In last Tuesday’s post It’s gas, not renewables, pushing up electricity prices the federal Minister Josh Frydenberg attacked the Queensland government through it’s state-owned generators for “gaming the system”, which, he said gave Queensland the nation’s most expensive electricity, costing jobs. In that post Queensland’s electricity was shown to be low compared to those of the other eastern mainland states, in recent years and in recent months the lowest.

The state has now been attacked by the AER (Australian Energy Regulator) and by the ACCC. At the end of it all, Steve Austin, the host of Mornings on Brisbane’s local ABC, sank the boot in. So what to make of it all?

I should have pointed out in the earlier post that there are at least four different electricity prices. The most common are the wholesale price, the residential consumer price, and the spot market price. Beyond that, businesses commonly have a contract price, which can be multi-year.

Regulator hits out at power monopoly

That was the title of the article by Mark Ludlow in Wednesday’s AFR Mark Ludlow which appears online as State-owned power companies entrench high prices, says Australian Energy Regulator:

- The Australian Energy Regulator chair Paula Conboy says high wholesale electricity prices will persist in Queensland while the two state-owned power generators continue to control two-thirds of market share in Australia’s third largest state.

Ms Conboy said the lack of competition in the Queensland generation market – dominated by government generators CS Energy on 35 per cent and Stanwell 30 per cent – had the potential to entrench the power of the two state-owned companies in influencing prices. Australian Competition and Consumer Commission chairman Rod Sims also had concerns.

On the ‘gaming’ through bidding and re-bidding, the article says this had happened on 30 occasions in Queensland since 2014, included seven times last summer, which is actually far less often than had previously been claimed. In the earlier post I had cited a report claiming 44 occasions in early 2017.

AER is suggesting that the rules are not being broken, but Conboy says the best outcomes would be achieved if there was more competition in the generation market.

Qld energy minister Mark Bailey said that:

- wholesale electricity prices have eased since March and fallen another 19 per cent since the Palaszczuk government issued a directive to Stanwell in June to keep prices down.

Treasurer Curtis Pitt told a budget estimates hearing this week that CS Energy and Stanwell were expected to deliver $1.5 billion into state coffers over the next four years.

- “The dividends are one of the key reasons we have kept them in public ownership,” he said.

$1.5 billion over four years sounds in the ball park to me.

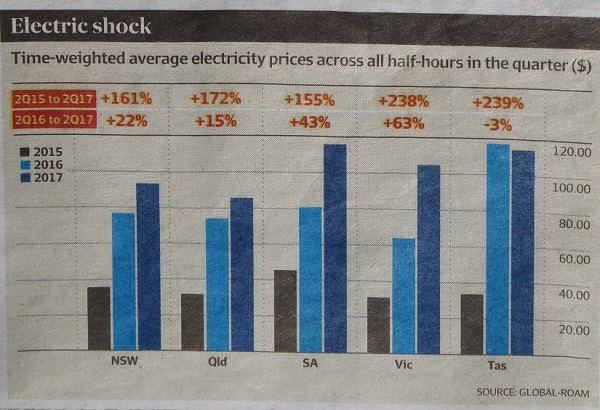

On the need for competition, Ms Conboy is singing from the usual neoliberal songbook. Mark Ludlow’s AFR article on Friday 7 Companies hit hard by soaring wholesale power prices shows pretty rugged increases in wholesale electricity prices over the two years 2015-17, from 161% in NSW to 239% in Tasmania. Of the five NEM pools there is a graph in the dead tree version. Leaving aside Tasmania as a special case, Queensland goes from slightly higher than Victoria to the lowest by a clear margin:

[My scanner doesn’t work, but my camera does.]

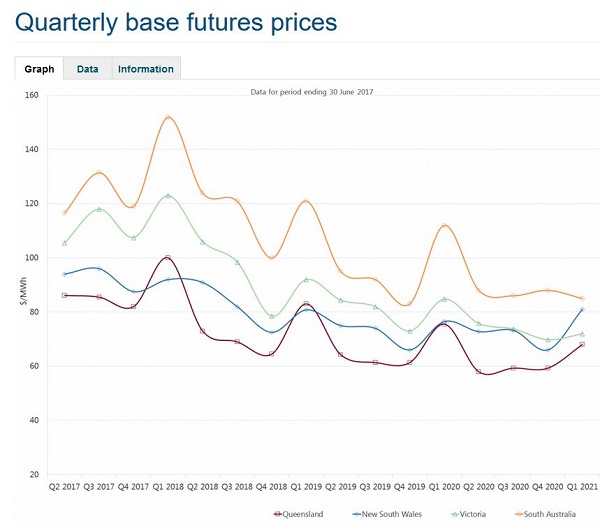

Conboy needs to acknowledge this. Indeed if she had taken the trouble to check her own site she could have seen this graph of future prices:

Queensland is bumping along the bottom. Now, why would that be when the other states have privatised everything?

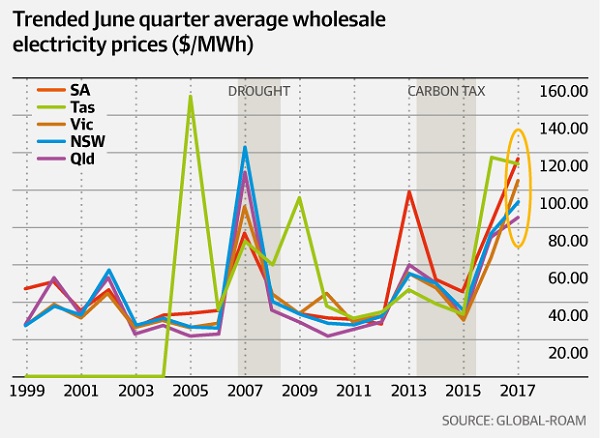

The same issue of the AFR had an article by Angela Macdonald-Smith ‘Gut-wrenching’: power prices rise 64pc in June quarter. That is, the June quarter year on year from 2016. She gives this graph of historical prices:

Again Queensland ends up lowest.

Just as well, because as Macdonald-Smith wrote two days earlier, Queensland has become the mainstay of the eastern coast system since Hazelwood shut down on 31 March. On every single day since then power has flowed south to NSW, which in turn sends power to Victoria, which has become a net importer.

No doubt that means more cash for the Queensland treasury.

ACCC joins the fun

On Thursday morning Steve Austin conducted two extended interviews, first with Martin Moore, CEO of the Queensland government-owned generator CS Energy since 2013, and Rod Sims, Chair of the ACCC. You can find it from 1.38:30 in the episode of ABC Mornings.

Among the points Moore made were:

- CS Energy was not gaming the system, and Ms Conboy said no rules were broken

- The letter from Qld minister Mark Bailey to keep prices down was in early June and directed to Stanwell, not to CS Energy

- The Queensland government is undertaking a market structure review, after three government generators were collapsed into two

- CS Energy does not just act like a commercial operator, it is wholly commercial

- The aim of CS Energy was to get the best short-term and long-term results for the Queensland taxpayer

- The business is going well now, but that was not always the case. Shortly before he came in 2013 the government had to inject $300 million in capital into the business, which still carries debt.

- The high prices during the peak of summer were due to record demand for electricity, LNG being exported through Gladstone, causing higher gas prices, the closure of plants in the south with no replacement because of the lack of a policy framework

- After the action by the minister in June, forward 3-year contract prices had dropped by 19%

- Nevertheless elevated prices are likely to continue.

Moore said it does make a difference whether an operation is public or private.

Rod Sims from the ACCC (from 1.50 in the audio) said he had been tasked by the Treasurer and the PM to undertake an inquiry into electricity affordability, which gave him access to confidential commercial material. While he clearly had an a priori assumption that having only two player means more market power and higher prices, he told Austin that the biggest problem was higher network costs.

Austin latched onto this, having done an interview of an ex-employee of Powerlink, who told of outrageous price gouging by the government-owned high-voltage operator. Austin recalled that Powerlink was more profitable than NAB, which was no doubt incontrovertible evidence of guilt.

Yes, I remember that interview. It could have been around the time Giles Parkinson at RenewEconomy wrote an article Is it ok for the regulator to ignore electricity networks’ extraordinary profits? Parkinson explains and complains that the regulator (AER) does not take profitability into account. I’m sure Sims will recommend a change to that practice in his report.

Meanwhile I have some concerns about the article. For example, it says:

-

from an income perspective, over the past 15 years, Powerlink Queensland achieved an average annual ‘return on equity’ of 27%, whereas most ASX50 companies struggled to deliver annual returns of 5% over that period.

I can assure everyone that if returns were so low capitalists would not get out of bed. There must be a lot of dud companies out there bringing down the average. I think it is facile to make comparisons across industries, as the article does. However, I’m a direct share investor and have a column on my spreadsheet for ROE. Last I looked the forward ROE for leading companies in our portfolio was an average of 22.6, leaving aside the banks. Banks around the world are not particularly profitable enterprises. Our banks, the big four, average around 12.

If you want profit, the blood products company CSL (the privatised Commonwealth Serum Laboratories) is around 57, the private road operator Transurban is 49, and Invocare, which owns funeral parlours, crematoria and such in Australia, New Zealand and Singapore is on 28.6.

These companies have steady, low-risk income streams.

I simply don’t understand the graph in Parkinson’s article and view it with suspicion.

Bottom line is that Powerlink and the distribution networks in Queensland, Energex and Ergon, set their prices by regulation, they don’t just charge what they want. No information is available as to whether their profits are greater or smaller than those in other states, where the profits go to private enterprise, in many instances overseas.

In Queensland, last time I looked, a couple of years ago, Energex was passing on a subsidy of some hundreds of millions to Ergon, which is then distributor and retailer to the provincial regions, with consumer prices equalised throughout the state.

Sounds a bit socialist, but only a foolhardy politician would change it.

Queensland provides the most decentralised network of the eastern states, is subject to frequent and severe weather disruption, yet somehow prices have been cheaper here for the past few years, apart from one short period, are cheaper now and are forecast to remain so into the future.

Are Queensland government owned operators, in spite of providing a health profit to state revenue, actually more efficient than their southern privatised peers? I’d like an answer, Mr Sims.

Back to Sims. At one point he said Hazelwood closed, hence higher prices in Queensland in the first quarter.

Wrong. Hazelwood closed from March 31.

He said more, but really he should wait until he’s finished his inquiry before he sounds off.

Austin asked him whether he was going to order the Queensland government to split its generators up.

Sims said he had no such power, he would just be making recommendations.

Austin then asked if he was just going to embarrass the Qld government into taking action.

Sims said, no, just making recommendations.

Austin concluded by asserting that consumers were being “bled dry” and that it was “taxation by stealth”.

There is a lot of information around, Mr Austin, if you care to look, and no doubt more will come out in budget estimates hearings this week, and in Mr Sim’s report.

On Friday morning, talking to finance expert Peta Tilse, Austin repeated that Queensland electricity prices were the most expensive in Australia, although he had been told the day before that they weren’t. Unfortunately she did not disagree.

I understand Austin’s desire to speak truth to power, but he should also understand that the electors have sent a sharp message to the politicians twice in recent times that they want no privatisation of public assets. They want government businesses to earn profits to provide services, like schools, hospitals, roads, infrastructure and such.

Back about 1996 Australia embarked on a program of privatisation of the electricity system. At the time we had some of the cheapest electricity in the world. It was to be made even cheaper under the rubric of privatised competition. Some how two decades later we’ve ended up with about the most expensive electricity in the world.

Some, like Professor John Quiggin, think the whole project is misconceived and should be nationalised. At John Menadue’s request, economist Ian McAuley wrote a post The National Electricity Market: What happens when economists get involved with electricity. He found the whole thing, shall we say phantasmagorical and bewildering. His conclusion is worth pondering:

-

The NEM, however, has heaps of “friction” – “transaction costs” in economic terms. All the bargaining costs between various entities. Legal costs. Retailers’ marketing and advertising costs. The costs of regulators. High executive salaries – much higher than were ever paid in the old government utilities. High profits – much higher than government bond rates. And it has the normal market mechanisms for prices to be set by the last supplier to come on line and incentives for firms to withhold supply to maximise prices.

I am not suggesting that economists should abandon their theoretical models any more than engineers should abandon the laws of physics. Rather, as a matter of sound professional practice, they should improve their models to make sure they have more robust predictive power and that the criteria for system performance is in terms of consumer benefits rather than adherence to the idealised models in Economics 1 textbooks. Bad economics leads to bad public policy.

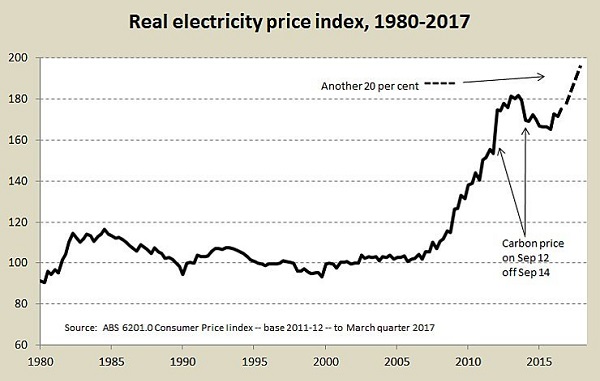

McAuley himself provides some answers in his recent post This time, let’s get electricity pricing right. It includes this scary graph:

Such graphs should be accompanied by graphs forecasting future prices, such as the one from AER above, which see prices flattening and coming down a bit.

Scary too was his fingering of the retail sector – “financial intermediaries who absorb 25 to 40 per cent of households’ electricity bill.”

His answer, in brief, is to take climate change seriously, leave generation privatised, but nationalise high-voltage transmission, distribution and retailing, with profits determined by a regulator in terms of a fair return on equity.

The real leaches in the system seem to be the retailers, who, as I said, do nothing of substance but advertise and send out the bill.

In my view, economists like Sims live intellectually in an ideological free-market cave, and are constitutionally incapable of seeing outside it. Still, he needs to explain how the Queensland system, which retains the most government ownership, and operates in difficult conditions, appears to have outperformed other comparable states.

The Queensland government plans to re-open Swanbank E, a mothballed gas-fired station to cope with any summer peaks, and, already a world leader, is strongly encouraging more rooftop solar, with a million roofs the aim. Latest advice on local radio was that rooftop solar costs about 19c per KWh. Finkel says large-scale renewables are cheaper than new coal. There are said to be 17 large-scale solar projects in the pipeline in 2017 in the state.

The LNP opposition has made two firm promises. Firstly, there will be no privatisation of public assets, nor a repeat of the 100-year leasing ruse it took to the last election. Secondly, it will initiate a coal-fired power station in the north of the state within 100 days of taking office.

Coal-fired power plants, if they can find a financer, take at least 5-6 years to build. My expectation is by that time the world will wake in fright and realise we can’t burn the stuff anymore. Certainly that will happen within the 30-40 year life of such a project, and financers are aware of the risk of stranded assets.

The LNP will also have to explain whether it is going to forego revenue from the electricity system, balance the budget, pay down debt and avoid the wholesale sacking of public servants while maintaining or improving the standard of service.

People may be interested in a recent media release Regulated Retail Electricity Prices for Regional Queensland in 2017‐18 from the Queensland Competition Authority in relation to the 3.3 per cent residential price increase:

“The higher regulated prices are primarily due to substantial increases in wholesale energy costs, which have been driven by a projected tightening in the demand–supply balance within the National Electricity Market,” Professor Green explained.

“A number of factors have contributed to this tightening, including the increased demand from electricity-intensive in-field gas compression associated with the LNG export facilities as well as the closure of Hazelwood power station in Victoria.

“On the other hand, network costs have decreased for many customers. These decreases are a result of the AER’s final decisions on Energex’s and Ergon Energy’s 2015–20 distribution determinations, and the Queensland Government’s removal of Solar Bonus Scheme costs from network prices.

“However, the lower network costs have not been sufficient to completely offset the substantial increase in energy costs.”

Small businesses were expected to experience a 4.1 per cent increase.

Large business has been tested to the limits by price rises, as reported towards the end of this piece. Some, such as Telstra in Central Queensland, are building their own renewable plants, but business has been less likely than home owners to take such initiatives.

Gas to burn

Change is happening. Queensland coal seam gas is reaching Melbourne in a turning point for energy prices. In recent times the net movement has been a great sucking motion ending at Gladstone. Increased production and lower usage, albeit associated with high prices, are given as reasons.

Unexpectedly, a huge gas field has been found at Betaloo in the NT, where billion year-old rocks accumulated beds of algae.

Conveniently, the find is near Tennant Creek where a pipeline connector is being built to Mt Isa.

This will take five to 10 years to make a difference, and again we may have a different climate agenda by then.

In the shorter term I place more confidence in AGL’s $300 million plan to create a floating hub off the south-east coast to import gas. That should limit gas prices to world prices.

And if you put a tracer on it you might find that some of the gas began in the coal-seams of Queensland’s Surat basin.

Well done, Brian.

I think Ian McAuley is well worth taking heed of. He’s been around the traps and seems a good analyst.

Part of the reason Qld power costs are low is that the Qld government (Joh) had the foresight to obtain coal leases to cover their power supply needs. For example, the Tarong power station is fed with coal from its own mine and Curragh got its leases from Liddell power station, leases that mean that Liddell gets very low cost coal. Shame they didn’t do similar deals with the gas companies. Sometimes you feel the state needs another cunning old bastard as premier.

Good one Brian.

Part of the problem is that privatization took place to make state books look good rather than for logical reasons. To make matters worse governments had this touching idea that the magic of the market would create a miracle even when the some of the bits being sold were monopolies.

What the market system doesn’t realize that the costs are dominated by the cost of providing capacity, not running costs and that the system needs to be run by a central organization that uses capacity contracts that give them control over what generators are running at any time and status of the generators that are not running at the time. (Generators can be at various stages of readiness.)

Thanks John, I didn’t know that. i do know that Qld’s fleet of generators is younger than those in the south.

Also in thinking about this, one of Queensland’s advantages is that they don’t have blood sucker retailers in the provincial areas, where Ergon is allowed to act as retailer, avoiding a 25 to 40 per cent markup.

In thinking about this, I’d be happy to leave generators as they are and Sims should stop obsessing about who owns them.

Retailers should be dispensed with. Let the distribution networks send out the bills.

Then the high-voltage utilities and distributors should be regulated to return 12-14% ‘return on equity’, which I think is around the market standard to incentivise free market entrepreneurs to get out of bed. Any more than that in government-owned entities should be fully disclosed as state taxation in a compact between the public and the state.

Hi John, Brian

Over here in Victoria the State Govt used to own all the (low value, soggy) brown coal; enough to run power stations for 500+ years. Only good for electricity.

Japanese firm tried coal-to-oil conversion plant in 90s, oil price still too low to justify large scale production.

Some use in agriculture for soil conditioning.

We used to export fuel “briquettes” made from it, a tiny market.

Hardly any higher value black coal hereabouts.

Did you really need a “cunning old bastard”? In those days it was just part of a Premier’s standard job, to bring Power to the People.

Times have changed I suppose.

Yep, maybe cunning, or a customer service mentality, is needed again.

There was more on the radio this morning with another interview with Sims. He’s have a session the arvo where he will listen to locals. I’m sure there will be 40 or 50 horror stories amongst a million or so users.

It’s no doubt necessary, but not a scientific way of coming to any conclusions about what is going on.

Ambi: WA, Qld and SA all got good deals in return for allowing mining companies to mine their precious resources. Steelworks, alumina plants, concentrators, cheap coal for power plants and pellet plants and, in the case of Qld outrageous charges for railing coal. Yes they were bastards but they got a good deal for their states.

Then we got Goss who started his reign by cutting rail charges to coal miners.

Now we have Malcolm and Anna publicly crawling to Adani and talking about subsidies on top of all the subsidies miners already get. Then we have the WA Nationals attacked for having the hide to want to increase the iron ore royalty from the current 25 cents per tonne and high gas prices because governments didn’t have the guts to insist that domestic markets should get gas at a lower price than overseas customers.

We even pay GST on the gas we consume domestically but no GST on the gas exported.

All the current pack of governments do is tell us they can’t afford to provide the services that could be paid for if we stopped subsidizing miners, got reasonable royalties and insisted that domestic customers got a better deal.