Ross Gittins says we have fake government rather than fake news, but it does appear that the political debate about company tax cuts has been inadequate and misleading, to say the least. In this post I take a look at what decent thinkers like Gittins, Craig Emerson, Ross Garnaut and others have had to say about the corporate tax cuts.

Ross Gittins in Company tax cut has a not-so-dirty little secret points out that the Australian taxation system has a feature different to other countries in the dividend imputation system – introduced by Paul Keating to ensure that shareholders did not pay company tax twice, once as a part-owner of a company, and again as a private citizen.

To explain, company tax is paid by the company at 30 cents in the dollar (now 25 for smaller companies). When dividends are paid the shareholder also gets a tax credit, known as a ‘franking’ credit, equivalent to the company tax paid. The dividend paid is added to the shareholder’s private income. The franking credit is then added to the income line to determine taxable income, but then is taken off again from the tax owing as a tax deduction.

Hope all that is clear.

Gittins point is that the company tax is really a withholding tax, and the real tax is what the shareholders pay as private citizens. So if companies pay less tax and pay higher dividends as a result then shareholders will pay more tax. The real benefit is to foreign shareholders who don’t participate in the dividend imputation system.

Peter Martin reports on work done by The Australia Institute which looks at the combined effect of company taxes and individual taxation rates to derive an implied total tax rate. In those terms Australia is 14th highest in the OECD, rather than equal 5th as it is on company tax alone, ending up just above countries like Great Britain. That makes us effectively a mid-range company tax nation.

TAI also found that 97% of foreign investment applications, and 71% by value, came from countries with lower taxation rates. Foreign investment into Australia is dominated by 13 countries, nine of which have lower taxation rates.

Peter Martin also reports on the Grattan Institute’s study, which finds that national income would fall as a result of the tax cuts, and it might take 10 years for the cuts to show any benefit.

- The Grattan Institute report, Stagnation nation? Australian investment in a low-growth world finds that a cheaper and more effective measure would be an investment allowance that permitted companies to immediately write-off a portion of their investment before depreciating the rest over time.

Grattan also finds that Australia is experiencing its biggest ever five-year fall in mining investment, as a proportion of GDP, and:

- non-mining business investment has fallen from 12 per cent to 9 per cent of GDP, lower than at any point in the past 50 years.

On this, Ross Gittins points out that we really do have a two-speed economy. Non-mining investment has been falling in the mining states but:

- In NSW, non-mining investment has grown at an average rate of 8 per cent a year for the past three years. In Victoria, it’s been 4 per cent.

Craig Emerson reports on modelling that indicates “jobs and growth” may not appear until the 2030s. He favours an investment allowance wherein:

- companies would be able to claim an extra, upfront deduction of, say, 20 per cent on new capital expenditure on top of the prevailing depreciation allowances.

This would have immediate effect, he says, and target genuine investment.

I couldn’t find Ross Garnaut’s opinion piece in the AFR, apparently based on an address to the Melbourne Economic Forum. There is a very incomplete report in the SMH, and a better one in the AFR by Ben Potter, probably pay-walled.

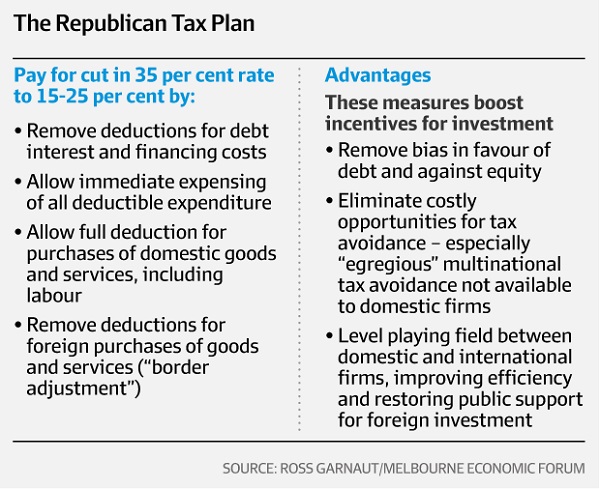

Garnaut says we might consider proposals being thought about by Congressional Republicans in the US.

He says it is not so important as to what the headline rate is, more how company tax relates to personal tax (he echoes thoughts about dividend imputation above), and what the tax base is within companies. By the latter he is referring to what is taxed and what is tax deductible in a company’s operations. The main change proposed is that interest on debt should not be deductible. However, payments for goods and services within the country should. The purchase of local goods and services, including labour, should be fully deductible. Investment expenses should be fully deductible up front.

In doing so, in one fell swoop the caper of multinationals of purchasing services from offshore entities they own in tax havens would be disrupted, and the local economy would be stimulated. It would also favour equity as a source of funding as opposed to debt, apparently a good thing.

Here’s a table summarising the Republican proposals:

What this all adds up to is that there should have been a more sophisticated discussion about the options in the first place. We had the opportunity with the Henry tax review, but we fluffed it. All Turnbull the PM with business smarts did was to float thought bubbles about the GST and state taxes, which popped within days.

Ken Henry had plenty of ideas about how the current arrangements could be changed to make our economy more dynamic and productive. However, he says:

- the worst thing anyone with a bright policy idea could do would be to give it to a politician.

“It will be dead within 24 hours.”

Ken Henry sounds upset.

Perhaps it would help if we asked some questions such as:

What would happen if we eliminated company tax altogether? AND replaced by:

Taxing all dividends at the top personal tax rate (with franking?) no matter where the dividends were going to?

Raised the GST enough to compensate including getting rid of all the special exceptions including the exception on exports? (Keep in mind that company tax and the GST are equally regressive and many exporters are avoiding Australian taxes like it is going out of fashion.)

Imposed some other simpler tax such as transaction taxes?

Increased some other existing tax?

Keep in mind that we need an increase in taxation if governments are going to start doing their jobs properly again.

John, I think Ken Henry had an idea about taxing turnover, or something suggested to him by a bloke in the pub, when he was working during his holidays on saving the northern hairy-nosed wombat.

Whatever it was it was simpler and would have put a lot of accountants out of work.

Most of the countries that have low company tax have a much higher GST.

Brian: I have made a new post on getting rid of company taxes altogether.