For a billing service that needs to invest no more than renting an office, hiring some staff and buying office furniture and computers, rewards for an electricity retailer are rich indeed. In this post I publish some comments I sent to our local ABC Mornings presenter, Steve Austin, who has taken up the cudgels on behalf of consumers who are hurting from electricity price rises. Austin is fighting the good fight but unfortunately regularly misfiring. Then, while I was writing those comments, information came through of another Victorian investigation, which is a bit of a bombshell.

Sophie Vorrath at RenewEconomy has a post Failed experiment: Now it’s retail arms gaming energy consumers with the grisly details.

To set the scene, in Queensland two state government-owned companies, CS Energy and Stanwell, provide about two-thirds of all electricity generation. High voltage tranmission is provided by the government-owned Powerlink. Distribution is effected by two government-owned entities, Energex, serving South east Queensland, and Ergon, serving the provincial areas. In SEQ retail has been privatised, but in provincial Queensland prices are set by the Queensland Competition Authority. Effectively this then becomes the actual price country people pay, collected by Ergon, and the basis for standard contracts in SEQ.

State-owned electricity entities in Queensland have been corporatised, allowing their operations to be performed as commercial companies free of government regulation and red tape in such things as hiring and firing staff, acquiring goods and services, and entering contracts. Certainly they need to operate efficiently, and have had the cleaners put through them many times, but it does not mean that they have to maximise profits. In the current state budget Queensland treasury took $771 million less than normal (that might be over three years) I think largely because coal seam gas revenues were up. So consumer price rises were limited to 3.3 per cent from July 1 this year.

Steve Austin has now done several interviews with Rod Sims, head of the ACCC, who is leading an inquiry into electricity affordability, touting him as the consumers’ hero.

The problem with Sims is that he’s a signed up neoliberal. Whatever he recommends, you know it will feature more competition and more privatisation. He also had some of his facts wrong about what had happened in Queensland, as others do from time to time, including the normally reliable Giles Parkinson at RenewEconomy.

On Monday Steve Austin had done a segment wherein he interviewed the CEO of CS Energy, the Queensland government-owned energy generator, who had just concluded a joint venture with Perth-based retailer Alinta Energy to offer residential and small business customers a two-year discount of 25 per cent from August 14, exactly the sort of thing Rod Sims, Malcolm Turnbull and Josh Frydenberg are calling for.

Then Austin made it all sound like shite, with an interview with an advocate for the poor and oppressed, who said as expected, no these offers will not mean anything to people who don’t/can’t pay their bills on time, and no it won’t be available to people outside the SE corner (see my comments below), replaying some of Sims selected criticisms of the Queensland market from earlier interviews (market too concentrated, government operators have too much power), and then an interview with LNP opposition leader Tim Nicholls, who gave cherry-picked and misleading information, saying that it was all a vote-buying stunt, unchallenged by Austin.

The Labor government was a no-show. I suspect they don’t like Austin’s program much. Yes, he tries to be fair, but he’s normally a vigorous interviewer and after an interview you’ll get an hour or more of callers slagging off at politicians, saying they don’t answer the questions, even when they do.

When you contact the Mornings program from their site you only get to direct the message to ABC Local Radio 612 as a whole, so I headed it to ‘Steve Austin Electricity Prices’, sent it off on Monday night and duly got an email message saying it had been received and thankyou etc etc. Steve was sick on Tuesday so they mostly played music. I’m sure my missive will now be lost in the bowels of the ABC.

Here’s what I sent.

Comments sent to ABC

Your hero Rod Sims recommends more privatisation and more competition. Yet when CS Energy and Alinta follow the script you turn it into dross and effectively criticism of the Palaszczuk government. Not sure they actually did anything except endorse the idea.

Consider:

- No private retailer will ever give a discount unless the consumer pays on time. Yet the more discounts offered, the higher will be the standard price, on which the poor, the frail and the old will be left.

- You bemoan the fact that the discounts are only available to SEQ. Do you understand that Energex subsidises Ergon to equalise the price across the state? The front page of the Sunday Mail put that subsidy at $488 million this year. Without that subsidy country people could not afford electricity.

- Do you know that the Grattan Institute did a study showing that electricity retailers in Victoria were charging mark-ups of 25 to 40 per cent? Just for sending out a bill.

- In Qld Ergon does the billing in the country, because we can’t afford the luxury of private retailers there. If Energex did the same, consumers and the treasury could split the gains.

Steve, privatisation and competition from 1996 on got us into this mess, especially from when the National Electricity Market operated from about 2009, plus high gas prices from 2015 and policy paralysis on clean energy from the Abbott/Turnbull government since 2013.

The answers are:

-

1. We need a clean energy target (CET) from the feds, and give up on coal. Everyone knows it is too expensive, takes too long to build, and risks becoming a stranded asset when we wake up about climate change.

2. Leave the generators as they are. With a CET they’ll work themselves out.

3. Nationalise high voltage transmission and the grids (keep them in government hands in Qld), but with transparency on how much goes to treasury. These are natural monopolies. In private hands in other states the profits go to companies, many of them foreign.

4. Nationalise retail and combine with the grids. Energex can send out the bills. The retailers don’t need compensation, because there is no actual investment, like a shopping centre with stock and stuff. Just tell them to piss off.

OK, employ their staff, and buy their computers and databases.

If you want to talk, which is your business, don’t ring me, I’m old and frail, and might have a heart attack. Seriously! Talk to Ian McAuley of the University of Canberra. See his post “This time, let’s get electricity pricing right” at John Menadue’s blog.

Comments on my comments

I said:

- No private retailer will ever give a discount unless the consumer pays on time. Yet the more discounts offered, the higher will be the standard price, on which the poor, the frail and the old will be left.

Giles Parkinson did a post based on AGL’s recent annual report AGL cashes in on coal splurge, renewable investment drought. On electricity retail Parkinson reports:

- It says that 80 per cent of its customers accessed discounts in the last year, but adds that this was “managed” so that its actual profits from sales to consumers increased over the year.

AGL made $485 million in the year basically for sending out bills. Parkinson says the report shows

- how AGL – like other gen-tailers – are able to profit from the way they influence policy, and can slice and dice earnings to their advantage

AGL is one of the big three retailers, and, along with Origin and EnergyAustralia, operates at all levels in the market. Their earnings per share are forecast to grow by 74.9% in the next three years, according to a leading broker. That is better than any company I know.

Also, when Rod Sims was in Brisbane holding a meeting to see what people had to say, ABC Afternoons sent along a reporter. They interviewed an advocate for electricity consumers who explained that the people who won’t get discounts are the ones who can least afford electricity. And, he said, the more discounts offered, they higher the standard price would be. It’s just not fair, he said.

Thirdly, when experienced AFR journalist Jennifer Hewett went discount hunting, she got thoroughly confused. Her piece Power prices: Complexity of supplier discount benefit offers is energy draining begins “If knowledge is power, I plead guilty to inexcusable ignorance of my own power bill.” It ends with her getting 113 offers when she typed her criteria into a website that was supposed to help.

Like many, she had had more pressing and more interesting things to do with her life than chase electricity bills, including moving house.

I think that all consumers in a state should pay a levelised price, in Queensland’s case decided by the Queensland Competition authority, with concessions for those in need. Remember, for every discount you chase, chances are the poor and needy will pay more.

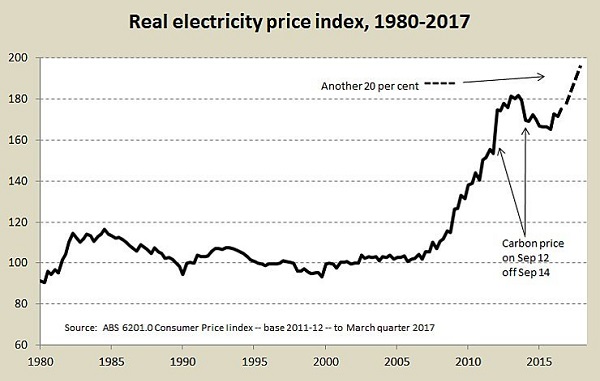

I recommended that Austin talk to Ian McAuley because my recommendations where pretty much lifted from his article which has this astonishing graph:

I do hope Rod Sims can explain why the prices went up so much as the NEM got organised. I suspect he’ll say it was the gold-plating of the networks. I suspect it’s more than that. And when he accused Queensland for doing the same, because we had a storm that blew down the wires a few years ago, well he should come and live here for a while. It happens lots of times every summer, Rod. We need robust networks.

Sophie Vorrath’s article

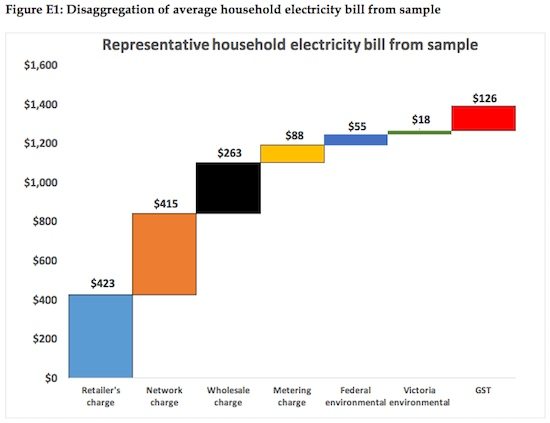

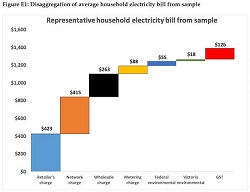

Here’s exhibit A, a breakdown of a typical annual electricity bill:

Retail, essentially a billing service, is the biggest item at around 30 per cent.

I would also like to draw attention to the network charge at $415. My wife and I have a standard, garden-variety contract with AGL and the network charge is $90 per quarter for the coming year ($360 pa), up from $89. This is the charge in Queensland that everyone has had a go at, including Giles Parkinson and Rod Sims. Steve Austin told his audience that it was “bleeding consumers dry”.

I’m not downplaying the seriousness of electricity prices, but I would like Mr Sims to explain in his report why other states charge even more, and why it is better for any profits from the networks to go to private companies, many off-shore, rather than to state taxes to pay for schools and hospitals and such.

Finally, metering cost us last year around $33 compared to $88 on the Victorian bill.

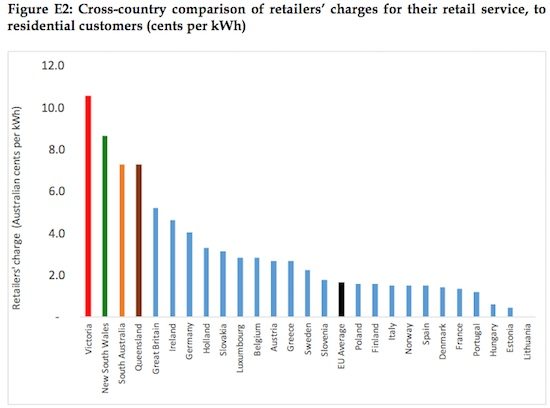

Now here’s the comparative prices for retailers in Australia and around the world:

Very strange.

Inconvenient facts

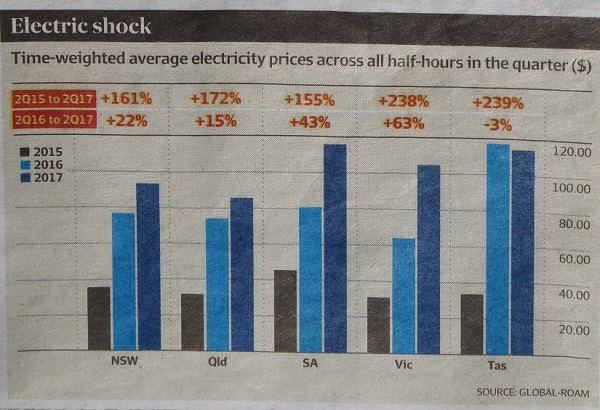

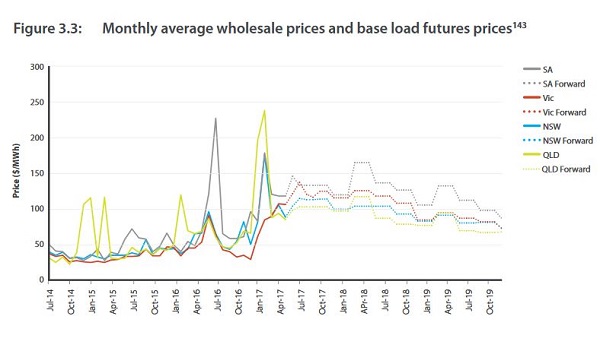

Here I’ll just repeat some inconvenient facts which Messrs Sims and Austin are apt to get wrong. There’s more in earlier posts here and here, but this one shows that in 2017 electricity prices in Queensland were below those in NSW, Victoria and SA:

They spiked in December-February, but they were already down in March. Hazelwood closed at the end of March and was not the cause of spot price peaks, which happened earlier. CS Energy CEO Martin Moore’s explanation that these had much to do with peak demand and gas prices is probably correct. There were only seven that attracted the interest of the regulator AER, who found no rules broken. And when the government asked Stanwell to change its bidding practices early in June, prices were already down from February, and I think did not relate to bidding on the spot market, rather to the balance between keeping prices down for consumers and supplying government revenue. It’s possibly in part why prices from 1 July only rose 3.3% to consumers and 4.1% to business, rather than 7.1% as the Queensland Competition Authority initially determined.

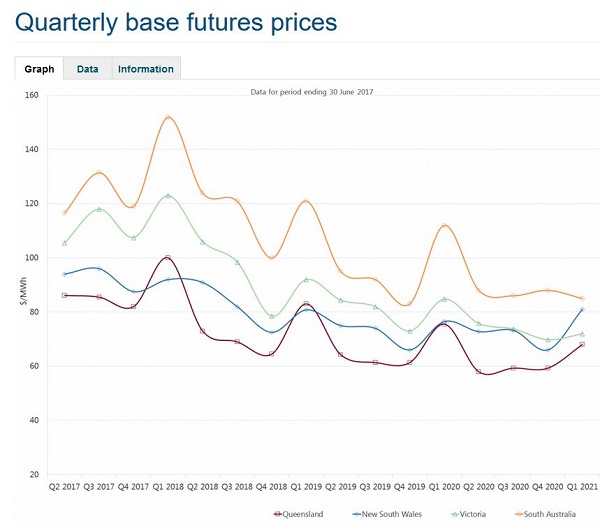

Here is Finkel’s forecast of future prices:

It has actual prices up to May 2017, where you can see what happened.

Why does the graph for Queensland future prices not rise above the rest, Mr Sims, with all that concentration and government ownership? After all Queensland has the most decentralised grid, lots of growth from trees and some really bad weather to cope with. There is every reason why Queensland prices should be higher, historically and into the future. Something unusual must be happening, which i hope Mr Sims will explain.

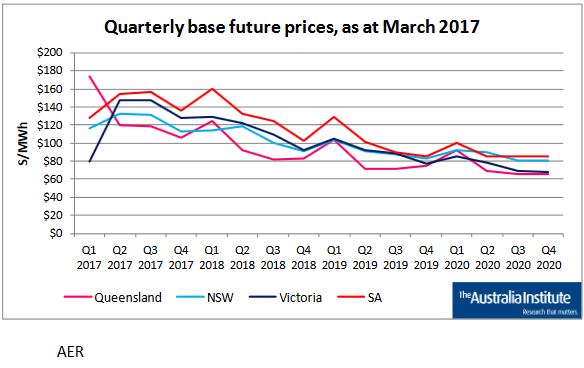

Here’s another one from national regulator AER:

For good measure, here’s the Australia Institute:

Get the picture?

Emerging solar

Sims in talking to Steve Austin roasted solar feed-in tariffs around the country as ridiculously expensive. Climate change did not seem to figure in his concerns at all.

Everyone in the industry, apart from the rusted on fossils, now say the way to cheaper prices is solar, wind, batteries and storage, plus newer techniques, old overseas, such as demand response.

From where I sit, government support for renewables federally through the RET, through ARENA and the CEFC, plus states supporting rooftop solar looks like getting ahead of the curve, so the industry is ready to go as aging coal stations need replacing. Or call it a transition to a sustainable future, rather than one that roasts the planet. Sims would call it ‘picking winners’ and as such verboten in the neoliberal playbook.

Update:

From an article in June at RenewEconomy, some 17 different solar projects with 1200MW of capacity are on the books in Queensland, with a further 36 (mostly solar) projects, but also including wind, hydro and biomass,in prospect amounting to a potential 4,200MW.

Update 2:

Origin Energy has brought in its annual report, showing solid growth in its energy markets division, expecting 14-21% growth in 2018.

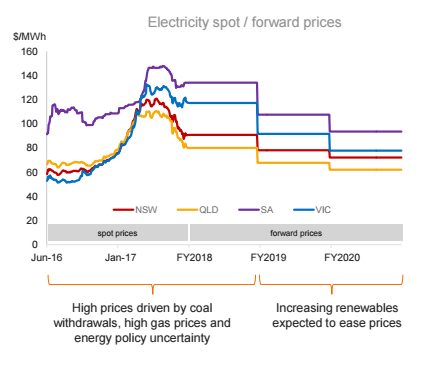

It sees renewables as the way forward, which in time will bring prices down. This graph of future spot prices is interesting:

Update 3:

In the AFR Angela Macdonald-Smith looks at the market reaction to Turnbull’s tough talk to electricity retailers, and finds there has been a negligible reaction, basically indescernible. In other words the sharemarket is not expecting company profits to be adversely effected.

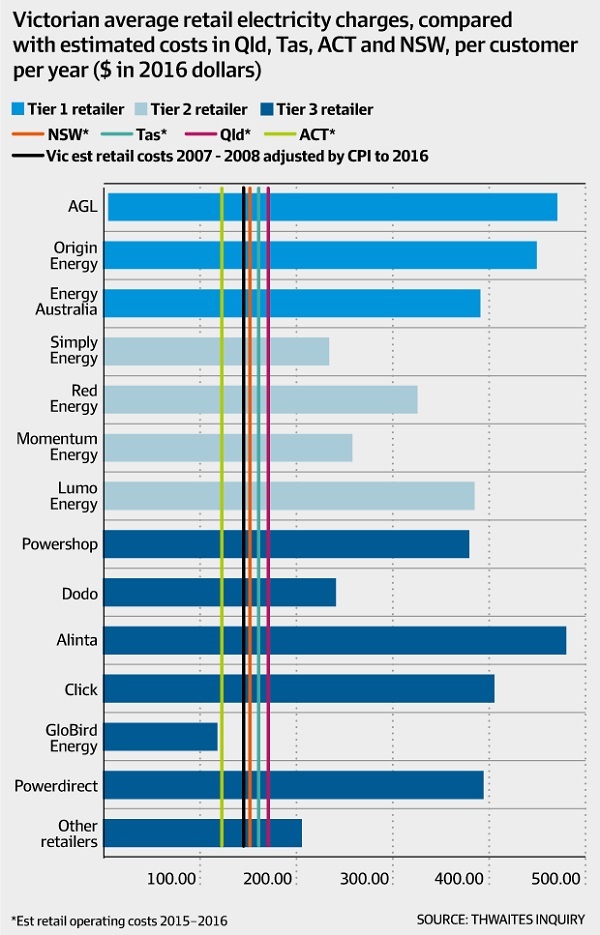

She posts this graph from the Victorian Thwaites committee report (download from here), which shows retailer charges against those of for 2007-2008, adjusted by CPI to 2016 prices:

Update 4: Alinta Energy plan to hire 100 people in their Brisbane office in anticipation of enlisting 250,000 customers in the next two years, or about 15 per cent of the retail market, with their 25% discount for new customers.

They say that to date the annual “churn rate” has been only 7 per cent in Queensland, compared to the high teens in NSW and SA. So they are expecting to shake things up a bit.

See also:

AER, ACCC and the ABC join the fray on Qld electricity prices

It’s gas, not renewables, pushing up electricity prices

Retailers gouging electricity prices: Grattan

Australia puts the brakes on wind

Electricity prices: Turnbull’s central policy scare campaign

I’ve updated the post just to explain upfront how the Queensland system is set up and also from an article in June at RenewEconomy, some 17 different solar projects with 1200MW of capacity are on the books in Queensland, with a further 36 (mostly solar) projects, but also including wind, hydro and biomass,in prospect amounting to a potential 4,200MW.

When experienced journalist Jennifer Hewett went discount hunting, she got thoroughly confused. Her piece (paywalled) Power prices: Complexity of supplier discount benefit offers is energy draining begins “If knowledge is power, I plead guilty to inexcusable ignorance of my own power bill.” It ends with her getting 113 offers when she typed her criteria into a website that was supposed to help.

Like many, she had had more pressing and more interesting things to do with her life than chase electricity bills, including moving house.

I think that all consumers in a state should pay a levelised price, in Queensland’s case decided by the Queensland Competition authority, with concessions for those in need. Remember, for every discount you chase, chances are the poor and needy will pay more.

Update 2:

Origin Energy has brought in its annual report, showing solid growth in its energy markets division, expecting 14-21% growth in 2018.

It sees renewables as the way forward, which in time will bring prices down. This graph of future spot prices is interesting:

Update 3:

In the AFR Angela Macdonald-Smith looks at the market reaction to Turnbull’s tough talk to electricity retailers, and finds there has been a negligible reaction, basically indescernible. In other words the sharemarket is not expecting company profits to be adversely effected.

She posts this graph from the Victorian Thwaites committee report (download from here), which shows retailer charges against those of for 2007-2008, adjusted by CPI to 2016 prices:

Alinta Energy plan to hire 100 people in their Brisbane office in anticipation of enlisting 250,000 customers in the next two years, or about 15 per cent of the retail market, with their 25% discount for new customers.

They say that to date the annual “churn rate” has been only 7 per cent in Queensland, compared to the high teens in NSW and SA. So they are expecting to shake things up a bit.