The Finkel review of the National Electricity Market is due to be revealed to the premiers at COAG tomorrow, but is you’ve been reading the Australian Financial Review it’s all done and dusted. There’s really only one horse in the race, and it’s the Low Emissions Target (LET), which Tony Wood of the Grattan Institute says is the third last horse in the race, but picked because it’s better than the other two. That may be harsh, but the visionary scheme was first proposed by John Howard in 2007. Here’s Howard and Costello launching the scheme way back then:

It’s the least-worst, least-best carbon pricing scheme, but has the attraction of giving coal a chance of sticking around for a while.

Business is swinging behind it, although they would prefer an Emissions Intensity Scheme (EIS). Barnaby Joyce thinks it’s OK:

- Barnaby Joyce – who opposed any carbon tax or an EIS – said he believed an LET was the way forward which could allow the development of next generation coal-fired power stations as well as renewable energy.

That was followed by some Barnaby blather which we don’t really need. Now we have:

Shorten has now written to Turnbull, saying Labor will consider a well-designed LET scheme.

The Greens are urging him to read it carefully before he signs up, and well they might, but in the end it probably matters little, for two reasons.

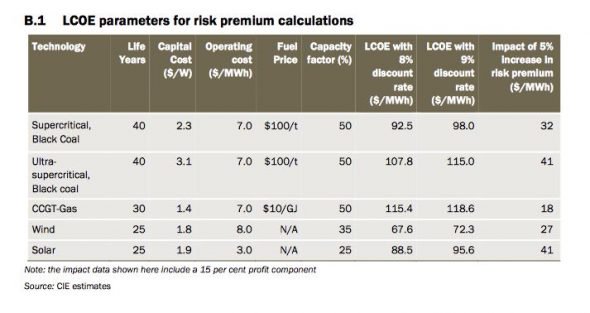

Firstly, renewables with batteries are coming in cheaper than coal and gas. Secondly, banks and financiers are worrying about stranded assets. A London-based team quantitative equity analysts at AXA Rosenberg did some research and found that global financial markets are already putting a hefty price on carbon, penalising companies around the world based on a cost of around $US30 ($40) per tonne of emissions.

Policy makers at all levels should also have read the page four AFR article published as ‘Virtual power stations’ leave coal in the dust. A joint report from the Climate Change Authority and the Australian Energy Markets Authority, no less, has found that the cheapest new energy could come from:

-

marshalling the rapidly growing network of “behind the meter” energy resources in people’s homes and businesses to manage prices and avoid blackouts through demand management and demand response.

“Behind-the-meter” energy includes batteries, solar panels, smart thermostats on energy hungry pool pumps and air conditioners, electric vehicle chargers and so on. Smart software aggregates them into a large energy source.

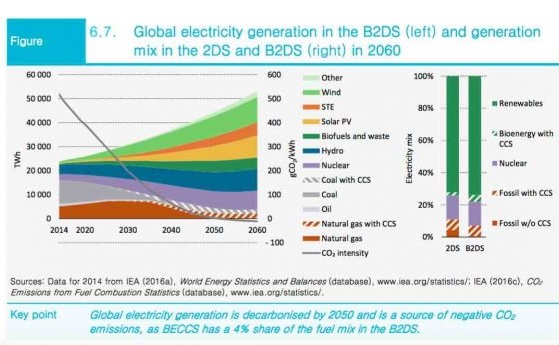

Also everyone should be aware that the IEA has found that if you want a 1.75°C target, coal generation must be gone by 2040. That is, there are only 14 years left of generation of unabated coal at current levels.

There won’t be much gas around either, at least not for burning.

Turnbull and company don’t seem to be looking beyond 2030. Power generation capitalists and financiers must take at least a 40-year view, and they must know that when the current political dinosaurs become extinct, targets will be powered.

So what is the LET?

In simple terms, it is like the RET, which it would replace after 2020, but allows low polluting gas and coal, as well as renewables, allowing the government to claim that it is technology-neutral. ‘Low’ in the latest scheme apparently means a threshold of 600 kgs of CO2 per MWh of power produced, about 25% down on the current Australiam market average, which is one of the highest in the world, and three times what John Howard was promising. There is even talk of 700 kgs of CO2 per MWh to allow supercritical coal to sneak in.

A critical difference seems to be that LET focusses on production carbon intensity, hence the “h”, whereas RET focusses on capacity.

However,the only way new coal will be built is if the taxpayers pay for it, for reasons given above. It’s too expensive, and financiers will worry about stranded assets.

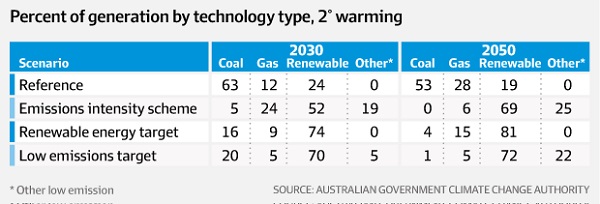

Ben Potter’s article has two figures. The first is the table which purports to show how the energy balance would work out:

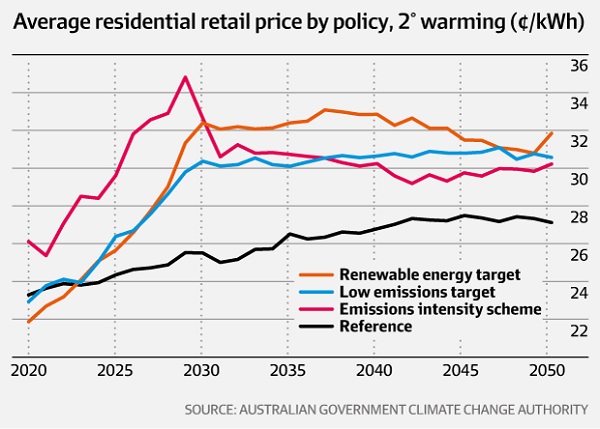

The second purports to show how the prices would work out:

I say “purports” because Giles Parkinson explains that it was all worked out on dodgy modelling to favour fossil fuels, and on reports that state the truth in the text but not in the conclusions.

- If realistic costs of renewables and gas had been used, then it is safe to assume that the results would have shown that a high renewables policy would deliver significantly more savings than a gas-focused policy.

The tragedy is that the AEMC and CCA have now released data that confirms that those modelling assumptions were completely out of whack, but they have done nothing about it.

The independent assessment from the Centre of International Economics confirms RenewEconomy‘s observations that their modelling for both the AEMC and the CCA report used renewable energy prices (way too high) and gas prices (way too low) that were well out of the ball park.

The table was there, in the last page of the addendum, with no commentary.

Parkinson says that the CSIRO even doctored a report to make gas look cheaper than solar and wind.

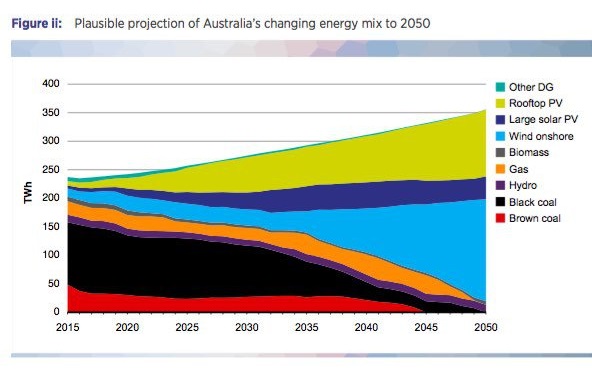

Forgotten seems to be the report last December from the CSIRO and Energy Networks Australia saying that wind and solar will provide nearly all our electricity needs by 2050, and save about $100 billion while doing so. This is how they saw the energy mix:

Parkinson seems to favour a high RET, which he said last December, could provide the cheapest option. Sitting in the dentist waiting room yesterday, I read in the Oz that Judith Sloan also favours a RET, but the word “high” seemed to go missing.

I’m betting that the government will favour a LET that applies only to new energy, thus leaving old coal unpenalised. A worry is that, obsessed with grid stability, they will seek to limit renewables to 45%, although the latest advice is that grid stability can be provided with new technology and batteries.

Nigel Morris reveals that hidden away in the latest CSIRO report was the estimation that in simple terms:

- using 90% renewable energy is cheaper than using 45% renewables. It also highlights (over and over again) that there are no reliability issues that can’t be readily overcome with either 45% or 90% renewables.

For every 1GW of or renewable capacity we need 2.6GW hours of battery storage. Morris asks the question whether we can provide the batteries needed, and finds, yes, we can.

Finkel will also have to come up with a better way of managing the grid, and an orderly way of phasing out coal-fired power. He will also tangle with the fraught issues of gas availability and price, which look like a wicked problem.

Finkel’s report may be pivotal to breaking the Gordian knot our electricity generation system has become.

Briefings yesterday from Finkel reveal several interesting proposals, including renewables have to come with storage. I think I heard batteries and pumped hydro. Presumably molten salt with large-scale solar would also pass muster.

This makes things a bit harder for renewables. Generally it is thought that up to 45% penetration is OK in relation to grid stability.

Also dirty coal plants have to give three years notice of closure. This may lead to compensation claims.

However, Finkel is trying to get away from the fixation with ‘baseload’ power, saying the concept should be power than can be delivered when it is needed.

Finkel is saying we can have reliable cleaner energy that is cheaper. Abbott is explicit in saying that any new energy regime should provide a future for coal.

Looks like some advancement in energy policy may yet come out of the maelstrom of the South Australian storm powered blackouts.

About time the PM declared a War On Glibness.

#Istandwithmalcolm

It is worth noting that it is not all that difficult to convert gas fired power stations to run on biofuels, other renewable fuels or oil. (The standby gas turbines ran on bunker oil.) This is particularly relevant for the power sources that will only be used for a few days a year when power consumption peaks.

(For this type of peak power what counts is capital cost and ease of fuel storage. Emissions are almost irrelevant considering the tiny % of time the generators would run.)

John, thats a good point, and not enough is said about alternative fuels which you have outlined in several posts.

I think standby power in Europe is put at about 3% of capacity, but given they are a much bigger system they probably have more internal stability through a mix of weather and generation sources, including nukes.

Brian: The BZE stationary energy plan had about 3% of time when back-up molten salt heating would be required.

One of the things to keep in mind is that there is a lot of excess capacity available at times in any system that is able to use peak power.

If this excess is coming from renewables it will come at zero cost. Markets for very cheap opportunity power are worth developing.