The ABC election team on Budget night suggested that the purpose of the 2018 budget was to generate talking points that the government could use in the forthcoming election campaign. It has been going on for a while. Turnbull ScoMo and all reckon they offer “jobs and growth” whereas Shorten is going to hit you up for $200 billion extra in taxes, and simply can’t be trusted to run anything.

Shorten says Labor is going to “bring the fair go back into the heart of the nation.”

To me the nation is at a cross-roads. One way offers a small-government straight jacket with firmly embedded tax provisions that permanently reward success. The other seeks to provide the necessary infrastructure (human, services and physical) for everyone and the nation to become the best they can be, and to take care of those on the fringe.

The 2018 budget has three main features:

- First, low to middle-income earners are going to get tax relief of up to $530 per annum, as a refund at the end of the financial year rather than through a cut in the tax rate, hence there is no call on the budget during the first year. Plus the extension of the Medicare Levy by 0.5% will not be necessary.

- Second, revenue is to be capped by law at 23.9 per cent of GDP. Any more has to be given back to the people.

- Third, there will be L-A-W tax cuts in the never-never. In seven years time, beyond the forward estimates, the 37% tax bracket will be deleted in three stages so that the tax rate from $41,000 to $200,000 will be an even 32.5%. The phases are uncosted, but will cost $140 billion over 10 years. It is promoted as eliminating bracket creep, but takes no account of what bracket creep there will be in the next seven years.

Peter Martin has important information in assessing the accounting that the budget is based on.

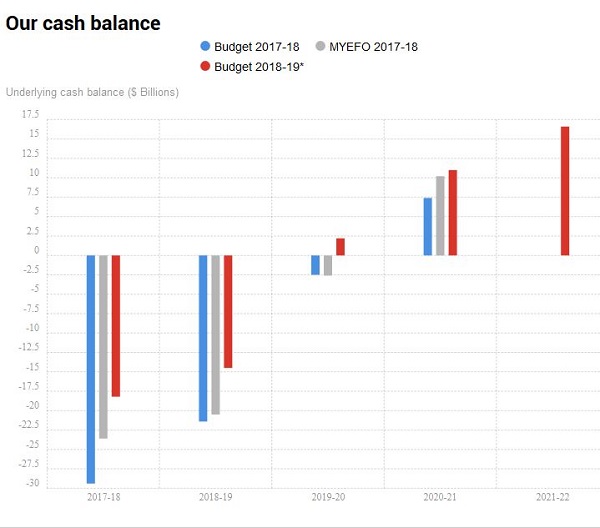

Here’s the cash balance from The Conversation:

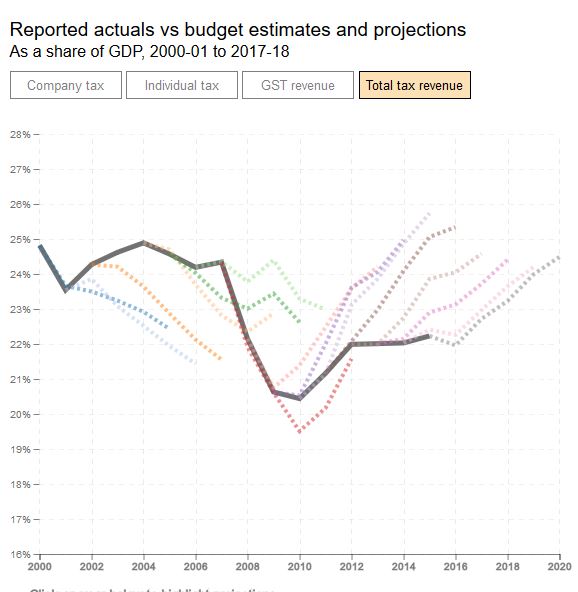

A second article from The Conversation gives us the forecasting record:

Peter Martin explains that only the next two years are forecasts. Beyond that Treasury uses projections, which are based on past performance.

Treasury seem to regularly get the forecasts wrong. This time:

They say wage growth will climb from 2.1 to 3.5 per cent, and growth in consumer spending will climb to 3 per cent. They were released as the Bureau of Statistics reported that retail sales had been flat for the past three months, meaning the turn-up will be have to be dramatic.

The projections simply have no chance of being right. However, the promise of the sunny uplands of budget repair and significant tax cuts depend entirely on the projections being correct or underestimated. If the projections are wrong the main alternative, is to make further spending cuts or rip more out of the poor, as they are doing with their program to dock people’s welfare if they repeatedly fail to pay fines. This has been denounced by advocates as a “brutal” measure that will drive those on the lowest incomes into homelessness and/or crime.

That’s while 1200 staff are being ripped out of the already overstretched Department of Human Services in this budget.

This example reflects the values underlying the budget, and the LNP approach to how they govern.

There is news and analysis aplenty on the budget at the AFR, the ABC, the Conversation and The Guardian. However, I found Tim Colebatch at Inside Story most instructive (thanks to John Davidson for the link).

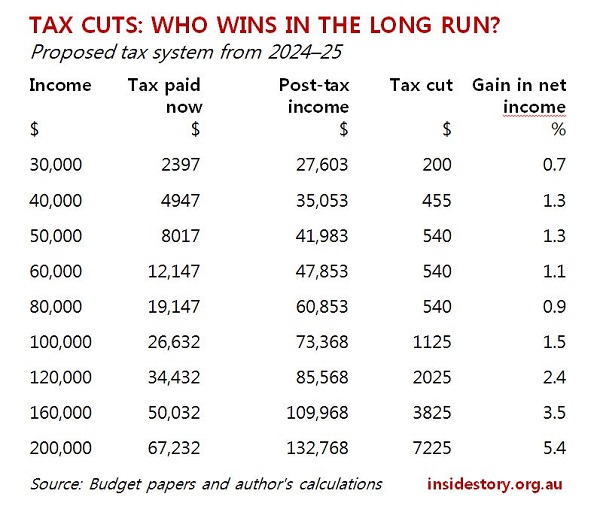

Leigh Sales put the outrageous proposition to Bill Shorten that the 32.5% tax rate for $41K to $200K was ‘fair’. Here it is:

Colebatch says:

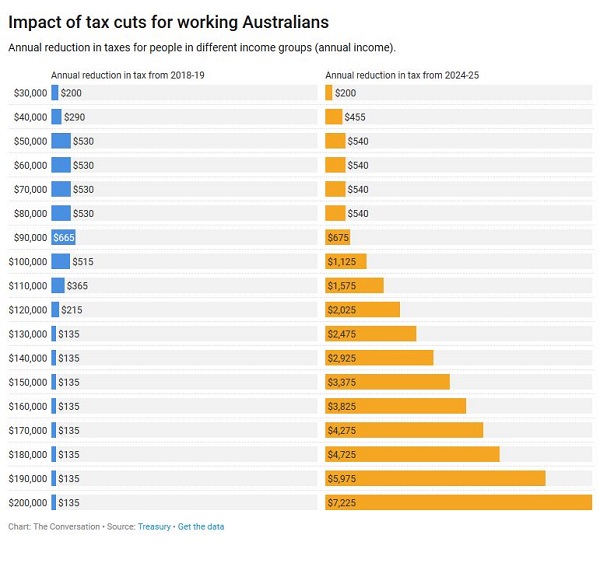

- A cleaner on $30,000 a year would get a tax cut of $200. A nurse on $80,000 would get a tax cut of $540. But a lawyer on $200,000 a year would get a tax cut of $7225 — thirty-six times as much as those on low incomes.

The best measure is the gain in incomes after tax. Everyone earning up to $100,000 a year, the vast bulk of Australians, would get an increase in disposable income of around 1 per cent — and that’s their only tax cut for fifteen years. Those on $200,000 a year would get a boost in disposable income of 5.4 per cent.

Colebatch points out that the budget contains the dubious assumption:

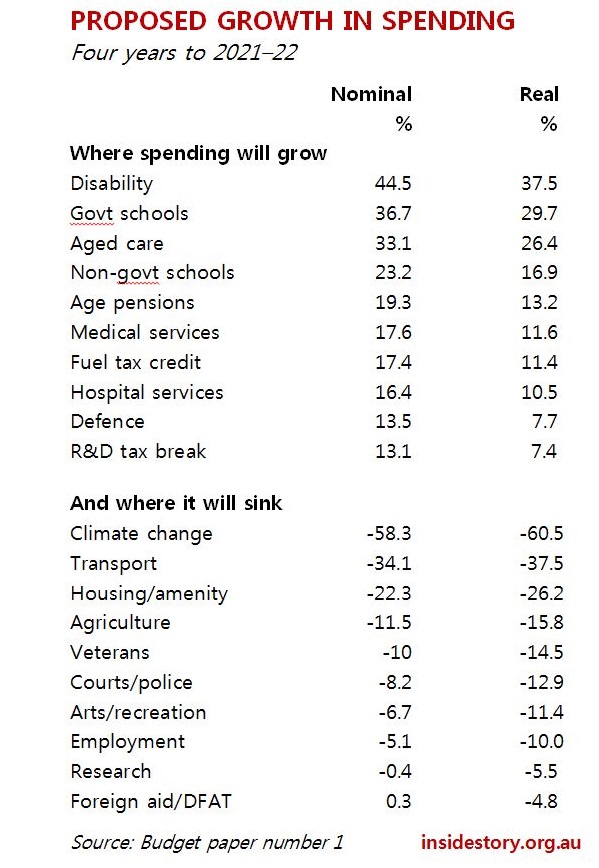

- that spending growth from 2019–20 will be contained to average just 1.1 per cent a year in real terms over the next three years — which implies real falls in per capita spending, since the population is growing by 1.6 per cent, and the government wants it to stay that way.

That is only half the 2.1 per cent average growth in real spending over the government’s two terms in office — in which the austerity has been pretty severe in many places, including the lack of wage rises for many public servants.

Colebatch has worked out that if nominal GDP is forecast to grow by 18.7 per cent over the next four years, then only disability services and schools are growing in expenditure, given that an increase in the aged pension expenditure is inevitable. This is how it works out:

Some of the cuts are astonishing, but that is the Turnbull government’s vision of how we are meant to live and thrive.

Turnbull talks up his $75 billion program for transport infrastructure as if it is all happening here and now, but it is a ten-year program, and much of it has been moved off budget. Actual spending on transport infrastructure is falling.

There is more in Colebatch’s article, but finally:

Australia has the eighth-lowest taxes of the thirty-four nations in the OECD. In 2015, the only countries where taxes were lower were Chile, Ireland, Korea, Mexico, Switzerland, Turkey and the United States. Twenty-six countries had higher taxes, most of them much higher, including successful economies such as Austria, Canada, Denmark, Germany, Israel, Japan, the Netherlands, New Zealand and Britain.

The government appears to want tax versus spending to be the election issue. It has chosen to fight on weak ground in economic terms, and, I suspect, political terms. It will make for a historic ideological battle.

The only decent summary I can find of Shorten’s budget reply is Phillip Coorey at the AFR.

Labor will almost double the tax rebate, giving $928 as against $530 for income earners between $50,000 and $90,000. It tapers up to $50,000 and tapers down after $90,000, cutting out after $120,000. That will include the 10 million lowest paid Australians according to Shorten.

Other than that, while promising to pay down debt faster, Shorten is focussing on education (schools – $17 billion more over 10 years, universities and TAFE) and on health in repairing the cuts of the last five years.

The LNP is benefitting from a $35 billion windfall (over four years, I think, so about $9 billion pa), of which it is spending roughly half, leaving the rest as budget repair, or to make further promises before the election.

Labor’s war chest derives from the official budget forecasts, plus policies relating to negative gearing, capital gains and other sources not so much affected by the vagaries of economic conditions. Central, of course, is the $85 billion over 10 years in corporate tax cuts saved. It is said to total $200 billion over the next 10 years, or $20 billion per annum. The latest I’ve heard is that it is actually $350 billion, or $35 billion per annum.

One way of judging Labor’s effort is to compare it with other countries. The Greens noted that to achieve the OECD average, as they suggest:

“Despite what the Liberals say, Australia is a low taxing nation. It is the 8th lowest-taxed among the 35 OECD nations. Australia’s combined tax-to-GDP ratio is 28.2% for all levels of government in 2015. The OECD average is 34%.

“If Australia collected the same amount of tax as the average OECD nation then we would need to collect an additional $94 billion per year”.

That would mean lifting the federal revenue take to about 30% of GDP.

Stephen Bell and Michael Keating have recently written a book Fair Share: Competing Claims and Australia’s Economic Future. There is a podcast at The Conversation, which I haven’t listened to. Bell, spoke to Emma Griffiths and answered listeners’ questions on Focus last week.

Stephen Bell is Professor of Political Economy at the University of Queensland and a fellow of the Academy of Social Sciences in Australia. Michael Keating is the former head of three Australian Government departments: Employment & Industrial Relations, Finance, and Prime Minister & Cabinet. He is a visiting fellow at the Australian National University and a fellow of the Academy of Social Sciences in Australia.

They have put together a case for lifting federal expenditure to about 27% of GDP. As far as I can make out that is about $50 billion extra per annum. If we did that we could have a compassionate society that works as a society and provides opportunities and a decent life for all within it. Labor seems to be heading in that direction, though still well short.

The LNP’s philosophy seems based on individual effort and rewarding effort and merit. However, it is in fact rewarding success, which is different, and shows its true colours by how it treats those in need or on the fringe. There is a strong element of punishment in what they do. It is a relic of the poorhouse of 17th and 18th century England, along with a stratified society with entrenched elites.

However, such is the state of politics which road we take may depend on sloganeering and scare campaigns rather than a seriuos policy debate. I blame John Howard with his anti-refugee 2001 election, Abbott turbo charged the practice after gaining the leadership, and Turnbull after promising better is a fully signed-up practitioner.

Update: There has been quite a bit of analysis showing that under the Coalition’s plans the rich will get richer. This graph is too good to miss:

Tim Colebatch has been one of our better economics journalists for quite a while.

IMO.

There has been quite a bit of analysis showing that under the Coalition’s plans the rich will get richer. This graph is too good to miss:

The thing that strikes me is that the people earning less than the tax free threshold get nothing and the people earning less that the minimum wage ($36420 p.a.) get less than $10 per week extra after tax.

It is time we started talking seriously about negative taxation or some other way of helping the worse off.

My calculations say that to provide an extra $100/week for someone currently on zero taxable income would require a negative taxation rate of 26 cents in the dollar if negative taxation started at the tax threshold or 13 cents if negative taxation started at the above minimum wage,

The really nasty thing that I picked up was the proposal nobody would get any welfare if they had outstanding fines. Given that most fine defaulters come from the poor end of the population one wonders how taking away welfare will help pay fines and how people who have lost all their welfare are going to be able to legally find the money to feed, clothe and shelter themselves.

Stats for WA included:

Fines are an incredibly regressive and unfair way of punishing people. For many of us a $100 fine is an irritation. For someone on the $273/week Newstart it is a financial crisis. These days many European countries are linking fines to income.

“The Law in its majestic impartiality fines the poor person $400 for an offence and the millionaire $400 for the same conviction, if he has forgotten to bring his barrister.”

John

You don’t like fines or jail to enforce social engineering laws.

What do you suggest?

Great roundup, Brian, but what is missing from this analysis is the first graph in this article

https://soapboxie.com/world-politics/Distribution-of-Income-and-Wealth-in-Australia

Remember that $200,000 is an income of $4,000 [er week. Hands up those who are on that income level!! Nobody here ? Perhaps you, Jump (a builder of $600,000 houses who pays a team of 6? the minimum wage?)

The graph very clearly shows that the state that will benefit the most from this income redistribution is the ACT, and the real loser is Tasmania, and nearly everyone else. The net impact of this will most likely be an increase in house prices (those on $2000 to $4000 per week don’t need more money for food or petrol).

Do the calculations on what sort of accommodation a person without pre-established home ownership a person on $800 per week can afford after they have fed themselves. Now look at the graph to see what percentage of t he population of each state that income represents. The answer is a huge percentage.

If we are talking fairness, Labor are holding that banner.

The LNP are holding the elbow in the face “to hell with you, Jack, I’m all right” banner.

I should have further qualified…….

“……a person without pre-established home ownership (your children or grand children starting out), a person on $800 per week can afford…..”

BilB

For starters I’m only a Subbie.

Most of my men take home more than I, and their agreed negotiated packages are well above minimum wage.

In fact on an hourly rate basis, all of them get payed more than I pay myself.

I would like for them to keep more of it, it’s theirs, they earned it for their families.

At the moment if one were to earn ( at the far end of the scale ) $200,000, the tax man takes about $ 70,000 of it to gift to those that didn’t earn it.

I don’t know how much you get payed from your manufacturing Company but feel free to donate to Government the proportion you deem morally correct.

Perhaps 80%, I hear manufacturing company owners in the renewable energy sector are doing great and on the up and up.

Only if one employs an incompetent tax agent.

The highest average earning job category is a surgeon ( as I’ve linked to previously), what are her deductibles ?

I’m with you, those greedy tax dodgers need to give back to society, tax them at 80% !!

From the ABS ( 2017 )

Should we have a higher tax rate for the public sector employees in the name of ‘ progressive fairness ‘ ?

Jump, I think there is an argument for paying public servants less and allowing them to pay no tax at all. Public servants paying tax has always looked like churning to me.

The Department of Human Services is nixing 1200 jobs. I understand the idea is to outsource more of the work, which will then be done by people working for less from labour hire companies. It also weakens the public service unions.

Brian, they are all false economies, and the domain of weak minded politicians, IMLLE. Our governments are no longer able to make valued judgements on a broad range of fields due to the loss of impartial expertise. The cost of this to the public is in the hundreds of billions of dollars. Just a moment, Brian.

Jump, as the bar for the top 10% of income earners is so low at $102,000, I am definitely in the top 10%. To how much I earn, the answer is I don’t know and don’t want to know. As long as the bills are being paid and the debt is coming down, I am happy. I leave that to the financial controller, who is an ex public servant, and doing an awesome job.

Sorry, Brian, I had to sort that out. The 2018 NMW trade show in Sydney has just ended. A faint reflection of what it was when Australia was a manufacturing country, now that we are tracking down Nauru’s historical path, the show is tiny. I had some really good conversations along the way though. I had the opportunity to network with a number of entrepreneurs and industrial scientists with the opportunity to push for an understanding of what PVT’s are and why they are important. Also on the notion for there to be a civilian version of the US’s DARPA which would become Civil Strategic Advanced Research Projects Agency (CSARPA).

The most common challenge to the notion of CSARPA is that we have the same in the CSIRO. Sounds logical, but actually false. Through the debate it became clear that the CSARPA works the opposite way around to CSIRO which is organised to be a hub to which people bring their problems for refinement and resolution. CSARPA on the other hand is an outreach of government to the private sector and the market for the best solutions to real community technological needs.

One of the fundamentals of innovation is that no-one has a franchise on good ideas. CSARPA recognises that and, following the successes of DARPA, calls for submissions for solutions to projected future technological needs from a broad pool of creative thinkers across the whole economy in the form of competitive submissions with prizes and the prospect of research and development contracts with the view to production contracts. Very similar to the tender process but serving future needs ie promoting innovation in a way that keeps the nation ahead of others technologically and industrially.

The notion was voted in the affirmative, at least with those who participated.

The Labor Party’s “fair go” campaign is fully the right approach at this time, and Bill Shorten’s serving the interests of the under $94,000 is spot on.

The LNP trinkets to the poor are insufficient to cover the rising costs of Climate Change (increased insurance costs, increased medical costs, damage to property (other), increased electricity consumption cost (air conditioning), so far) let alone do anything at all to alleviate the ever increasing cost of housing (due primarily to the over investment of the wealthy). The whole LNP proposal is an affront to the workers of Australia.

Shame on Scott Morrison and Malcolm TurnBull.

Brian

Human Services was responsible for what NDIS is now.

I suspect ( without any evidence at all ) that many of the 1200 just changed over.

The budget for the same service sector has gone up.

And yes, PSs paying tax is just a book work trick.

It gives the illusion that they’re benefactors more so than beneficiaries of the tax burden.

Jump, I’ve got a couple of rellies close to the NDIS thing. I don’t have a good grasp on what is going on, but the evidence is that they’ve got the wrong model and they are well on the way to buggering it up.

Everything turns to dross in the hands of this mob, so the public service gets a bad reputation.

BilB, you are close to the action so I’m glad you think Shorten is on the right track. Someone here locally talking on the radio said that in Qld innovation as distinct from manufacturing, was gaining traction in Brisbane, and in some regional centres such as the Gold Coast, Cairns, Townsville and Mackay. Funny, nothing much comes out of Rockhampton or Toowoomba, and least of all Bundaberg and Maryborough/Hervey Bay.

Jumpy: “Earning” is a funny word which people like you sometimes try to link to honest hard work. However, all it really is is income and this doesn’t always come from honest hard work like many very well paid bankers don’t do.

I always thought that it was not really fair that someone like me who had an interesting job with a lot of independence was paid as well as I was compared to the operators and tradespeople who worked for me. Sure, I could point at the millions some of my ideas made for my employers but I recognized that lower paid workers often worked physically harder in more uncomfortable environments with less job satisfaction.

You claim to get less than the people who work for you but would you want to change places?

Jumpy: I am not totally opposed to jails or fines. In terms of jails I see them as a last resort because time in jail early in life may lock people into a life of crime. (Although a sociologist I know says that sentences below three months work because the are short enough to convince the young that jails are a terrible place while not being long enough to get used to being in jail.)

Fines may be OK as long as they are linked to income and community service is an alternative for people who cannot afford to pay anything.

The aim of the justice system is to reduce the crime rate, not to give people the satisfaction of revenge.

John,

In Victoria, minor offences are often punishec by a “diversionary” stint of community service: a specified number of hours, in a suitable and welcoming workplace, sometimes under supervision.

If the offender defaults by not attending or not working, the short jail sentence is hanging there as a sword of Damocles.

Matching the service area with offence can be tricky, e.g. shoplifter not sent to a retail shop. Ulitmately, weeding in a work crew on Council land or in a park, for those who can’t be placed elsewhere. It lowers the prison population; not sure whether it helps offenders to develop new skills.

I’m sure this happens all over the country.

Mr Turnbull has scored a higher popularity in N***poll. Apparently many voters agree with Jump, that Mr Shorten was foolish to claim that the ALP outshone the Coalition in form-filling and attention to detail. Well we already knew that the Feeney Fiasco had disproved that claim…..

Ambi: Part of the reason for using community service instead of jail is that it reduces the chance of learning more criminal skills or seeing yourself as part of the criminal sub-culture.

Yes John

Some of the offenders were small-quantity drug users, not dealers. Some minor thieving.

Certainly not “hardened criminals”, and relatively minor offences. So your point about keeping these people out of the

College of Crimenearest prison is good.Essential poll post budget shows a slight swing to the government. (PP 48/52 up from 47/53.)

Noticeable that Lib voters were strongly in favour of budget, rest far less so. A budget for the heartland before losing power?

In today’s SMH is an op-ed by Ross Gittins, headlined ‘Rich whingers’ not as hard done by as Morrison would have you think, link here. It includes:

On last Monday’s (May 14) ABC Q&A, a question asked by EMMA FRAMPTON:

ELIZABETH PROUST said:

TONY JONES

ELIZABETH PROUST

TONY JONES

ELIZABETH PROUST

TONY JONES

ELIZABETH PROUST

No thought for a post- ‘peak oil’ and post- ‘peak gas’ world.