1. The inequality paradox

A New Scientist article by cognitive scientist Mark Sheskin of Yale University (pay-walled) says we should aspire to ‘fair inequality’ rather than ‘equality’ or ‘unfair inequality’, and most people would be happy with that.

Confused?

He’s saying if you force people to choose between complete equality and high levels of inequality, most choose the latter. Given an open choice, however, people will choose moderate inequality.

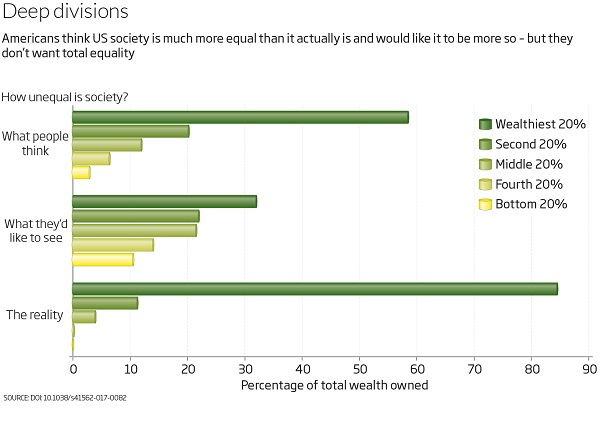

One study found that Americans thought the top 20 per cent should hold 30 per cent of all wealth, and the bottom 20 per cent just 10 per cent. This graph shows what people in the US think is happening, what they want and the reality:

On the planet, just eight people own as much wealth as the poorest half of the population. In the US 85 per cent of wealth is owned by the top 20 per cent and the bottom 40 per cent own just 0.3 per cent. The bars on the graph are barely visible.

Fairness, he says, is what allows humans to work in large groups. We don’t mind unequal reward for those who do the best within the group. It is key to our big brains and our success as a species.

A Pew Center canvassed opinions in 44 countries. In all 44 a majority of people thought the gap between rich and poor was a “big problem”. In 28 the majority thought it was a “very big problem”.

2. Individuals are propping up the nation’s finances

New analysis by Perth-based workplace expert and risk adviser Conrad Liveris has warned the federal budget is becoming increasingly reliant on revenue from individual income taxes. AFR article here.

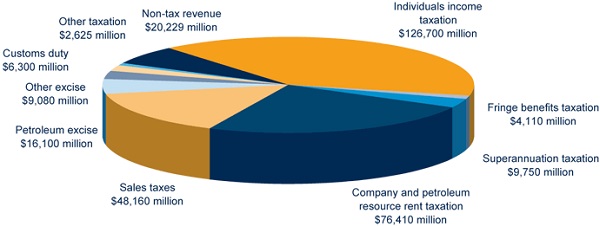

Here’s the revenue sources from the 2008-09 budget:

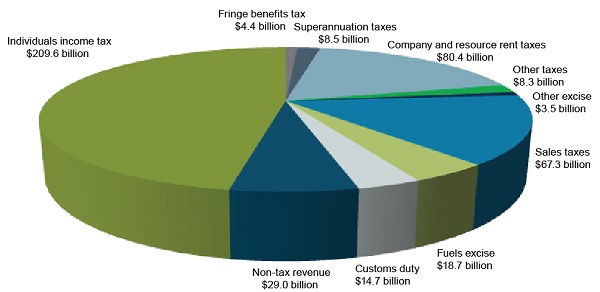

This is how 2017-18 shapes up:

The budget revenue has grown from $319.4 billion to $444.4 billion, an increase of around 39 per cent. Individual income tax has grown from $126.7 billion to $209.6 billion, an increase of 65 per cent.

Company and resource rent tax has barely moved, from $76.4 billion to $80.4 billion. Clearly the poor things are hardly done by and need a break, according to our all-wise leaders with their $65 billion corporate tax cut (over 10 years)!

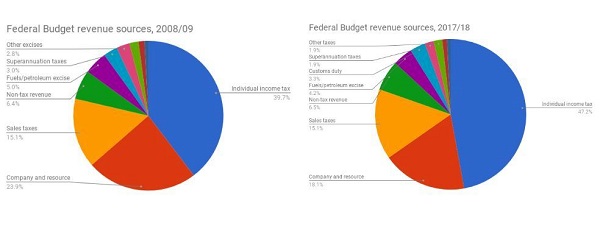

Here’s the difference in percentage terms:

That’s not easy to read, but individual tax has gone from 39.7 per cent to 47.2 per cent, whereas the movement for companies is 23.9 to 18.1.

The report says:

Relying on one source of revenue will always be a risk to the stability of government revenue, but especially on individual income tax at a time of casualisation, subdued full-time job creation and with low wage growth.

So the recommended answer is:

1. Encouraging part-time workers to become contractors outside their work; Allowing multiple forms of income for workers gives them greater security of income and make more stable contributions to the tax base.

2. Reduce the complexity of starting a small business and the tax arrangements; and, The processes to start contracting and align tax obligations for individuals can be complex. Individuals can struggle to understand their duties on their own and, accidentally, not pay their

fair-share of tax.

3. Developing revenue sources in other areas. Reliance on one income stream is a risk to the stability of government revenues. The current

tax base is too narrow for a 21st Century economy, and is built on individual income tax.

How turning us into business centres, responsible for our own superannuation, recreation leave and sick leave, is going to solve the problem beats me. Seems like Howard and Costello’s vision of how we should all operate. Remember, It’s all John Howard’s fault.

3. Jaw-dropping behaviour by those who manage our money

I’d have to say that what is coming out of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry is about 10 or 20 times worse than I expected. It boggles the mind. Charging for services not provided, as a conscious decision, lying to the regulator repeatedly, charging fees to people who are dead – unless you’ve been living under a rock, you know the story.

Now AMP CEO Craig Mellor has resigned in disgrace, as well he might.

Wikipedia tells us:

- AMP formed in 1849 as the Australian Mutual Provident Society, a non-profit life insurance company and mutual society. In 1998, it was demutualised into an Australian public company, and listed on the Australian and New Zealand stock exchanges.

Then it went mad. This ‘beacon of trust and integrity’ engaged in a series of corporate blunders, like paying far too much for GIO and Axa Asia Pacific, then, it seems, systematically fleecing its customers.

I’d always thought that only a royal commission would bring out the true stories. I hope the middle managers who must have been in it up to their eyeballs are put on the stump.

We have shares in AMP and the big banks, you would too if you have any superannuation. So I took a bit of a look to see whether all that loot was flowing through to the shareholders.

Not much, as it turns out. AMP has probably been the best, it just feels like a dog because we bought in 2007 just before the GFC at $9.91 per share. It’s now $4.31. However, its earnings per share have increased by 46% since 2013, and are forecast to go up by another 15% in the next three years. You need 8-10% to look after inflation.

The Commonwealth Bank has increased 18% in the last four years and is forecast to increase by only 2.3% in total in the next three. That’s the best of the bunch.

Westpac has increased by only 4.5% in the last four years, NAB is down -2.8 and ANZ -9.7. The forecasts for the next three years are -1.8% for Westpac, -1.1 for NAB and +6.6 for ANZ.

Generally speaking they are floundering, after doing well for five years after the GFC, and surviving the GFC better than most in the world (they only went backwards by about 20%).

Moreover, they are all vulnerable to disruption.

What to do?

There is a lot of money involved. The big banks pay about a fifth of that corporate tax mentioned above. So handing the banks $13.2 of the $65 billion to be foregone in corporate tax cuts over 10 years will be really popular.

Obviously, financial advice and wealth management needs to be institutionally separated. Why anyone thought you could keep foxes in the hen house has me beat. I would point out that fining companies only hurts the shareholders. Jail time for the miscreants, may bring better behaviour.

Referring to the inequality segment above, perhaps there should be compulsory regular community service for senior and middle management executives, so they stay in touch with the real world.

For us, if we’d known what was going on there is no way we would have bought these stocks. Now we assume they will be cleaned up, so the decisions are to be made on investment criteria. We are overweight in banks, but probably the prices will recover when things settle down. Selling now looks like doing the buyer a favour. AMP looks like a raging ‘buy’ if you have the stomach for it, however not without risk.

4. Democrats sue Trump campaign and Russia over 2016 election loss

-

The Democratic Party has sued President Donald Trump’s campaign, his son, his son-in-law, the Russian Federation and WikiLeaks, saying they conspired to help Mr Trump win the 2016 presidential election.

The party alleges in the federal lawsuit that top Trump campaign officials conspired with the Russian government and its military spy agency to hurt Democratic presidential nominee Hillary Clinton and tilt the election to Mr Trump by hacking Democratic Party computers.

The lawsuit also names Donald Trump Jr, Trump associate Roger Stone and Mr Trump’s son-in-law Jared Kushner as defendants.

The claims raised are already being investigated by Robert Mueller, but it should be fun to watch.

Sorry for the delay. I had to do some desperately overdue gardening around here, now have to go to the shops.

And it’s never enough…..

The side by side pie charts are a little confusing.

What do the light blue, pink, light green and dark red represent?

Those figures are not adjusted for inflation.

In 2017 dollars the growth is roughly 13% which matches the 13.7% growth in Australia’s population during the same period.

Population in Dec 2008 = 21,722,820

Population in Sep 2017 = 24,702,900

$100 in 2008 = $121.17 in 2017

zoot, that’s a valuable correction to the notion of rampant growth.

However, the point of the study is still valid. Revenue is increasingly dependent on the taxation of individuals.

Brian, I was responding to Jump’s impersonation of Eeyore, not criticising the study.

zoot, thanks, I got that!

The Age online.

Caption on photo from the Royal Commision:

As much as 5 per cent, or one set of advice in 10, from ANZ’s……….

Oh the horror.

Oh the arithmetic.

Oh the bankers.

Today I called my local Federal Senator’s office, Doug Cameron, and Mark Butler’s office to call for a Royal Commission into Australia’s Response to the Threat of Climate Change.

The most common question asked at any seminar, lecture, discussion, etc on Climate Change is “how do we get this message through to politicians”!

A Royal Commission is the only way to ensure that every politician in Australia is confronted with the true scientific, environmental, economic, and social reality of the threat to all Australians due to the dramatically changing climate that we are all now confronted with, and do this in the absense of priority vested interest bias, “persuasion” and propaganda.

I will be following these calls up with emails and registered letters.

I ask that anyone who has a love for all things Australian, and a sincere concern for the future well being of our children and their children, also make the calls to your local Members of Parliaments and make the same call.

Very good idea, BilB.

On banks and stuff, saw an article in the New Scientist which said finance companies in the UK had suffered tens of billions in fines over the last few years, but not as much as senior executives got in bonuses. Fines didn’t work.

Send them to the slammer, I say.

Thanks for that graph on wealth, Brian! I suppose we all knew, but just like the people in the study, we need to be shown graphically.

Considering over 50% of that income tax is payed by the top 10% of people, I hope we’re producing or importing enough of those.

When I encourage people I generally say “Go Brian!!” But in your constantly changing name case “Go Jump!!” Would be misconstued.

Having said that, we have covered this anomally, Jump. Taking the tax load off the 10% can be achieved in an instant. We will double the minimum wage, reinstate the penalty rates removed from hospitality industry workers and increase the lower 60% of incomes to where they carry a greater load of the taxtion burden. Ready,…..Set,……GO….Jump.

There’s no problem, Jump, in producing “the top ten per cent”. They reproduce by inheritance, or by social mobility. Importing them is a cheap trick.

And to be really pedantic, if all of the current “top 10%” were to disappear overnight, why the next 9% who had been directly ‘below’ the top 10%, would instantly get promoted and become the NEW “top 10%”, … ..though given that they would have mean incomes lower than the previous “tops”, they wouldn’t contribute 50% or 50.5% or even 52.5% of income tax any more. Rather, some lower proportion.

Then some time later, when all the bequests had been finalised, a sorting out would occur and a revised “top 10%” would do all the hard work so valued by us “lower” folk.

BilB

And just who exactly would ultimately pay for all of that if not the same consumers that would receive it ?

Imports would be far cheaper than the local products.

Small business exports would decline.

Inflation Venezuelan style is born.

Its called a fair suck of the sav, Jump. What you are saying is that you would prefer to have a slave class who worked for nothing so that some people can be even richer than they already are.

It is time to level the income field. As far as I am concerned everyone’s time is of equal value, more or less. But the more or less is not a factor of hundreds. The outlined proposal would have minimal impact on my export business. You are wrong in your understanding.

Mr A

Here’s a list of the top paying men jobs, one by one i asks myself where that money comes from, who pays.

And I ask, Sanders style, ” are they in the Evil 10% that don’t pay their fair share ”

AUSTRALIA’S 50 BEST-PAID JOBS

Men

Neurosurgeon $577,674

Ophthalmologist $552,947

Cardiologist $453,253

Plastic and reconstructive surgeon $448,530

Gynaecologist; Obstetrician $446,507

Otorhinolaryngologist $445,939

Orthopedic surgeon $439,629

Urologist $433,792

Vascular surgeon $417,524

Gastroenterologist $415,192

Diagnostic and interventional radiologist $386,003

Dermatologist $383,880

Judge — law $381,323

Anaesthetist $370,492

Cardiothoracic surgeon $358,043

Surgeon — general $357,996

Specialist physicians — other $344,860

Radiation oncologist $336,994

Medical oncologist $322,178

Securities and finance dealer $320,452

Thoracic medicine specialist $315,444

Specialist physician — general medicine $315,114

Intensive care specialist $308,033

Renal medicine specialist $298,681

Neurologist $298,543

Financial investment manager $288,790

Investment broker $286,530

Paediatric surgeon $282,508

Clinical haematologist $271,738

Futures trader $264,830

Endocrinologist $258,972

Cricketer $257,527

Rheumatologist $256,933

Dental specialist $253,442

Magistrate $246,737

Equities analyst; Investment dealer $245,826

Paediatrician $239,405

Stock exchange dealer; Stockbroker $238,192

Psychiatrist $234,557

Emergency medicine specialist $232,595

Member of Parliament $232,093

Pathologist $224,378

Company secretary — corporate governance $218,432

State governor $212,652

Actuary $196,144

Sports physician $187,468

Petroleum engineer $185,808

Chief executive officer; Executive director; Managing director; Public servant — secretary or

deputy secretary $181,849

Mining production manager $179,439

BilB

Nothing in Law prohibits you from instituting your plan to “ your export business “.

Do it, ready….set….go even.

I’m sure your competitor agree that I’m wrong.

In my domestic business I’d be toast and my Men unemployed on 60% more dole and free everything.

They’d love it.

Brilliant !!

Jumpy your list isn’t complete. You haven’t included brickies builders or property developers. And not a single CEO in sight. Nor most of the jobs in the ACT or the Northern Territory. All in the top 10% of income earners.

BilB, CEO average is there, developers and builder are usually companies so personal income tax don’t apply to this list and brickies are too far down to fit in the top 50.

Furthermore, it’s not my list it’s ATO data.

So I’m wrong and you win again, you winner you !

I’m positive if you had led East Germany things would have been totally different.

BilB

Just out of interest ( enquiring minds and all that ), you ve said $50/hour should be minimum wage in the past + penalty rates.

In your export business, how many hours do you work/week and how much do you pay yourself ?

Ball park of course.

Looks like everyone is enjoying Anzac day.

I spent most of the day attacking jobs in the garden, where, after a dry January, we’ve had unbelievable growth bursting out all over, like people in southern climes never get to experience.

I’ve been wondering why I’m having trouble with posting output. I compared my diary with last year, and find that I’m doing approximately two and a half times more work now than then.

I’m planning to do something late and brief for Anzac tonight, and am working on a I think a rather important climate post, which will have to be tomorrow night at earliest.

Hey, Jump, when you want information its a good idea to reveal some of your own first.

By the way I said raise the minimum hourly rate to 35, but you think that fifty would be better, OK. It will be call ec the “Jump wages jump”.

Jumpy: Most of the time movement in the value of the $Aus has more effect on international competitiveness than wages expressed in $Aus. Changes in Aus pay and conditions will tend to be offset by resulting changes in the value of the $Aus.

I’m a little unsure where that goes John, the $AU fluctuates constantly over the last 50 years and the average income rates are continually rising.

Are you suggesting to somehow wage levels are pegged to the exchange rate across the entire economy ?

Generally speaking the exchange rate effects the business owners margin be they importer or exporter in opposite directions, but not the employees wage.

I can see any correlation between the employment rate/ exchange rate either.

In essence, I’m not sure if I’ve interpreted what you said correctly.

Just a suggestion, J.

Perhaps it’s the old story: for many products, wage costs are a small proportion of the selling price. Possible??

Here’s an example.

Product H sells for AUD100.

Included in this price are $15 wages/on costs.

One day, wages rise by 10% and the AUD appreciates by 10%.

The wage increase, had it happened by itself, would increase the price to $101.50, ceteris paribus.

The rise in the Pacific peso would, by itself, raise the cost to $110. You get the idea: I simplify by quoting AUD. It should be some other currency.

If both occur, the price rises to $111.65.

Blind Freddy can see that the wage effect wasn’t the larger influence. Blind Freddy knows his arithmetic.

Jumpy: What I was trying to say was that changes in the $Aus effect the value of the $Aus to partially compensate for the wage change.

If Australian wages go up compared with that of major competitors and customers the value of the $Aus will tend to drop compared with the currencies of these countries.

Mr A, in the main, wages and related mandatory on-costs in my business are around 60 % of the quote.

I’d rather they be 15% but I’d never win a tender.

Ask blind Freddy to do that arithmetic.

Better still, ask yourself if 15% was plucked out of your or Blind Freddy’s arse.

John, I’m not that educated on exchange rate economics so I’m going to have to research a bit more.

That said, I know every Country is a competitor in 2 way trade.

Inflation has more effect on the value of a pay packet than the exchange rate.

What would your preferred $ AU – $ US rate be ?

Jumpy wages for the 90% have been declining in recent times. The only reason why the average wage increases is because of the extreme income increases for the 10% which pull up the average wage figure but not for the broad body of wages.

Ambi “Perhaps it’s the old story: for many products, wage costs are a small proportion of the selling price. Possible??”

This is true for most volume manufactured goods. An example that I know of for a product that most will be aware of is the Simpson dishwashers that were manufactured at Orange. For that product there was just 20 minutes of human time involved in its manufacture.

Most plastic components have virtually no human time involved in their production as injection moulders run fully automatically. For high volume products such as drink bottle caps where the production tool had 24 cavities, for one tool that I saw, and the tool had run 24 7 for three months non stop doing 3 shots per minute to produce nearly 10 million caps before the run finished. While that run was in process there was a person filling hoppers, checking the product from time to time, moving finished product in bags to the store, etc, but doing that for two other machines at the same time.

Lily Plastics who made the Cafe bar cups had a variety of machines producing some 3 million cups per day. Later they installed a single machine which included the extruder, the vacuum former the cup post processor, and the scrap material recycler all in on machine set which produced 2 million cups per day.

Engineers are really good at making machines do more faster with less labour. That is why the oceans are awash with our waste plastic.

Once upon a time people knew how to swing a hammer to drive a nail, now they pull a trigger on a nail gun and can 3 nails per second. Most building trusses are manufactured in a jig and the fasteners which are punched plates with some fifty fastening fingers per plate and the frames are bonded together in a press. Then delivered to the site in a single truck load so that the Jumpies of the world don’t need to make the roofing trusses on site any more.

The actual cost of the labour is not as critical as corporate operators would have the public believe, at least in the manufacturing world that is.

Dems Sue Trump.

Sarah Kendzior

https://www.youtube.com/watch?v=flJXp5lBXmI

https://www.youtube.com/watch?v=sz6lNU_poV8&t=5s

Listen to what this lady has to say carefully.

An article by Ian Dunlop headlined Climate Change: The fiduciary responsibility of politicians & bureaucrats was published yesterday, link here.

Well, J.

I refer you to BilB’s examples.

Wages could well be 60% in your business, I’m happy to take your word for it. But I was talking about goods exported.

Cheers.

BTW Blind Freddy does not require an enema. But thanks for offering.

PS I trust that your son has safely completed his sea voyage that you mentioned a few months back.

Mr A

BilB’s example ?

I wasn’t aware we exported many Simpson dishwashers, plastic cups or roof trusses.

My son is good, thanks. He’s back at Newcastle doing his final tests. Apparently there’s a shortage for his qualifications on the big yachts ( not the wind driven type) so he’s going toward that it this point.

Hope your family are doing good too.

Ambi I was talking to the the Jump’s point.

Your example very clearly outlines the exchange rate issue.

Jump, you are failing to understand that if the minimum wage doubles, it doubles for every one not just you. Everyone is equally advantaged and so your quoting position relative to your competitors has not changed. What has changed is you buying power relative to imported products, meaning you could finally be able to buy that worksite boombox you have been dreaming about.

The real advantage though is that you will be able to pay more tax and share the tax burden more equally with the rich people you admire so much. Its win win win.

If anyone finds a lazy 45 minutes over the weekend they could use it watching Dave Rubins recent interview with Thomas Sowell. He explains things better than I.

Incidentally, Thomas Sowell was the reason I got that Library card I mentioned a while back.

Unfortunately when I asked the the lady at our brand new, state of the art, multi-million dollar library for “ The Quest for Cosmic Justice “ ( recommend) she firstly didn’t know who I was talking about so googled him.

I said he has written over 40 on economics and social implications on society’s. ( she had a double take at that coming from a Tradie in his work gear )

Anyways, no was the answer but they were connected to a network of libraries around Australia and a search revealed 2 copies, each at different Universities so I could go on a waiting list.

I politely said no thanks, I’ll get it on Amazon in a week for $10 or so.

And that’s what I did.

Morning Mr J

Family’s going well, thanks.

Beautiful cool, sunny morning in Gippsland. Early mist clearing.

Cheers