Climate Progress has picked up on the story:Australia’s clean energy development plummets below Algeria, Myanmar, Thailand, and Uruguay .

Large scale clean energy development is basically dead in Australia, thanks to the Abbott Government’s negativity and delays. Giles Parkinson says that the Government is effectively trashing the industry:

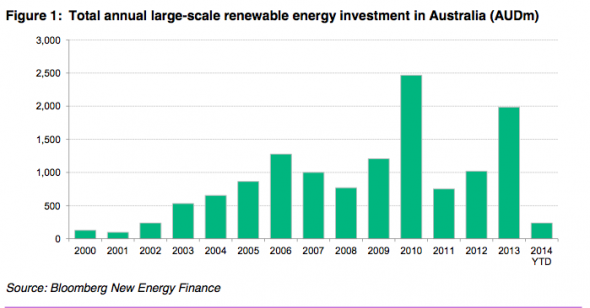

Bloomberg New Energy Finance data shows that Australia is on track to record its lowest level of asset financing for large-scale renewables since 2002 – as just $193 million was committed in the third quarter of the year. From ranking No 11, in the world in 2013, Australia has fallen behind Algeria and even Myanmar.

This graph tells the story:

Australia, which should be one of the world’s leaders in the industry, is seeing its industry collapse. The three biggest Australian investors in renewable energy are in deep trouble.

Industry Funds Management is being forced to write down the value of Pacific Hydro, the largest specialised investor in renewables in the country, by $685 million, according to the Australian Financial Review. This from a business that was to have been floated a year or so ago with a value of more than $2 billion.

Infigen Energy, the largest listed investor in renewables, has said it is facing massive writedowns, and potentially taking dramatic action to protect shareholder funds. It has brought Australian investments to a halt. So has Silex Systems, which has effectively abandoned the solar industry.

International investors have also made clear that their investment in Australia will end soon un less policy stability is restored. These include First Solar, Chinese wind turbine leader Goldwind, and numerous others. The US-based Recurrent Energy has already packed its bags, Spanish based FRV has said its $1.5 billion pipeline is at risk.

Australia’s year-to-date investment of $238 million in large-scale renewables development so far this year compares to Canada’s $3.1 billion.

The world leaders are now China and Japan.

China may add more than 14 gigawatts of solar capacity this year — almost a third of the global total, according to BNEF.

China is fast approaching its goal of installing 35 gigawatts of solar by the end of 2015.

Apparently they believe in picking winners and subsidies, as does Japan:

Japan, the world’s second-largest solar market, increased spending 17 percent to $8.6 billion in the third quarter. Japan has approved about 72,000 megawatts of clean energy projects since the country’s feed-in tariff program started in 2012, with about 96 percent being solar projects.

Meanwhile the LNP have entered into negotiations with Labor on the Renewable Energy Target, presumably having given up on PUP and the cross bench. Labor seems to favour a numerical target similar to the status quo, whereas the LNP favours an actual 20% target, which would be a reduction and disastrous for the industry. Labor seems to be prevailing. There is talk of an exemption for aluminium processing.

We’ll have to wait and see whether what comes out is too little too late, and whether the LNP plays fast and loose with yet another industry sector.