The release of the national accounts the other day provided unexpected good news. GDP was barrelling along at a healthy rate of a 3 per cent increase per annum. Paul Syvret took a look behind the headline figures and discovered the ugly truth. We are in an income recession.

He says, a broader statistical measure for how the economy is faring is the net national disposable income figure rather than the simple GDP figure. National disposable income shrank again for the sixth successive quarter.

At an individual level, real wages are flatlining:

According to the ABS, real wages growth “is now the lowest on record since the series was first published in September quarter 1998”.

Productivity has improved, as companies “do more with less”. So the extra profits must be going to company profits. Oddly, however, this article says that gross operating company profits declined by a larger than expected 2.8 per cent in the December quarter. Something doesn’t line up!

Returning to the beautiful GDP numbers, a closer inspection reveals that half the growth was attributable to government expenditure. After that the biggest item was household expenditure.

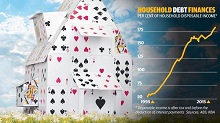

Unsurprisingly, then, “the household savings ratio has fallen to just over 7 per cent, down from a peak of 11.6 per cent in the aftermath of the global financial crisis.” This graph shows rising household debt as a percentage of disposable income:

Retrospectively the growth in household debt was strong throughout the Howard-Costello years.

Clearly it’s unsustainable. Both government and household debt are expanding as we relax under Tory management. We’ve got a budget problem, but if either government or household expenditure is constrained the problem will worsen.

Morrison will need to weave some magic in the May budget. Best to go straight to an election campaign with a big scare about negative gearing and the need to control union power.

Meanwhile some capitalists have sought to resolve their problems by paying workers next to nothing. We had the 7-Eleven problem. Now some seasonal farm workers are being paid as little as $9 per week after deductions, and 60% of international students in Sydney are being underpaid.

Its called global income equality for the masses. The steady march is on.

The problem is we have a government that, at its heart, wants most employees paid less and less in real terms. Problem is you grow the economy by growing consumers capacity to pay.

Yes, I think the idea is that with lower wages more people have jobs. But that only works at the margin. And they need a pool of unemployed to keep downward pressure on jobs.

There’s a story that Henry Ford paid his workers well enough so that they could all buy the cars they were making. The other capitalists thought he was mad!

Yes, Brian. Henry Ford famously declared that he would pay his workers $5 per day for 8 hours at a time when workers could only expect to earn $2.34 for 9 hours work. Mr Ford was a true visionary. This one action it is claimed jump started the middle class in America, and guaranteed Ford a steady supply of highly motivated workers.

http://www.henryford150.com/5-a-day/

Henry Ford did a lot of other brilliant things and I am a great fan of he man.

Brian: You said, “Something doesn’t line up!” Could it possibly be because of financial jiggery-pokery?

Funny thing is that I have never worked anywhere where extra people are put on just because wages dropped.

Business employs more people because their business is booming.

Business replaces high paid people with lower paid people if they can.

Overall cuts to wages simply reduces the capacity of the masses to buy – hardly a benefit to business.