“there are no cuts to health, no cuts to education, pensions don’t change…”

That was Tony Abbott at the National Press Club just days before the last election, as reported by Peter Martin.

JOE TO SLASH AGED CASH

was the headline of Samantha Maiden’s Murdoch paper report in the Courier Mail on Sunday.

Budget pain to hit all: Hockey

That was the headline of Laura Tingle’s front page article in the AFR on Monday.

Treasurer Joe Hockey says no group will be safe from cuts in the May budget, as he braces voters for potential changes to the age pension and tighter asset tests.

Large numbers are cascading everywhere. Maiden’s article tells us that 94% of Australians over 70 qualify for either a pensioner concession card or a seniors health care card. Some 78% of the cost of scripts claimed under the PBS is going to concession card holders. Half of the $40 billion age pension bill goes to households with assets of more than $500,000. The $40 billion bill could rise to $70 billion over the next decade.

Labor increased the aged pension from 65 to 67 but that is to be phased in by 2023. The LNP are considering lifting the eligibility age to 70.

Another option is to include the family home in the assets test if it is worth more than $1 million.

Moreover, Hockey reckons the age pension indexation needs to be sustainable. Labor increased the rate and indexed it to average male earnings, which escalate faster than the CPI. Hockey appears to favour a return to the CPI.

Cutting the ‘seniors supplement’ (I get $500 taken off my tax because I’m old) has also been mentioned.

Justin Greber quotes the savings (paywalled) calculated by Stephen Anthony of Macroeconomics. Anthony reckons we need to cut the budget by about 1% of GDP or $16 billion. Overall he says:

the primary focus for the government should be in stemming middle- and upper-class welfare, with the most obvious savings in the aged and family benefits, drugs, industry assistance and removing overlaps between different levels of government.

As to the oldies, he says changing the indexation back to the CPI will save $900 million. Including the family home in the assets test will save $1.1 billion, while cutting the seniors supplement would garner a further $500 million. Peter Martin identifies a further $1.5 billion in carbon price compensation, so in all about $4 billion could be screwed out of the oldies.

Peter Martin also points out that the aged pension has increased by 25% since the indexation changed four and a half years ago, compared to the CPI of 13%.

There’s little doubt that rich old men could contribute a little more.

For context we need to note that the Australian budget is approaching $400 billion.

As a disclosure I’m modestly self-funded with no superannuation. I’d appreciate help with pharmaceuticals but get none other than the normal PBS. In this post I’m not arguing the merits or otherwise of any of the proposed changes. I do think, however, that we could consider paying a bit more tax.

Yet Peter Martin argues that tax increases are already included in the forward estimates because they don’t compensate for bracket creep. The CPI and bracket creep could make our incomes virtually flatline in real terms. He favours increasing the GST.

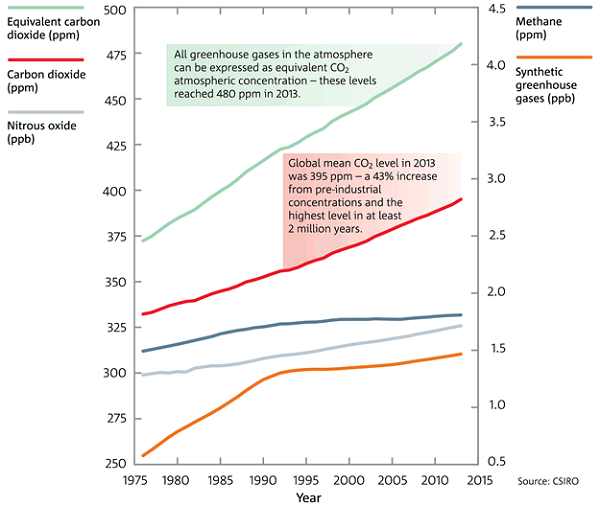

New Zealand increased the GST in two phases from 10 to 15% without stalling the economy or undue public concern. John Hewson says we are the champions in the OECD in tax concessions, including notoriously concessions to rich retirees and the fossil fuel industry. There are plenty of options available and Anthony stresses the problems are in the out years, not the next budget or two. There should be time for debate.

The Commission of Audit report is said to be available shortly as is a review of the welfare system.

My main worry in all this is that the poor and the vulnerable are going to be hit as well when there really is no need. Also there are sectors where we need to increase spending, such as skills, education including universities, research, innovation and smart industry development. Did everyone see the 4 Corners program on the hollowing out of sophisticated manufacture with the demise of the car industry? That at a time when the CSIRO prepares to cut another 300 jobs.

Meanwhile the Fairfax poll is now 48/52 in favour of Labor. There are some problems for Abbott in the regions, perhaps over foreign investment and trade policies. However, the Labor TPP surge is largely courtesy of a stunning increase in the Greens vote. 26% of 18-24 year-olds now favour the Greens. From 16-39 the LNP vote is lower than Labor, while within the margin for error. It’s the oldies that are keeping Abbott afloat. They don’t always vote in their own interest.

You can use this post as an open thread on politics.

As

As