The Australia Institute has instituted a National Energy Emissions Audit , which Giles Parkinson wrote about at RenewEconomy.

The April-May update tells us:

- The capacity of large-scale solar generation supplying the National Electricity Market tripled between March and early May.

- South Australia became a net energy exporter for the first time in March, selling the state’s abundant wind-generated power into Victoria.

- NSW coal-fired power stations have been consistently at 65% capacity despite three closures and speculation over Liddell, with imports switching from Victoria to Queensland post Hazelwood.

“Four new wind farms and eight grid-scale solar farms came online between March and early May, with a total capacity of 1,030MW,” said author and energy expert Hugh Saddler.

“The 500MW of solar generation will almost triple the grid-scale solar capacity of the NEM in just three months.

“This demonstrates that the cost advantage wind had over solar has been reduced and we can now expect new capacity to be a mix of both technologies.

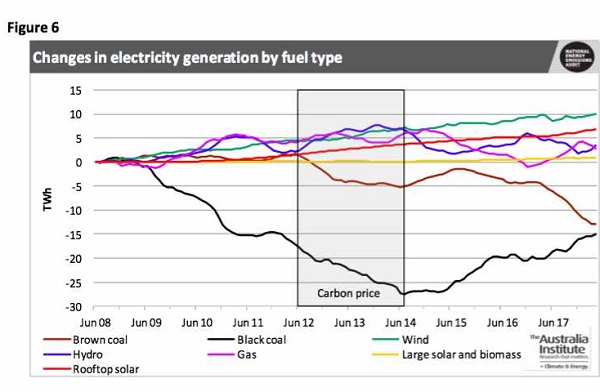

Here’s the generation by fuel type:

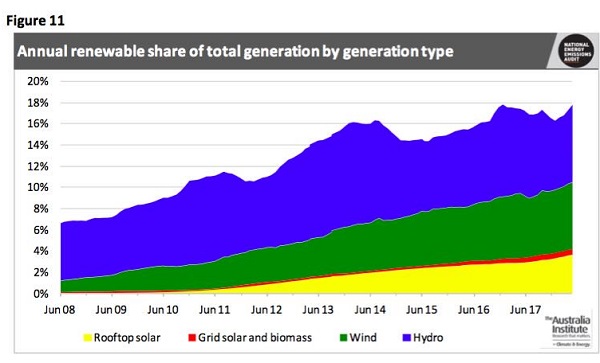

We can see that black coal has made a bit of a comeback since the election of Abbott-Turnbull. The mix between the renewables is better seen here:

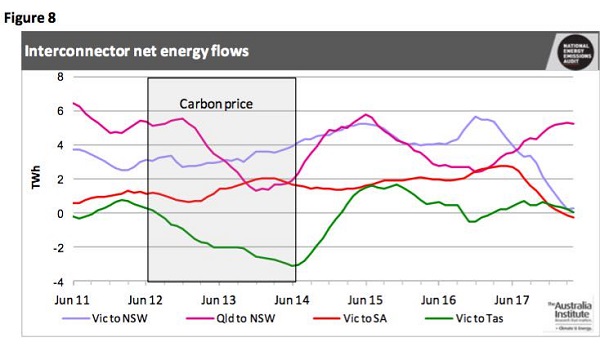

Large-scale solar has barely started, but the report suggests that it will figure more prominently in the future. Monitoring the interstate interconnectors is instructive:

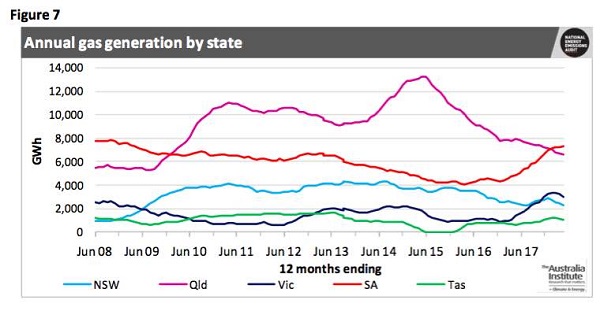

South Australia has tipped into becoming a net exporter to Victoria, which is stunning. Victoria and NSW are now in balance, but the flow from Queensland to NSW is significant and increasing. The following graph shows, as I’ve said elsewhere, that gas is being used most in Queensland and SA, and is plays a large role in balancing the grid.

The problem child, however, is NSW where the update notes that coal-fired power stations have been consistently at 65% capacity. The AFR published an article on the weekend – Energy grid in crisis as winter power outages hit.

- Australia’s biggest aluminium smelter was bracing on Friday night for a third power disruption in four days, as a combination of cold weather, planned and unplanned power generation outages created a shortage of supply and sparked fresh calls for reform of national electricity market.

Potlines at the Tomago aluminium smelter in NSW were taken offline on Tuesday and Thursday because of power shortages, and the smelter’s management was advised by its power provider AGL Energy on Friday of a potential similar squeeze on Friday evening amid warnings from the Australian Energy Market Operator (AEMO) of a “lack of reserve”.

This was not meant to happen in winter. Tomago took a potline offline for 45 minutes on Tuesday, and two of its potlines offline for an hour each on Thursday. After that it takes three days to return the molten ore to a thermally stable state.

- The Australian Energy Market Operator said a combination of factors had created the supply squeeze in NSW, which saw 3800 megawatts of generation become unavailable in the network on Thursday and earlier in the week.

After a busy summer period, some big coal-fired generators were locked in for planned maintenance, with about 1200 MW out of action.

But another 1300 MW of unplanned shutdowns, combined with reduced capacity from other generators and some players choosing not to bid into the wholesale market, led to the shortfall which caused spot prices to soar.

At one stage, three out of the four plants at AGL’s Bayswater power station in the Hunter Valley were out of action, while AGL’s ageing Liddell generator, controversially slated for permanent closure in 2022, was operating at a reduced capacity.

Tomago Aluminium CEO Matt Howell is not amused. He wants coal, saying no smelter anywhere in the world runs on wind and solar backed up by batteries. I’m amazed that these people don’t know about pumped hydro or molten salt. A few weeks ago the owners of Victoria’s Portland aluminium smelter said renewables and battery storage would not alone be able to power the smelter when it power contracts come up for renewal in 2021.

Part of Tomago’s problem is that when it signed the agreement with AGL back in 2010 they did not foresee the current state of affairs. They allowed interruptability in the contract to save them from spot prices. However, the current fragility in the market which is in danger of becoming the norm was then rare.

As Giles Parkinson said, the recent troubles have been all about coal, so the Murdoch press did not fire up as it usually does if renewables are involved.

All this came just after the energy bosses clashed with Josh Frydenberg on intervention. Ausgrid, Transgrid, online retailer Powershop and others have been complaining about intervention by government and regulators. It’s the scrapping of the Limited Merits Review, Snowy 2.0, threats of asset write-downs, and threats by the ACCC. Taken as a whole, they say, these interventions will inhibit investment, limit supply and in the long run drive up prices.

Sounds like business as usual, with leadership form government either lacking or wrong-headed.

Brian,

The SMH also published a similar article in Saturday’s paper edition, online article headlined Tomago Aluminium warns of ‘energy crisis’ as power supply falters, link here.

Perhaps governments need to heed Professor Andrew Blakers message (21 Feb 2018 Committee Hansard transcript, on page 53, bold text my emphasis):

From Friday week ago through to last Wednesday, I phoned:

Andrew Gee MP office (Fed. Member for Calare);

Paul Toole MP office (NSW Member for Bathurst);

all the 12 NSW Senators‘ offices;

Josh Frydenberg MP – Fed. Minister for Environment & Energy office;

Mark Butler MP – Fed. Shadow Minister for Climate Change & Energy office;

Adam Bandt MP – Fed. Greens spokesperson on energy office;

Prime Minister‘s Office;

Bill Shorten MP – Fed. Opposition Leader’s office;

Senator Richard Di Natale – Fed. Greens Leader office

to highlight Professor Blakers testimony and YouTube video 2017 CURF Annual Forum – Andrew Blakers keynote. I hope some of them get the message and act on it.

I urge you all to draw your political representatives’ attentions to this message also. Can you risk not to do it?

I can understand why Matt Howell wants to stay in a comfortable past where it was OK to run aluminium smelters on power made from fossil carbon and his smelter got cheap power because it had steady demand. However, it may be more productive for Matt to realize that the really cheap power of the future will go to major users who can handle variable supply and to start thinking about how to adapt to this.

This may mean that Al smelters may run flat out in the middle of the day while using solar thermal with molten salt energy storage to stop the pots freezing during the night (but not running flat chat unless wind power is going strong.

On the downside these changes may mean that the relative cost of Australian aluminium will increase and that aluminium will be replaced by other materials.

John Davidson (Re: JUNE 12, 2018 AT 1:07 PM):

I think Tomago Aluminium CEO Matt Howell demonstrates his ignorance and lack of imagination.

Those people who recognize the new opportunities and exploit them are likely to survive. Those who stick firmly to the past in a changing world paradigm are at risk of becoming extinct – like the dinosaurs.

GM: I find statements like

ignorant and showing a lack of the imagination required to understand what the problems that the CEO of an established aluminium plant faces.

Al smelters will maximize their profits by finding a very low cost source of steady power that is available 24/7.

What Matt is facing is a changing world where there will be a source of very very low cost power for some parts of the day, in the form of direct solar PV and/or wind, but other times in the day when the cost of power will be too high for competitive Al smelting or simply not there at all.

Battery storage is not the answer because, in terms of Al smelting, the cost is too high for the hours per day required.

It may be that the problem might be solved by adding pumped storage to the system and/or solar thermal with molten salt heat storage. However, I haven’t got costs for these options but suspect that they too will cost too much for competitve Al smelting.

Apart from get another job have you got any bright ideas to offer Matt?

John

I take it there are very good reasons why Al smelters run continuously?

Closely related to the physical properties of aluminium oxides and hydroxides? Thermal properties?

Ambi: Not an Al smelter expert but the pots contain a molten salt that includes fluorides. I assume that there are operating problems if the pots freeze but I don’t know how long this takes or how difficult the restart is.

There is of course the issue of lost production.

I think I posted this on the earlier thread. Howell has called shutting a potline a $100 million decision:

When Portland shut down through unforeseen power failure the cost of repairs was reckoned at $240 million.

Here’s the story of Tomago in February 2017.

I don’t know how much flexibility there is with aluminium smelters. I suspect not much. They probably should have the same sort of priority as hospitals and fire stations.

Brian, John

It sounds as if aluminium smelters are extremely vulnerable to power supply interruption, however brief.

BTW Portland Al smelter was considered an important industrial asset for Victoria; it had a very long term and concessional power supply contract with the State Electricity Commission and its successors.

I think its high tension supply lines were built especially for the smelter. A dedicated spur line, anyway. No doubt that infrastructure assisted other parts of south western Victoria too.

In the AFR today Howell has said that when the electricity spot price hits $14,700 they lose $5 million per hour. So they shut down for short periods because that way the lose less.

Ambi, my impression is that Portland is not a good place from an electricity POV. Too easily isolated.

Brian: Sounds like there is a lot of bluster coming out of the Al industry which makes it harder to sort out what should be done and if it is worth continuing to support the Al industry if it is unable to take advantage of the very cheap surplus power coming from renewables.

A few questions:

Can potlines be shut down safely for long periods by draining most of the metal and molten salt out of the potline.

Can the power going to a potline be ramped down? How much can it be ramped down for long periods without putting the potline at risk?

If a potline is shut down for an hour how long does it take to get back to normal operating temperature? (What % of time can a potline be turned off without running into cooling problems?)

My guess is that there is some scope for short/partial shutdowns of Al smelters as part of demand management policies but we will have to wade through a lot of bluster to understand how much is avaialble.

Hard to avoid the conclusion that Australian smelters that have depended on cheap baseload dirty power are not going to compete unless they work out how to take advantage of the very very cheap surplus power coming from renewables.

Yes, very cheap in Victoria at least, John.

But aluminium is such a useful metal…..

and there was all that bauxite, just up the coast at Weipa….

Ambi: There are plenty of overseas smelters that operate on renewable hydro-power or other renewable power sources. We used to use Tas hydro-power to make aluminium and ferro-manganese.

Ah yes, John.

I had forgotten the Tassie smelter.

John Davidson (Re: JUNE 12, 2018 AT 9:37 PM):

So why has UK “green steel” billionaire Sanjeev Gupta made a landmark agreement to provide cheap solar power to five major South Australian companies, promising to slash their electricity costs by up to 50 per cent? Why doesn’t Tomago Aluminium CEO Matt Howell have the imagination to do/attract something similar for his business?

I would suggest it’s 19th century thinking for Howell.

I would suggest it’s 19th century thinking for Howell.

Not so GM, for example the first Aluminium production in Europe was done by Alusuisse which built a plant next to Switzerland’s mightiest waterfall at Neuhausen back in 1888, using its hydro power capacity.

It is the ‘quick and lazy money’short term corporate thinking which is Howells problem, it is endemic and paints a bleak future for Australian Aluminium production and manufacturing of the same ilk.

Howell appears to be one of these obstinate and destructive morons who don’t hesitate to kill off a major industry in this country for purely ideological purpose while having been on a gravy train for decades.

He really seems to actually believe what he is quoted as saying, here from the horses mouth.

He really has a hide too or too bloated when you consider

From Subsidies to the Aluminium Industry and Climate Change by Clive Hamilton and Hal Turton

While expert advise has it that Tomago is missing the boat

Seriously Australian corporate leadership need to get up to speed with technological and social developments or face a Kodak moment.

That’s some seriously important information, Ootz.

(Some Aussies are wont to believe that hydro power began with our post-War project up in the Snowy Mountains….)

Cheers

Corporate Australia has become almost totally reliant on subsidies to be profitable, or even just viable.

That’s why Canberra is dripping with lobbyists.

The Government loves this for market control reasons.

#endallsubsidies

(* I just made that # up. If it already exists it’s a coincidence)

(** don’t know anything about twatting either 🙂 )

tweeting

Mr J.

Please, show some disrespect!

*Australia Needs More Disrespect*

[Be Alert

Australia Needs More Lerts!]

… or as an inner Melbourne slogan had it many years ago:

Keep Warm This Winter.

Make Trouble!

Hear hear Jump (into my car), I cherish this rare moment of agreement. It’s is not just subsidies, but the tax avoidance enabling and royalty rorts, as well as rampant ecological and social irresponsibilities. Politically and economically we are led by self-serving ideological crooks. There is nothing wrong with lobbyists and corporate enterprise nor governing regulations, as long it is done on a sustainable and responsible basis – nation building not destroying.

Stuff ‘growth’ if it resembles cancer.

That’s excellent work Ootz. I was aware that the Australian industryhad been heavily subsidised and was struggling in relation to overseas competition, but didn’t know the details.

To pull out a couple of points:

Australia’s smelters are in the bottom 25% of global competitiveness.

On varying power usage:

Your last link was from a Ben Potter article in the AFR yesterday, based on commentary by Dr Bruce Mountain:

The AFR article was on page 6 of the printed version. Hopefully Mr Howell or someone associated with him would have read it.

Please correct me if I have this wrong about the state of NSW electricity generation.

It was a succession of NSW Governments, through tax-payer funds, that built and operated NSW coal-fired power stations – Liddell, Wallerawang, Vales Point B, Eraring, Bayswater, and Mt Piper. Yes?

The NSW Parliament Public Accounts Committee inquiry into the Economics of Electricity Generation, in 2012, was warned by Delta Electricity in its Submission (#10) that Liddell would likely retire in 2021/22, Wallerawang in 2027/28, Vales Point in 2029, Eraring in 2033/34, Bayswater in 2036/37, and Mt Piper in 2042/43. The submission included the following statement:

The inquiry’s Final Report, tabled in November 2012, included these recommendations:

So what did the then NSW Coalition Government do? It sold-off all the NSW coal-fired electricity generators, with the blessing of the then Federal Rudd II (27 Jun 2013 – 18 Sep 2013) and Abbott (18 Sep 2013 – 15 Sep 2015) Governments.

Wallerawang and Mt Piper were sold together to EnergyAustralia for $160 million in July 2013.

Eraring was sold to Origin Energy for reportedly $50 million in August 2013.

Liddell was reportedly sold for a token $1 to AGL in September 2014, as part of the deal to include Bayswater.

Vales Point B was sold for a reported $1 million in November 2015 – the average price of a Sydney home.

EnergyAustralia announced in November 2014 that it would close Wallerawang power station in 2015. Were there any objections from the Abbott government? None! Were there any objections from the right wing commentators? Not a peep as far as I can tell.

AGL announced in 2015 that they intended to close Liddell in 2022. Were there any objections by the Abbott government? None! Were there any objections from the right wing commentators? Not a peep as far as I can tell.

Then the “system black” event occurred in South Australia occurred in 2016, together with the announced closure of Hazelwood, and the rhetoric changed.

AGL has repeatedly reiterated that it will close Liddell in 2022.

Now Abbott and his cohorts want the Federal Government to compulsorily re-acquire Liddell, when Abbott and his government had no objections a few years ago for the NSW Government selling it off to a commercial entity. Go figure!

BP Statistical Review of World Energy 2018 (67th edition) was released on June 13, link here. It’s a snapshot of world energy reserves, production, consumption, trading, primary energy mix, etc. in calendar year 2017.

Ootz (Re: JUNE 15, 2018 AT 2:52 PM):

I agree. Ian Dunlop has been ‘banging on’ about this subject for more than a decade, see here.

Thanks for the reference. The Swiss seem to demonstrate repeatedly that they are forward thinkers. Howell seems ignorant that Aluminium production can be achieved utilizing renewable energy. As I said earlier:

I think you, Ootz, and John D, haven’t provided any compelling arguments to the contrary.

Renewables all have their down times.

Not sunny? Not windy? Hasn’t rained for months? Not the right tide time? No big swell coming across the Pacific?

And fossil fuels have their down times: boiler repair, regular maintenance, fire in the open cut, oil tankers didn’t arrive, oil refinery fire, Bass Strait on shore gas terminal fire, gas pipeline punctured.

Etc.

Tidal has a down time of less than 80 mins every 24 hours.

Every aspect of tidal output can be predicted decades in advance.

Short of human or mechanical failure it’s the most reliable source there is.

I was merely pointing out that down time is not unique to ‘renewable’ power sources.

How’s your planning for generating tidal power on a moored boat?

Slow 🙁

My Sons and I are all flat out with work to get experimenting.

My basic idea is a helical prop in a tube with collision and blockage protection, direction reversible and as simple as possible.

After that, investigate a scaled up version that can accomodate multiple generators. Sort of like how an automatic transmission on a car works, under low flow ( ends of the tide ) a single motor is engaged and during full flow multiples are actively generating.

Lots of math and physics that middle Son is better at. I’ll do most of the sweating work. 🙂

Ah, the old “division of labour”. Son does calculations, father does grunt work. But why helical? Why not a screw shape like a wind turbine or a boat propellor?

Genuine question.

No entrapment intended.

France 0 : Australia 0

It is screw/propeller like.

Archimedes was pretty good with water.

Jump: The original propeller driven boats apparently had helical screw propellers. Then one of them lost part of the helical propeller and performance suddenly jumped. Ships have been screwed ever since.

However, Archimedes screws are used for low lift agriculture pumping so maybe a screw would work. These helical screws are sloped with water only sitting in the bottom part of the screw. Wait you full report with interest.

BTW: Tidal power can run 24/7 because tide times change as you move up rivers or around the coast. All you need is more than one generator. If you think about it you can also do things with more than one weir and generators on each weir.

Archimedes was a top bloke and maths genius. Obviously also what we we now call a “physicist and engineer”.

Love the stories of his crane to lift an enemy war boat until it capsized, and small parabolic metal mirrors to set an enemy sail ablaze. All defensive weapons against invaders.

(The bath incident is best passed over in silence.)

🙂

Thank Zeus he took my advice, closed his souvlaki stall, and devoted himself full time to maths!

Give me a place to stand, and I will move the world.

+ + +

By the way, his short booklet “The Sand Reckoner” is well worth reading, in translation. Basically, he is inventing a way of writing (and conceiving) enormous numbers. We would now use ‘powers of ten’ for precisely the same purpose.

What a mind: from agricultural low volume pumps, to astronomical numbers, to detailed mechanical and geometrical volume/area calculations, foreshadowing limit arguments and calculus (step out of the shadows, Leibniz and Newton).

An addition to my comment (at JUNE 16, 2018 AT 10:39 AM):

Yesterday, I attended as an observer the scheduled public hearing at the NSW Parliament for the Select Committee inquiry on Electricity Supply, Demand and Prices in NSW. I trust that the transcript of this hearing appears soon on the inquiry website, as there was some interesting revelations heard.

I think the NSW tax-payers were right royally screwed on the sale of state-owned generator assets. But isn’t that always the case: Privatize the profits and socialize the losses?

There’s an article in The Guardian by Katherine Murphy headlined Tony Abbott tells party he was misled by advisers over Paris climate deal, link here. The article includes:

Methinks Abbott is attempting to re-write history over what he was signing up for at the time.

The Committee Hansard transcript (Uncorrected Proof) for the public hearing on Monday 18 June 2018 for the NSW Parliament Select Committee inquiry on Electricity Supply, Demand and Prices in NSW is now available, link here. On page 29, the transcript includes:

Greg Everett is the Managing Director of Delta Energy, that owns and operates Vales Point coal-fired power station.

I think the sale of NSW generator assets is nothing short of scandalous!

Under this headline:

Coal-linked government fund pumps $500m into QLD renewable project

SMH and The Age report:

Now the Kidston hydro development has been granted a loan of up to $516 million in financing for the second stage of its project, the largest NAIF funding to date. However, it will still need to secure offtake agreements and grid connection before the NAIF board makes a final investment decision.

Genex’s Kidston stage 2 development is the first major project to win funding since the government announced the overhaul of the NAIF after it was found its investment criteria were too restrictive, which reduced the pool of potential money recipients.

The story says the loan has a term of 20 years.

I wonder: might Minister Canavan’s job be to keep spouting coal bubbles, while the serious money moves across to renewable energy?

Ambigulous (Re: JUNE 20, 2018 AT 6:34 PM):

Yesterday, Federal Minister for Resources, Senator Matt Canavan, was talking with Radio 2GB broadcaster Chris Smith, link to podcast here. I believe he also wrote an op-ed in yesterday’s The Australian (paywalled).

In the podcast at about time interval 2:55 Canavan agrees with Chris Smith that coal growth is larger than wind and solar, which contradicts sworn testimony by Professor Blakers at the 21 February 2018 public hearing conducted by the NSW Parliament Select Committee on Electricity Supply, Demand and Prices in NSW, link here. From the Transcript, on page 53, Blakers states:

Canavan and Blakers can’t both be right.

In the podcast from about time interval 6:10, Canavan says:

From the transcript, on page 53:

Again, they both can’t be right.

No, they cannot.

Ambigulous (Re: JUNE 21, 2018 AT 4:51 PM):

The Federal Minister’s Oath of Office (2013) is:

Alternatively, the Federal Minister’s Affirmation of Office (2013) is:

For NSW Parliament Legislative Council Committee hearings, before giving evidence:

Once again people are failing to talk about solar thermal even though SA is installing some of this tech. Solar thermal with molten salt heat storage and back-up molten salt heating can provide both baseload and slow response peaking power.

John Davidson (Re: JUNE 21, 2018 AT 5:55 PM):

Some are. See RenewEconomy article headlined World’s biggest solar tower with storage starts commissioning, dated June 6, link here. The article refers to the Noor III solar tower 150 MW gross / 140 MW net capacity with 7.5 hours thermal storage in Morocco, but includes this reference:

In May, I phoned the SolarReserve office at Port Augusta to draw attention to the NSW Parliament Select Committee on Electricity Supply, Demand and Prices in NSW and suggest that SolarReserve could make a submission.

Also in May, I phoned the secretariat of the Select Committee to suggest that they could invite SolarReserve to make a submission.

Today, I rang Paul Green MLC office (Paul Green MLC is the Chair of this NSW Parliament Select Committee) to suggest that the Committee could invite SolarReserve to make a submission.

The Committee can’t compel people or business/organisation entities to make submissions/contributions.

I think it would be a real shame if SolarReserve declined to make a submission or provide some input/insights on solar thermal technologies to the NSW Parliament Select Committee on Electricity Supply, Demand and Prices in NSW.

Any suggestions?

Today in the SMH online is an article by Cole Latimer headlined The 130 per cent power price surge that reveals a ‘broken’ market, link here.

This has been a decade in the making, and we appear to now be reaping the whirlwind.

Geoff, the latest Grattan report has been much in the news today. I’m not denying the magnitude of the problem, but some of the statements sounded off key.

And heard nothing about the rise in the charges made by distribution networks. I’ll try to take a closer look.

Here’s an op-ed in the AFR by Tony Wood headlined Why politicians have to stop promising to cut electricity prices, dated Jul 1, link here. It includes:

It seems the price of petrol has increased by its biggest margin in almost a decade – and the cost for motorists is expected to increase.

Are we seeing the symptoms of ‘peak oil’? There’s an interesting article, dated 20 Sep 2017, about how peak oil has been hidden by the US Energy Information Administration (EIA) by including condensate and other non-transportation fuels.

In recent days, Trump has asked Saudi Arabia to increase its crude oil production by an extra 2 million barrels per day (mbpd) to compensate for lower supplies from Venezuela and Iran. That’s a huge increase – it will be interesting to see if that’s possible. If Saudi Arabia can do it, then it will be the world’s largest oil producer.

See BP Statistical Review of World Energy 2018, page 14:

US average 2017 production 13.057 mbpd (14.1% global share);

Saudi Arabia average 2017 production 11.951 mbpd (12.9% global share).

Geoff, I saw the article by Tony Wood. Grattan have always said that renewables will cost more. They seem to say now that prices will stay about the same.

I was hoping there might be some commentary at RenewEconomy, but there we have an article by Lucy Percival, originally published at The Conversation – Higher energy prices are here to stay – here’s what we can do about it. Percival is from Grattan. It’s the best outline of the report I’ve seen so far.

Wood says:

That may be true of some on the left but I can’t see how it’s true of Labor.

Brian (Re: JULY 3, 2018 AT 10:56 PM):

There’s nothing at RenewEconomy about the Grattan report, but Giles Parkinson has commented with an article yesterday headlined Turnbull’s fine line on climate: Capitulation or denial?, link here. The article includes:

It seems to me that the Abbott, Murdoch and “endless cast of malcontents” are entirely ideologically driven. They seem to refuse to accept any evidence/data that solar-PV and wind are now cheaper than coal, gas and nuclear power – i.e. the economic argument for renewables is now compelling, irrespective of the climate change arguments.

I think for Abbott, it’s mainly about damaging Turnbull, at the expense of Australia’s energy security and prosperity – I suspect this is an opportunity for payback for losing the leadership.

I think there’s a very real risk many people/businesses will become collateral damage in the “energy wars”, unless Australians wake-up and tell these “malcontents” to go away – make them impotent by making them irrelevant/ignored.

Tony?

Payback?

Surely not! He has been so loyal.

SolarReserve Solar Energy Aurora project update information can be found here.