Some time in the last few days I heard a person who should know better say that 1800 coal-fired power plants were being built around the world. One wonders where this (dis)information comes from. It went unchallenged by the ABC interviewer, showing once again that ABC journalists and presenters need an update on climate change – in the national interest.

As Adam Morton at The Guardian writes The world is going slow on coal, but misinformation is distorting the facts. Back in June, John “Wacka” Williams asked the Parliamentary Library how many coal plants there were, how many were being built, how many closed etc and could he have the information by 4pm?

The Library included the information that 621 units were being built, the point here being that power plants typically have multiple units. Hazelwood had eight.

Unfortunately, this information was wrong.

Since then, of course, the information has travelled and has become plants rather than units.

Morton writes:

- Analysis of CoalSwarm’s database shows that in July, construction was taking place at 300 plants globally. Of those, 183 were new power stations and 117 extensions of existing plants. But that number is changing rapidly.

For example:

Last week, China announced it was stopping or postponing work on 151 coal plants that were either under, or earmarked for, construction.

The reason? They have a glut of power.

For the same reason many countries are using existing coal plants less.

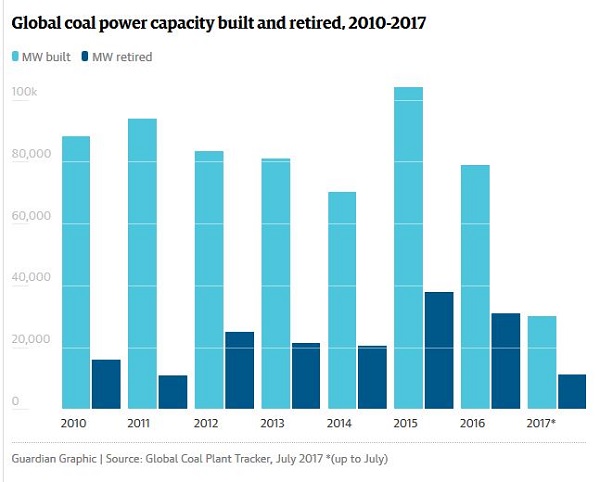

Coal plant capacity was still increasing to July 2017:

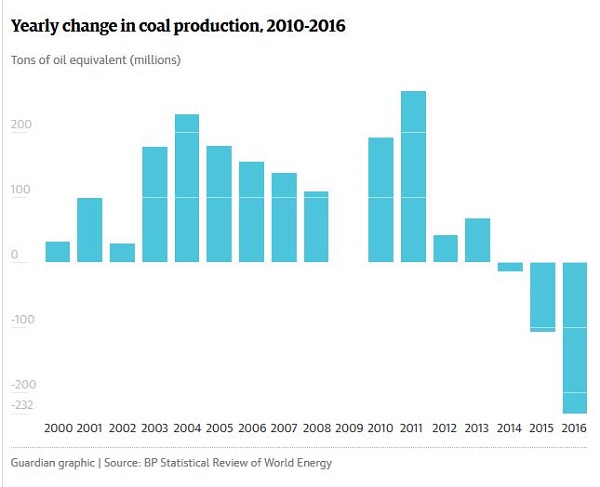

However, the real story is in coal production world-wide. Here we go:

The graph sourced from a BP Statistical Review of World Energy shows peak coal in 2013, with production dropping year by year from there.

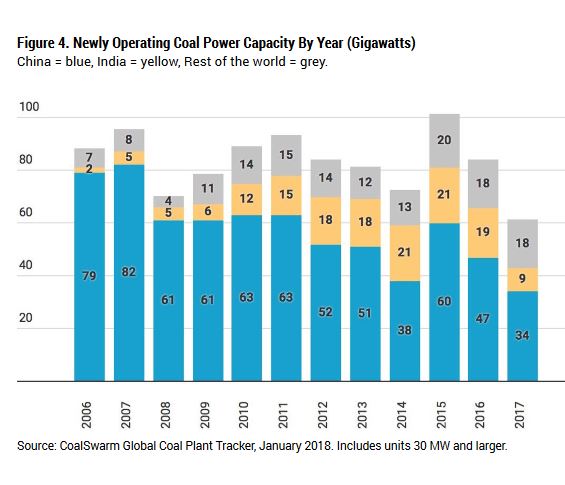

In the report Boom and Bust 2018 we get the following, which shows where the main action is:

This graph of coal capacity in pre-construction and construction gives a somewhat different impression:

Please note, however, that each category is diminishing.

All these projects need finance, and it seems that many in the ‘rest of the world’ have been financed by just three Japanese banks – Sumitomo Mitsui Banking Corporation (SMBC), Mitsubishi UFJ Financial Group, Inc. (MUFG) and Mizuho Financial Group (Mizuho). According to RenewEconomy New Japanese bank policies rule out one third of overseas coal plant finance because they now demand that power plants use ultrasupercritical technology. This article is more specific:

- SMBC would be definitively ruled out of 27% of its pipeline projects by capacity.

- MUFG would be ruled out of 31% of its pipeline projects by capacity.

- Mizuho would be ruled out of 40% of its pipeline projects by capacity.

In an update to Reconnecting climate change politics with reality I cited an article by Giles Parkinson at RenewEconomy Fair dinkum! Renewables and storage soon to be cheaper than existing coal plants:

- A new report from Australian and international researchers suggests there is no prospect for a new coal generator in Australia, and even existing coal generators are going to be challenged by the falling costs of renewables and storage.

The report, “Implementing coal transitions: insights from case studies of major coal-consuming economies” has been produced by an international consortium, including French think tank IDDRI, and researchers from the Australian National University, among others.

It is the Australian conclusions that are the most striking, particularly in relation to the renewed political dialogue around the need to protect existing and encourage new investments in what the Coalition government is describing as “fair dinkum” “reliable”, “24-hour baseload” power. i.e. coal.

Frank Jotzo, from the ANU, has some sobering news. The point where new wind and solar, backed by energy storage become cheaper than operating old coal plants is not far away – a conclusion more or less confirmed by AGL, with its plans for Liddell. (Emphasis added)

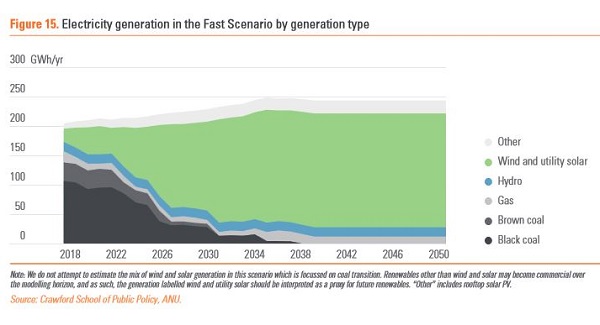

Frank Jotzo, Salim Mazouz and John Wiseman wrote Coal transitions in Australia: Preparing for the looming domestic coal phase-out and falling export demand 2018. This was one of six country reports as background data for the Coal Transitions Project which explores how “below-2°C”-compatible transitions away from thermal coal could be implemented. The Synthesis Report found that, with the right policies, coal transitions that are consistent with the goals of the Paris Agreement can be done in an economically affordable and socially acceptable way.

The Australian report looks at what might happen based on economics, without a specific emissions trading policy or other similar climate-specific policies.

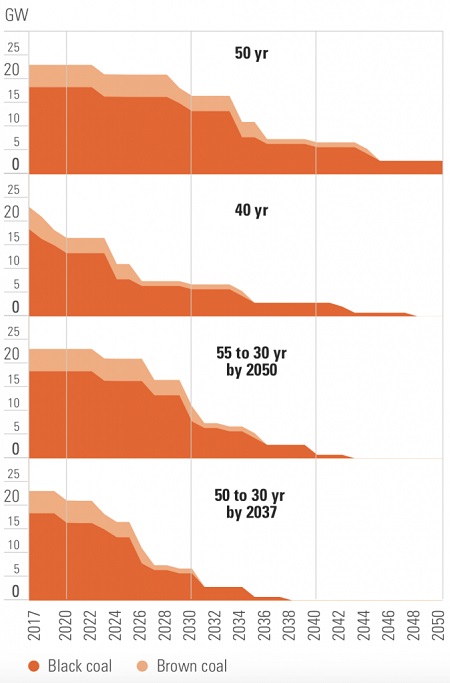

It looks at scenarios where the life of existing coal plants may be shortened, from 50 years to 40, or even 30. They come up with these scenarios:

-

The top two panels in Figure 10 illustrate the retirement pathways associated with a fixed 50 year and 40 year retirement age for the remaining coal fleet. The ten-year difference between the two scenarios makes a dramatic difference for future domestic coal use in Australia, especially in the 2020s. Note that the average age of the past ten coal plant retirements in the NEM was 40 years.

Then:

- The bottom two panels represent our coal plant closure scenarios, recognising the mounting economic pressure on coal plants, even without climate policy and based on higher levels of renewables penetration and changing load profiles in the NEM.

They then set these scenarios aside and formulated scenarios about what they thought would happen when the cost of new renewables started to prove cheaper that maintaining existing coal. Their ‘moderate scenario’ saw initial closures lagging what AEMO came up with in their Integrated System Plan (AEMO 2018). Initially they assumed closure after 55 years, but then retired plants progressively earlier from 2024 onwards as the economic pressure of cheap new renewables builds up. This is what the moderate scenario looks like by generation type, where wind and solar are undifferentiated:

There is a two-page outline of the overall project here written back in 2016 which recognised that holding the increase in global temperature to well below 2°C and pursuing efforts to limit it to 1.5°C would require the early phase-out of both coal production and consumption.

In the earlier post I mentioned that last November 20 countries signed up to phase out coal power by 2030 in the Powering Past Coal Alliance. Frank Jotzo told the SMH that 36 governments and 28 major firms had now committed to phasing out coal from the power sector by 2030.

Yet here in Oz the coal-fired new government sees resources minister Matt Canavan saying that the Paris deal does not prevent us from building new coal, or anything we choose, for that matter:

-

Canavan said on Friday the Paris commitment was a three-page document that allowed Australia flexibility to build new coal plants. The resources minister said rather than focusing on the situation in 2030, “what I want to focus on is solving the crisis we have in energy today”.

“We have to build power stations. There’s nothing in the [Paris] agreement that would stop us building power stations, including coal-fired power stations,” Canavan said.

“We need new ones”.

If you take one pencil and one back of an envelope, no calculator required, you will find what living in the moment with coal-fired power means. A year to get the project up, seven years to build and commission it, then a 40-year life to get a return on investment. Yet around the time you expect the engine of death to spew its first excrescence into the atmosphere, the project will be uneconomic and unable to underbid renewable energy which takes about a third of the time to build.

This morning, Saturday, the hills were alive with the sound of the bright shiny new PM Scott Morrison talking up the death of the NEG, the National Energy Guarantee. The coalsheviks have won. There was even talk of dumping the Paris Agreement, after foreign minister Melissa Price was just back from assuring the Pacific Leaders Forum that Paris commitments were ‘front of mind’ for ScoMo. But he too is emphasising that he lives in the present.

This morning also the AFR has an article Business and industry to ‘go it alone’ on a new energy policy after death of NEG:

-

State governments, business groups and industry are going it alone and preparing a framework to provide certainty for investment in the energy sector, saying they are dismayed by the implosion of the Coalition’s National Energy Guarantee and the policy vacuum that has followed.

With new federal energy minister Angus Taylor under fire for not properly engaging with his state ministers since his promotion, state Labor governments are contemplating their own initiatives to ensure reliability in the National Electricity Market, which would also help meet Australia’s emissions reduction targets.

They say a return to investor uncertainty will result in higher electricity prices.

There is also a push to flush out federal Labor to find out what its plans are for national energy policy post-NEG, especially if they win the federal election, which is due early next year. This could involve resurrecting the NEG or using another mechanism such as the Finkel review’s discarded Clean Energy Target to meet the Paris climate targets.

Business groups and other stakeholders have been left stunned by the collapse of the NEG and have started thinking about ways to circumvent the Coalition government’s apparent paralysis on the long-term energy policy framework.

See also RenewEconomy Australia gets out the wrecking ball, again, in international climate talks:

Words fail, they really do.

If they didn’t I would use the words of The 2018 Report of the Global Commission on the Economy and Climate Unlocking the Inclusive Growth Story of the 21st Century: Accelerating Climate Action in Urgent Times. From the Key Findings, we have a choice:

-

We are on the cusp of a new economic era: one where growth is driven by the interaction between rapid technological innovation, sustainable infrastructure investment, and increased resource productivity. This is the only growth story of the 21st century. It will result in efficient, liveable cities; low-carbon, smart and resilient infrastructure; and the restoration of degraded lands while protecting valuable forests. We can have growth that is strong, sustainable, balanced, and inclusive.

The report found:

While recognising the shortcomings of current economic models, analysis produced for this Report found that bold action could yield a direct economic gain of US$26 trillion through to 2030 compared with business-as-usual.

I believe that the world economy is currently worth about US$100 trillion.

But ‘business as usual’ is not cost-free:

Making such a shift would also limit dangerous climate change. With each passing year, the risks of unabated climate change mount. The last 19 years included 18 of the warmest years on record, worsening food and water security risks and increasing the frequency and severity of hazards such as wildfires. Disasters triggered by weather- and climate-related hazards were responsible for thousands of deaths and US$320 billion in losses in 2017. Climate change will lead to more frequent and more extreme events like these, including floods, droughts, and heat waves. It is increasingly our ‘new normal’.

That is stating the implications quite mildly. See my post Climate change: the end of civilisation as we know it, posts under the tag Dangerous climate change, and/or the relevant posts at Key posts.

Do you know what you are doing, Mister Morrison?

See also:

Coal power is expensive, unreliable and intermittent

Update:

In his comment of September 10, 2018 at 1:40 pm Geoff Miell links to the BP Statistical Review of World Energy – 67th Edition, published 13 June 2018 which is a snap-shot of the calendar year 2017, and comparison with previous years. Here are some graphs.

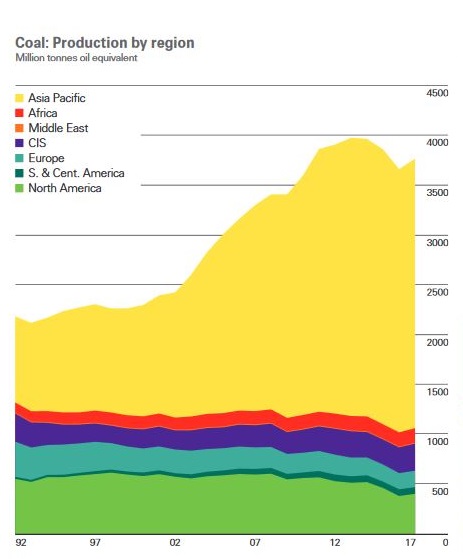

First, coal production by region:

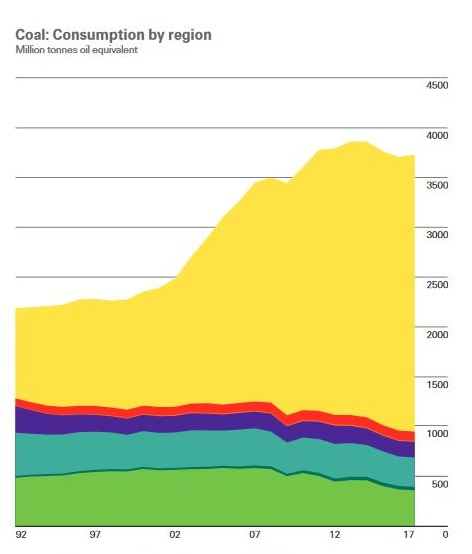

Second, coal consumption:

I’ve split them for legibility. The graphs are followed by the note:

-

World coal production increased by 105 million tonnes of oil equivalent or 3.2%, the fastest rate of growth since 2011. Production rose by 56 mtoe in China and 23 mtoe in the US. Global coal consumption grew by 25 mtoe, or 1%, the first growth since 2013. Growth was driven largely by India (18 mtoe), with China consumption also up slightly (4 mtoe) following three successive annual declines during 2014-2016. OECD demand fell for the fourth year in a row (-4 mtoe).

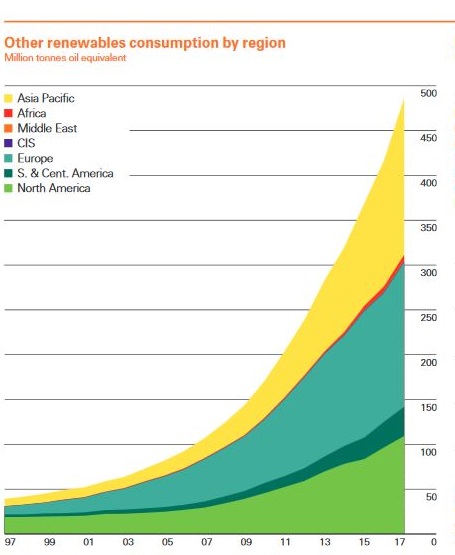

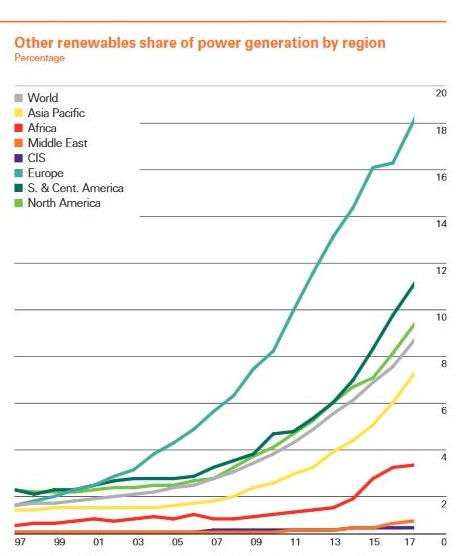

Here we have the progress by region of ‘other’ (meaning other than hydro) renewable energy consumption:

Followed by share by region:

With the note:

-

Renewable energy in power generation (not including hydro) grew by 17%, slightly higher than the 10-year average (16.2%) and the largest increment on record at 69 million tonnes of oil equivalent (mtoe). Wind provided more than half of renewables growth, while solar contributed more than a third despite accounting for just 21% of the total. In China, renewable power generation rose by 25 mtoe – a country record, and the second largest contribution to global primary energy growth from any single fuel and country, behind natural gas in China. The share of renewables in total power generation increased from 7.4% to 8.4% globally, and from 16.5% to 18.3% in Europe, a new high.

Given the impetus behind renewable energy it seems likely that the coal’s share of the market, which has held up reasonably well, will soon start to recede.

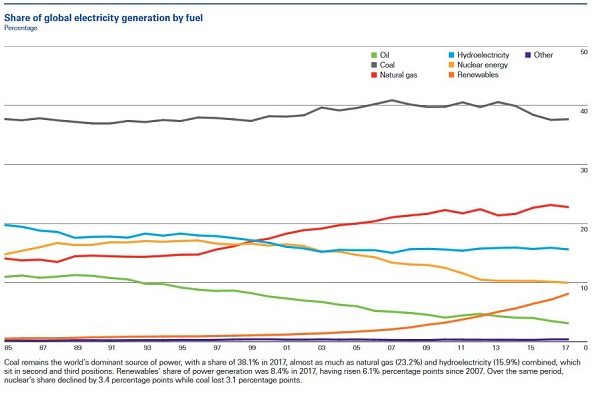

Here we have electricity generation by source over time:

- Coal remains the world’s dominant source of power, with a share of 38.1% in 2017, almost as much as natural gas (23.2%) and hydroelectricity (15.9%) combined, which sit in second and third positions. Renewables’ share of power generation was 8.4% in 2017, having risen 6.1% percentage points since 2007. Over the same period, nuclear’s share declined by 3.4 percentage points while coal lost 3.1 percentage points.

In recent years the rise of renewables has effectively made up for the decline in gas and nuclear.

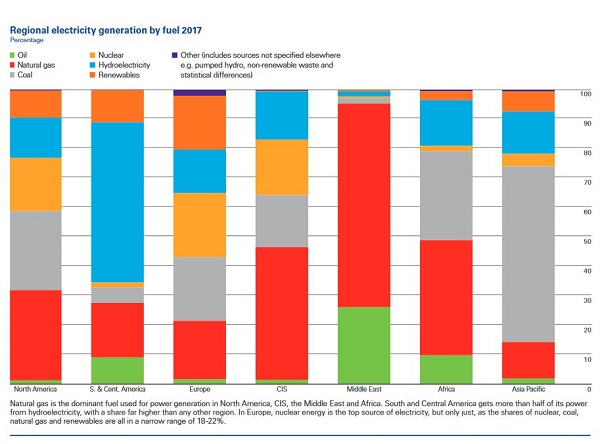

Here’s regional electricity generation by source:

-

Natural gas is the dominant fuel used for power generation in North America, CIS, the Middle East and Africa. South and Central America gets more than half of its power from hydroelectricity, with a share far higher than any other region. In Europe, nuclear energy is the top source of electricity, but only just, as the shares of nuclear, coal, natural gas and renewables are all in a narrow range of 18-22%

Taking the last two graphs together, early this century China and India went on a rampage of building coal-fired power stations. Their position was that they had the right to industrialise as advanced economies in the west had done before them. Their position was that the West’s legacy production had created the climate change issue and the West should cut back their emissions to make room for the developing countries to catch up.

Whatever the ethics of this position, the planet is now in peril.

Brian: Do the coal production figures you quote thermal only or do they include metallurgical coal and other coal products that are not used for power production.

Even if emissions were not an issue it is worth noting that:

Fossil power is not the only source of baseload power. Solar tower and hydro power can be used as baseload as well as dispatchable. Combinations of solar PV/wind with energy storage can also function as baseload.

What the fossils seem to be ignoring is that coal fired is not dispatchable because coal fired takes so long to start up and has limited flexibility. Solar tower and hydro are dispatchable as well as baseload.

Expanding coal fired no longer makes sense even if you believe that there is no need to reduce emissions.

Yes John.

By the way, a foolish writer elsewhere recently asked “what is the point of using electric power to pump water uphill, if you only get 90% of the energy back again when you run it down through a hydro generator?”

My comments include

I) energy storage can be very useful

II) all conversions of energy from one form to another, in the real, frictional, heat-conductive world we all inhabit, involve some energy losses. Engineers, designers, scientists and economists (and other humans) have been living with this reality, and its constraint, for centuries. And since the C19 development of rigorous thermodynamics, have understood it.

/sermon

John, my narrative is that people are turning away from building new coal power, but they are also using existing capacity less.

So the real story is in coal production, which I would assume to cover both thermal and coking, and has been falling from the peak of 2013..

I’m relying on Geoff M to set me straight if I’ve erred, when he gets here.

Is that 90% figure correct ?

I would have thought it way less.

Just askin.

Is your Google broken again?

So no then.

Thanks, good chat.

I thought 90% was likely too high. The writer seemed to think anything kess than 100% was simply ridiculous.

My hypothesis is that the figure has to be less than 100% .

Yer know, when I were a lad, summat tells me the incandescent light bulbs were round aboot 5% efficient. Put in 100 units of power: you got 5 units of bl**dy light and 95 units of bl**dy heat. And it could set your flamin’ hut on fire. More heat than light, like. So my old Dad used ter say: use the candle or the kero lamp, son. They’ll not set bl**dy hut ablaze, mark my words. I’ll never forget sound of ‘orse bells on fire truck, as it came oop hill. Those were grand days.

Nephew sent word by carrier pigeon. He reckons Snowy 2.0 FAQs admits there is an energy loss but won’t give a figure. Not even a guesstimate. Nephew says “typical!”

Nephew lost me when he talked about Web Sight.

Flamin’ Webs can’t see. Sent him off with a right scolding. Youngsters these days!!

Ancient AMBI sir: When what you are storing is surplus renewable power that costs almost nothing, storage makes sense even if it isn’t all that efficient. Mos t people don’t seem to have twigged that almost all the costs for solar PV and wind are fixed costs that you pay whether the power is used or not or whether the power is switched on or off.

If you want low cost power in a renewable future try and set up your business or house so that it needs as little on demand power as possible and gets the rest in some form of controlled power that doesn’t have to be on all the time.

Yes, yes, yes young John.

I agree.

In my meandering way, I was criticising the clown who seemed to believe that pointing to an efficiency < 100%, was a killer argument against pumped storage.

I dare say said clown has made use of inefficient household appliances, possibly a car battery, possibly domestic hot water from a storage tank, etc., with never a complaint, never a sneer.

Accepting less than 100% efficiency is part of thermodynamics and therefore part of life.

Ambi the Ancient

Lower Hut (ashes of)

Much Ado Museum of the Imperfect Machines

Prefecture de Carnot

Fixed costs, eh?

Like for those small farm windmills that might be slowly pumping water when it was needed to top up a storage and switched off when it wasn’t needed?

You mean our grandfathers were not entirely stupid? Crikey!!!

And some evaporation losses here or there weren’t the most important aspect?

On the other hand ancient Ambi it doesn’t make sense to use all the solar power to pump water up to the dam that feeds all the water to the hydro power generators who provide all our power.

Beware of the title “all wise ancient….” You have to be an ancient Jumpy to try and claim the all wise title…..

If you go to Snowy Hydro’s Snowy 2.0 FAQS you are told that the energy loss is “small”.

If you go to Marsden Jacobs report on Snowy 2.0 you will find at 58 on the counter:

They would emphasise that you pump when power is cheap and make a mozza by feeding into the spot market when power is scarce.

However, Giles Parkinson will tell you that Snowy 2.0 will have a largely negative effect on the NEM system in Snowy 2.0 will result in more coal power, delayed solar and other storage:

Charming!

Ancient I will accept.

“Wise”, never!!

Yes, Brian. It says “small” with not even a guesstimate. The FAQs look more like PR than real, technical info. I prefer the latter.

Turnbull has gone so why keep on with his Snowy mountain monument? He doesn’t need photo ops any more.

Given the distance between the Snowy and the power sources that it will use and the distance again to customers network losses should be added to the actual system losses.

Probably makes a lot more sense to have pumped hydro closer to power sources and customers.

John Davidson (Re: SEPTEMBER 9, 2018 AT 1:49 PM):

An article by Mark Diesendorf at RenewEconomy headlined Is coal power “dispatchable”? is one answer to this prickly subject.

The article includes a table of dispatchability with four different ranks that the author proposes, with baseload thermal coal, gas and nuclear ranked 4th.

There’s an explanation for why the author includes coal (and by inference gas and nuclear):

But I’m inclined not to buy that argument – Pumped Hydro Energy Storage for long duration events like Snowy 2.0 (and high-voltage interconnectors) would be a better long-term sustainable strategy to achieve zero-carbon emissions objective.

GM: Many of my comments are based on the table you refer to.

The problem with keeping cola fired as an occasional reserve is that coal stockpiles can spontaneously combust and there aren’t always going to be coal mines that would be willing to divert product from steady customers. In addition, many coal fired power stations have a dedicated mine feeding them. (Ex: All brown coal mines.) Hard to only run a coal mine for a few months a year. (This is why the SA coal fired and the Leigh Ck dedicated coal mine shut down.)

Brian (Re: SEPTEMBER 9, 2018 AT 7:01 PM):

BP Statistical Review of World Energy – 67th Edition, published 13 June 2018 is a snap-shot of the calendar year 2017, and comparison with previous years.

On page 38 is a table for coal production, country-by-country, region-by-region, and globally, for years 2007 through to 2017 inclusive. Global coal production reached an overall peak in 2013 (3978.9 Mtoe), declined in 2014 (3966.4 Mtoe) and substantially further in 2015 (3862.1 Mtoe), and has grown in 2016 (3663.5 Mtoe) and 2017 (3768.6 Mtoe), but still below the peak in 2013. Below the table is shown:

I interpret that to include all commercial coal – thermal and metallurgical.

On page 40 are graphs of coal production and consumption for period 1992 through to 2017.

A more recent indication (to July 2018) that the global coal-fired generator fleet is reaching a global peak is indicated here. It includes these statements (bold text my emphasis):

4 GW represents just two (2 GW nameplate) Liddell power stations. And this (bold text my emphasis):

And why is this happening? Because new renewables are cheaper than new coal, and renewables can be deployed much faster than coal-fired generators.

John Davidson (Re: SEPTEMBER 10, 2018 AT 1:32 PM):

The economic argument for new coal-fired generators has dissipated, and as a consequence the coal pipeline is shrinking. Some in government just haven’t worked that one out yet. And neither have most of the media, as Brian has commented above:

…and on energy generator technologies, re costs, deployment times, etc.

At least SMH‘s Peter Hannam and The Guardian‘s Katharine Murphy appear to be more aware of the issues.

Thanks for the links, Geoff.

I get the impression that at the Guardian Katharine Murphy has taken on climate from Lenore Taylor, who is too busy being the boss. They do have other writers on climate there and run a couple of specialist climate blogs.

I’ve done an update to the post, based on the BP survey:

In his comment of September 10, 2018 at 1:40 pm Geoff Miell links to the BP Statistical Review of World Energy – 67th Edition, published 13 June 2018 which is a snap-shot of the calendar year 2017, and comparison with previous years. Here are some graphs.

First, coal production by region:

Second, coal consumption:

I’ve split them for legibility. The graphs are followed by the note:

World coal production increased by 105 million tonnes of oil equivalent or 3.2%, the fastest rate of growth since 2011. Production rose by 56 mtoe in China and 23 mtoe in the US. Global coal consumption grew by 25 mtoe, or 1%, the first growth since 2013. Growth was driven largely by India (18 mtoe), with China consumption also up slightly (4 mtoe) following three successive annual declines during 2014-2016. OECD demand fell for the fourth year in a row (-4 mtoe).

Here we have the progress by region of ‘other’ (meaning other than hydro) renewable energy consumption:

Followed by share by region:

With the note:

Renewable energy in power generation (not including hydro) grew by 17%, slightly higher than the 10-year average (16.2%) and the largest increment on record at 69 million tonnes of oil equivalent (mtoe). Wind provided more than half of renewables growth, while solar contributed more than a third despite accounting for just 21% of the total. In China, renewable power generation rose by 25 mtoe – a country record, and the second largest contribution to global primary energy growth from any single fuel and country, behind natural gas in China. The share of renewables in total power generation increased from 7.4% to 8.4% globally, and from 16.5% to 18.3% in Europe, a new high.

Given the impetus behind renewable energy it seems likely that the coal’s share of the market, which has held up reasonably well, will soon start to recede.

(1) Coal isn’t just coal – and the inability of politicians, journalists and the general public alike to distinguish between thermal coal and metallurgical coal is clouding all discussions and causing everyone no end of mischief. Sorry, I don’t have any brilliant ideas on renaming the two different types of coal.

(2) The game of financial pass-the-parcel has been unkind to the pro-coal, anti-climate-change investors. Why keep it a secret? They have been caught with their pants down; they know it only too well and will continue doing everything they can to get something, anything at all, back out of their stranded assets and to promote more coal-fired power stations so as to give the suckers confidence to so they can flog off their stranded assets off to them.

(3) I’ll trot out my favourite hobby-horse: We are wasting our breathe unless and until we start addressing the very real issue of re-employing and redeploying all those whose livelihoods depend on the mining, the transport and the burning of coal. Becoming so obsessed with only the ecological and the economic aspects of the whole issue, whilst ignoring the social impacts, will get us nowhere at all.

Graham

How about ‘cola’, or for coking coal:

‘coker-cola’.

Rots your teeth, mucks up your atmosphere!!

***

Down South here, ABC News reports that the Andrews Govt is announcing six new renewable power projects: three new wind farms in the south west* of the State, and three solar projects in the North.

Makes sense: windy Warrnambool, sunny Sunraysia.

Will have to check if any of these schemes involve that old politicians’ trick of re-announcing a previous announcement.

Minister D’Ambrosio said the projects are intended to move Victoria towards its own renewable energy targets. Of course, we have a State election coming up in November. (Wentworth isn’t the only election opportunity to highlight

emissions and reliable, cheaper power.)

* it’s noticeable that Victoria is under-equipped in wind farms, compared with SA: drive across the border heading towards Adelaide, and it’s obvious.

I’ve added to the update:

Here we have electricity generation by source over time:

Coal remains the world’s dominant source of power, with a share of 38.1% in 2017, almost as much as natural gas (23.2%) and hydroelectricity (15.9%) combined, which sit in second and third positions. Renewables’ share of power generation was 8.4% in 2017, having risen 6.1% percentage points since 2007. Over the same period, nuclear’s share declined by 3.4 percentage points while coal lost 3.1 percentage points.

In recent years the rise of renewables has effectively made up for the decline in gas and nuclear.

Here’s regional electricity generation by source:

Natural gas is the dominant fuel used for power generation in North America, CIS, the Middle East and Africa. South and Central America gets more than half of its power from hydroelectricity, with a share far higher than any other region. In Europe, nuclear energy is the top source of electricity, but only just, as the shares of nuclear, coal, natural gas and renewables are all in a narrow range of 18-22%

Taking the last two graphs together, early this century China and India went on a rampage of building coal-fired power stations. Their position was that they had the right to industrialise as advanced economies in the west had done before them. Their position was that the West’s legacy production had created the climate change issue and the West should cut back their emissions to make room for the developing countries to catch up.

Whatever the ethics of this position, the planet is now in peril.

GB:

Easier said than done. Part of the problem is that coal mining and processing jobs are very well paid, particularly when we are talking about non-tradespeople. I am not impressed when people talk about “just transition” aimed at converting coal miners to solar panel installers etc.

If you have got used to earning 3 or more times the minimum weekly wage the alternatives are not very attractive. (You might argue that a lot of the high wages come from shift and overtime penalties but you are still telling people that they will have to live on a lot lot less unless they can find work in other mines. (The growth in the number of mines using driverless trucks doesn’t work.)

Graham Bell (Re: SEPTEMBER 11, 2018 AT 7:05 AM):

I think perhaps you are glossing over the “social impacts” of human-induced climate change. May I suggest you read Ian Dunlop’s submission (#036) to the Australian Senate inquiry into the Implications of Climate Change for Australia’s National Security? It includes (bold text my emphasis):

And also Ian Dunlop’s testimony at the 8 December 2017 public hearing, which includes (on page 52):

Something to think about:

There are no jobs on a planet inhospitable to life.

Good planets are difficult to come by.

Brian (Re: SEPTEMBER 11, 2018 AT 12:04 AM):

Thanks. BP has been producing annual editions of its BP Statistical Review of World Energy (published mid-June each year) for longer than I’ve been alive, and longer than the International Energy Agency has been in existence. It’s not ‘the be-all’ document, but I think it’s a good indicator of what has been happening in the field of energy economics, often quoted (meaning the data tables and graphs are apparently widely regarded as a reasonably reliable global reference). I’m more skeptical of the commentary at the front of the document – I suspect BP needs to maintain impressing its shareholders with positive/upbeat news/assessments of trends.

John,

Yes.

One of the immediate reactions of Hazelwood families, mostly with male coal-mine employees, was for wives and kids to seek full-time jobs, pronto.

This wasn’t going to fully make up the lost income, but cushioned the family finances a bit. Problem was, youth unemployment had been notoriously high in the region for decades. Exit (emigration) was another response.

Hazelwood blokes were generally very well paid. One consultant in Gippsland opined that it was going to make them very unwelcome applicants for jobs elsewhere…. “overpaid and lazy”, though there was no doubting their technical competence.

It seems that the immediate answer for many displaced workers has to be, “start by finding a lower-paying job”, in direct contrast to Coalition Ministers’ pronouncements in recent years: “get yourself a high-paying job!!”

The very high gross income from jobs in coal-related industries is at the heart of the re-employment problem.

Protecting this problem against remedial change are all the supporting, dependant or parasitic jobs.

For example, in real estate and housing construction in the “dormitory cities”, in aviation for FIFO, in financial services.

Or, another example that is very relevant out here in The Bush: without the very high income from coal mining supporting them , many of the farms and grazing properties would collapse overnight. Having the main breadwinners back working full-time on their properties wouldn’t save them either. Alternative off-farm employment is difficult to come by; besides, as Ambigulous pointed out with ex-Hazelwood employees, former coal industry employees can face unwelcoming attitudes. It is fear of rapid, irreversible destitution that would happen if anything changed in the coal industry that drives so many people Out Bush into the arms of the coalsheviks.

It is a devilish problem but that is no reason at all not to start striving to resolve it right now.

Geoff Miell: Thanks for those quotes. You misunderstood me when you said, ” you are glossing over the “social impacts” of human-induced climate change.” That is a vital matter which does worry me greatly.

Brian: Thanks for all those graphs; they’re quite helpful.

How about all the supporting, dependant and parasitic end consumers of fossil fuels ?

You know, the ones that use stuff that runs on them or is made using them.

If enough folk totally boycott these and either use a totally fossil free alternative or just go without the whole industry has no reason to exist.

Sure, it may be a bit uncomfortable for a while, but hey, better than complete cataclysmic self extermination.

That’d be far more effective than making a few phone calls and emails to people that don’t care about you at all and criticising other for not performing the same useless exercise.

Graham Bell (Re: September 12, 2018 at 4:50 am):

I’m glad we’ve cleared up any “misunderstandings” on this issue. Thanks.

Jumpy (Re: September 12, 2018 at 2:22 pm):

Jumpy, are you going to lead the way by example?

Methinks it’s a small mercy that you aren’t in charge, Jumpy.

At the Carbon Tracker Initiative, dated Sep 10, is an article on and link to a new report 2020 Vision: why you should see the fossil fuel peak coming. It includes:

GM

You need to be lead ?

No need for you to personally do it hard to “ save the planet “, others can. After all, you made a few phone calls so burn on you climate Champion you.

OK Jumpy,

I’ll bite.

Boycotts have been effective under some circumstances. You may remember some of Gandhi’s efforts in British India: getting people to boycott British salt and imported textiles from England, wasn’t it?

In some ways, a partial boycott has begun: folk buying rooftop solar; folk specifying they prefer buying power generated by “green sources” from their power retailers; folk buying electric or hybrid vehicles; folk trying to buy food that involves fewer “food kilometers”; installing or upgrading home insulation; cycling or walking instead of driving; and yes, GM, folk having fewer children.

OK, this is small beer.

So Jumpy: put forward your thoughts or plans for more effective boycotts please.

Otherwise, you might seem not to be serious: much like someone who calls for “socialism” without specifying the details of governance, democracy, the economic system, the financing, and the social arrangements.

Are you serious?

Cheerio

Ambi of the Overflow

Mr A

I’m the Dude that thinks it’ll be ok when enough individuals are convinced enough to act meaningfully individually.

What is not a serious position is warning all and sundry about how carbon sin will lead to hell fire and brimstone then think a few phone calls will absolve ones sins like some sort of confessional, then go back to carbon sin repeatedly.

I know Brian is trying to educate and convince the common man, and good on him.

Because we live ( thank Jehoshaphat ) in a consumer World where he who pays the piper calls the tune, not the flute makers.

On the social effects of necessary change and on easing the pain of transition out of old-fashioned industries:

Yes, I know, Joe Hockey did say that the Age Of Entitlement was over but nobody of consequence (= money) took him seriously, did they? Or was it that slogan that ended his career as Treasurer?

Anyway, how about a bit of Creative Entitlement for highly-paid workers to induce them to leave the coal industry for good and not return to it through a back door? Something like a ninety-percent cut in their income tax liability for their next six years in another industry? Would that do for the hors d’oeuvres, with even more attractive goodies served up for the following courses? Unfair? Of course. Abuse of Entitlement? Undoubtedly – just like all the other outrageous perks and freebies people in some professions regard as their God-given right. Unaffordable? Oh come on; we are talking about a tiny fraction of the wealth and treasure we forego in all the tolerated tax dodging by multinational companies; at least the bulk of this money is likely to stay in Australia and stimulate the local economy. Naturally, measures would have to be in place to stop firms replacing redeployed Australia workers with imported ones and to stop them pulling any other swifties.

Why not? Who knows but it might even work.

Well, Graham.

There’s a suggestion.

Whereas Jumpy will wait for individuals in sufficient numbers to bestir themselves…. but hang on, Mr J suggests folk could “use a totally fossil-free alternative”.

Well, Mr J, where will these appear from? How will that happen? And what’s to stop vested interests, coal-lovers, from sabotaging every small change?

This Market of Autonomous Consumers choosing emissions neutral products and services, ?donde es, amigo? where eez eet Mister Jarmpy? In El Dorado??

Sancho Panza

Sancho, I’m sure Senor J is thinking of the rapid takeup of rooftop solar power by Australia’s peons.

Over here in the fair Sandgroper state it reduced consumption of grid electricity to such a degree that the Wealthy People’s Party (in power at the time) suggested people who went off the grid should still be billed a supply charge for the electricity they weren’t buying (because economics). They didn’t get away with it.

I think it’s way past time we dealt properly with the undeserving rich.

Well, Senor Jarmpi holds up suffering Venezuela as a very bad example. But it’s still not clear to me how Not Venezuela translates into “ideas for the Australian polity”.

Meanwhile, we peons are muttering amongst ourselves, as we are wont to do. But also installing rooftop solar PV, as you eez saying.

But the the knowledgeable senors have explained us, eet just won’t be enough!!

What must we do, in cities and countryside??

GB: Ex coal mining employees who are doing well enough to benefit much from tax cuts don’t need help.

John D.:

True enough. Leaving aside those whose very high wages keep their farms and grazing properties only just out of the clutches of mortgagees and other creditors, many of the others, who have amassed fortunes out of working in the coal industry don’t deserve any help at all, and especially not tax cuts. The same can be said of those in other fields whose connections and unfair influence get them a licence to dodge tax, or, worse yet, get us to subsidize them as well.

That’s a strong moral argument. I feel that way too.

But – if we want these people to stop working in the coal-related industries, and to do so willingly and at the lowest long-term cost to us (and to the planet) then we are going to have to consider measures that work, even if such measures do have a moral cost and seem to have a high short-term cost. Sending in the troops to hunt them out would be the quickest and cheapest solution – and I’m sure that would delight the screaming greenies in the more fashionable suburbs too – but tempting though that measure might be, it does have serious social and economic costs.

Traditional measures to get us out of this mess aren’t working or aren’t working fast enough to stop us all being cooked – so we will have to be creative. Doing nothing ceased to be an option a few decades back.

GB: When a small business goes bust the employees are left to look after themselves. However, when John Howard’s rellies business goes bust or some big industry gets into trouble the government sees the need to help.

I feel for the coal miners because they are people I have worked with but do get irritated about the prattle of the just transitions people.

Maybe coal miners could find work if industries based on the use of renewable power to generate electro fuels were set up on poor agricultural land near existing coal mining towns. There is certainly a lot of talk about manufacturing renewable ammonia as a transport fuel these days.

John Davidson (Re: SEPTEMBER 14, 2018 AT 10:25 AM):

Your link for “electro fuels” includes:

Why do you keep trotting out this apparent line of wishful thinking re renewable hydrocarbon liquid fuels? Without a reliable cost comparison that’s genuinely competitive (without significant subsidies in monetary or energy terms), and the technology can be scaled-up to meaningful quantities (i.e. millions of barrels of oil energy equivalent per day) in a reasonable time-scale (i.e within a decade), then I think you are just peddling a pipe dream.

John, please come up with some compelling cost comparisons (and EROI analysis) for this tech, or otherwise I think you are just pushing a false hope. What encouraging developments have occurred since your post (dated 30 March 2013) more than five years ago?

I keep asking you, and you just keep avoiding my (apparently) inconvenient questions.

In today’s SMH is an article headlined ACT becomes first in Australia to join UN’s Powering Past Coal Alliance by Peter Hannam.

The momentum against coal builds.

At the end of the article, under the sub-heading Adani switch, it includes:

IEEFA analyst Tim Buckley says even though the capital cost would likely halve, the economics remain challenging.

https://www.openpr.com/news/1199304/Global-eFuel-Market-Research-and-Forecast-2018-2023.html

Jumpy (Re: SEPTEMBER 14, 2018 AT 3:00 PM):

Thanks for the link to a public relations website, but it doesn’t answer my question about competitive costs for so called “electro fuels”. Did you actually read the webpage, Jumpy?

And I’m not going to spend $3600 on the Global eFuel Market Research and Forecast, 2018-2023 on a hunch that it might answer my question. It may also be a scam – thanks Jumpy.

The synopsis for the report includes:

How high a cost? All very coy about the most important details. Without revealing indicative unsubsidised competitive costs (compared with and to displace/replace petroleum-based fuels) I think “electro fuels” are just a false hope.

The synopsis also says:

Is that code for unending tax-payer funded subsidies? Jumpy, I thought you were against all subsidies? And what does “cost-effective” mean without numbers to compare with?

Thanks for the link Jumpy. I have been rabbiting on about e-fuels for some time and happy to see that others are taking them seriously. I see renewable ammonia as the easiest e-fuel to produce. Current thinking is that it is a logical material to feed fuel cells.

Jumpy (Re: SEPTEMBER 14, 2018 AT 3:00 PM):

I think your link is similar to the vague promises in this Submission on small modular nuclear reactors.

Section 2. Affordability includes:

No indicative costs to gauge objectively whether “SMRs could become the lowest-cost generation available in Australia“, or not. It suggests to me we are expected to take their word for it.

Section 7. Economics includes:

Today’s exchange rate means US$60/MWh equates to AU$83.25/MWh.

Lazard’s Levelized Cost of Energy Analysis indicates nuclear is in the range US$112-183/MWh.

Methinks someone is telling porkies.

I can’t see how new nuclear energy is or will be competitive with new renewables:

Wind: AU$55/MWh (per Professor Blakers);

Solar-PV: AU$30-50/MWh ()per Prof Blakers);

CST: AU$78/MWh (project Aurora capped rate, and this figure is likely to fall further with more development iterations).

And I suspect there’s the same BS being spewed forth about “renewable hydrocarbon liquid fuels”. You can’t ignore the constraints imposed by the laws of physics/chemistry/biology (and thus EROI).

John Davidson (Re: SEPTEMBER 14, 2018 AT 5:12 PM):

Costs, John – where are they?

GM, could you please provide the group with what your attitude toward mobile phones was in about 1980 ?

And was this attitude formed from EROI analyse?

And did that 1980 attitude exactly manifest in what we experienced today.

Think back, take your time.

Just out of interest ( mine ) EROI is a poor metric compared to LCOE when considering viability.

That said, cost is different to value.

GM: If you had looked you would have realized that what it was was a marketing report.

I don’t know enough about operating ammonia plants to be sure about how well they could deal with variable power supply but my guess is quite well

I suspect that the real economies of e-fuels comes from the effectively zero cost of surplus solar and wind power.

John D.: Transition of workers out of coal-related industries must become a social disaster UNLESS there is:

[1] thorough and adaptable Planning,

[2] thorough Involvement of those affected.

[3] thorough Preparation,

[4] sufficient Time to carry it all out,

[5] thorough Honesty and Sincerity on all sides.

[6] a realistic, attainable goal – and not some pie-in-the-sky.

But all that applies to any major change.

There is a 7th requirement in this Australian context, no effort must be spared to keep the training racketeers and the job placement gangsters right out of it, (not sure how that could be done without those thieves using their pelf to sue the government, successfully, for hindering their opportunities to commit further felonies).

Right at the heart of it all is the need to create, in for coal-industry workers and their families, the real desire to change and for them to see real personal advantages for themselves in changing. Sorry but appeals to patriotism and to saving the planet won’t work, neither will bullying and coercion.

This is merely a difficult problem and a tough challenge. It is certainly a long way from being an impossible task.

Jumpy (Re: SEPTEMBER 14, 2018 AT 6:42 PM):

I didn’t have the need for one then, and it was way too cumbersome and expensive for me to afford – at least I had an idea then of the tech and what the indicative costs were to make a judgement call at that time. John D still can’t provide any cost comparison for “renewable hydrocarbon liquid fuels” to be able to make a judgement call, and he seems to have a continued fervour for promoting this form of electro-fuels apparently without indicative costs. It seems to me like he has a lack of critical thinking on this issue – an apparent blind faith that this is the way forward.

If new credible data becomes available then I will reassess my position, like I did when mobile phone tech became affordable and useful for me in the late 1990s.

Energy Returned On Investment (EROI) has nothing to do with mobile phone tech. EROI is used as an indicator of the viability/sustainability of primary energy generator technologies.

EROI studies are a recent activity (within this century, I think from circa 2010 onwards) pioneered by people like Charles A.S. Hall – EROI was not thought about in the 1980s that I can tell.

Oil, natural gas and coal had high EROI values in the 1980s and earlier – that’s why they were cheap sources of primary energy. EROI for oil, gas and coal are steadily declining as resource depletion has greater effect, which results in higher extraction costs (and thus higher fuel prices).

High EROI values indicate low primary energy costs;

Low EROI values indicate high primary energy costs.

I suspect renewable hydrocarbon liquid fuels have low EROI values, hence they are likely to be high cost (i.e. unaffordable for many people). But without indicative costs it’s all speculation. I suspect those that know the indicative costs won’t publicly reveal them because they are probably prohibitively expensive, which would scare away prospective investors in this tech.

Jumpy (Re: SEPTEMBER 14, 2018 AT 7:06 PM):

You are dead wrong IMHO. Please read Twenty-First Century Snake Oil, particularly Section 5: Energy Return on Investment to gain a better insight into using EROI as an indicator of viability/sustainability of primary energy supply technologies to support/sustain our civilisation’s level of sophistication. It includes:

And view this YouTube video Peak Oil Postponed? – Charles A. S. Hall, from about time interval 21:00. At about time interval 22:20 Hall talks about Society’s Hierachy of “Energetic Needs”.

John Davidson (Re: SEPTEMBER 14, 2018 AT 9:46 PM):

John, perhaps you missed my comment (at SEPTEMBER 14, 2018 AT 4:57 PM) where I stated:

Perhaps I should have included the sarcastic remark: We all know how truthful public relations organisations can be.

And yet your response to Jumpy was (bold text my emphasis):

…which implies to me you appear to be taking “a marketing report” “seriously“. Have I got that right?

You say:

You don’t get something for nothing. You still need to build/construct equipment, that requires energy from somewhere, to convert solar and wind energy to other forms of energy (whether that is in the form of electricity, or “electro fuels”). That’s the denominator part of the EROI calculation.

1. Something only makes its way into a marketing, PR report if it is vaguely plausible and meets a foreseeable need (hence a foreseeable market, investment opportunity).

2. Geoff has been talking about the concept of “peak oil” here for a while.

3. As I understand it, that scenario involves dwindling supply hence high prices, dwindling supply hence both a transport and a national security challenge.

4. Geoff, you should not complain if other posters posit alternative fuels.

5. GM undoubtedly understands the economic concept of “supply and demand” as it relates to price movements. If oil production dwindles, and oil prices rise sharply, suddenly alternative sources of fuel will willy-nilly become economic, cost-competitive. Especially if there are still trucks, cars and machinery working on liquid or gaseous fuels.

6. Smart investors and smart engineers will seize the day. Capitalism is nothing if not quickly adaptive to new opportunities for profit. Capitalism also is not averse to short-term action if there’s a buck in it. Wise folk think of the longer term; capitalist investors are broader minded if I can put it that way.

7. I recall discussion of hydrogen fuel and strong advocacy by Australian engineers in the 1980s and perhaps earlier. Two reasons were given:

a) only H2O as a fuel combustion emission

b) the availablity of solar electricity to hydrolyse H2O as the fuel source. Such discussions were partly but not entirely prompted by the Oil Shock of 1974.

8. Some may regard water as a fuel source as “pure moonshine” (as the great Ernest Rutherford said when deriding the prospects for nuclear power). I respectfully suggest, Professor Rutherford, that water-as-a-fuel is “pure sunshine”.

Thanks, GM, for links to further explanations of EROI. Your efforts are truly ‘eroic.

Cheerio

‘Embodied energy’ is also a useful concept and has been used by advocates of renewable energy, and engineers etc. for many a long year.

We, your readers, didn’t come down in the last shower, Geoff.

(Apologies to any folk who are desperately hoping for ANY showers, or decent soaking rain. )

No ones got an accurate crystal ball.

The prediction dump is overflowing with advocates and sceptics.

The future reality will come about due to the decisions of individuals.

Simply floating ideas is what blogs are for.

Perhaps it’s time for GM to announce his fool proof Master Plan for scrutiny.

Jumpy: Thanks for

They are a form of brainstorming where someone’s ridiculous idea can prompt someone to come up with a much better idea.

Blogs are also for floating problems and opportunities that may spur someone to put in some think time or go and do some research. I used to say that I had an ideas bucket and solutions bucket. Every so often I would stumble on a new problem that matched something in the ideas bucket. Every so often i would stumble on a new idea that I could match to something in the problem bucket.

GM: Understanding cash flows and costs can help identify where effort is justified. I used to ask my self “If X is successful, so what?” (The SOWHAT TEST can boost productivity enormously. I have seen too many technical people waste a lot of time because they didn’t use the sowhat test.)

You don’t seem to have grasped that surplus renewable power is essentially free. You size the installation to satisfy peak demand but there will be times when demand is less than peak and the excess capacity can be wasted or diverted to something useful.

Have a look at small, manoeuvrable drones.

(I don’t mean the large, heavy miltary models.)

Relatively cheap to build.

Battery operated hence solar pv free running costs. Thanks John.

Ten years ago, anyone talking about electric aviation would have been derided.

Monitoring (e.g crops and soil moisture for irrigators to help improve efficiency of water use) had to be done by light planes chewing up avgas. There was a huge tomato farm in Australua with an inbuilt systematic watering system. The owners paid for a weekly light plane overflight to produce crop images to guide their watering schedule. Plane flew from hundreds of km away. Still cheaper than persons traversing the farm.

Drones: even cheaper.

Blogs are blooming marvellous.

Ambi: Battery powered planes are OK for short trips but would need radical improvements to be OK for long haul flights. This problem is part of what is driving interest in e-fuels. (I this case hydrocarbon based fuels that don’t need to be carried in pressure vessels instead of the less energy intense ammonia that does need a pressure vessel.)

I wasn’t thinking about passenger aircraft or freight carrying craft, just those tiny little cameras and sensors. Small electric drones.

The tomato farm manageress could run it herself, with the right software.

Ambi: Australia’s first electric aircraft has begun test flights at Perth’s Jandakot Airport, amid hopes the plane will be flying to nearby Rottnest Island within months.

The two-seater single-engine Alpha Electro — designed and manufactured by European company Pipistrel — has two batteries that can keep the plane in the air for an hour, with an extra 30 minutes in reserve.

The team which purchased and imported the plane into Australia says while there are environmental benefits in doing away with jet fuel, electric planes are also safer and easier to fly.

“Electric propulsion is a lot simpler than a petrol engine,” Electro.Aero founder Joshua Portlock said.

“Inside a petrol engine you have hundreds of moving parts.

“In this aircraft you have one switch to turn the aircraft on and one throttle lever to fly.”

Just the thing for a quick jaunt to Rottnest.

There is also a lot of talk about electric passenger drones. For example:

Onwards and upwards it would seem.

Bl**dy little ripper, John.

Onwards and ever upwards.

My admiration for some of my fellow evolved hominids is as secure as ever.

Bl**dy little ripper, John.

Onwards and ever upwards.

Evolved hominids rule!!

Ambi: There is a story about an evolved hominid who learned to fly using wax wings. Problem was the hominid got too close to the sun and the wings melted.

Sometimes it doesn’t seem all that smart to let evolved hominids rule the skies, let alone Australia.

And went into legend, the old Prometheus.

Dead set legend.

Dead legend.

Failed to notice that his friends the bees used wax mainly for storage units rather than aviation.

That da Vinci blighter did a bit better.

Well, yes.

Evolved hominids can be fairly (how may I put this in a tactful way?) STUPID.

Ambigulous (Re: SEPTEMBER 15, 2018 AT 5:38 PM):

I’ve asked on numerous occasions for indicative costings – no response from John D. Alternative fuels are fine if they can compete and displace petroleum-based fuels on price and/or scale (i.e. volume) – if they can’t then they are of limited (if any) use to society as they are uneconomic (i.e. unaffordable for all but the super-rich) and/or provide too low a volume of supply to be of significant benefit.

Ambi, what is your idea of “economic” and “cost-competitive“?

Today’s market price per barrel of crude oil is:

WTI crude: US$68.92

Brent crude: US$78.06

OPEC basket crude: US$76.46

URALS crude: US$76.33

Then add refinery, shipping and retail costs. I filled up my car today with 95 RON petrol paying 156.9 cents per litre (roughly half that price includes state and federal taxes). Alternative fuels must compete with finished petroleum-based fuels on price and volume. So, are these alternative fuels within the “ball-park” in terms of price (and volume), or do petroleum fuels need to increase in price substantially (i.e. multiples of current price) before alternative fuels can be substituted competitively on price? No one seems to be able to answer my question. Until someone can then I remain highly skeptical that “renewable hydrocarbon liquid fuels” are (or will be in the near future) “economic” and “cost-competitive“.

The other point I make is that if petroleum oil prices increase beyond about US$100 per barrel then recessions ensue (see what happen in 2008). So I don’t see much leeway for alternative fuels to become “cost-competitive” with petroleum-based fuels. And there’s the EROI issue.

Ambi, what would you be prepared to pay for your liquid fuel: $2 per litre; $4 per litre; $10 per litre perhaps? And think about how that would impact on prices for everything else.

You may be better off by having an EV in future. But that will take time to ramp-up production and reduce costs.

John Davidson (Re: SEPTEMBER 15, 2018 AT 11:22 PM):

Indeed, so John, where are the indicative costs for “renewable hydrocarbon liquid fuels“? You seem to be ignoring your own “dictum”.

There’s a better test: Does it comply with the laws of physics/chemistry/biology and engineering principles? If it doesn’t, it won’t work. And for energy transformative equipment/infrastructure (i.e wind turbines, solar-PV panels, CST power stations, nuclear-fission power stations, “electro fuel” production, etc.) an EROI analysis can indicate whether these technologies are worth pursuing further, or not.

It’s either free or it isn’t (not “essentially free“). You, John, don’t seem to be able to grasp the basic fundamental that in order to get energy, you need to expend energy (and monetary capital) on energy transformative equipment/infrastructure – you don’t get these for nothing. How you manage that equipment/infrastructure during their operational lives is a matter of efficiency of utilization. Nothing in this world is 100% efficient.

There are energetic and monetary input costs for design/planning, construction, commissioning, maintenance, decommissioning and disposal/recycling of these energy transformative equipment/infrastructure. These all have limited operational lives (whether that’s in terms of years or decades, or perhaps a century or more) that at some stage need to be replaced by new systems. Energy and resources need to be available/reserved for maintenance procedures and renewal/replacement of retiring equipment/infrastructure, or the energy systems will become unreliable and ultimately decay. You seem to be overlooking this when you say its “essentially free” energy.

That is exactly our plan: to have an EV and to have extra solar PV dedicated to powering the vehicle.*

Or if that takes too long to be price-competitive, electric wheelchairs in the retirement village.

* and thousands of other Aussies have precisely the same plan. Ask around amongst over 50s and/or retirees. We are also, with higher confidence, waiting for the price of domestic battery storage to drop.

You are correct to point out that oil is relatively inexpensive at present.

Many corporations make very long-term plans. In the 1980s, a serious scientific/engineering project over many years investigated the feasibility and cost of producing petroleum from Latrobe Valley brown coal. I wager there must have been hundreds of similar efforts in other countries. And many other styles: agricultural biofuels, aquaculture algae growing, etc.

“I’ve asked on numerous occasions for indicative costings”.

Yes.

One point to consider is that for many energy sources there are (at least) two cost factors which can make a large difference to the cost estimate…… the two I have in mind are

A. The present rate of interest on long term loans

B. The expected productive lifetime of the equipment

Example: on B, we are told 15 years for our new solar panels. Could be 20? If it’s 30 will they be superseded by better gear well before they conk out (that’s a technical term from DIY).

Example: during my working life, interest rates have varied across a broad range of about 3% to 19%. That figure can make an enormous difference to an indicative cost estimate.

Just saying.

GM:

All this is confirming to me you haven’t got a clue what is involved in producing indicative costs and the likely margin of error.

Things you need to consider:

Ammonia production was about 176 million tonnes in 2014 of which about 88% was used in nitrogen fertilizers. Almost all nitrogen compound production starts with ammonia. About 70% of ammonia is produced from hydrogen derived from natural gas. (See the above link for more on ammonia uses, properties and production as well as the use of ammonia as a transport fuel or a means of transporting energy.)

Renewable ammonia has been produced in the past starting with H2 produced by electrolysis using cheap hydro-power and nitrogen from the air.

Unlike dirty ammonia, renewable ammonia can be reduced anywhere there is water, renewable power and air available. Makes it practical to produce ammonia close to point of use.

The use of renewable ammonia may be justified in terms of emission reduction rather than simple cost comparisons.

Ambigulous (Re: SEPTEMBER 17, 2018 AT 3:16 PM):

Typical solar-PV panels should have an operational life of the order of 25 years (provided they are not damaged by projectiles – i.e. hail). Typical PV panel outputs degrade over a time period of 25 years to about 80% of output (compared to when new), unless they are highest quality (e.g. like Sunpower with a 25-year energy supply guarantee).

There isn’t even an indicative cost for “renewable hydrocarbon liquid fuels” to make a judgement call whether it is viable/sustainable – so why think it is? I think it is foolhardy to think it would be without indicative costs.

John Davidson (Re: SEPTEMBER 17, 2018 AT 4:48 PM):

Why do you refer to renewable ammonia and hydrogen production? I think this is just a diversionary tactic by you to keep avoiding the real issue – indicative costs for “renewable hydrocarbon liquid fuels”.

I’m asking you (again and again) about indicative costs for “renewable hydrocarbon liquid fuels” – the example you keep plugging here – that you refuse to provide, probably because you don’t know. Yet you keep promoting it.

Without affordable hydrocarbon liquid fuels long-range wide-body aircraft traffic will decline once petroleum-based fuel supplies begin declining, or aircraft propulsion technologies radically change in a timely manner.

Electric powered aircraft appear to be making inroads into the lightweight, few passenger, short distance, low speed segment of aviation, but that’s not going to provide adequate engineering solutions for larger, heavier, long-distance aircraft – nothing so far beats the energy density of liquid hydrocarbons.

I hear that Australia holds about 60% of currently known, accessible lithium minerals.

Before lithium ion batteries, who would have cared?

Which global resources report foresaw that demand, in 1998, say?

Technologies can change quite rapidly.

The iron laws of physics including thermodynamics are not open to revision and certainly provide constraints on human machinery.

On wasted-energy grounds, space travel rockets and ICBMs make little sense. But advances in miniaturisation, transistors, solid state devices, etc arising directly from the space race, is a tale long told, and seems more or less correct.

What is the EROI for a space exploration program?

What is the value of earth-sensing orbiting satellites?

Blowed if I know.

Geoff: once most land transport is by EV, perhaps long distance aviation can continue, in an overall carbon-negative emissions budget.

You know the story: a sum of numbers can be negative, even though not all the numbers summed are themselves negative.

-1 plus -4 plus -2 plus 3 plus -6 is negative (-10)

even though one of the contributions to the sum (3 here) is positive.

Why do I mention this?

It would be terrific if all sectors of the economy lowered their emissions by significant proportions. But what matters is total emissions. One sector might be left behind, while others achieved strong reductions. Yet overall there would still be a lower total. Even ’emissions negative’…..

I accept that Australia hasn’t done anywhere near enough to reduce carbon emissions, by the way.

GM: Just accept that I am not going to provide you with indicative costings. I haven’t got the resources, time or inclination to produce even RAG comparisons. However, in my last reply the aim of the comments was to suggest that e-ammonia production will be in the right ball park and justifies the ongoing efforts by organizations such as CSIRO into the production and uses of e-fuels.

You said:

Seems a bit strange given that the e-fuel link that started this discussion was about the production of Jet A e-fuel using surplus (=very cheap) atomic power. Distance traveled, the importance of energy/kg and price will affect whether batteries and/or which e-fuel is optimal for renewable transport.

That would be Icarus:

John Davidson (Re: SEPTEMBER 17, 2018 AT 10:27 PM):

But you do have the time to continue to promote that renewable hydrocarbon liquid fuels are (to you apparently) the way forward without indicative costings, or any other plausible basis. I think its foolhardy for you to take that position, but I think it’s reprehensible to promote it to others – peddling false hope without supporting evidence (even when challenged).

You say in your comment (at SEPTEMBER 15, 2018 AT 11:22 PM):

So what if it’s possible to produce enough “electro fuel” to power a model aircraft as indicated in the article you refer to in your 13 April 2014 post. You are ignoring your own “SOWHAT TEST“, and your stated dictum “understanding cash flows and costs can help identify where effort is justified“.

The conclusion I reach is you appear to have been duped by false promises re renewable hydrocarbon liquid fuels being the way forward, and you seem to be doubling down, rather than admitting that your judgement has (and is) demonstrably flawed on this issue. I challenge you to prove me wrong, John.

Atomic power is not cheap – see Lazard’s Levelized Cost of Energy Analysis – version 11.0, where nuclear energy is indicated as US112-183/MWh. This is for civilian nuclear power generation – I would expect seaborne military nuclear power generation (on-board a US aircraft carrier) would be significantly more expensive.

Secondly, the nuclear fuel in the 2 reactors on board a US aircraft carrier usually last around about 20 years before nuclear refueling is needed – it’s roughly a 20 year energy supply, dependent primarily on the distance traveled and average speed attained. Budgeted refueling costs US$678 million (circa year-2015) for one US aircraft carrier. Draw down on that energy at a faster rate in part to power an energy intensive on-board “electro fuel” production facility (assuming you have the room to fit it on-board) and the nuclear fuel is consumed faster, meaning the aircraft carrier needs to be refueled sooner – you don’t get something for nothing, John.

So your statement that “Jet A e-fuel using surplus (=very cheap) atomic power” is demonstrably false. You clearly aren’t thinking this through using the laws of physics to support your judgement.

Ambigulous (Re: SEPTEMBER 17, 2018 AT 7:04 PM):

Land transport: I see electrified rail, battery-electric and hydrogen-fuel-cell vehicles displacing current fossil fuel-based transport systems – but the transition needs to happen quickly.

Long distance aviation: I don’t see any cost-competitive alternatives emerging that can be deployed in substantial volumes within a decade time-frame (before declining petroleum-based liquid fuel supplies are likely to begin a sustained decline).

Biofuels have poor to very poor EROI, compete with food production and water resources, and are likely to be unable to be scaled-up to provide sufficient volumes (and be sufficiently affordable) to displace petroleum-based fuels.

So called “renewable hydrocarbon liquid fuels” haven’t yet demonstrated that they can be scaled-up and be cost-competitive to displace petroleum-based fuels.

“Renewable hydrogen” may be an option, but that requires aircraft replacements with new propulsion and fuel tank systems. And there’s a question about how affordable this tech is.

I doubt (at this time) that batteries would have sufficient energy density, but time will tell. Battery-electric aircraft would require aircraft replacement with new propulsion and energy delivery systems.

I see huge challenges for the aviation industry that are unlikely to be resolved in a decade time-frame – we’ll see how it pans out.

I agree that the present aviation industry has enormous challenges.

Can we think outside the hypercube and find ways to sidestep or ameliorate the problem??

For example, email has surely by now almost replaced international air mail (letters, postcards, photos)?

Freight by sea (better EROI than aviation)?

Higher taxes on passenger air tickets? (There was a proposal to fund the UN through such taxes, long ago.) Move holiday makers onto cruise ships or electric train travel….

Plenty to think about…..

Oh, by the way, my uneducated feeling is that advances applied to electric land transport are likely to be adapted to other transport: sea, river, canal, public transport…. in addition to possible adaptations to stationary sites such as homes, shops, factories.

(I’m thinking, as one example, of the European windmill: used centuries ago as a power source and adapted in many ways since.)

Ambigulous:

Sorry but current sea transport is not so hot: century-old propulsion systems, slightly improved hull-designs and very dirty fuel. Containers are marvellous but they’re still made out of heavy steel and their contents often bring to mind that old Second World War slogan, “Is your journey really necessary?” In other words, why is half this rubbish even cargo in the first place?

Geoff Miell:

Aviation will remain in the 20th Century until its decision-makers cure themselves of the Hindenberg Syndrome and stop fearing hydrogen as a lifting gas, and until they stop being obsessed with speed and bigness too. There are hundreds of terrific concepts out there: let them fly – and fly beyond a prototype stage.

Yes, shipping is not so hot.

Wind powered ships may be old fashioned but wind is cleaner than diesel.

Much cargo is junk.

(So why fly it? Shipping it is bad enough.)

Shipping containers make good temporary houses.

Graham Bell (Re: SEPTEMBER 18, 2018 AT 9:17 PM):

Moving mass on water is the most energy efficient way.

From When trucks stop running: Energy and the Future of Transportation by Alice J. Friedemann, published 2016, in chapter Shipping Makes the World Go Round, there’s a table 2.2 for energy efficiency of transportation in kilojoules/ton/kilometer:

Oil tankers and bulk cargo ships: 50 kJ to move 1 ton of cargo 1 kilometer

Smaller cargo ships: 100-150

Trains: 250-600

Barge: 360

Trucks: 2000-4000

Airfreight: 30,000

Helicopter: 55,000

The type and long-term sustainability of energy sources are the issues in question, not the mode of transport.

Hydrogen, being the smallest atom, is so difficult to contain – any weakness in containment produces leaks, and then in the presence of oxygen all that is needed is an ignition source to cause combustion (or explosion).

Geoff

The mode of transport is Very Important, because the energy source must suit the mode of transport.

e.g. a lithium ion battery cannot lift a rocket into orbit; neither would present lithium batteries be good to power helicopter lift.

On a ship, heavy gear isn’t a “roadblock”.

In aviation or space flight, heavy gear adds to costs and emissions much more significantly, or in extreme cases means no flight occurs.

Not much point trying to drive a passenger airliner from Brisbane to Adelaide, by highway. Better vehicles exist.

I reckon that energy sources are important but not the last word.