are, and I’ll fix them so they look OK.

No hurry, and if you’d rather not or want to stay anonymous and just link to the site we can sort that too.

From Forbes, via Lethal Heating – Does Solving The Climate Crisis Require Antiracist Feminist Leadership?

Diversity matters in climate and energy policy because for too long, concerns of vulnerable communities have been minimized and dismissed while white-male-dominated-fossil-fuel interests have profited from exploiting marginalized people. Without diverse leadership, the United States has invested in concentrating wealth and power by supporting the “polluter elite” rather than investing in the basic needs of people and communities.

Research shows us that when women, people of color, and indigenous folks show up in leadership spaces where they have been historically excluded, they bring with them different lived experiences and different perceptions of risk that lead to more socially just outcomes. Research also shows that more diverse teams, more diverse organizations, and more diverse sectors are more innovative.

For the transformative changes that are needed to effectively respond to the climate crisis and equitable transition to a renewable-based future, diverse leadership is essential.

Bilb: CGRPT is an interesting concept. However, if it is run in parallel with the existing system it is not all that workable for people who have to move. (Unless they can always be sure of having instant access to CGRPT housing whenever they move.)

For example, the John D’s have moved over 8 times during our married life. All of the job driven moves were the result of new jobs being hundreds of km from where we lived. (Three of these moves were into employer provided accommodation.)

What we did for the 19 yrs living in company provided accommodation was retain the houses we had bought as a housing inflation hedge so that we would be able to pay for a new big city home when we stopped living on mine sites.

We never went back to the cities where we owned homes but we had to sell homes to pay for the new home in the new city.

Keeping a CPRG house might have worked if we ended up moving back to where the CPRG house was or a place where there were plenty of empty CPRG homes. However, our strategy would not have worked if we had been forced to buy a non-CPRG house financed by the sale of a CPRG house.

Having said all that some housing problems would be reduced by a good supply of low cost basic housing that can be used to provide everyone with a low cost alternative to housing as a speculative investment.

It’s nonsense, unless you want housing investment to plummet and government to step in increasingly tax and spend us into communism.

Show me an example of this not being a rerun failure anywhere on Earth at any time in history.

No it’s not.

You’re wrong.

Jumpy: The current system is good for old codgers like me because the growth in house prices makes me richer at the expense of those struggling to find affordable accommodation. Don’t think it is good for me is always what is good for the country.

Post WWII the government was scared of communism. the government response were policies that gave very low unemployment and more Australians to have a chance to own their own home.

Your lack of concern for those near the bottom of the pile are the very thing that creates revolutions.

Show me an example of this not being a rerun failure anywhere on Earth at any time in history.

With due respect, if it’s a new, untried idea, that demand is irrelevant.

John, it seems to me the scheme isn’t intended to meet the needs of upwardly mobile middle class professionals.

At present it’s quite difficult for even middle class professionals to break into the market, so for them it could provide an entry into home ownership.

John D, thanks for taking an interest.

CGRP’s are for people on low incomes. They are not for everyone. Although the entry cost is low, they will never be a capital investment as their value will track the Consumer Price Index, not the property market, so that is the choice. Do you buy a low cost property you can afford to buy and maintain using that period of your life to save more money? or do you keep paying very high rents and never accrue any capital at all?

When you sell a CGRP you will get back the money value that you paid for it ie inflation adjusted value, and that money can be the deposit for a market value house for those whose employment situations have improved.

The people who will build the greatest number of CGRP’s will be the end of life downsizes. These are people who have had modest incomes their whole life but have little savings but own a property with an inflated market value. These people can have a CGRP built for them, move in and bank the difference. They still have a freehold house but sufficient money to see out their days. These people will be doing the community a service by creating Social Housing which they will occupy for a relatively short time before its becoming available for others to use.

This is how, JohnD, your location mobility is resolved in time as more properties of this type are built in all areas where there is a need.

Brian,

“ so for them it could provide an entry into home ownership.”

That is exactly right.

The other thing a CGRP achieves is make affordable properties in more areas nearer to city centers where low wage work is available but not affordable accommodation. Low income people are forced to live in outer areas and travel costing time that should be spent having a reasonable quality of life.

Such people also are forced to use older less efficient fossil fuel vehicles which in the near future will be ever less environmentally acceptable, so having affordable accommodation in more central areas is to everyone’s advantage from wage pressure and sustainable communities perspectives.

CGRP’s can be commercial properties as well. Having a proportion of owner occupier shops in small community centers enables for a broader variety of businesses to survive providing greater commercial service to communities. The corner store and town square will become viable again, reducing trip times for casual grocery needs.

Bilb: Most of the workers who live in mining towns are trade people and unskilled workers. They could have similar problems to me when they move away from mining towns.

FIFO solves some of these problems and makes CGPP’s more practical but FIFO is hardly something I would want to impose on families.

In places as large as Sydney people may still want to move if they get a job at the other side of the city. Same problems as moving between cities.

Our last move has been to a retirement village combined with intensive care capacity. The capital cost of moving there was similar to the capital cost of buying a new home. Someone would have been unable to buy into this village if all they had to offer was a CGRP house.

I think that it makes more sense to focus on secure, affordable housing. This implies investment in something like “Just for Rent” accommodation where a renter cannot be forced to move as long as they are paying the rent and taking reasonable care of the property. Not quite the same but rentals where renters must be given say at least one yr notice of rent increases or requirement to vacate. (One yr means no renter will have to move during a school yr. Renters could move on much shortage notice.)

Co-op housing is also growing in Australia. https://thefifthestate.com.au/innovation/residential-2/whats-the-big-driver-for-co-op-housing-we-askand-find-many-answers/

It has some attractions.

My take is that the lack of secure, affordable housing is a serious problem for a lot of Australians and we should be looking for innovative ways of solving this problem.

BTW: I think CGRP would make sense for retirement villages and allow old people to relocate without the large financial losses that are a feature of the system that I think Howard gave us. (If we move now we would be repaid less that what we paid to get into the village.)

Ok BilB, let’s put some numbers up so we can put meat on the bones.

What would you consider to be the ideal price of one of these CPRG abodes in say Sydney and Sarina.

Under what average interest rate over 30 years do you expect ?

And, by how much housing stock do you expect this scheme to add ?

I’d be looking more at reducing government regulations, compliance costs, taxes and fees for a start if lowering entry level housing is the goal. Not just on the build but also the land ( exorbitant rates too )

Also decentralisation, with so much land in this country it seems unnecessarily expensive to cram so many into a few pockets near capitals.

Another big cost of housing is home and contents insurance.

I’d encourage individual site assessments so that risk and costs properly reflect each home. A block home should be far cheaper to insure than a timber one for example.

Good approach, Jumpy.

My target price for Sydney would be $300,000 in a soil to sun configuration, at 3.5% to 4.5%.

The number built would be dependent on suitable land availability in locations of accommodation need. One of the greatest needs is near Universities for student accommodation, and the properties could well be built by Student Unions or University Trusts.

Such buildings designed for student share (4 per dwelling) accommodation would bring the per week accommodation cost down to under $100. On that basis you could expect some 4,000 dwellings be built for that purpose alone serving several Universities.

All of the things that you have suggested, Jumpy, are part of the formula of achieving accommodation affordability.

Governments and benevolent organizations can be more helpful when concessions given deliver a permanent advantage over decades rather than one up opportunities that are cashed up by the recipient at their first relocation.

JohnD,

Rent control is a powerful device, and is common in Germany where far fewer people own their dwellings. As a consequence Germans invest more of their personal capital in industry, I believe from a number articles I have read.

I think, though, that rent control would be a far greater threat to the Negatively Geared Property market than CGRPT’s would be. CGRP’s would reduce rental pressure by a small percentage, whereas rent control could be applied to the industry as a whole.

How great though is the need?

https://apple.news/ANBVS0jM2TmKwlKN4bafbgA

I would encourage people to look the table in bilb,s link How much more will it cost to buy a house if prices rise as much as economists forecast?

They are expecting the median price to be about $1 million, with a deposit of around $200,000.

For Brisbane it is $715,000 and $143,000.

A few months ago a woman I worked for at The Gap (20 mins drive from the CBD or 30 mins by bus) had her house on the market. It was a garden variety home for the area and sold for $819,000. When I first checked after the sale and before the handover, the real estate firm offered a helpful plan no doubt tailored for the area.. A deposit of $150,000 or so and then a loan with repayments of a mere $3200 per month.

Accumulating the deposit would be quite intimidating for a young couple of teachers or nurses, especially if they are paying rent and have 2 or 3 kids.

Seems to me CGRP’s would offer a ‘first home’ pathway.

On course, as bilb says, that is only one scenario.

I think an average of 4% interest rate is highly optimistic given the inflationary pressures that have been created by governments lately , but let’s leave that alone.

So, in essence, your promoting spending about $500,000 on a $300,000 home and sell it at the biggest loss you can, is that it ?

Hard to see that as an incentive that many will take up and does nothing for the supply side.

Also, that option is available right now and I don’t see many takers.

Just out of interest, did you sell a home when you left Australia?

Brian: “A deposit of $150,000 or so and then a loan with repayments of a mere $3200 per month.” The Gap is leafy suburb, not the place you would look when you were struggling for your first home.

Beenleigh, for example, has a median house price of $340k

Exactly John.

No sweeping broad brush governmental legislation can account for regional differences, suburb differences or even individuals in the same street differences when it comes to value.

Only Capitalism can.

The olde “ I built this home for my family with my own two hands “ is dead because of government.

Jumpy, upstream you wroye

I’m not sure what you are trying to say here.

Official interest rates are currently hovering around zero.

So are you saying that the inflationary pressures which have been created by governments have pushed interest rates lower?

And are you saying it is optimistic to expect an average interest rate as high as 4%?

Yes, interest rates will go up.

Folk that think record low interest rates is the forever norm are in for a world of hurt, just like every other time.

I’m saying there is a lag between government actions and it’s ultimate manifestation.

And that lag is usually far longer than the election cycle.

( giving a racist troll the benefit of the doubt here, bracing for disappointment)

Jumpy: “Only Capitalism can.” Free market capitalism can do some things well but, when we are talking accommodation not nearly as well as the mix of capitalism and social welfare that we had under Menzies.

When I was young there was enough public housing to help keep housing prices under some control by providing a low cost base. I had numerous friends in one of the nearby public housing towns. The houses were adequate and could be afforded by poor widows and low level public servants like teachers.

The other thing that helped control housing prices in those good old days under the socialist Menzies government was that the banks made it hard to borrow too much. When we built our first house the government Commonwealth bank would only allowed me to borrow what could be paid for by 25% of the male income. (Women’s earnings were not counted because “they got pregnant you know.”)

Land prices weren’t inflated by developers. For the first house we built the cost of land was only 7% of the total cost and the house was a basic 3 bedroom house. I bought the land from the bloke who owned the block of land I liked without any help from real estate agents.

You will be pleased to know that plastering was a building trade in those good old days.

Jumpy, thank you for your response even though I would have preferred you to actually provide answers to my questions.

It seems that even when governments around the world have been unable to lift interest rates (despite their best efforts) you will continue to assert government policies always keep interest rates higher than they should be. That’s your prerogative but it does undercut your arguments somewhat.

John, you do realise the amount of extremely expensive regulatory burdens that have been added since the “good old days “when married females were banned from the public services and Menzies loved the White Australia Policy.

Keep reminiscing about your glory days fella.

https://www.youtube.com/watch?v=xQ4BjQFtXdI

Jesus zoot !

Yes, now,but up a lot soon.

Yes.

Now, return the favour, what governments around the world have been trying to raise interest rates ?

Is that a policy of any political party in Australia and if so, show the class ?

Pretty much all of them. I don’t know, nor do I much care, what your guru Sowell has to say about it but capitalists get a bit toey when the returns on their capital trend toward zero. Or are you going to tell me that Capitalism welcomes negative interest rates?

To return to my questions, your answer seems to be that interest rates are going to rise in the future but not as high as 4%. Thank you for clearing that up. Much appreciated.

Wrong interpretation again zoot, interest rates can easily exceed 4%.

Now, show me some politicians openly advocating for higher interest rates or shut the fuck up about it.

( I knew the racist troll would, yet again, let us down. Intentionally evidently.)

Jumpy: “you do realize the amount of extremely expensive regulatory burdens that have been added since the “good old days.”

I do understand that some regulations have been justifiably tightened in response to things like workplace accidents, noxious discharges etc. I also understand that some of these justifiable regulations have been opposed because of cost or “this is not how we are used to doing things.” or “all these whingers need to toughen up.”

Bit hard to work in industries such as mining and construction without noting some changes that have improved OH+S performance over the years.

None of the above means that there are some regulatory changes that add an unnecessary cost or complexity.

John, I’d be just as happy in a solar powered shipping container with a hand pump bore. All levels of government would deem me a criminal if I did.

Recently one of my builders had a sign off rejected because there wasn’t fly screens on every window. It’s out of control the controls government demand. And they’ve got gun toting enforcement on their side ultimately.

You want “ affordable housing “ then remove the costs and increase supply. This Keynesian demand side thinking is counterproductive, always has been. I’ve no idea why this is so hard to understand.

Pretty much sums up your inability to move beyond the first chapter of “Economics for Dummies” (which you have failed to fully understand).

Jumpy,

Your interest rate fear mongering argument falls flat simply because if interest rates go much above 4% the entire economy begins to unravel, and government is intensely aware of this. They did, after all, create the situation.

The fact is that in the event of a crash the most sought after properties will be CGRP’s.

The $300,000 figure included the land (no appliances other than water heater), by the way, so your interpretation is way off the mark. Even at a 6% interest rate the debt servicing for a CGRP is safe for a one income $40K family. Meanwhile at 6% interest rates the Negative Gearing Property industry falls in a heap as the debt servicing cost far exceeds rental returns and the easy bank finance tightens up.

No doubt you are going to say that “you can’t build a house for that little”, which is really your saying “I won’t build a house for anyone for that little profit”. The fact is that these properties will be built using techniques with which you are totally unfamiliar.

You really should visit the SwissBau in Basel …. https://www.tradefairdates.com/Swissbau-M5159/Basel.html

… to learn just how far behind Australian building practices are.

JohnD, please remind Jumpy of all of the workplace garbage he put up on the Abbott trumped up “insulation” scandal.

BilB

Yep, you seem to think governments can centrally control interest rates rather than just affect them uncontrollably.

BTW, how much did you get for your home when you sold it, as much as possible I assume ?

What were interest rates under Keating and did the economy unravel?

Jumpy,

The interest rate argument is a complete red herring in the CGRP discussion. The fact that an oil war driven interest rate bubble caused rates to hit 27% some 40 years ago that has zero relevance to today’s economic realities. The economy very nearly did unravel at that time with people taking out bridging loans to make their mortgage payments, but Australia had a broad based diverse production sector and was able with Keating’s good stewardship to restore control, setting the stage for Howard’s easy ride, on the crest of a global high productivity run base on cheap goods out of China. It should be noted that that run was set up by Whitlam at the UN sponsored Lima Agreement.

Please don’t bore me with your cheap shot Catallaxy supplied “gotcha” attempts on subjects you know nothing about. Stick to building matters where you do have relevant information.

Can’t quote the interest rates off hand but I clearly remember the Coalition carrying on as if it were the end of the world.

And while you’re flailing around, what was the top marginal tax rate under Menzies and did his government tax and spend us into communism?

There are interest rates and interest rates, but I recall John Quiggin pointing out that the highest post-war interest rates were actually for a brief time when John Howard was treasurer.

bilb’s right, though, jumpy is using the old red herring trick.

John, going back to house prices in The Gap, I’m saying that the inner suburbs are gentrifying to the extent that they are getting out of range for middle class couples, first, second or third house even if both are working unless they decide not to have kids, or postpone baby-making to a time when it is less likely to happen.

I cited teachers and nurses, because those two professions are pretty much the backbone of our society and provide the most social mobility opportunities.

I don’t welcome a society where the middle quartiles have to move to the fringes to get a roof over their heads.

Jumpy “Recently one of my builders had a sign off rejected because there wasn’t fly screens on every window. It’s out of control…”

To put that in context housing sizes have grown dramatically. One set of figures I have seen said: ” over the past 60 years Australian homes have more than doubled in size with going from an average of around 100 square metres in 1950 to about 240 square metres today.

Other sets of ABS data gave an indicative figure of $746/m2 for land and $2017/m2 for land +building. The 140 m2 increase in area would cost $280,000 extra.

How much does it cost to fit a screen????

Too right.

Next thing you know they’ll want us to stick to the contract. Bureaucracy gone mad! Why, I can remember when we could get away with leaving the whole roof off – those were the days.

Brian: “I don’t welcome a society where the middle quartiles have to move to the fringes to get a roof over their heads.”

I suspect that the middle quartiles always have always needed to move towards the fringes or what used to be inner city working class suburbs. In those good old days only about 5% of school leavers would go to university and women like my wife would stop full time work when they started having children. Teachers are no longer members of the middle quartiles and the distance from the CBD where middle quartile can afford have moved further out.

Haha, red herring indeed, BilB is a hypocrite.

John, there are hundreds of thousands of regulations in a built dwelling that we rent from Councils, every one of them is compulsory and adds costs.

What if I don’t want fly screens, or opening window when I want fixed panes, or plumb it myself, or have it closer to the road for a bigger back yard garden, or dig a fucking well without permission costs, or have chickens, or…..

Some years ago, in Mackay, water tanks were banned by labour ( mosquitoes or some such ), tear them all down,then a few years later they were made compulsory by labour on new builds ( climate change droughts or some such, Flannery), now they don’t know what the fuck they want to dictate….for now.

When is it not governments business to add costs to living?

I go to the shops and buy the food and other necessities I need to get through the week and I have to spend money to obtain them and the cost is always rising.

When is it not capitalism’s business to add costs to living??

Zoot I think the whinger is referring to this

https://www.mackay.qld.gov.au/__data/assets/pdf_file/0006/50469/Mosquito_Management_Fact_Sheet_2009.pdf

…. which is about prevention of serious illnesses such as Ross River Virus, Barmah Virus and Denge Fever. No doubt the missing mosquito screen was also about this.

It is looking more like his being one of those tradies that never finish the job properly, then blame every one else for their failure.

Sounds like it bilb.

I always wonder why he stays in Mackay being ground down by the jackboots of government.

Libertarianism (according to him) is such a perfect system there must be hundreds of places where it flourishes and he could be truly free, yet he chooses to stay put and whine incessantly. It’s not much of an advertisement for Libertarians.

But BilB, what about all those fashionable “ EXISTENTIAL, UNPRECEDENTED THREATS “ suddenly reversed themselves 180 degrees for another “ EXISTENTIAL, UNPRECEDENTED TREAT “ because “ science experts “ like Flannery ?

( oh, btw, the dams that would never fill again ever are overflowing right now)

Zoot, whilst you’re spending other peoples money, at least show a little gratitude and drop the snark a bit hey ?

( is there anything more unattractive than a parasitic, racist troll)

Deflection alert. Airlines it seems are more important …

https://today.rtl.lu/news/business-and-tech/a/1484763.html

……… than millions of Australians suffering from rental and mortgage stress.

Thanks bilbo

Que?

It appears Mr Cryptic finds the question too hard.

“Spending other people’s money” is an interesting concept. It implies I have somehow reached into somebody else’s pocket and taken cash out. It would be fanciful to even suggest I have ever done this at any time in my life. So the “other people’s money” our giant intellect from the north believes I’m spending must have somehow been given to me by those “other people”, whoever they are.

But surely, once these anonymous “other people” have passed their money to me it becomes my money? Or does our Mackay correspondent consider he’s using “other people’s money” when he gets paid for a job and heads to the pub to spend some of it on a celebratory pissup?

Knowing his biases and bigotry I actually believe he incorrectly thinks I’m surviving on welfare. A bit like building contractors who have weathered the pandemic thanks to Jobkeeper payments (what was it like being on welfare Jumpy? Were you spending “other people’s money”?)

For the record, even though I became eligible for it more than a decade ago I don’t receive a cent in age pension. After my savings ran out I have worked a few hours a week to earn enough to cover my modest needs.

Now Mr Snark. Whose money do you reckon I am spending?

John, my first house was in Indooroopilly (1968), about 8.5k from the CBD. The house has had extensions, but it’s now worth around $980k.

We came here in Ashgrove 40 years ago, but couldn’t afford the place now.

At that time the outer fringe was probably Inala. Sunnybank was still market gardens. New suburbs opening up included Kenmore, The Gap, Mt Gravatt, a little further out than Indooroopilly, but there was still land available in the strip between Indooroopilly and the city.

Apologies to those who don’t know this patch.

My argument is that there should be a class mix everywhere and CGRPT might help in that direction.

In any case, we have too much space per capita under roof, we are losing the interpenetration of the natural world we once had, and are spending way too much for a roof over our heads.

You could afford a house on the fringe then and, if you had the same job could afford a house on the fringe now. The big difference is that the fringe has moved.

“My argument is that there should be a class mix everywhere.” Not sure that that is right. Remember a survey of happiness vs electorate. The two best performers were Ryan (relatively homogenous leafy suburb) and Hervey Bay, (homogenous low wealth.) The link was “homogenous”. We are comfortable living with neighbours that are not all that different than us.

My take is that morale in mining towns where housing is not hierarchical are better places to live than ones where housing depends more on seniority.

John, my ideal place is where there is diversity and fraternisation across cultural differences, but I’d have to agree that the drive to homogeneity is strong.

One of the features of CGRP’s is that those who think in terms of profiting from free market real estate ( for some one to profit some one else must lose) the notion that anyone would choose to forego capital growth is not logical. The fact is that very few people profit as cash in hand from the value of their personal dwelling, as where they might sell a dwelling in one place for a higher price than they bought it (capital gain) they routinely buy a replacement for the same value else where. A profit can only be made where a person downsizes property holding, and in an open market that gain is limited.

It is this deterrent against profiteers that ensures that CGRP’s remain available and are not bought up for profit, as there is none due to the nature of the title.

That brings up the subject of can CGRP’s be converted to a regular title? Yes, but the rules for this will be determined by those who draft the legislation to create the CGRP Title structure. The core principle is that to convert a CGRP title to Torrens Title, the difference between the CGRP value and the open market value must be paid to the state or local government. This ensures that there is no back hand way to eliminate the social value of the properties, while enabling community restructuring where property must be merged to build other facilities such as malls.

Can a person be offered more for a CGRP than the asking, no, the property can only ever be offered and transacted at the title value.

BilB

Well that’s incorrect. A 3 bedroom home sold in intercity Sydney to purchase a 3 bedder in say Finch Hatton at the foot of the Eungella Range would see plenty of extra cash in the bank.

There’s a trend toward sea changes and tree changes lately. Some even yacht change and trouser the profit.

It’s a supply and demand thang Dude, there’s no amount of government mandated ( and that’s essentially what you want ) jiggery pokery will change that. Individual value judgments to better themselves in the way THEY judge best and theirs.

It’s a nonstarter mate.

Not on the flimsy evidence you’ve presented here.

Jumpy,

Certainly there is the remote downsizing option. However that is not necessarily as cost effective as it might seem, and I can evidence that claim by looking at property values in various places, but only a percentage of people want to move away from their families. Remember that CGRP’s are not for every one. In fact the move away idea can be disastrous as it was for one part (sibling’s in-laws) when the long dreamed of remote location turned out to be totally deserted between holiday periods. In that case had a CGRP been built it could have been funded on the security of the long time family seat without the in advance sale and the remote location tried out before total relocation. Lots of possibilities.

Brian did you get the file I sent?

This is going to help low income home aspirants ……

https://apple.news/ArM3Z3VzITLGYMoAgeZ3f9Q

Not!

Bilb2: “This is going to help low income home aspirants ……” Yep.

You might like: “Australian public policy is inflating home prices, as usual..” https://thefifthestate.com.au/columns/spinifex/australian-public-policy-is-inflating-home-prices-as-usual/

“In a chaotic time for the nation’s economy, some will find reassurance in one unchanging facet: Australian governments of all kinds, and the Reserve Bank, are committed to policies that will raise home prices.

Promoting inflation in the price of residential property seems to be the formal aim of public policy. It certainly has that effect, along with another direct consequence – that of rendering home-ownership unachievable for at least a third of the population.

And, despite rhetoric and some incentives from all governments about incentivising home ownership, the reality is very different. On current trends, the majority of Australians aged 25-39 will be renters, not owners, within 20 years, possibly sooner.”

“there are two problematical consequences.

The first is that the guaranteed property-inflation of Australia helps to divert investment from potentially more productive and innovative parts of the economy, bearing in mind that in Australia, 80 per cent of bank loans go towards property. By comparison, in Germany – one of the world’s more innovative economies with a strong industrial sector – 50 per cent is invested in commercial and industrial lending, often to SMEs.

The second is that ever-rising home prices and rising wealth for existing homeowners created by public policy results in a permanent property-less underclass that increasingly is not just the poor but those on average incomes.

Remember, before Covid, Sydney was in the top four cities globally for unaffordable homes, with average earners needing eight, nine or 10 times their salary to get a mortgage, when in the 1980s it took three or four times. ”

“This is surely the central paradox of public housing policy: by enabling those who have homes to buy more homes we are preventing those without homes from getting their first. This looks like an iron law to me: if someone has two homes there needs to be someone without one to rent them. Multiple homeownership in Australia is creating the supply of renters.

The answer to this is not to attempt to build more homes. Firstly, as I have explained, the private sector developers’ business model does not enable them to build so many homes that the price drops. So they never do. “

Good find JohnD.

That spells out just what I discovered in trying to get a discussion going with NSW State Government both Labor and Liberal. I did spend some thousands of dollars in the effort, but my conclusion was that they saw this as a threat to the rental desperation that secures negative gearing profitability. And that is just straight up soft corruption with extremely hard consequences.

The fact is that the impact of CGRP’s on the whole system would take time to develop and be minimal to the profits of developers.

Prediction, the housing price bubble will burst within the next 12-18 months, most profoundly in the bigger city areas and radiating outward.

This will be as bad or worse than the US housing bubble crash causing that “GFC” for Australians I predict.

In any event, was the home price crash in the US better or worse with regard to homelessness?

( ABZ question)

Not your blog. Not your rules. If you want to control the conversation you’ll need to set up your own site. And my nym has a lower case z.

Prediction: Jumpy’s prediction will not come about.

For the record:

Labor promises to cut negative gearing and capital gains tax concessions

That was in February 2016, the first real shot in the election campaign held on 2 July 2016.

Turnbull’s response was a lie and a scare campaign. He said it would smash property values. See:

Malcolm Turnbull warns property values will fall under Labor negative gearing policy

Home owners across the country will see the value of the family home “smashed” under Labor’s “very blunt, very crude” negative gearing policy, Prime Minister Malcolm Turnbull has warned.

In a blistering political attack on the opposition’s policy, which was unveiled last weekend and which restricts negative gearing to new properties while also reducing capital gains discounts available to investors, Mr Turnbull warned “this should put concern into the minds of every single house owner”.

Turnbull had promised a better standard of political debate. Lenore Taylor observed:

Turnbull’s claim that Labor will ‘smash’ house prices shows evidence-free politics is back

She goes looking for evidence. Some say the price will go up, more say it will go down. And this is what Labor apparently had in mind:

A report by the progressive McKell Institute, which Labor drew upon when developing its policy found it was “unlikely that the changes to negative gearing proposed in this report would have a material effect on prices in the near term”.

“Over time it is expected that these reforms would improve housing affordability. As other reports, including the Henry Review, have noted tax settings play a relatively minor role in the price of housing. Other factors such as market fundamentals, zoning and building regulations and interest rates have a more material impact on house prices than tax settings.”

Then in January 2018 we have Peter Martin:

Why Treasury thought Turnbull was wrong on negative gearing

Here is the advice from Treasury at the time:

Labor wanted to limit negative gearing to newly-built homes. Losses from investments in other homes and shares could still be deducted from income, but only from investment income. Existing investments would be unaffected. And the capital gains from those investments would be taxed more heavily, at three-quarters rather than half the income tax rate.

Treasury said the changes would have a “relatively modest” effect on prices.

Returns for investors would fall. But owner-occupiers, unaffected by the changes, would be “likely to limit the extent to which is an impact on prices”.

“Overall, price changes are likely to be small, though the composition of ownership may shift away from domestic investors,” the candid assessment concluded.

Labor’s policy, or cut-down versions of it, has been supported by the Property Council, the Business Council, the head of the Abbott government’s Commission of Audit, the head of its review of the financial system, the Reserve Bank governor Philip Lowe, the Institute of Company Directors, and the Committee for the Economic Development of Australia.

Treasury, but not Turnbull, thought they were on the right track.

The advice was to the treasurer, who at the time was Scott Morrison. Did Turnbull see it? We don’t know, but as the smartest person in the room my bet is that he knew perfectly well what he was doing.

As he did when he attacked Labor’s approach to renewable energy as reckless.

Michael Janda on the NZ house price boom:

Housing boom in New Zealand threatened by loan, tax changes. Will Australia follow?

Interest expenses will not be allowed as a a tax deduction, even on investments.

Maybe the Australian government will follow suit and make a virtue of it.

In my opinion both Turnbull and Ardern are incorrect.

Basically because raising taxation on a thing has never made it cheaper or more abundant, quite the opposite.

Jumpy: “In any event, was the home price crash in the US better or worse with regard to homelessness?”

My a bit hazy recollection was that the GFC in the US resulted in houses with unpaid loans being destroyed or left empty. Suggests that homelessness would have grown assuming not everyone could find some place to share.

Jumpy: “In my opinion both Turnbull and Ardern are incorrect.

Basically because raising taxation on a thing has never made it cheaper or more abundant, quite the opposite.”

Maybe the Jumpies of the world ignore what is happening re taxes when making financial decisions. Surprising given their hostile reaction to any increases in taxes!

Some of us who are not Jumpies are influenced by relative taxation rates. For example, if you sell a rental property where you have not lived at all you will pay capital gains. On the other hand, if you sell “the family home” and meet certain requirements you can avoid paying capital gains. This means it may make sense for an astute investor to buy a very expensive family home instead of doing something more useful for the community by buying a property to rent. (Living in a better home is a bonus.)

I am sure I am not the only person who makes financial decisions on an after tax basis.

John

Firstly I’m an individual Jumpy that doesn’t pretend to think and speak for others. I’ll leave that to the arrogance of collectivists.

Then you go on to say, despite stating non influence of tax rates, you are influenced by after tax outcomes. You can’t hold both of these positions in parallel.

In any event, for you, Turnbull and Ardern to be correct then the added taxes and regulations on cigarettes should have seen prices drop and more folk becoming smokers. Guess what, the opposite occurred.

This is basic economics mate fair dinkum.

A basic problem causing the GFC was that Americans, if they had problems with their loan repayments, had the option of handing in their keys and walking away with no responsibility for the debt.

I believe it was a scheme introduced by Clinton to encourage home ownership.

The secondary problem was that these American housing debts were parcelled up and sold around the world as secure investments.

From memory, subject to correction, but unbelievably stupid.

Recently Jumpy claimed to be focusing on positives from now on. Perhaps he will be kind enough to suggest a way that Australia could avoid the dire predicament he predicts?

Didn’t close the tag again. D’oh!

But I’m sure the message is clear.

For the record here is the abridged CGRPT thread.

Capital Growth Restrained Property Titles for the creation of Social Housing

Housing Affordability has been a major problem in Australia for at least 15 years and has now developed into an extreme problem not just for those on basic incomes, but also for those on single middle incomes.

https://www.domain.com.au/news/how-much-extra-will-it-cost-to-buy-a-house-if-prices-rise-as-much-as-economists-forecast-1039074/

Whereas owning a valuable property has prestige and provides security for the owner, obtaining property at ever higher prices creates debt servicing issues, particularly in a nation with static income levels for those of middle income and lower.

We’d all love to own a $1,000,000 house, but that requires mortgage payments of some $35,000 plus Land Tax of $6036 plus rates of perhaps $1200. That is a total of $42,200 , which will require a minimum income of $120,000 for an in the hand amount of $85,703. This puts such a lucky person in the top 6.3% of income earners.

https://www.abc.net.au/news/2019-05-21/income-calculator-comparison-australia/9301378?nw=0

It should be absolutely clear that the figures no longer add up, and the situation is not getting any better.

More importantly, young people starting out with educational debt haven’t got any chance of living the Fair Go life until their mid 30’s, if ever at all.

The problem is that an open property market fails to serve a community in a fair way. In today’s property market property values are based on location opportunity cost at one level, then perceived property value as delivered by property developers at the second level. Both of these methods are opportunistic, and do not in any way represent “fair value”. Actual Land value is completely arbitrary. As 200 square meters will sell for the same price as 300 square meters where the smaller area allows the same location opportunity. Subdivision into ever smaller allotments fails to solve the problem of affordability in the Australian Market under standard Torrens Title.

The affordability problem is extreme to the point where no reasonable level of first home buyer grants from government can make any difference, particularly where such grants quickly become factored into the property prices and effectively become a grant to the vendor rather than the buyer.

Similarly no amount of community benevolence can resolve the problem as the factors are too great, and any such grants, gifts, concessions, allowances, etc, become cashed up at the first recipient relocation, and therefore offer no community building advantage.

There has to be an alternative to allow those on low incomes to share in property ownership in the true Australian Fair Go way.

Such a method is available in the form of a new Property Title proposed as a Capital Growth Restrained Property Title (CGRPT). Some might say creating property title types is extreme, but the history of property title types belies that notion. The original Australian property title, Torrens Title, goes back to the 1800’s ( I believe) but the now very common Strata Title originated in 1961 in just one state originally, NSW, to be later adopted in all states, and the newest title type, Community Title or Community Strata Title is as recent as 1996. Each of these titles was created to allow for newer building innovations and denser communities. Does any one remember the Aussie quarter acre block?

Those denser communities however serve to increase land competition to the point where wage growth cannot keep pace with market growth, and cracks in the community structures are appearing in many forms. One such crack is with the location of Universities. Once non central Universities are now surrounded by very high value real estate and the rental affordability for students disappeared a decade ago.

The Capital Growth Restrained Property concept utilizes a Property Title onto which the establishment cost of a property, (that is the land cost, the cost of constructions added, and over time substantial improvements added) is registered and thereafter that Property’s value is calculated over time as the Establishment Value times the published accrued Consumer Price Index value. By this method such a title remains permanently affordable to the income level that established it. All grants, gifts, concessions, allowances, land subdivision advantages, subdivision zone ratio requirements, etc, offered to the buyer/creator become permanently preserved in the constrained property value, and therefore become a practical and serviceable method to achieve socially affordable housing in an aggressive but static-income-level property market without the need for government or corporate ownership involvement.

It should be recognized that a person participating in the CGRPT concept accepts that their investment has limited capital growth, which is a significant limitation. However in accepting that they obtain the opportunity to actually afford to have property, or in the case of Property Downsizers, obtain property that allows them to bank the difference between their long held family asset and their new smaller one. For this trade off they obtain the possibility of living nearer to their work, study, family and interests.

How Does a CGRP Title Deliver Affordable Property?

The primary cost reductions are achieved from property subdivision, the use of ethical builders, advanced “design for purpose” concepts, and the deployment of advanced modular building components and techniques. Suitable CGRP designs take a long hard look at maximum utilization of minimum land to deliver high quality living space with 60% land footprint as open air living space. Solar power is also a high priority with the use of Solar Photovoltaic Thermal Panels with up to 80% energy conversion capacity capable of repaying the Carbon Cost of the construction in well under 10 years.

CGRP land footprints will range from 50 square meters to 100 square meters. They will be multi level 3 bedroom dwellings but include the provision for a unique integrated battery backed up elevator design for the elderly.

See http://www.cgrpt.com for further elaboration.

“In any event, for you, Turnbull and Ardern to be correct then the added taxes and regulations on cigarettes should have seen prices drop and more folk becoming smokers. Guess what, the opposite occurred.”

My recollection is that the price of cigarettes went up and consumption went down because the nicotine dealers had to increase prices to continue making an after tax profit. They got away with this because the drug they are selling is strongly enough addictive for the addicts to put up with a higher price.

As you point out nicotine taking has been reduced and you could speculate that the increased price inspired some smokers to give it up and others not to take it up in the first place. Haven’t got enough data to determine to what extent price increases and education drove this reduction.

At the moment house prices seem to being driven by speculative investment. Under these circumstances increasing capital gains tax and/or tightening the rules for unrented houses may help drive both house prices and rents down.

John, there has been “ speculative investment “ since way before your great great great grandmother was born. That’s not it, obviously.

But hey, you want to try more taxing and regulating, go ahead, you’re going to anyway. But don’t keep blaming capitalism and the free market when it inevitably doesn’t lower prices because of taxes and regulations increasing prices.

Jumpy, your prediction is ridiculous. The Australian economy has borne of the factors that caused the GFC, on the one hand, the Australian property market is buoyed by a steady influx of Asian money, and Australia has a far better economic management regulatory structure than the US.

Also, because Australia has a reasonable minimum wage, a slightly flatter relative wealth field, and Australian banks (I believe) don’t speculate with debt products in the way Wall Street was doing to create the GFC nor does Australia have a Fannie and Freddie type function, though …….

https://www.afr.com/politics/federal/the-first-step-down-fannie-and-freddie-s-path-20190515-p51ni3

This all further demonstrates the value of and need for CGRP’s to reduce the volatility of property market.

…has non of the factors…

Jumpy: ” there has been “ speculative investment “ since way before your great great great grandmother was born.” Yep, there have been speculative booms and busts going back further than that. Problems start when people start talking about the boom that will never end and obvious mugs start borrowing to invest.

Problems also occur when the speculation starts happening with stuff that real people actually need. For example:

1. The mining share boom and bust ended up harming some speculators but we don’t eat mining shares. (The bust did have an effect on geo jobs so it was not good if that was what you did.

2. This housing boom is a problem because people actually need somewhere to live and the speculative boom is making housing less and less affordable. At the local level you would have seen the coal industry driven boom and bust in Central Qld and would have noticed that housing prices are growing faster than most people’s incomes for quite some time.

John, Wikipedia suggests:

The term “bubble”, in reference to financial crisis, originated in the 1711–1720 British South Sea Bubble, and originally referred to the companies themselves, and their inflated stock, rather than to the crisis itself. This was one of the earliest modern financial crises; other episodes were referred to as “manias”, as in the Dutch tulip mania. The metaphor indicated that the prices of the stock were inflated and fragile – expanded based on nothing but air, and vulnerable to a sudden burst, as in fact occurred.

The tulip thing went bust in 1637.

Investopedia has recent examples, including dot.com.

Tonight I believe Four Corners will reveal the serious head butting that has been going on between Angus Taylor and the ESB and AEMO – Kerry Schott and Audrey Zibelman.

I’ve suspected it, but all will be revealed.