Respected financial journalist Michael Pascoe thinks the Commonwealth Bank class action would hurt everyone but the lawyers.

- Two ambulance-chasing firms are inviting CBA shareholders to punch themselves in the head and pay the firms for the privilege.

A narrower version of the story is that lawyers Maurice Blackburn and litigation funder IMF Bentham are out to profiteer by provoking one group of innocent CBA shareholders to rip money off another group of innocent CBA shareholders and further damage the share price in the process.

Maurice Blackburn has made much of the fact that there are 800,000 CBA shareholders, and the price fell from an intraday high $84.69 on Thursday 3 August, when AUSTRAC launched proceedings in the Federal Court to a close of $80.11 on Monday 7 August, a loss of $4.58 which translates into $7.8 billion in the value of the bank.

Of course not everyone can join the claim. Only those who bought after the bank should have informed the market on 17 August 2015, and held them past 7 August 2017.

That would be a minority of shareholders.

Pascoe says a fund manager who follows these things thinks the bank has a defence – that the drop in price was not material. CBA shares opened at $84.09 on August 3, the day the news broke, and closed at $83.97 – a negligible movement.

On Friday August 4, in spite of headlines everywhere screaming about the money laundering, CBA shares opened at $82.51 – very much in line with the market’s general gyrations. The fund manager thinks this is a signal that the information about AUSTRAC was in itself not material.

We’ll have to wait and see whether enough people join up to make the case worthwhile. Strikes me that you’d have to own a very large parcel of shares before a notional loss of $4.58 per share made it worthwhile to employ fancy lawyers.

Stephen Mayne, talking to Patricia Karvelas, said there had been about 60 of these class actions. He said they are usually settled because the company does not want to air its linen, dirty or not, in public. He reckons it could be a few hundred million dollars, depending on how much insurance the bank has, which would make it the biggest ever, beating Centro Properties at $200 million.

Mayne says that the AUSTRAC action would cost about a billion, which would amount to around 7.5% of the bank’s pretax profit. That would no doubt be paid by all shareholders.

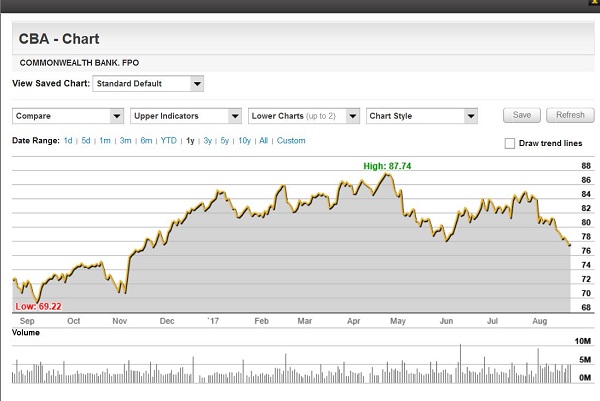

Take a look at the three-month share price:

After the price fell from $84 it stabilised for a week or so. Then with the market as a whole coming off it slid further, and further again as the class action was announced. However, the initial drop does not look all that unusual, and now, closing for the week at $77.72, and up slightly on the day, it looks similar to the end of June, when the market as a whole was similar. I reckon a descent chartist could mount a fair defence.

The more so if you look at the 3-year chart:

The disclosure should have been made on 17 August 2015 when the price closed on $81.27. (It’s near where it shows “JUL 15” on the chart.) In fact the price was in a slide that started on 4 August at $87.50 and ended up at $70.15 on 29 September. You would have to look at what was happening back then, but there is a bit of a whiff of insider trading about it, where the big players knew that something was amiss.

Overall, however, as I have been saying, CBA like the other banks has been going pretty much nowhere in the last few years in terms of earnings growth, and that is reflected in the price. It is notable that many buyers since August 2015 have bought in below where the price is now.

As Pascoe says the miscreants responsible for this at the bank will have been punished or moved on. Lawyers Maurice Blackburn and litigation funder IMF Bentham are “out to rip off nearly every working and investing Australian.”

But not by much, as super funds are usually well-diversified. It’s mainly just a lawyers picnic. As he says, it’s a sanctimonious exploitation of our legal system, which is second only to the US in facilitating this kind of thing.

APRA announced an inquiry into the Commonwealth Bank today, which will include past misdemeanors in insurance and wealth management.

There is some expert commentary at The Conversation.

On the one hand they say that APRA is the only body with enough understanding of how banks work. One wonders, then, what in positive terms the AUSTRAC court case is meant to achieve.

OTOH, APRA has no power to interrogate witnesses outside the bank, unlike a royal commission, and does nothing to mend the fracture in trust in the banking system overall.

There is also the long shadow of a prospect of international regulators having a go at CBA.

In the AFR today, we had some additional information.

Seems APRA usually does these things quietly, working with the banks, but it was significant that this was a big announcement, even before the terms of reference were worked out.

Seems like the Government was keen to show it was doing stuff for the people.

At the same time ScoMo called the CBA board chair Catherine Livingstone in for a “dressing down”. If there is anyone who doesn’t need to be told by ScoMo how to behave it is said Catherine Livingstone, who has impeccable integrity, respected by everyone.

Another cloud on the horizon is that the credit agencies are watching how all this plays out. If they downgrade the credit rating all borrowers will pay more.

Pascoe was right, only the lawyers are sure to be winners.