The release of the Grattan Institute report Hot property: negative gearing and capital gains tax has raised the temperature of the scare campaign for a day or so on Labor’s Positive plan to help affordable housing, aka negative gearing.

The release of the Grattan Institute report Hot property: negative gearing and capital gains tax has raised the temperature of the scare campaign for a day or so on Labor’s Positive plan to help affordable housing, aka negative gearing.

Turnbull says Labor’s policy will drive down house prices:

- “What Labor is proposing is a huge reckless shock to the market. This is not fine-tuning. This is a big sledgehammer they are taking to the property market,” Mr Turnbull said.

Grattan found otherwise. They found that the effect on house prices would be about 2%, in the context of a market that has been rising by about 7% each year.

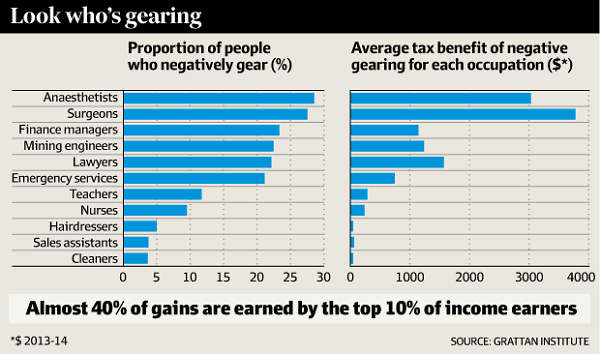

Turnbull says that it’s the average mums and dads who are doing most of the negative gearing. Peter Martin has an excellent summary of the Grattan report. He says they found that the top 10 per cent of earners collect almost half the negative gearing tax deductions and three-quarters of the concessionally taxed capital gains.

The AFR has this chart, sourced from Grattan, that shows who is really tucking into the pie:

Grattan found that the two policies that benefit the rich, negative gearing on income and capital gains tax concessions on housing investment, cost the budget $11.7 billion per year. Labor has proposed limiting new investments to newly built homes and reducing the capital gains tax concession from 50% to 25%. Grattan wants to go all the way over time, including the removal of concessions applying to existing homes. Grattan says:

Australia is almost alone, along with New Zealand, in allowing rental losses to be deducted from ordinary wage income. The United States only allows deductions against other investment income, while Britain only allows deductions against capital gains from other rental properties.

In a second article Peter Martin points out that since the late 1990s when Howard halved capital gains tax and thereby made negative gearing more attractive:

-

Within two years, prices jumped from less than three times household disposable income to four times disposable income. The new negative gearers faced no problem finding renters; the owner occupiers who missed out were forced to rent from them. It’s as if, to use the words of Coalition backbencher John Alexander, we are turning into a nation of landlords and serfs.

Alexander chaired a government-dominated parliamentary inquiry into home ownership, which for some reason has yet to publish its report, even though the initial deadline has long passed.

The Grattan Institute’s new contribution to the debate is the finding that negative gearing not only forces would-be owners to rent but also limits their security of tenure. Negative gearers buy and sell houses much more often than investors who aren’t driven by tax.

Once, Turnbull himself labelled negative gearing “tax avoidance”. He co-wrote a paper that said it skewed “national investment away from wealth-creating pursuits, towards housing”. Only Labor, the Grattan Institute, the Murray financial system review and the Reserve Bank would say such things now.

Turnbull took to his blog to rebut the Grattan report. Here John Daley responds.

Ross Gittins says we need an independent umpire to sort the issue out, and luckily we got it in the Grattan report. See his article Umpire calls time on negative gearing and voters should listen.

See also earlier articles:

-

Macro Business: Dodgy Turnbull drowning in negative gearing lies

Greg Jericho: Don’t underestimate Labor’s property tax plans

And on the shonky BIS Shrapnel report, still being quoted by some politicians and industry representatives:

-

Ross Gittins: Time to take a stand against misleading modelling

Peter Martin: Negative gearing. Confused by the economic modelling? That’s the whole idea

John Daley: Why the ALP was right to ignore bad modelling on negative gearing

Waiting for the dentist back in early March I read in the Oz (paywalled) “government sources said cabinet had resolved to attack Labor’s tax policies every day until the election”. Negative gearing is certainly going to get a lot of attention in this project.

Tim Dunlop thinks this election will be about class warfare and fairness. He could be right.

Finally, Turnbull erroneously asserted that Labor’s negative gearing policy applied to business ventures. It does apply to share investment, which I think is unfortunate. As citizens we should be encouraged to invest in productive enterprises rather than dead assets.

Yes, I do have an interest, but I think the argument stands.

Shame on Labour!! I think anastheticist really need to be protected from this insidious tax rookery!

Jumpy might want to correct me but my understanding is that if I set up the John D company I could combine consulting and house rental in this company. In this case the combined costs and income for both these activities would be used to calculate taxable income even if the house rental was running at a loss due to the size of of the interest payments on the rental property. I may be missing something but I am assuming that this will not change under Labor’s even if I buy a second hand house using a loan after the changes.

However, if I am an employee who is buying a rental property with all the cash flows remaining the same all of a sudden i will be paying more tax. Even worse some of the consulting expenses I could claim as in the first case cannot be claimed by me as an employee. (I had to pay extra tax at one stage during the past because the tax dept ruled that I was not a real contractor.)

It would be nice, before making decisions re negative gearing to look at the differences between how people are taxed who work for their own company that also owns rental properties vs people whose main source of income is working for someone else.

It might also be worth looking at how the tax rules work for houses that the owners live in and houses that are rented. (For example, costs that can be claimed as tax deductions on a rental property. On the other hand no capital gains tax is paid when owners sell their normal place of residence.

John I’m not an accountant, but you’re probably right.

John D Consulting would have to pay tax on all income, whereas an employee or a sole trader would have access to the tax-free threshold.

John D Consulting cannot simply be handed a property, it has to buy it and that requires the full conveyancing process including paying stamp duty. Not as simple as it sounds. Then there are all of the other complications such as paying fringe benefit tax if John D uses his company’s property personally. There a whole lot of factors, not all bad, but require serious consideration.

As to this policy forcing property values down, I call BS on that.

If 40% of NG properties are held by 10% of the property owning community then the other 60% are shared amongst 90% of property holders which means that 7% of 90% use NG in their property holdings. And not every one of the 10% will necessarily use NG at all as only 50% of loans are negatively geared therefore it is only 3.5% of the broader property buying public who are involved. So, as it is 96.5% of the broader public who buy property do not include NG in their purchase price decisions, I think that a change to NG rules in a steady property market will only have a marginal effect.

NB: Back of the envelop evaluation requires checking.

If what I have said above is true and Turnbull after reading the Grattan figures still publicly claims that Labours’s policy will force prices down, then is Turnbull skating on thin insider trading ice considering his position of influence particularly if he or any of his friends and associates (very large group the LNP) buy or sell property during this election campaign?

Seems to me negative gearing is simply Truffle’s Whyalla; he’s emulating Abbott.

BilB, as of March last year Malcolm owned seven houses, but lots of them on all sides are into it.

Average 2.4, total 541 worth $350 million.

There is nothing wrong with owning property, Brian, but if one uses ones government position and influence for personal gain then that rapidly becomes something else.

But how to get around this BilB?

If one is a man of some not inconsiderable means, the only way out is to have all assets put into a blind trust for the duration, apparently mandated for the POTUS, but not popular here.

Cayman, hey man, quelle probleme?

BilB, I’m not suggesting that there is anything wrong with owning property. But with negative gearing it seems that they have skin in the game.

331 owned by LNP members, 162 by Labor, 16 by Greens and 13 by independents.

Video explaining negaqtive gearing.

What I am saying Brian is that for someone with the business expertise and acumen of Malcolm Turnbull to take a prominent and seemingly contradictory position on an issue that might cause people to buy property in expectation of a new market reality it could, depending upon the outcome, ultimately be seen as an attempt to manipulate the property market.

The LNP, for the time being, get away with blatantly false statements on Global Warming and the environment for political and ideological purposes, but utilising the same tactics where markets are concerned could lead to very rapid and unanticipated consequences. If Turnbull’s statements lead to a small run on the property market driving prices up sharply while he or his close associates (the LNP) sold property that could be interpreted as there being an intention to profit from specific knowledge not available to the market.

I couldn’t get past the first sentence of the Gratton thing,

Let’s get a few things straight the even a Non-leading public policy thinker like me knows.

A ” save ” is spending side reduction not tax tax increase.

Removing the NG discount of 50% raises the tax liability to 100% = tax increase.

Whatever ones view ( I’ve no skin in this game ), at least we should be skeptical of ” think tanks ” that can’t/won’t get the basic terminology right. It’s either accidentally or intentionally misleading from the get go.

I gave it another shot, only to come to this guff,

So this dill has never heard of the ” tax free threshold ” and who it benefits most ?

Enough, no more..

I thought the ALP proposal was to change the capital gains tax discount from 50% to 25%.

Instead of paying income tax on 50% of the gain, pay income tax on 75% of the gain. That’s still a concession. Still benefits only those who have a gain.

And you can see where the PM gets his “50% increase!!!” from.

An increase from 50 to 75 is an increase of 25, which is half of 50.

Persevere, Jumpy: Grattan report said “like most tax concessions”, not “like ALL tax concessions”.

I applaud the (income) tax-free threshold; I’m sure you do too,

Jumpy. It’s fairer than the GST.

Geez Ambigulous, can you not see tax concessions benefit lower incomers most ? That’s the main feature of ” progressive ( sic) ” taxation.

I do however apologise for not knowing the tax increase is only 50% of current legitimate personal investment savings and not 100%., if that is in fact the ALP policy.

Yours sincerely,

Net Tax Payer,

Jumpy.

BilB, you are right, Turnbull could easily move the market.

Jumpy, maaaaate

Income tax rates (brackets, percentage taken etc.) I take as the basic framework.

The rates are ‘progressive’. I take that as a basis. Then what constitutes “taxable income”… all sorts of rules on that and how to calculate, e.g. “averaging” for primary producers.

Then adjustments to make the system FAIRER, by accounting for individual circumstances, e.g. can spouses share their income; are they really joint operators of the family business? Then deductions for some expenses, not all.

Then concessions for some activities, etc.

I DON’T regard the income tax scales themselves as involving ‘concessions’.

I do think the current system could be improved.

Do you prefer “flat tax” on incomes Jumpperson? Or “poll tax”? or “zero tax”?

Signed,

Puzzled taxpayer

I’m glad you asked nonsensically named one.

Obviously a Poll tax is the the fairest as no citizen is any more obligated than any other to pay for services of Government.

But I’ll settle for an unfair Flat Tax out of generosity, and even a philanthropic Tax Free Threshold.

All I ask in return is a Net Taxpayer Day for beneficiaries of above mentioned generosity to show thanks and appreciation for the shit they got but didn’t earn.

Thanks for the opportunity to educate,

Unpuzzled Taxpayer,

Jumpy.

Jumpy: I actually like the idea of replacing income taxes with a flat tax combined with a flat payment. Apart from complexity the current income system is unfair in the sense that the tax paid by a family with an average income of say $50,000 per year over 5 years varies substantially depending on how evenly the earnings are spread over the years and between husband and wife. (Spreading the income more evenly is the basis of many tax reduction schemes.)

If we get the settings right we may be able to:

Avoid the unfairness mentioned above.

Avoid making the rich better off.

Kill most tax avoidance schemes.

Reduce the cost of running the tax system.

Avoid the need for much of the welfare system.

Make it financially more attractive for the unemployed and pensioners to get work.

Tax accountants and lawyers will hate it.

The system would work better if trusts and companies all paid the flat tax.