The headline is that oil giant BP sees global demand for coal continuing for decades in the face of dynamic growth of renewable energy.

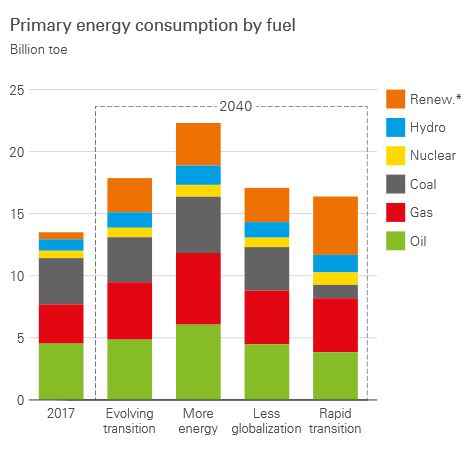

That is what BP thinks will happen on the basis of projecting forward what we are doing to date. However, in what they see as a Rapid Transition Scenario, BP still sees around half of our energy needs in 2040 coming from fossil fuels in the form of gas and oil. Here from the BP Energy Outlook, 2019 in a nutshell is the story:

Evolving transition (ET) scenario, assumes that government policies, technology and social preferences continue to evolve in a manner and speed seen over the recent past.

The More Energy scenario recognises that a special effort may be made to meet the needs of around two-thirds of the world’s population who in 2040 would still live in countries where average energy consumption per head is relatively low, that is, the energy deprived. Some 80% of the world’s population live in countries where average energy consumption is less than 100 GJ per head. For reference, the EU average is 120 GJ per head.

Key to solving this problem, says BP, is improving energy efficiency in countries that use a disproportionate amount.

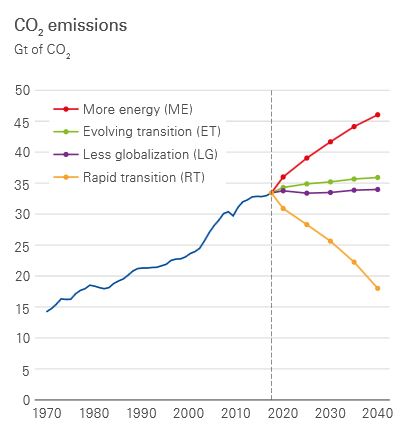

The problem with ET is that it would see CO2 emissions rise by 7 per cent, so a Rapid transition (RT) scenario has been formulated which see carbon emissions fall by 45 per cent by 2040:

RT, BP says, would meet the goals of the Paris Agreement. I think they have simply ignored the 1.5°C target examined by the IPCC late last year. In truth that report probably came too late for them to consider.

So the options are stark:

-

1. We carry on as we are, and we cook the planet.

2. We make a special effort to meet the energy needs of the poor, and we cook the planet even more rapidly.

3. We transition more rapidly to achieve the 2°C target adopted in Paris, which scientists now appear to be telling us is dangerous.

Rapid transition (RT) is achieved by gains in energy efficiency, a switch to lower-carbon fuels, and greater use of CCUS. (I think that means ‘carbon capture utilisation and storage’.) They say:

- The gains in energy efficiency means energy demand increases by around 20% in the RT scenario by 2040, compared with a third in the ET scenario.

- The shift to lower-carbon fuels reflects a combination of rapid growth in renewable energy – which more than accounts for the entire increase in primary energy – and a sharp contraction in the use of coal. By 2040, renewables account for around 30% of primary energy.

- Despite the strong growth in renewables, oil and gas account for close to 50% of primary energy in 2040 in the RT scenario. The level of oil consumption falls to around 80 Mb/d in 2040, with roughly 60% of this remaining use in transport and much of the rest in the non-combusted sector. In contrast, gas continues to grow aided by growing use of CCUS – with close to a third of natural gas in the RT scenario in 2040 being used in conjunction with CCUS.

- CCUS is used in both power and industry and captures almost 4.5 Gt of CO2 emissions by 2040 in the RT scenario.

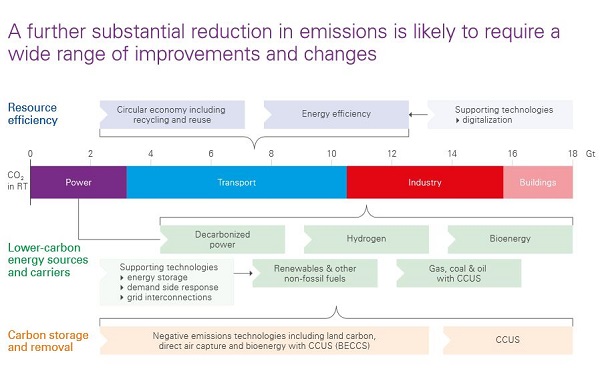

This graph gives the broad idea:

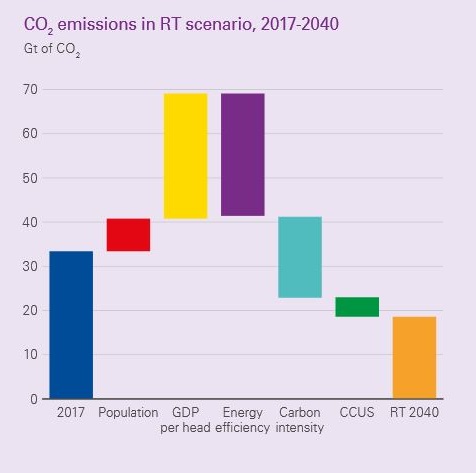

Their scenarios are built on the assumption that population will increase by 1.7 billion to reach almost 9.2 billion, GDP per capita will increase by 3.25% pa so that total GDP will double, however energy consumption will only increase by about a third. Some 80% of growth will come from developing countries, and half of that from India and China.

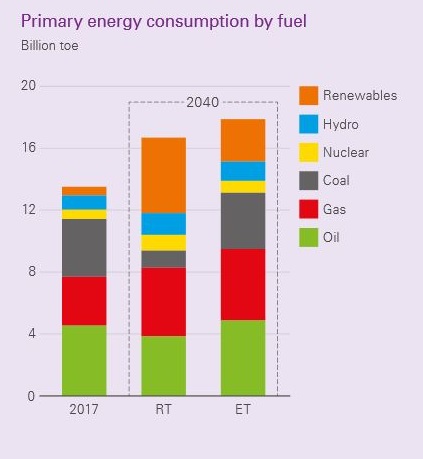

Here’s energy consumption by fuel type, with RT compared to ET:

I think “oil” should read “liquid fuel” (see below).

Energy efficiency is increased under the RT scenario, reducing energy consumption overall. Renewable energy (mainly solar and wind) are ramped up more rapidly, and coal is diminished by about 70 per cent. However, oil and gas remain in substantial amounts to comprise about half the energy needed in 2040.

Emissions beyond that are captured in this diagram (p61 of the report):

They regard this as difficult but achievable. It involves the complete decarbonisation of the electricity grid, more CCUS in conjunction with gas and coal, alternative fuels including bioenergy and hydrogen, further resource and energy efficiency including both increased use of circular economy techniques, and more use carbon removal techniques including direct air capture.

There is no elaboration, but clearly they consider the above possible – albeit post 2040. Next year they may contemplate whether these outcomes can be achieved sooner than 2040.

There is much in the report, so I’ve selected a few aspects for consideration.

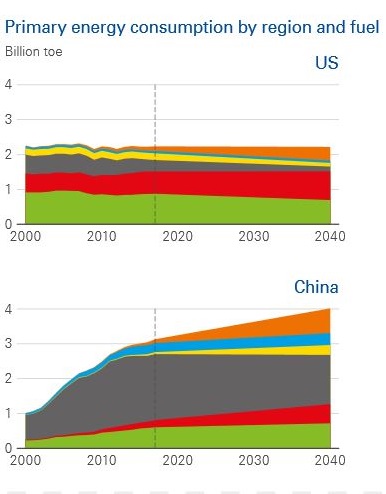

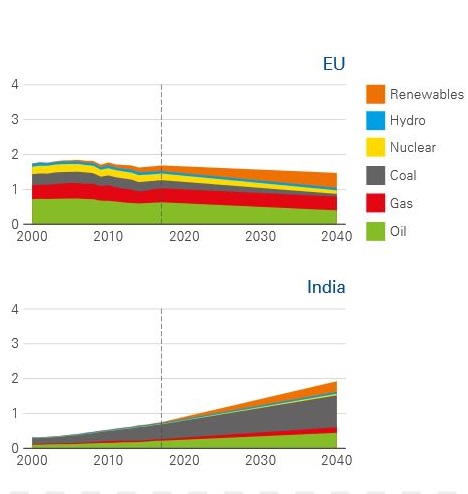

Primary energy consumption by region and fuel

Below I’ve shown the primary energy consumption by region and fuel. I’ve split and stacked the image for legibility. You have to pick up the fuel type from the second:

The above shows where the momentum is and where things need to change.

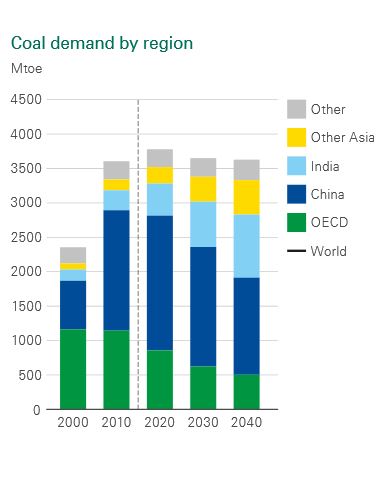

The future of coal

This graph shows coal consumption under ET:

In this graph the US, Canada, Japan, South Korea, Mexico, Europe and Australia would be included in the countries belonging to the OECD.

On another thread, Geoff Meill has cited information from CoalSwarm’s Global Coal Plant Tracker showing trends for countries cancelling plans to build new coal. The summary is, where GU equals ‘generator units:

- GLOBAL TOTAL: 6,732 GUs operating, 491 GUs under construction, and 729 GUs planned.

If a coal plant lasts 40 years one would expect 168 units to be built each year for replacement purposes. Peak coal may be in sight, but BP sees it as enduring unless we make a plausible attempt to implement the Paris Agreement at the 2°C target level.

The extraordinary growth of renewables

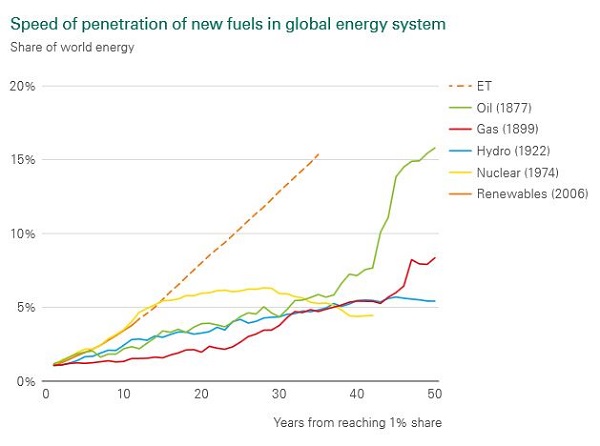

The report points out that the growth of renewables and speed of market penetration has been extraordinary. Here’s the speed of penetration in years after reaching the 1% foothold:

As to the future, here’s how they see the increase in renewables share of generation by source:

The future sees an explosion in the use of solar. On the face of it there seems no good reason why the adoption of solar cannot be even more rapid.

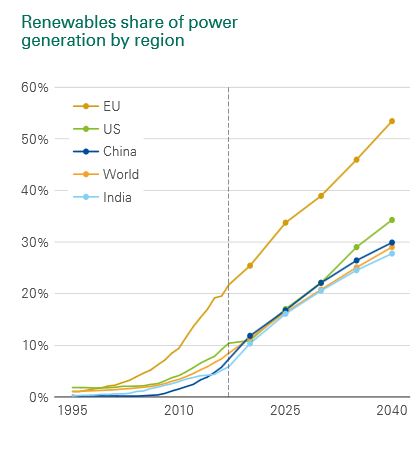

This graph of renewables penetration by region is instructive:

China’s rapid move into renewables in recent times is impressive, but merely mirrors what happened in Europe a decade earlier. Europe will maintain its leadership.

The strange story of oil

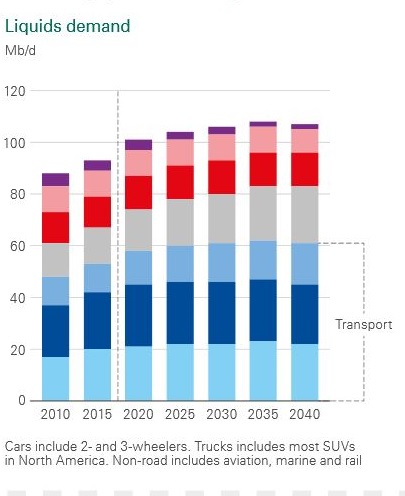

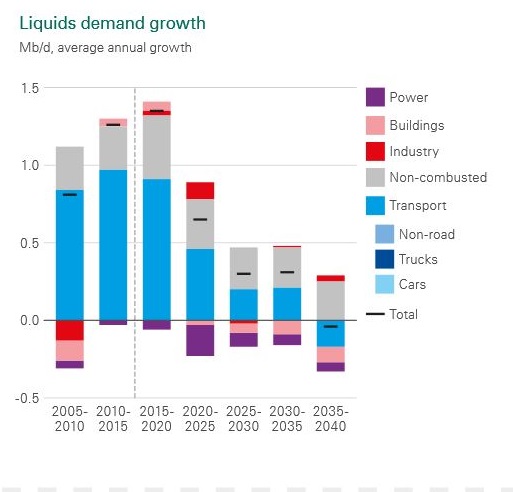

BP, of course, is not a disinterested observer, but their big message is that they believe there will be strong need for the continued use of oil. Again, for legibility I’ve split and stacked the graphs:

Peak ‘liquid fuel’ they see arriving in 2035. They see strong demand in motorised transport, electric cars notwithstanding until about 2035.

In terms of supply, they see American tight oil as the main factor until the latter part of the period, when they see leadership in supply returning to the Middle East and Russia.

Their big message, however, is that this will require investment, indeed trillions of dollars of investment. The question arises whether those trillions should be spent elsewhere to provide alternatives to oil. This particular report does not help use to know whether that is feasible within the time frame.

However, they see oil demand as essentially flat from 2020, but not declining thereafter, with the growth then coming from NGLs (natural gas liquids) and ‘other’ including biofuels.

The extraordinary story of China

The report finishes with a reflection on what has changed in this year’s report. The standout in the last five years has been China:

- The most important factor driving revisions over the past 5 years has been the faster-than-anticipated pace of economic adjustment in China: rebalancing its economy away from energy-intensive industrial sectors and shifting to a cleaner, lower-carbon energy mix. These changes are most marked in the revisions to Chinese industrial and coal demand (-22% and -37% respectively in 2035).

- The softer prospects for Chinese energy demand has led to a downgrading in overall energy demand (-4%), partially offset by upward revisions to other parts of developing Asia and Africa as some Chinese industrial production is relocated to lower-income countries.

- The shift in China’s fuel mix directly accounts for roughly 80% of the downward revision to global coal consumption, and around a third of the upward revision to the outlook for renewables over the past 5 years. The overall impact on renewables is even greater since the quicker adoption of renewable energy in China helps to drive down the costs of wind and solar energy as they move down their learning curves more quickly, increasing the penetration of renewables in other parts of the world.

So what might be achieved quickly if we went onto a war footing?

Plenty of scope for rapid ramping up of renewable electricity and major cut back of fossil fuels production.

E-ammonia could replace ammonia currently produced using natural gas, oil or coal as feedstock.

Dirty methanol produced from fossil carbon could be replaced by e-methanol like that already being produced by Iceland.

E-ammonia can be used in petrol engines with minor adjustments and the fitting of cars with liquid ammonia tanks similar to LPG tanks.

It is fairly easy to fit existing car fleets with EV conversions that would allow the cars to become battery or e-fuel driven.

Also scope for rationing power and fossil fuels to reduce both average and peak energy demands. Scrapped coal fired power stations and gas guzzling cars could provide raw materials for the construction of renewable infrastructure.

Not sure to what extent petro-chemicals could be replaced by products produced from basic e-fuels but suspect quite a lot could be done in this area.

Some cement could be replaced by different types of cement that don’t use fossil carbon containing limestone as a key material.

What else could be added to this list?

On a war footing a lot more could be done in a lot less time than the 21 yr BP projection.

John, it’s my bed-time and generally I agree, but what did you mean by:

May I briefly comment? In the very last sentence you quote, Brian, BP has China moving down its learning curve…

Traditionally, the cliche has folk moving up: “it was a very steep learning curve”.

But never mind. It seems China’s domestic market for renewables is huge; they made some technical advances and enjoy economies of scale; a side-effect is the world receives cheaper solar panels.

Win win.

Brian: It is just so easy to replace e-methanol with e-methanol.

Have edited the comment to “Dirty methanol produced from fossil carbon could be replaced by e-methanol like that already being produced by Iceland.“

Forgive me John, should it not then read:

Brian, you say in your post:

Indeed. The question is whether the major oil producers can continue to keep up with demand. The evidence I see suggests that may not be the case for much longer. See my Submission (#09) to the Australian Parliament Select Committee into Fair Dinkum Power (now publicly available among 33 so far).

As I’ve indicated in my Submission, American tight oil is not suitable for producing diesel fuel. Diesel fuel and fuel oils are the main transport fuels for trucks and shipping. There are some indications that global ‘peak diesel’ fuel supply may have already occurred (i.e 2015), and could explain why diesel is now more expensive than petrol.

IMO, BP’s outlook suggests option one is the likely consequence where they see us heading:

Somehow, our leaders need to be informed that option is not acceptable.

Brian, you say in your post:

With 6,732 GUs operating as at Jan 2019 (per Global Coal Plant Tracker (GCPT)) and with a coal-fired generator lasting at least 40 years, then it would be expected that at least 168 GUs would need to be added each year to match retirements of old units. Coal plants apparently take about 6 to 9 years to build, so there should be of the order of 1,008 to 1,512 GUs under construction at any one time.

Alternatively, if a generator lasts 50 years, then it would be expected that at least 135 GUs would need to be added each year to match retirements of old units. There should be of the order of 810 to 1,215 GUs under construction at any one time.

So, it seems that only 491 GUs under construction on a global scale as at Jan 2019 is apparently insufficient to sustain the global coal-fired power station fleet long-term. Fleet numbers should begin declining soon.

Globally, in 2018, coal-fired capacity of (per GCPT):

• 30,141 MW started construction;

• 52,686 MW resumed construction from 2017;

• 50,265 MW started operations;

• 30,890 MW were retired; and

• 119,427 MW of projects were cancelled.

So, it appears retirements are beginning to exceed new starts. Therefore, global coal-fired power should peak within a year or two, if trends continue.

GM: The high price of oil exploration makes it hard to protect when reserves will dictate when, if ever, peak oil will be driven by shrinking reserves. The surge in EV’s, the possibilities associated with e-fuels, the real possibilities of breakthroughs in a range of energy tech in addition to the risk of real government action add to the uncertainty.

John Davidson (Re: FEBRUARY 25, 2019 AT 4:23 PM)

‘Peak oil’ is about production of oil reaching a peak, then beginning a decline – the beginning of the end of oil. It is not about the end of oil.

Australia’s oil production peaked in year-2000. Australia’s oil production did not stop then – Australia continues to produce oil today, but at a steadily decreasing rate of production below the peak in 2000. Many other countries have also passed peak oil production and continue to produce oil at steadily decreasing rates today.

Evidence I see indicates a growing risk that global peak oil production will probably occur in the 2020s. The balance between pre-peak oil producing countries and post-peak oil producing countries will become destabilised and a global post- ‘peak oil’ supply world will have arrived – geology will inevitably win over technology. But that is not the end of oil supply – it’s just that there won’t be enough to go around if demand is not reduced by alternative energy technologies.

…needs to be much faster. The market pushing up numbers is not fast enough IMO. Governments need to encourage a more rapid transition. Energy policy paralysis by governments and ad hoc planning is not helping.

…need to translate into solid technological, economic and environmental progress really quickly – time is running out. Progress needs to be much faster to make a substantial contribution – I don’t see that happening at present.

There have been peaks and troughs in oil production for ever. The same folk, it seems to me think the peaks are terrible for humanity and the troughs were to blame for everything from the Venezuelan catastrophe to Whitlams economic vandalism.

Regardless, it’s only Government dictates that cause the instability of oil production, even today.

Nonsense, running out of stones didn’t end the Stone Age.

I’m starting to think GM is doing a brilliant spin off Alene Composta.

Loving it !! Seriously.

Jumpy:

You are right of course. Governments can help drive down fossil carbon consumption as a result of gross incompetence or brilliant, far sighted governing.

Then again the move away from fossil carbon can take off even when the government doesn’t want this to happen.

Just look at what is happening to investment in rooftop solar at the moment despite the feds not liking it. (Must admit though that government privatization of the electricity industry has has made renewable electricity look a lot more attractive.

Jumpy (Re: FEBRUARY 26, 2019 AT 8:51 PM)

Oil is a finite resource. Are you denying this, Jumpy? What’s your evidence?

Nothing happens without energy. Not enough energy (oil in particular) to go around means means higher energy prices and recessions ensue as a consequence. Unaffordable energy means life become unaffordable.

Only Governments? What’s your evidence, Jumpy?

Tom Whipple is the editor of ASPO-USA’s two flagship publications, Peak Oil News and Peak Oil Review. Tom is a former senior analyst for the Central Intelligence Agency (CIA). Since retiring from the CIA, Tom has become a well-known researcher and writer on energy and oil issues. Tom writes a weekly column on peak oil for the Falls Church News, a daily newspaper based in northern Virginia. Tom holds degrees from Rice University and the London School of Economics.

Tom Whipple produces a post called Peak Oil Review. Each week’s post includes a Quote of the Week. This week’s quote is (bold text my emphasis):

Quoted from Steve St. Angelo, independent precious metals and energy researcher.

Peak Oil Review summarises the significant events influencing oil production during the previous week around the world.

Oil companies have a role in oil production too.

It looks like shale oil geology is winning against Exxon to me.

GM: The average Aus car travels about 15,000 km/yr. The cost of this works out at $22/week for a car that consumes fuel at 5 litres/100km at a price of $1.50/litre. Sure cost would be much higher if we take into account total Aus oil consumption but I would suggest that price increases could be absorbed by most of us.

This is part of the reason why the switch to direct and indirect renewable power could be done without destroying the economy as long as it is done over a few years to give us time to install the new infrasructure.

John Davidson (Re: FEBRUARY 27, 2019 AT 1:11 PM)

Australia’s top selling vehicles (dated Feb 2):

1st Toyota Hilux

2nd Mazda3

3rd Ford Ranger

4th Toyota Corolla

5th Mazda CX-5

6th Hyundai i30

7th Mitsubishi ASX

8th Toyota RAV4

9th Mitsubishi Triton

10th Holden Colorado

The Toyota Hilux petrol engine uses a whopping 11.1L/100km combined. The smaller of the two diesels, at 2.4L displacement, uses around 7.7L/100km and the larger 2.8 diesel glugs through 8.1L/100km.

The Ranger, Triton and Colorado aren’t thrifty on fuel either.

That’s just cars, and light vehicles.

What about trucks, John? Are you forgetting those, and the cost impact that would have on food and goods and services?

GM: OK a car that consumes 10 litres/100km will cost $44/week for fuel if it does the average 15,000 km/yr. Double that to $88/week and it is still not enough to make much difference to car selection or use for most people.

Bananas are selling at around $4000/tonne in my supermarket. I would suggest that the fuel cost for moving one tonne of bananas from nth Qld to Bris would be pretty low if you wanted to calculate it.

My take on the effect of OPEC crisis in Aus was that the unions expected wage increases to be ahead of the inflation rate and the result was stagflation until Hawke came along.

The real crisis might come if peak oil is reached before supplies of alternatives are in place.

John Davidson (Re: FEBRUARY 27, 2019 AT 10:16 PM)

hallelujah!!! By George, I think you’ve got it.Hang on – “The real crisis might come…“? Correction: The real crisis will come if peak oil is reached before supplies of alternatives are in place.

If petroleum-based fuels become scarce (and therefore expensive) then people will cut back on activities (petroleum is embodied in just about every economic activity – agriculture, mining, manufacturing, transport, etc.), resulting in an economic recession/depression (depending on the degree of fuel supply constraints and whether alternatives have sufficient capacity to mitigate sufficiently the energy supply constraints).

GM: WWII was a period of shortages and rationing yet economies flourished. (I remember being sent to the shop with a rationing ticket to buy butter.)

A war against climate change will stimulate the building our renewable power capacity as well as the production capacity required for renewable, transportable fuels.

John, I can remember my mum shuffling the rationing tickets. At the time we would have had 7 people including kids in the house.

That was just after the war. Later she bought a parachute and cut it up to make PJs, sheets and work shirts.

My WW2 aftermath stories date from the 1950s: what an abundance of discarded non-lethal war materiel in the Army Disposals shops, and odds/ends in the sheds of ex-servicemen. Rolls of insulated wire, variable capacitors, good for the lad building a “crystal set”.

Old, smallish artillery pieces used as potent war memorials or RSL meeting house markers, in main streets.

Compulsory marching at primary school.

Went out to the playground to watch British “V Bombers” (?) do a fly over, Melbourne 1950s.

You Queenslanders were closer to the action through WW2 and during Korea, Malaya, Viet Nam, and on to the present.

WA and SA had the Bomb Tests.

Not complaining, mind.

Actual war losses hadn’t visited my family, thanks be.

My father was wounded badly enough during WWII to be sent home after a year in a hospital in Alexandria. Got him home in time to marry my mother and produce the young JD before the end of the war.

WWII was good (essential) for me and had a large effect on the Aus of the fifties.

– essential –

Look, I just hope that isn’t your deep, underlying reason for wanting a “war footing” to make rapid progress on decarbonising, John.

i.e. the feeling that the planet needs a whole tribe of tiny, bright jd’s to be born ASAP!!??

I mean, no doubt a wonderful outcome for the planet. …….

But huge efforts from everyone, making changes BIGLY.

All right, you’ve convinced me.

The decarbonising will be a very good result.

(Ulterior motives notwithstanding.)

Seriously GM

It seems the ALP is taking concerns over Australia’s limited oil reserves seriously. Proposing to set up a Federally sponsored reserve, after industry consultations.

On ABC news they said the Int’l Energy Agency advocates three months consumption as a minimum reserve.

Ambi: This blog has Zoot, Jumpy and me to cause trouble. Do you really want more trouble and strife?

Ambigulous (Re: FEBRUARY 28, 2019 AT 7:43 PM)

Fact check: Does Australia have 3 weeks of petrol in reserve? Checks out.

IMO, too little, too late. Humanity must leave petroleum oil before oil leaves us. The evidence I see suggests by the time a Federally funded reserve is established a post- ‘peak oil’ world will have arrived. With dwindling oil/fuel supplies soon, I think it will be difficult to fill those reserves.

I suspect it would be more prudent to encourage a rapid large scale deployment of battery-electric vehicles in Australia – this will lower carbon emissions and reduce Australia’s dependency on petroleum.

Posted yesterday at the SMH by Cole Latimer is an article headlined Power companies top list of nation’s biggest emitters. Based on Clean Energy Regulator data, the largest emitters are:

The article includes:

Apologies GM

I thought you were the poster here who was strongly deploring last year Australia’s very low petroleum stocks.

Must have been mistaken.

Ambigulous (Re: MARCH 1, 2019 AT 12:59 PM)

I was – the current situation puts Australia in a precarious situation if supplies are disrupted for more than a few weeks.

But what are you suggesting, Ambi? Continue to burn more oil and add more GHG emissions into the atmosphere?

I’m advocating rapidly reducing Australia’s dependency on oil, gas and coal (and in doing so reducing Australia’s GHG emissions). Are you advocating against that, Ambi?

Tim Buckley at IEEFA has published a new report titled Over 100 Global Financial Institutions Are Exiting Coal, With More to Come: Every Two Weeks a Bank, Insurer or Lender Announces New Restrictions on Coal, dated Feb 27. The Executive Summary begins with:

Not at all, GM at 3.34pm.

I merely thought it might interest you that the Federal Opposition seems to be pointing to the same risk.

Please forgive me, GM.

Private Ambi!!!!!

Step forward sonny.

You are in so much trrrr rouble I don’t know where to begin, sonny.

Were you the clown who peeked over the top of Trench H yesterday at 23.30 hours? Against all common sense and direct orders??? Jeepersbloodychristalmighty what do I have to do to get youse to behave in such a way Gerry doesn’t blow us all to smithereens?

And don’t even think of sticking your helmet on a pole and edging it up an inch above the mud. All right???!!! I said all right???!!!

Straight to latrine duty Private Ambi.

You just never learn.

Ambi/GM: Australia is particularly vulnerable because almost all our fossilized transport fuel depends on seaborne trade. Makes it easy for an enemy to to stop the flow of transport fossil fuel by threatening to blow up tankers coming within x km of Aus.

The 3 weeks assumes consumption as usual. Apart from filling more fuel tanks options include:

Rationing if supply drops below x weeks.

Reducing transport energy in general.

Reducing normal fossil transport fuel consumption.

Developing sources of Australian produced transport energy.

It is worth noting that Bill Shorten is talking about developing the renewable hydrogen industry in addition to doing something about fuel reserves. He talks like someone who actually understands the transport fuel problem and what needs to be done in the short and longer term.

When there were motor vehicle fuel shortages in Queen Victoria’s State in the late 1970s, John, the State Govt introduced a very quick (and crude) rationing.

“Even” or “odd” final digit on the car’s number plate determined whether the driver could buy fuel today, or would have to wait until tomorrow.

Simple, easy for retailers to comply with, and easy for police or other officials to watch. Of course, there was initially panic-buying and many drivers who might previously not have striven to drive with a near-full tank, probably stocked up for the duration. Not rocket science. (Not even “rocket surgery”.)

I can’t recall whether train/tram/bus passenger numbers rose dramatically. It lasted a few weeks, IIRC.

Yes, John. Mr Shorten and his Shadow Ministers do seem to be proposing practical, doable cures for a few of our foreseeable difficulties.

John Davidson (Re: MARCH 1, 2019 AT 6:19 PM)

IMO, three weeks is an inadequate buffer. It may take a few days to understand the significance of events impacting on Australia’s fuel supplies before rationing is implemented (like a major refinery failure or large-scale storm disrupting supplies, or military conflict that starts off small in a critical supply area and escalates).

Reducing transport energy by rationing will have significant impacts on Australia’s economy.

There are many residential areas in Australia that have little if any access to public transport. These areas may become stranded if supplies of liquid fuels for transport are heavily restricted for private purposes.

Why now? Perhaps there’s an election due soon?

I didn’t hear/see Shorten supporting Senator Jim Molan when he raised the issue about Australia’s poor fuel reserve capacity (Apr 16) last year.

As for hydrogen, it depends on whether Bill Shorten can differentiate between hydrogen sourced from:

– natural gas (i.e. non-renewable and unsustainable), but currently cheaper to produce; and

– electrolysis of water using renewable energy (i.e. renewable and sustainable), but currently more expensive to produce.

This article at RenewEconomy is an interesting take on renewables vs fossil fuel lobby.

GM: Agree with most of what you said above. A detailed plan is needed for dealing with potential fuel crisis that takes account of issues you mention above such as higher dependence on cars etc. in the outback.

What renew economy said is telling. Problem is that there are none of the sort of large players like what supports the fossil fuel players.

Isn’t before an election when an opposition formulates and announces policies? You might have noticed that within Labor policy development is a deliberative and consultative process under Bill Shorten. This means he doesn’t lightly run off at the mouth every time an issue comes up. Unlike the Greens he needs more than a phone box to consult the relevant people. This means that Labor is often stumm when the news cycle demands to know their stance.

Perhaps he did listen to Molan, undertook the necessary consultations, and now you have the response.

Another question is why the Government did not respond to Jim Molan, because he’s one of theirs, even if they have consigned him to the knackery.

Posted earlier this afternoon at The Guardian by Ben Smee is an article headlined Deal signed for huge coal-fired power plants in Hunter Valley, Hong Kong firm says. The article begins with:

Will the federal government commit taxpayer funds in the last weeks before caretaker mode starts before the federal election?

GM, thanks for the link.

I think they will if they can, and if they do it is just outrageous. Labor should indicate that any such approval would be rescinded if they win.

However, surely the NSW state government would have to be involved and they would be in caretaker mode. There is a small window at the end of this month when the NSW election will be over before the Feds go into caretaker mode.

This is developing into a complete shambles, but the indications are that the present govt does not have the space to actually do anything.

But we are becoming a joke and a funny farm internationally.

Thanks for that link GM.

I was puzzled about “converting an economic zone into a 2000MW coal fired plant”.

Turns out it was a local “zone” created to encourage enterprises to set up and employ local persons; and hadn’t succeeded.

We had a few “proposals” of that ilk in 1980s, 1990s Latrobe Valley. With very scant success.

Everyone knew that industrial and economic diversification was needed. No future in being tied mainly to brown-coal-for-electricity.

By contrast, a small “technology park” adjacent to Ballarat College (later Uni, later Fed Uni) attracted several private firms and some outposts of Govt Depts. Helped diversify job types in the town and district.

It seems Major Cameron Leckie in the Australian Army is taking the issue of ‘peak oil’ seriously in an op-ed dated Feb 6. He ends with this:

But will our leaders do anything about this? Previous track record of our pollies suggests not (for both Labor and Coalition administrations) – all too hard – unless the voters start asking inconvenient questions and insist on effective action to get Australia out of this precarious mess.

GM: It is a long long time since Aus faced an external threat that would make oil reserves important and most would say that there is no immediate threat at the moment that would fall into this class. Makes it a bit hard to maintain a sense of urgency.

However, history has shown this feeling of security can be very very false. Like Singapore wasn’t going to fall because everyone knew that the attacks would come from the sea.

ABC fact check supports the sort of figures you have been quoting