Peter Martin states it directly:

- Those sighs of relief are prayers of thanks for a budget that embraced reality: the reality that schools, healthcare, roads, railways, pensions, the National Disability Insurance Scheme and the other things that we want need to be paid for.

Except that almost nothing happens immediately except slugging the big banks. Spending, including infrastructure is weighted to the out-years, even beyond the normal four-year projections. Revenue improvement depends on heroic assumptions – $44 billion from income tax bracket creep from higher wages, when wages have actually been falling, more than 40% increase in company tax even though company tax cuts are assumed, an increase of 60% in capital gains tax receipts by 2021.

That’s from an AFR piece from John Daley and Danielle Wood, probably the best single article explaining the budget. I’ll explain more in a separate post, but Ross Gittins has done the sums and found Scott Morrison’s budget stimulatory, but only mildly so – about 0.7 per cent of GDP.

That includes $12.8 billion for the second Sydney airport and Melbourne to Brisbane inland freight railway, which ScoMo doesn’t include and Gittins does. Ironic, because that very amount is about 0.7 per cent of our $1,822 billion GDP. Hands up who thinks that anything significant will be spent on those two projects next financial year.

Jackie Trad, Deputy Premier in Qld and infrastructure supremo, has found some numbers (probably pay-walled, but Google her name and “This week Malcolm Turnbull proved what Queenslanders have known all along – he governs for Sydney, not for the country.”)

- For all his smooth talk and big ideas Malcolm Turnbull’s Budget delivers the lowest infrastructure spend in 10 years.

Analysis by Infrastructure Partnerships Australia showed that the Budget massively cuts infrastructure investment, with $7.4 billion slashed over the forward estimates and funding as a percentage of general government expenditure falling significantly from 1.55 per cent to just 1.19 per cent.

She says that of the $10 billion over-hyped national rail fund only $600 million is even included in the forward estimates, with no money to be allocated until 2019-20 at the earliest.

Laura Tingle explains what is going on and how it relates to the mechanics of good and bad debt.

Firstly, she states :

-

the 2017 budget includes a shift to a greater emphasis on the “net operating balance” – a move popularly referred to as dividing government debt into “good debt” (funding for capital works that will ultimately pay for themselves) and “bad debt” (funding for recurrent spending on government services like healthcare and education).

Governments have traditionally focused on:

-

the underlying cash balance, which indicates whether they are meeting their spending and physical capital investments from recurrent revenues.

The “underlying cash balance” will continue to be the primary fiscal aggregate reported in the budget papers.

- However, the budget now “provides increased prominence” to the net operating balance, which is “an accrual measure of revenue minus expenses including non-cash items such as the annual depreciation of existing capital stock”. It does not include “net new capital investment (such as spending on infrastructure)”.

I’m already confused, but we’ll soldier on.

Tingle says that there is a total of about total $50.6 billion on capital expenditure in the 2017-18 budget, or around 12% of total spending.

First, there is about $13.5 billion spent directly to acquire physical assets. Most of this is military equipment “but it also includes direct spending by Commonwealth government departments on acquiring infrastructure, buildings equipment and software”. This is a charge to underlying cash balance, but not the net operating balance.

Second, government provides grants to others, mainly the states, to buy their own capital assets. These grants are a charge to the underlying cash balance as well as the net operating balance. Here lies the Western Sydney Infrastructure Plan, which will spend around $14.2 billion in 2017-18 alone.

(I can see what Ms Trad means about governing for Sydney.)

Finally, there is direct government spending to acquire financial assets taking the form of loans or equity contributions to third parties, for example, NBN Co.

In 2017-18 this will amount to $22.9 billion and will include $8.4 billion for inland rail and up to $5.3 billion for Western Sydney Airport as direct equity investments in corporations to be set up for the purpose.

This category appears as a cash flow statement, but otherwise avoids the budget altogether.

So colour me confused when I hear statements on overall budget spending and the infrastructure component. The Government has been spruiking a $75 billion construction program over 10 years. Sounds a big number, but $7.5 billion per annum is 0.4 of one per cent of GDP and 1.6% of the budget. I suspect the $75 billion relates to the third category of capital expenditure above.

The Government is going to establish a new Infrastructure and Project Financing Agency (IPFA) unit to be set up in the Prime Minister’s Department, based on a UK model, to leverage the spend by partnering with private funding, taking an equity stake in investments.

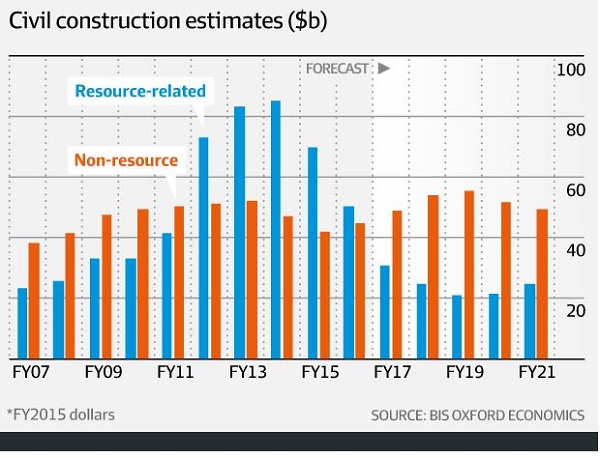

Jacob Greber in today’s AFR gives the following graph of forecast of civil construction forecasts against mining construction:

That comes from a BIS Oxford Economics report, which you can read if you pay $17,380. I gather it covers all civil construction, not just government.

I understand that while net debt will continue to grow as a proportion of GDP, it will diminish. I’m not going to look for the link, because the tale depends on those heroic assumptions being accurate, the chances of which must approach zero. Chris Bowen says these assumptions should come from the Parliamentary Budget Office rather than Treasury and Finance.

On ABC RN’s The Money program on The economics of immigration, Dr Jane O’Sullivan of QU took an interesting view of ‘good’ and ‘bad’ debt.

She said that infrastructure typically lasts 50 years. As a society we need it to operate, so in the terms specified it is ‘bad’ debt. Assuming it needs replacing, an ongoing operating cost will be a fiftieth each year, or 2 per cent of the capital value. If we increase the population we must expect that we increase the infrastructure by the same proportion in order to operate. Again it’s ‘bad’ debt.

Straying a bit here, she also challenged the notion that immigration was good to provide workers to pay for the aged. She said Japan is the most ageing country in the OECD. If you take the hours worked on average by the Japanese adult population it was the same as Australia. So they are getting as much work out of their aging population as we are out of our younger population.

By the way, Ms Trad says that Queensland submitted a 2000 page business case for our Cross River Rail project a year ago, which now has to be redone in the format required by the new Infrastructure and Project Financing Agency (IPFA) unit. No funding can become available until 2019-20 from that source at the earliest, although she says the project is “shovel-ready” and the city due to jam up by about 2021. By contrast, she says, Perth got $800 million for a Metronet rail project with no business case at all.

I think the large Western Sydney spend is to reward NSW for selling its electricity assets, whereas Qld won’t sell public assets because the people will kick out any government that does, on past performance. Strangely, with this budget feseral governments owning assets is seen as visionary and good.

The big change then is that the Federal Government is going to be active in intervening in the economy, with a direct stake in owning resources, and adopting accounting practices which separate out such ventures so they don’t seem like a burden on tax payers. However, politics is alive and well. The Government used pollsters to put together the budget priorities. This morning’s polls suggest the people like the budget initiatives, but not yet the Government. Turnbull’s pollsters must have missed the recent Galaxy poll that showed them losing 6 or 7 seats in Queensland.

To answer my own question, I think the division into good and bad debt is an honest attempt to get Australian people more comfortable with the idea of carrying some debt. In the corporate world if you don’t have 30 to 60% of your market worth in debt you are said to have ‘lazy’ balance sheet, and not interested in growth.

However, it makes what we are told about figures harder to understand and politics has not been eliminated. The whole thing is being beaten up to seem bit more exciting that it is.

The government has dropped in the polls after the budget even though there was approval for some of the key measures and Turnbull went ahead in the preferred prime minister stakes.

I think that it has struck Turnbull that, like Abbott, he is on track to be an “achieved nothing” prime minister. Just how far he will go to get something done is not clear at the moment.

John, I’m waiting to see how Essential breaks. Fairfax-Ipsos had the government improving from 45-55 to 37-53, where the earlier poll looked like an outlier.

It all looks a bit same, same. In the AFR Laura Tingle emphasised that Labor held its primary vote and according to them Shorten’s personal approval improved.

The Oz was very hard on Turnbull, saying his budget was blatantly political in an attempt to fix the polls and has failed. Dennis Shanahan, like Cory Bernadi, scolded the Liberals for ditching Liberal Party values (by raising taxes and big government, not repairing then deficit quickly enough).

Quite a few commentators were saying that there wouldn’t be an immediate lift for the LNP, but the budget gives them a platform from which they can improve their standing over time.

I also meant to say that it’s now 12 dud Newspolls in a row for Malcolm T.

Just heard Phil Coorey on RN Drive. He says if there is no improvement in the polls in a month’s time there will be Angst in the LNP ranks.

He also thinks that the people have simply turned off politics, after Brexit, Trump and all. Turnbull has a problem if he can’t get anyone to listen to him.

Well policy by Polls is never a long term winner for the citizens

From my roaming of the inter web, my take on the vibe is, Turncoat is playing to those that will never vote Lib.

Taking the the Party away from them.

A good many will vote for a Candidate that will fill that void, but not Peanut Head.

“Insiders” panel were very critical of Mr Shorten’s budget reply speech.

They thought he had had several wins, in Govt coming very close to Labor policies, and he should have said “thanks”.

Instead, he laboured to point out Govt shortcomings. They claimed he once supported a flat Medicare levy increase to fund NDIS and now argues against that.

I suppose very low taxable income persons pay no Medicare levy, then it phases in. He wants the extra levy to apply only at the top two marginal rate brackets. Previously he said it should be whacked onto every taxpayer who currently pays a Medicare levy.

Inconsistency like that starts to look like bloody-minded obstruction. Mr Abbott anyone? Turnbull goes Labour Lite, Shorten goes Abbott Lite.

Ambigulous, I’m struggling with some of this stuff in the next post, hope to finish tonight.

However, I think there is a danger in holding politicians to previous statements, as it discourages learning.

Who is to say that Bill S was not being political back then and is being rational now, which just happens to align with being political?

I think asking those who have to help those in need, or take the load off them, is not a bad principle.

I’d have an 80% tax on everyone earning more than $2 million, or would increase the tax on any boss who took home more than, say, 7 times the average worker. Or both.

Brian,

I’m assured they don’t pay anything with the current rate, what makes you think raising it will make a difference.

I wonder how crap our Australian Sports Teams will be after all the best Players migrate….

Same with Australian Companies….

Or our Postal Service…oh, wait…

Actually, why not 110% ?

They obviously stole that money, take it all + 10%.

Gotta discourage these ” types “

Jumpy, I have two modes of thinking. One is in principle in an ideal world (dreaming), the other is practically speaking in the real world, hopefully taking account of principle and values from the ideal world.

I was dreaming.

I seem to remember that once upon a time in India there was a wealth tax on the wealthy, irrespective of earnings. I think so, but maybe I was dreaming about that too.

I call that socialist thinking and Capitalist thinking.

I don’t think there can ever be an ideal World Brian, that it is impossible.

Too many have made it worse pursuing it, all as far as I can tell, socialists.

I’m ok with a little socialism parasitically riding the back of True Capitalism but if it gets too big it kills the host.

Not all tyrants and murderous dictators were self-proclaimed “socialists” Mr J.

Many were in power long before “socialism” in its 19th century guise was thought of and fought for.

For myself, I far prefer the Parliamentary road to a better world. You may say I’m a dreamer, and I might be the only one.

Too often, revolutions devour their idealist supporters; too often the slogan “revolution” has been used by power-hungry proto-despots, to attain power…… then the old (Czarist, French Revolution Terror, Hitlerian, Maoist, Pol Potist, …..) nightmare begins again:

secret police

wild denunciations

executions

propaganda

denunciations

death of free speech

idolatrous praise of Dear Leader

show trials

criticism, self-criticism

executions

policy by whim

rigged “elections”

and throw in a bit of military aggression

Homo Politico can be a long, long way from Sapiens.

I prefer the Parliamentary road. Not because of theory, but because of some horrors of the last few hundred years, in Europe, Eurasia, Asia, the Americas, and Africa.

Cry, the beloved planet!

Vote 1: freedom of speech, democracy.

That’s wrong about socialists, jumpy. They’ve only been around for about 150 years.

I’m not really an historian, but when I read about the history of Prussia, between Frederick William, the Great Elector, who took over in 1640, and when Frederick the Great died in 1786 there were four benevolent despots in a row, who made the place astonishingly better in almost every way.

Two of Fred’s reforms were compulsory primary schooling in 1762, over 100 years before it happened in England, and making legal qualifications compulsory for judges. I think it was Otto von Bismarck in the late 19th century who was first with the aged pension and he was no socialist.

There is progress – we don’t burn witches any more – but it is hard won and can’t be taken for granted. However, we do need to imagine how it could be better, hence the dreaming.

Yes, Ambi, in the end the parliamentary road is best. The benevolent despots of Prussia I mentioned were exceptional, and there have been others elsewhere, but more often they are sociopathic tyrants.

I didn’t realise our only options were socialism and capitalism.

Is there no other alternative?

Good item Brian. I’ve been in Melbourne for a trade show, so haven’t been able to participate here. The NMW and Austech combined machinery shows had faint crowds as Australian manufacturing progressively shuts down with announcements such as

“INDUSTRY ANNOUNCEMENT

LOCAL BRONZE PRODUCTION TO CEASE IN JUNE 2017

Flocast Australia have announced to Interlloy that due to increasing costs within the Australian market place they have made the regrettable decision to close their business completely in June this year.

This announcement means that local Australian manufacturing of Continuous and Centrifugally Cast Bronze will end at this time.”

They say costs, and that is true for the value of the real estate that businesses must occupy, ie the land value has become too great to be used for production plant, but that aside real the issue is drooping demand.

The big infrastructure con is the failure to develop the regions for anything other than rural production. The above production shutdown is testament to that. There are no viable alternative small cities to relocate to where costs are lower and people are available.

Our governments are convinced that blowing billions of dollars on temporary fix road widenings are cheaper than opening new areas with affordable real estate.

Labour are just as bad as the Liberals on this. While enjoying the trams in Melbourne I thought to see which bunch of blithering idiots removed the trams from Sydney. Guess! Yes it was labour.

zoot, for Cornelius Castoriadis the choice was between socialism and barbarism.

BilB, I recently read an article which pointed out the the US had a range of cheaper cities to which people could relocate. The one I remember was Minneapolis.

I’m not sure our second range cities offer a suitable environment – Newcastle, Geelong etc. Maybe Adelaide.

Brian, thanks for the link; that’s another movement I hadn’t previously heard of. And it shouldn’t be a surprise that I agree unconstrained capitalism is indeed barbarism.

Think yourself luck you don’t live ( if you could call that living ) in that barbaric hellhole Singapore !!

With their GST of 7%, corporate rate of 17% or less, top income rate of 22% and even no CGT for pity’s sake !

Let us pray for them….

What is wrong with you Jumpy? You are saying that somehow the cost of government and infrastructure for a country with 100 square meters per person (and earns more from Australian iron ore than Australia does) should be the same as a country with 32 hectares per person (to manage and maintain)?

http://www.afr.com/business/legal/how-bhp-and-rio-tinto-channelled-billions-through-singapore-20150405-1mezkc

I think it is time to keep a tally of these cheap, and false, pot shots of yours.

Well, it was meant to be humorous but ask yourself why they do that.

Can lower tax rates raise more revenue ?

The m2 argument is a furphy, the majority of our land mass is basically uninhabited.

What’s wrong with you Bilb ?

Jumpy seems to be implying that capitalism in Singapore is unconstrained.

Reading what is written often helps reduce confusion.

This ” the rich can pay for it all ” is nonsense.

What are Our Fed debt repayments, $16Bil ?

If we confiscated the entire wealth of Our top 50 it won’t pay 5 years of it.

Just the stinking interest, the capital amount enbiggens with every deficit.

Me:

Jumpy:

Me:

Jumpy:

What did I misread?

Jumpy @ 7:29 PM:

Hate to break it you Mr J, but “soak the rich” applies to more than the top 50.

Area per person is certainly relevant to costs of infrastructure. I remember the magnificent underground railway MRT (?) from mid-90s in Singapura. That were looxury!!

But they had guaranteed high useage, especially as there was an expensive “central area” permit zone for private cars, probably a high annual fee.

And even to own a private car, you had to buy a TEN year permit, at AUCTION – permit could cost as much as the vehicle, in those days. No wonder Singaporean Uni students in Australia were keen to buy a car while here: likely to be their only chance to tool around.

Does that sound like a capitalist paradise?

Not to me.

But to reduce congestion and vehicle pollution: a reasonable, workable policy.

Mr J

‘enbiggens’ – is that derived from The Donald’s ‘bigly’ ??

An Etymologist

Pedants’ Anon

Director, VIII Point Programme.

Zoot

Ok, I did the work finding the next 5 years of paying just the interest as it stands.

As they look at 10 year outlooks now, you find out how many to pay the second 5 years.

Everybody is invited to guess at zoots findings, I bid 950.

I’ll keep tabs on the bids till zoot reveals the answer.

So what are my bids ?

Mr A.

No, it’s from the Simpsons and a perfectly cromulent word!

Jumpy, if you want to start quoting tax rates in the socialist paradise of Singapore, don’t forget their social security tax at 37%.

I believe it goes into their sovereign wealth fund, which buys up our infrastructure and other stuff.

BilB the article I was thinking of was this one that John D sent me the link for.

It talks about the spill-over to second tier cities, and towards the end some innovative housing models for the tier one cities. That won’t help the price of real estate for industry, however.

zoot, I’d never heard of it before, but an alternative way is called ‘distributism’. Race Matthews has written a book Of Labour and Liberty. He told Andrew West that the socialist objective of the Labor Party – socialising the means of production – was meant to end in workers owning businesses.

I believe it happened in Argentina when the currency went bust, and they got on pretty well for a while. Then when financial order was restored capitalists wanted to take the show over again.

Distributism is said to have deep origins in Catholicism.

What on earth are you babbling about?

Interesting, Brian

Co-ops were popular in former decades. When we moved to the Latrobe Valley in early 80s (that’s 1980s Mr J, not 1880s) there was an active Co-op in Morwell, and the Yinnar Pub had been bought by a community co-op, and was thriving.

In the 1970s there were many small “building societies” operating in Victoria, co-ops specifically taking deposits and giving loans for housing. Also small medical insurance outfits called “friendly societies”, e.g. Druids. (I know, it’s starting to sound like a medieval phantasy).

Then there were worker-owned enterprises, Fletcher Jones clothing manufacturer perhaps the best known here. Dairy farmers still have co-op processing I think.

R.J.Hawke’s ACTU operated a retail department store in Melb in early 70s, discounts for union members, partly as a tactic to have “resale price maintenance” abolished; to the advancement of retail competition.

These days, union superannuation funds have extensive investments. Not quite direct worker ownership, but indirectly some ownership. As “shareholders”. And the joint stock company, sneered at y Karl M, is a powerful engine that can harness the small savings of multiple persons, workers or capitalists alike, to achieve large and expensive projects.

Much food for thought. Thanks.

Ambi, Mark once told me that in the 19th century the notion of creating a stockholding company for particular public projects was common, where after completion the company was dissolved. The model was taken over by private corporations as a means of accessing funds.

On industrial democracy, there was a lot of talk about it in the 1970s. Worker representation is common in Europe and was promised by Theresa May.

Yes, and at the leftmost (“revolutionary”) part of the spectrum, not industrial “democracy”, rather worker control.

Stage a sit-in, lock the bosses out, take over the enterprise and run it under a workers’ soviet.

A version from the UK wasn’t seizure, at Lucas Aerospace, but worker directed conversion from military production to consumer and medical goods, I think. The ‘Science Show’ on ABC Radio National covered it a few times.

I prefer the “worker representation” method, as long as the Union doesn’t monopolise the delegates.

Co-Ops are a wonderful thing, honestly.

The Workers are the Bosses and the Bosses are the Workers.

Risk and reward shared as Bosses and Workers.

As a person that has been both, I respect both.

Unfortunately the most militant haven’t spent time in the others shoes.

Envy though ignorance is not a good thing.

Getting back to Tax, I see the Bloke I send my money to has made good use of it.

Should I stop doing that till this is sorted out ?

What does your moral code say?

Well I’m conflicted, so many many mixed views.

Surender my money coz it’s the Law and they spend it well, ignore Laws that I regard as unfair because they don’t…

I hope this arsehole ( alleged ) has contaminated every ATO audit for the last 30 years he’s been there, we all get a refund ( if applicable ) and ride that magic wave of stimulus for Businesses.

What’s your advice if you were in my shoes ?

If you knew my history there is no way you would ask my advice and I can’t imagine any circumstance when I’ll be in your shoes,.

For me the government is an expression of our collective will as determined by elections. Judging by your contributions to this blog over the years, you seem to view the government as the enemy and taxation as theft. (Feel free to correct me if I have misunderstood your position)

What, neither a Worker nor a Boss ?

From what perspective do you base your experienced opinion on?

( again, what I write is what I think. ” Seems ” is what One spices it with )

Dichotomous Thinking Alert…..

“neither a Worker nor a Boss”

There is far, far more in the world than is dreamt of in your philosophy.

Different decades, different social roles. Different days of the week, different social roles. Different years, varying attitudes.

“I am various, I contain multitudes” – Walt Whitman (approx).

You’re welcome!

And the comment to which I responded to made no mention of worker or boss, only an individual contemplating approaches to paying tax.

Why would anyone not a worker or boss have any ” approach ” regarding the ATO ?

Ummmm unearned income from bank deposit or investments?

Happy to help.

Oh investor, my bad, he must be that then.

Self employed ?

Writer?

Sculptor?

Independent scholar?

Philanthropist?

Inheritor of savings that earn interest in banks?

cheerio

According to the latest figures the top ten could pay it for 5 years and still have $2 billion each to live on.

Paywalled.

Oops – it’s actually the top 20 who are worth 100.7 billion according to the 2017 Financial Review Rich List.

My bad.

So I should have written “the top twenty could pay it for 5 years and still have $1 billion each to live on.”

And then what, that’s just the interest ?

Doesn’t look sustainable.

Socialist Economics never has, is, or will be.

Jumpy, you’re the one who suggested we should use the total worth of the wealthiest Australians as a measure. (Is Madame Defarge one of your ancestors?)

Most of us wouldn’t be quite so draconian, preferring instead to look at their income.

I don’t know that you speak for most of us.

But in any event, I would have thought you would prefer to disincentives consumption rather than investment and innovation ( which the rich finance the most of )

Most of the Australian population disagrees with Madame Defarge. Look ‘er up, M’sieur J.

She eez quite a woman. Old Charlie Dickens knew ‘er, in ze days of ze street parties in old Paree, when ze innovators and investment bankers and noblepersons were for ze chop chop chop wiz zat wonderful innovation, Madame Guillotine.

Monsieur Le zoot, on zis ‘e speak for me. I don’t like confiscatory taxes. I abhor the guillotine.

In fact, I like a leetle bit of zis with a leetle bit of zat: consumption tax (GST); a wealth tax (e.g. land tax or luxury car tax, or holiday house tax (at a modest rate); death duties (at a modest rate); income taxes; resource removal taxes (mining royalties etc.). If you add to that a stupidity tax on gambling turnover, then very few can EVADE the whole blinking lot.

Oh, she’s fictional character, can’t say I know how that helps.

Is it moral for a Government to discriminate on the basis of an individuals income ?

According to the current lot, yes!

Drug tests for poor people but not for wealthy parliamentarians (who I believe have a mutual obligation to at least be sober when they’re spending my money).

I think J’s ‘socialist’ and ‘socialism’ is also a fictional bogey person for anyone or anything on the left of him.

Who these days claims to be a socialist? Most on the left want to be called social democrats rather than democratic socialists apart from the Democratic People’s Republic of Korea.

Hmmm

DPRK?

not Democratic

not belonging to the People

not a recognisable Republic

but, yes, located in Korea.

One out of four.

The title is “25% free of lies”.

Oh, she’s fictional character, can’t say I know how that helps.

was a response to zoot’s:

“Jumpy, you’re the one who suggested we should use the total worth of the wealthiest Australians as a measure. (Is Madame Defarge one of your ancestors?)

Might I suggest that the reference to Madame Defarge might better be read as a witty aside? Much like the repartee I heard recently when Nigel, down at the Club, said of Claude (always a bit of a Pink) who had praised that chappie Corbyn for his new tax policy [and I quote],

“I see that Claude rather takes a Defargean view of distributive justice!!!”

Guffaws and squeals of delight all round. Nigel is such a wag! And really, we’re all rather fond of Claude……

But Claude would never want us chaps guillotined as far as I can tell. No: he says, “Keep paying tax, you blighters; don’t go bankrupt! That would be like killing the geese that lay golden eggs.”

Brian,

I made the mistake of following your DPRK link.

On the middle right of the webpage was a link (in red) titled

* Demise of the Great Leader KIM JONG IL*

…. either the web persons don’t understand what “demise” means, or an impish hacker has been at work……

No Mr A, I flitted it off as irrelevant zootism then you resurrected it.

I looked into after that.

Aaand it’s still irrelevant.

Yet still the question of the morality in discriminating on the basis of income is EVADED.

Ambi, I only looked at that DPRK site for a few seconds to verify that they claimed to be socialists.

Wikipedia suggests the whole thing is basically a personality cult, which is probably right.

Venezuala claims to be a Bolivarian republic, Bolivia says it’s a Plurinational State, which brings us to Cuba as “one of the few remaining Marxist–Leninist socialist states”, the other candidates being China, Laos and Vietnam.

Dealing China in makes a big difference, because one can now say with confidence that on the average people living under socialism have made giant strides economically in recent years.

Brian

My mistake. Kim Jong Il has indeed suffered a demise. He is not the current leader. I should pay closer attention to the different names of the Socialist Royal Family, the marvellous Dynasty ruling the fabled paradise.

Long Live Feudalism.

(There was no typo on the website, but multiple untruths.)

Ambi, it was still a fairly amazing site from what we think of as a backward state.

I think it’s a fair bet that they were behind the recent mass ransom-hacking, in part because the hackers were not actually well set up to receive the bribe money, it not being a natural skill for them.

New Saturday salon should be up by around the middle of the day.

I seem to recall that under the Bolsheviks the average Russian was economically better off than they had been under totalitarian rule of the Czar.

zoot, I believe that is correct, and Kenneth Galbraith said when the Great Depression hit many people thought capitalism was broken, which had many people looking seriously at communism, and arguably opened the way for Fascism.

Interesting..

http://www.bolshevik.org/1917/no30/no30-Venezuela.html

Can you please explain why an article in 2008, written from a Trotskyite perspective, is of use to us, and of interest to you Mr J?

I have been wondering recently whether your insistence that everyone is either a worker or a boss, indicates that you have adopted a Manichean, dualistic, vulgar Marxist view reminiscent of the Australian Communist Party circa 1950?

Enough of your Commo crudity!!

Being both at the same time, as I have and may be again, would make that a position I could not hold.

And do not hold Mr A.

I wonder how many ” experts ” in Employer motives have actually been one, very few is my guess.

In fact most don’t know what a ” Boss ” is.

I’m not sure what the Jumpster’s link has to do with previous discussion in this thread.

Is it significant that he finds “interesting” a Trot critique of South American socialism as not “real” socialism? (He does appear to have an obsession with Venezuela).

Is he transmogrifying into a leftist by associating with non-bosses?

Only time will tell. Tune in for the next exciting episode.

Call it a learning experience for me zoot.

You gave some endorsement to Bolshevik economics so I thought I’d have a look.

It’s from HERE.

Haven’t looked for Trots yet.

Interesting you won’t engage in the boss/worker thing.

Err, no I didn’t. I pointed out that under the Bolsheviks the Russians were generally less worse off than they had been under the Czar. That is a statement of fact, not an endorsement. (For example, if I state the sky is blue I am not endorsing the sky or the colour blue.)

So

.

Changed to

Telling…..

In your universe maybe, but out here in the real world, not so much

Haha, you speak for the ” real world ” now.

I’ll let the objective judgement of the fair minded judge for themselves on that.

Anyway, zoot, could you pay more tax than you do now ?

Read the article you linked to, Comrade J.

zoot and I think it was written from a Trotskyite perspective.

What do you think?

Cheerio

Citizen A