1. March scorcher

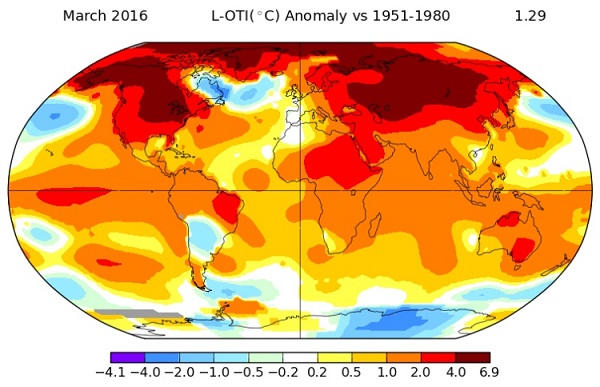

March temperatures were the hottest March ever and second largest monthly anomaly. Here’s NASA via Open Mind:

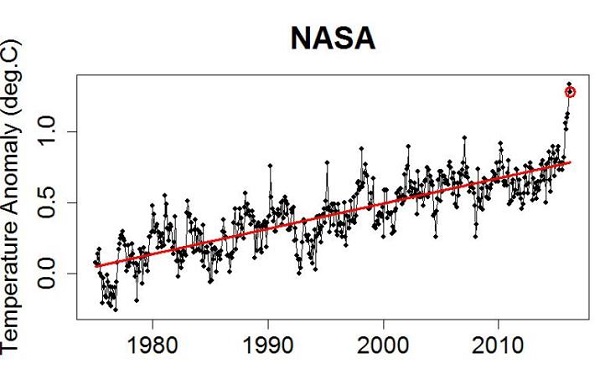

Here’s where it sits in relation to the trend from the early 1970s:

The Japan Meteorological Agency (JMA) actually has march hotter than February, and hence the hottest month ever.

2. US coal miners going broke

They are melting away before our eyes. At Climate Progress:

- Peabody Energy, the world’s largest privately-owned coal company, announced Wednesday that it has filed for Chapter 11 bankruptcy.

- The company attributed its financial woes to “a dramatic drop in the price of metallurgical coal, weakness in the Chinese economy, overproduction of domestic shale gas and ongoing regulatory challenges.”

The Australian operations are not included, but are also stressed by debt.

That was on 13 April. This article from 21 January said:

- Patriot Coal Corp., Walter Energy Inc. and Alpha Natural Resources Inc. have all filed for bankruptcy in the past year. Now that Arch Coal Inc., the second largest coal miner in the U.S., has joined their ranks, investors are wondering if the biggest, Peabody Energy Corp., could be next.

It was.

This graph from the article shows that the market capitalisation of American coal miners had decreased by 94% since its peak in 2011:

Elsewhere Norway’s sovereign wealth fund is divesting from coal miners and power producers.

At The Guardian we learn that he world’s three biggest coalmakers (Anglo American, BHP Billiton and Glencore) are not affected because their coal businesses represent less than 30% of their overall revenues.

3. Investment dollars are starting to move to renewable energy

A number of investment funds have been burnt by holding fossil fuel investments. In Australia, for example a recent study from Market Forces found that fifteen major retail, industry and public sector fund options have lost an estimated $5.6 billion on fossil fuel equity investments in 2014 and 2015. Investment dollars are starting to move to renewable energy, because it’s cheaper, and because it’s the future.

A tipping point may have been reached:

- A year ago, a solar project in Dubai went online, and offered electricity at a rate of $0.058 per KwH. “This was the solar equivalent of the shot that was heard around the world,” he explained. “In the Middle East, a solar project was producing electricity more cheaply than you could produce it using natural gas.”

Since then even lower prices have been on offer in Morocco, Texas, Nevada and elsewhere. It could be that renewables are now driving fossil fuel prices (see also John Quiggin).

One way and another, big finance is starting to take climate change seriously. A study has found that climate change could knock $2.5 trillion off the world’s financial assets, or up to $24 trillion, or 17% of the world’s assets if we are unlucky, which would wreck the global economy. Cheaper to mitigate, and smarter to move money to the new economy.

4. Naomi Klein gives Clinton a serve

Naomi Klein thinks Hillary Clinton is “uniquely unsuited” to the task of stopping climate change. Her “pro-corporate ideology” shows she does not have the willingness to take on “fossil fuel companies and the banks that finance them.”

It seems Clinton has taken a lot of dosh from fossil fuel companies, and did not follow through on her promise to review donations from that quarter after the Paris summit last year.

However, if the above trend continues that source may dry up anyway.

5. Kimberley coral reefs bleach

Normally the enormous tidal variations make the reefs of the Kimberley much more resilient than others in Australia and around the world. It looks as though their luck ran out this year, with bleaching worse than the Great Barrier Reef.

6. World Bank to spend 28% of investments on climate change projects

The World Bank says that climate change will drive 100 million more people into poverty in the next 15 years unless action is taken. They are also concerned that poor countries should be able to avoid burning carbon to increase living standards. By 2020 they expect to be directing $16 billion per annum to climate change projects, plus $13 million attracted from the private sector, making $29 billion in all.

7. Off-grid solar plus storage comes to Melbourne

Victorian network operator Ausnet Services will take 14 homes in an outer Melbourne suburb completely off grid, powered only with rooftop solar and battery storage, in a “distributed energy” trial. Most utilities now accept that within a few decades around half of all electricity demand will be satisfied that way.

The hope is that “distributed energy” could offer as much, or even more, benefit to the network operator than to the consumer.

- That’s because of the potential savings on network upgrades, and the ability to use battery storage to reduce and manage peak demand, provide stability to the grid, to provide power during outages caused by storms and other events, and to defer upgrades.

8. NSIDC suspends Arctic ice cover service

NSIDC has suspended daily sea ice extent updates until further notice, due to issues with the satellite data used to produce the images. If they can’t fix it they’ll have to move to another satellite.

A pity, because the jet stream is going a bit crazy, bringing exceptionally warm weather to Greenland. The Beaufort Sea area is also under early pressure.

Wow, that hot blast for Greenland is an eye opener. More evidence that an equable climate for the northern hemisphere is a very real possibility.

There I was optimistically asuming that coral could escape bleaching by moving south. However we now we have coral bleaching in Sydney Harbor!

Perhaps there is a message there somewhere.

The coral in Sydney Harbour has many issues to deal with.

http://www.environment.nsw.gov.au/beachapp/SydneyBulletin.aspx